Press release

Chamber Belt Vacuum Machine Market to Reach CAGR 5,01% by 2031 Top 20 Company Globally

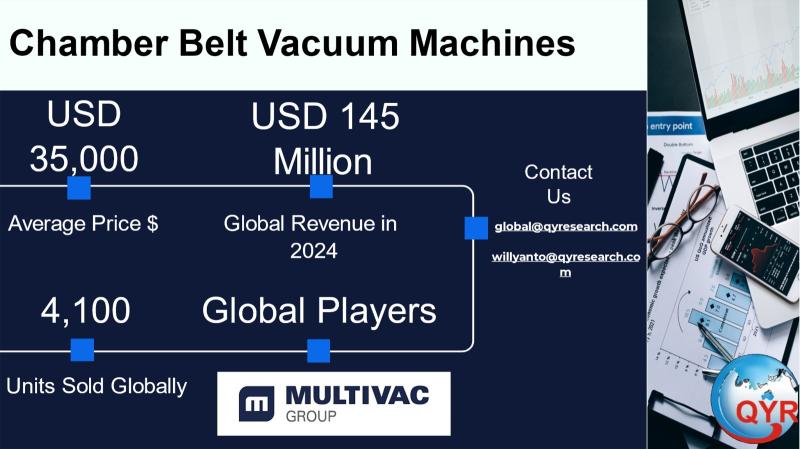

Chamber belt vacuum machines are industrial vacuum-packaging systems that combine a stainless-steel vacuum chamber with an in-feed and out-feed conveyor belt to automate high-throughput packing of pouches, bags and pre-formed packages for meat, cheese, seafood, prepared foods and other bulk products; they deliver the high-quality evacuation and MAP (modified-atmosphere packaging) capability of chamber machines while enabling continuous loading and integration into automated lines, making them the preferred solution for processors that need chamber-level seal quality at line speeds. These machines vary from compact narrow-belt units for small pieces to large multi-seal, multi-pump systems for heavy, continuous production, and are specified on cycle time, pump capacity (m3/h), seal bar length, hygienic design and options such as pouch loaders, gas-flush modules and shrink tunnels for downstream finishing. Major OEMs position chamber belt machines as productivity enablers that reduce manual handling, improve hygiene and extend shelf life compared with non-vacuum or tray solutions.The global chamber belt vacuum machines market estimates the subsegment expanded from roughly at USD 145 million in 2024, driven by rising industrialization of meat, seafood and dairy processing and greater adoption of automated packaging lines. With a projected CAGR in the 5,01% to 2031.

The Average Selling Price stand in USD 35,000 per unit to the USD 145 million 2024 revenue gives an implied 4,100 units sold globally in 2024.

.

Latest Trends and Technological Developments

The chamber-belt market is evolving along several practical vectors: automation to reduce manual loading (pouch loaders and robotic infeed), hygienic and stainless-steel design for easy cleaning and regulatory compliance, MAP/gas-flush integration for extended shelf life, digital control and recipe management for fast product changeovers, and modular downstream add-ons such as shrink tunnels and conveyors to form complete lines. MULTIVACs recent launches and tooling for chamber belt systems highlighted in press coverage around its pouch-loader for chamber belts and product shows in 20242025 illustrate the automation-first direction (MULTIVACs product communications and trade show activity, including CPMA Montreal and CheeseExpo participation, have emphasized pouch loading and efficiency improvements; see MULTIVAC news, CPMA coverage, 20242025). Reepacks ongoing belted machine portfolio (BT series and BT-1000/BT-1350 models) and Reepack product refreshes in 2024 similarly show demand for stainless, higher-speed belters suited to bakery and meat processors. A concrete priced listing on Alibaba from a Chinese supplier (Automatic Chamber Belt Vacuum Packaging Machine at USD 19,800, listed 20242025) gives a visible low-end market reference, while Multivac press and industry articles (B-425, B-625 updates) date back to product rollouts in 2022 to 2024 demonstrating OEM refresh cadence that continues into 2025. These dated product announcements and catalogue updates materially affect purchasing decisions by reducing labor requirements and increasing throughput for processors.

Asia-Pacific is the largest regional demand center for chamber-belt vacuum machines both because of the scale of meat, seafood and processed-food manufacturing in China, India and Southeast Asia and because many converters and packaging OEMs have local assembly or production footprints there. Manufacturers serving butcheries, seafood processors and ready-meal plants in APAC increasingly adopt belt chamber machines to handle high moisture and large format packs while complying with food-safety regulations; local OEMs and distributors offer competitive price points on basic machines while European OEMs supply higher-spec stainless units to premium processors and export packers. APAC suppliers such as Reepack and regional ULMA/Multivac channels have strong penetration through local distributors and trade shows; this regional mix compresses ASPs at volume but expands unit growth as lower-cost automated belters enable processors who previously used manual chamber machines to upgrade to inline operation. Market trackers and product pages indicate that nearly 6070% of incremental demand in the recent expansion (2020 to 2024) came from APAC processors automating high-volume product lines.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/4745842

Chamber Belt Vacuum Machine by Type:

Compact (600 mm)

Chamber Belt Vacuum Machine by Application:

Meat and Poultry

Seafood and Fish

Ready Meals and Prepared Foods

Non Food industrial

Others

Global Top 20 Key Companies in the Chamber Belt Vacuum Machine Market

Multivac GmbH & Co. KG

Variovac

Reepack

Triton International Enterprises

StarVac Systems

ULMA Packaging

Henkelman B.V.

Harpak

Sealpac

Henkovac Vacuum Systems

AMAC Inc

Komet Maschinenfabrik GmbH

Webtomatic Maschinenfabrik GmbH

Promarksvac Corporation

Robert Reiser & Co,, Inc.

Sammic S.L.

Sealed Air Corporatiopn

Syntegon Technology

Zhejiang Dongfeng Packing Machine Co., Ltd

ECHO Machinery

Regional Insights

Within Southeast Asia, demand for chamber belt systems is bifurcated: Indonesia, Thailand, Vietnam and the Philippines show strong appetite for mid-volume belters to serve seafood, poultry and snack food processors, while Singapore and Malaysia are more oriented toward higher-spec, hygienic installations. Indonesias large archipelagic seafood sector, expanding meat processing and fast growth in packaged foods and QSR supply chains have driven local interest in automated belt vacuuming for throughput and shelf-life gains; distributors report rising inquiries and higher tender activity in 20232025 as e-commerce and cold-chain logistics improve. Localizing assembly, after-sales service and spare-parts stocking in ASEAN markets reduces landed costs and is therefore a key route to volume growth in Indonesia and adjacent markets. Publicly visible investments by regional converters and OEM distributor announcements in 20242025 support this ASEAN trajectory.

The chamber-belt niche faces a number of practical constraints. First, capital intensity and long payback for large turnkey belt lines slow adoption among smaller processors capital access and financing terms therefore matter. Second, OEM differentiation and service footprint are critical: premium hygienic stainless steel designs and validated MAP performance command price premiums, and customers often require local service networks and fast spare-parts response in perishable supply chains. Third, labor and integration complexity installing belters into existing lines requires conveyors, synchronization and sometimes upstream portioning or downstream shrink tunnels, which can increase project delivery time and perceived project risk. Fourth, raw-material and pump-sourcing volatility (e.g., Busch/Busch-style vacuum pumps) can influence delivery schedules and warranty economics. Finally, regulatory and sustainability pressures (reduced packaging waste, preference for recyclable films) can shift material compatibility demands, forcing OEMs and processors to test new film sets and adjust cycle recipes. These challenges lengthen sales cycles and favor OEMs and integrators with turnkey capabilities and local support.

Winning suppliers will combine modular automation (pouch loaders, robotic infeed), validated MAP and vacuum process recipes, and local service networks to shorten buyer lead times and reduce total cost of ownership; offering finance/leasing options and performance guarantees (throughput, uptime, gas-consumption metrics) helps close deals with capital-constrained processors. For OEMs and distributors, a two-track approach compete on price with simplified belted chamber platforms for high-volume commodity processors while selling premium hygienic and fully integrated lines (with shrink tunnels and packaging conveyors) to export-oriented or retailer-compliant processors is the most practical route to capture both unit volume and margin expansion. Integration of digital recipe control, remote diagnostics and consumables programs (spare seal wires, vacuum pump maintenance kits) also creates recurring aftermarket revenue and stickiness. For ASEAN market entry, forming local assembly partnerships and guaranteeing local spare parts and technical training are obligatory to win volume deals.

Product Models

Chamber belt vacuum machines are advanced food packaging systems designed to extend shelf life, maintain hygiene, and improve product presentation. They are widely used in meat processing, seafood, cheese, and prepared food industries.

Compact (>400mm) models for small-scale or specialty operations. Notable products include:

Henkelman Lynx 32 Henkelman Vacuum Systems: Compact chamber belt vacuum machine ideal for butcher shops and small processors.

Webomatic Compact 350 Webomatic Maschinenfabrik: Designed for small-scale meat processors with high sealing quality.

Sipromac 350A Sipromac Packaging: Small chamber belt machine built for consistent sealing performance.

Reepack BT-1000 Reepack: Mid-entry compact chamber belt machine with 1000 mm seal bars, ideal for automating medium-production packaging lines.

Ossid BT 1000 Ossid: Offers two sealing groups and pneumatic infeed guides perfect for preservation needs in meats, cheese, and more.

Mid-Range (401 - 600 mm) machines for medium production lines. Examples include:

Henkelman Lynx 42 Henkelman: Stronger, wider belt system designed for larger batch processing.

Promarks TC-520LR Promarks: Mid-range belt vacuum unit suited for seafood and meat packaging.

Webomatic SuperMax I 500 Webomatic: Medium-size machine with robust hygienic design.

Sipromac 580A Sipromac: Offers higher capacity with semi-automatic functionality.

Minipack-Torre MVS 45X Minipack-Torre: Compact mid-size machine with stainless steel construction.

Large Industrial (> 600 mm) machines for high-volume food processing facilities. Notable products include:

Henkovac M7 Industrial Henkovac: Designed for continuous large-batch operations.

Reepack RV 800 Reepack: Large industrial belt vacuum system offering automation integration.

Promarks TC-720F Promarks: Heavy-duty machine suited for bulk food packaging.

Reepack BT-1000 (Industrial Use) Reepack: Despite being listed above, this model also serves as robust industrial equipment when upgraded with booster or shrink system.

VC999 K9 Vacuum Chamber Machine VC999 Verpackungssysteme AG: The "GIANT" of vacuum machines; wide belt, multi-height lid, and 99.9% vacuum capability all in a compact footprint

Chamber belt vacuum machines are a distinct packaging automation niche that sits between single chamber bench units and full thermoforming lines, providing the evacuation and MAP quality of chamber systems at continuous line speeds required by medium-to-large food processors; using a reconciled 2024 baseline of approximately USD 145 million for the chamber-belt subsegment and a central CAGR of 5,01% to 2031, the market offers stable growth tied to meat, seafood and prepared-food automation, with Asia-Pacific especially APAC and ASEAN markets such as Indonesia providing the principal unit-volume upside. The markets economics are characterized by a wide ASP dispersion, which implies that revenue growth can be achieved either through many low-ASP automated belters or fewer high-ASP turnkey lines; OEMs that combine automation, hygienic design and local after-sales service are best positioned to capture share.

Investor Analysis

For investors, the what is a capital-equipment niche that sits inside a non-cyclical, necessity-driven end market food processing where automation investments reduce labor cost, improve shelf life and support higher-value retail programs. The how is to target OEMs and distributors that offer modular systems with strong aftermarket margins (service, spare parts, consumables) and to favor business models that bundle installation, training and spare-parts agreements to convert one-time equipment sales into recurring revenue. The why is that steady growth in processed foods, cold-chain expansion in APAC and the need for hygienic, automated packaging create predictable replacement and retrofit cycles; furthermore, consolidation in OEM channels and the premium placed on service responsiveness in perishable value chains create scale advantages for market leaders. Diligence should prioritize warranty terms, pump-brand partnerships (Busch and equivalents), local service network depth in ASEAN (Indonesia spare-parts staging), and order-book composition between commodity belters and high-margin turnkey integrations.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/4745842

5 Reasons to Buy This Report

It reconciles a focused chamber-belt market baseline for 2024 and provides a transparent CAGR scenario to 2031, enabling defensible top-down planning for investors and OEM strategists.

It translates revenue into a practical ASP sensitivity analysis and implied global unit-shipment ranges for 2024 useful for capacity and service-parts planning.

It collates dated product and industry signals that materially affect buyer specifications and procurement timing.

It delivers regional granularity for APAC and ASEAN (including Indonesia) so go-to-market decisions on local assembly, stocking and financing can be prioritized.

It profiles the competitive set and strategic levers automation, hygienic design, MAP validation and aftermarket services that determine which OEMs will expand margins and share.

5 Key Questions Answered

What is a defensible 2024 market size for chamber belt vacuum machines and what CAGR should be modeled to 2031?

What realistic ASP bands exist across the chamber-belt spectrum, and what global unit volumes did 2024 revenue imply under those scenarios?

Which dated OEM product launches and automation attachments in 20222025 materially alter buyer economics and labor savings?

How will APAC and ASEAN demand dynamics China/India volume growth vs. Indonesia/Thailand mid-volume adoption affect pricing, local assembly and spare-parts strategies?

Which suppliers and integration partners are best targets for investment, distribution agreements or M&A to capture recurring service revenue and regional growth?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Chamber Belt Vacuum Machine Market to Reach CAGR 5,01% by 2031 Top 20 Company Globally here

News-ID: 4178194 • Views: …

More Releases from QY Research

Top 30 Indonesian Beverages Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Multi Bintang Indonesia Tbk (MLBI) Beer & alcoholic beverages

PT Delta Djakarta Tbk (DLTA) Beer brands like Anker & Carlsberg

PT Sariguna Primatirta Tbk (CLEO) Non-alcoholic beverages

PT Akasha Wira International Tbk (ADES) Beverage producer including water & drinks

PT Ultrajaya Milk Industry & Trading Company Tbk (ULTJ) Milk products, juices & drinks

PT Mayora Indah Tbk (MYOR) Coffee,…

Behind the Paint: Cost Structures, Technology Trends, and Strategic Growth in An …

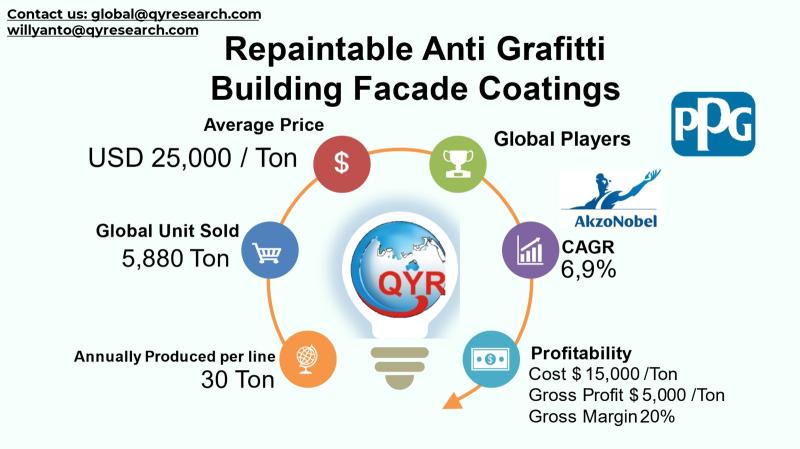

The global repaintable anti-graffiti building facade coatings industry is a specialized segment of the broader protective coatings market concentrating on products that protect exterior architectural surfaces from vandalism and urban environmental wear. Repaintable anti-graffiti coatings are engineered to allow repeated graffiti removal and overpainting without degrading the underlying surface, making them critical for durable facade protection in urban environments that demand aesthetic preservation and reduced lifecycle maintenance costs. Against a…

Ensuring Compliance and Growth: Asia Pacifics Role in the Future of Food Contact …

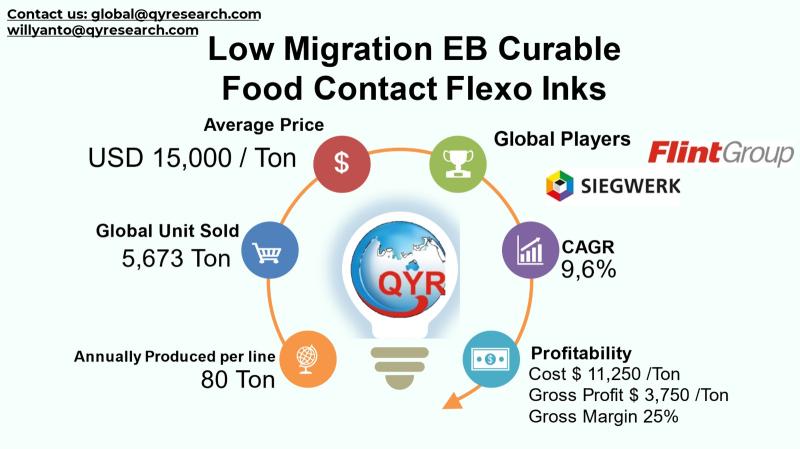

The global Low-Migration Electron Beam (EB) Curable Food Contact Flexo Inks industry encompasses specialized flexographic ink formulations that are designed to minimize chemical migration into food packaging, satisfying stringent regulatory safety standards. These inks cured via electron beam technology eliminate the need for photoinitiators and solvents that could potentially transfer into food or sensitive products, thereby addressing both regulatory and consumer safety concerns. The industry supports a broad range of…

From Flavor to Fortune: Market Dynamics in Global Fruit Syrups Explained

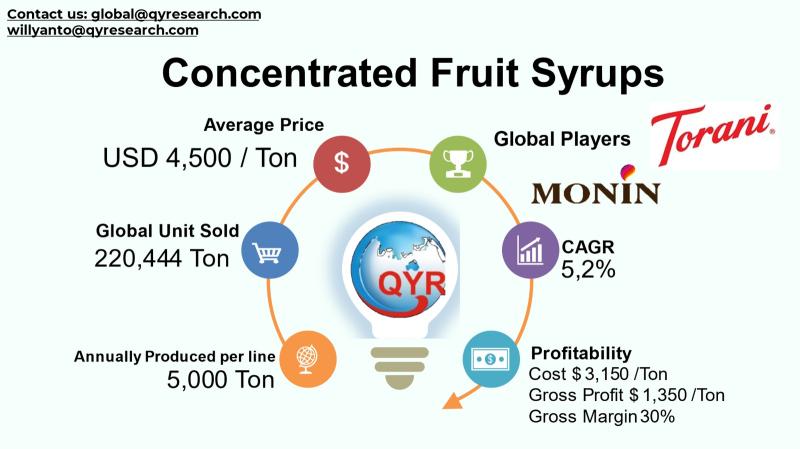

The global concentrated fruit syrups market represents a crucial niche within the broader non-alcoholic concentrated syrup and flavorings industry. These syrups, made by reducing fruit juice to a dense, highly flavorful liquid, serve as key ingredients across beverages, confectionery, bakery, dairy, and sauces, enhancing sweetness, flavor, and product versatility. The industry is influenced by rising consumer demand for natural, clean-label ingredients and the rapid expansion of the global food and…

More Releases for OEM

OEM Partnership Guide: Working with a Touch-free Automatic Kitchen Garbage Can O …

With increasing global demand for smart home solutions, Sinoware International Ltd, a top provider in household products industry, is pleased to unveil expanded OEM partnership initiatives.

Sinoware has established itself in Jiangmen--China's premier stainless steel industry zone--as an indispensable touch-free automatic kitchen garbage can OEM manufacturer for global brands seeking to incorporate high-tech sanitation solutions into their portfolios.

By combining their decades-old tradition of metal craftsmanship with cutting-edge infrared and…

Revolutionizing OEM Coatings With Sustainable Solutions Trend: A Crucial Influen …

Which drivers are expected to have the greatest impact on the over the oem coatings market's growth?

The surge in requirements from final consumer industries is forecasted to boost the expansion of the OEM coatings market. These coatings, referred to as OEM, are utilized during the integration of other firms' products into the substrate process or application. They prove to be beneficial for a variety of end-user sectors, including automotive and…

OEM Technology Partnerships Launches Brokerage Specializing in 100+ OEM Technolo …

San Francisco, California, USA - February 13, 2025 - OEM Technology Partnerships is thrilled to announce the launch of its specialized brokerage focused on connecting businesses with a comprehensive portfolio of over 100 Original Equipment Manufacturer (OEM) technologies. This new venture is poised to revolutionize how companies access and implement cutting-edge solutions across diverse industries.

Leveraging deep industry expertise and a vast network of OEM partners, OEM Technology Partnerships offers a…

OEM or ODM Watches? What's the Difference?

When searching for a watch manufacturer for your store or watch brand, you may come across the terms OEM and ODM. But do you truly understand the difference between them? In this article, we will delve into the distinctions between OEM and ODM watches to help you better grasp and choose the manufacturing service that suits your needs.

Image: https://www.naviforce.com/uploads/15a6ba3911.png

What's OEM / ODM Watches [https://www.naviforce.com/products/]

OEM (Original Equipment Manufacturer) watches are produced…

OEM Partnership with Extreme Networks

ComputerVault announces an OEM partnership with Extreme Networks and has certified its switches for use with ComputerVault enterprise software to deliver virtual desktop infrastructure (VDI).

Extreme Networks industry leading switches deliver ComputerVault Virtual Desktops at faster than PC speeds in the LAN and WAN.

“ComputerVault is very excited to work with Extreme Networks. Not only are their switches very reliable, but their exceptional performance guarantees a great user experience”, said Marc…

Humidity Measurement Module for OEM Applications

The EE1900 humidity module from E+E Elektronik is optimised for the measurement of relative humidity (RH) or dew point temperature (Td) in climate and test chambers. With outstanding temperature compensation across the working range from -70 °C to 180 °C (-94 °F to 356 °F) and the choice of stainless steel and plastic probes, the module is suitable for a wide range of applications.

High Accuracy in Harsh Environment

The excellent…