Press release

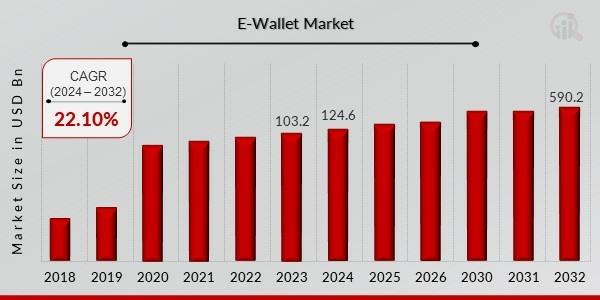

E-Wallet Market Projected to Surpass USD 590.2 Billion at 22.10% CAGR by 2032

E-Wallet Market Overview:The global e-wallet market has witnessed significant growth over the past decade, driven by the rising adoption of digital payment systems and a shift from cash-based transactions to digital platforms. The E-Wallet market size is projected to grow USD 590.2 Billion by 2032, exhibiting a CAGR of 22.10% during the forecast period 2024 - 2032 | E-Wallet Industry E-wallets, also known as digital wallets, provide users with a convenient and secure way to store funds, make payments, and conduct transactions via mobile devices or online portals. The increasing penetration of smartphones, growing internet connectivity, and the surge in e-commerce activities have propelled the demand for e-wallets globally. Moreover, consumer preference for contactless payments, especially accelerated by the COVID-19 pandemic, has further fueled market growth. Financial institutions and fintech companies are increasingly investing in e-wallet solutions to provide seamless payment experiences, improve financial inclusion, and cater to the evolving needs of tech-savvy consumers. As a result, the market is witnessing robust competition and rapid technological innovations aimed at enhancing security, user experience, and interoperability across platforms.

➤ Click Here to Get Sample Premium Report -https://www.marketresearchfuture.com/sample_request/4633

E-wallets offer multiple benefits, including faster transactions, ease of use, reduced dependence on physical cash, and enhanced security features like biometric authentication and encryption. Furthermore, government initiatives promoting digital payments, such as India's Unified Payments Interface (UPI) and various cashless economy programs in Europe and North America, are supporting the adoption of e-wallet solutions. The market also benefits from partnerships between e-wallet providers, banks, and retail chains, which facilitate widespread acceptance and integration of digital wallets across industries. However, concerns regarding cybersecurity, data privacy, and regulatory compliance pose challenges that market players must address to maintain consumer trust and drive sustainable growth.

Market Segmentation:

The e-wallet market can be segmented based on type, application, and end-user. By type, the market includes closed, semi-closed, and open e-wallets. Closed e-wallets are typically issued by merchants for use on their platforms, while semi-closed wallets allow users to transact with multiple merchants without withdrawing cash. Open e-wallets, often linked to bank accounts, provide maximum flexibility, including cash withdrawals and cross-platform payments, making them the most versatile option for consumers.

In terms of application, e-wallets serve various purposes, including bill payments, peer-to-peer (P2P) transfers, online shopping, ticketing, and financial services like insurance and investments. Online shopping remains the dominant application segment, driven by the exponential growth of e-commerce platforms and mobile commerce. Bill payments and P2P transfers are also witnessing rapid adoption, particularly in emerging markets where digital financial inclusion is a priority.

End-user segmentation categorizes the market into individuals and businesses. Individual users primarily leverage e-wallets for convenience, speed, and accessibility in personal transactions. Businesses, including small and medium enterprises (SMEs) and large corporations, utilize e-wallets to streamline payment collection, payroll distribution, and supplier payments. SMEs are increasingly adopting digital wallets due to lower operational costs, faster transaction settlements, and enhanced financial transparency.

Key Players:

The e-wallet market is highly competitive, with several prominent global and regional players driving innovation and market expansion. Major players include PayPal Holdings, Inc., Ant Group (Alipay), Apple Inc. (Apple Pay), Google LLC (Google Wallet), Samsung Electronics Co., Ltd. (Samsung Pay), and Tencent Holdings Limited (WeChat Pay). These companies offer comprehensive digital payment solutions, including mobile apps, QR-based payments, and integrated loyalty programs to enhance user engagement.

Regional players are also playing a significant role in market growth. For instance, PhonePe and Paytm dominate the Indian market, offering extensive services ranging from mobile recharges to financial products. In Southeast Asia, GrabPay and GoPay have gained prominence through strategic partnerships and localized services. Similarly, Africa sees rapid adoption of mobile money wallets like M-Pesa, enabling financial inclusion for unbanked populations.

The competitive landscape is characterized by continuous technological advancements, strategic mergers and acquisitions, and collaborations with financial institutions and merchants. Key players are focusing on expanding their user base, offering seamless cross-border payments, integrating cryptocurrencies, and enhancing security protocols. As the market evolves, companies that invest in innovative features, user-friendly interfaces, and robust security frameworks are likely to maintain a competitive edge.

➤ Buy this Premium Research Report | Immediate Delivery Available at -https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=4633

Regional Dynamics:

Geographically, the e-wallet market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific is the largest and fastest-growing market, led by countries like China, India, and Southeast Asian nations. The region's high smartphone penetration, rising internet connectivity, supportive government initiatives, and growing e-commerce sector contribute to rapid adoption. China, dominated by Alipay and WeChat Pay, represents a highly mature market, whereas India is witnessing dynamic growth with Paytm, PhonePe, and Google Pay driving digital payments adoption.

North America, particularly the United States and Canada, represents a mature market with high adoption of advanced e-wallet solutions, including Apple Pay, Google Wallet, and PayPal. Consumers in this region prioritize convenience, security, and integration with existing financial services. Europe is also witnessing steady growth due to increasing digital literacy, e-commerce expansion, and government policies promoting cashless transactions.

Latin America and the Middle East & Africa are emerging markets for e-wallets. In Latin America, countries like Brazil and Mexico are experiencing growth due to the rising adoption of smartphones and fintech innovations. Africa is witnessing significant uptake of mobile wallets, particularly in East African nations, where mobile money has transformed the financial landscape and enhanced financial inclusion. These regional dynamics highlight the importance of tailoring e-wallet solutions to local consumer behaviors, regulatory frameworks, and technological infrastructure.

Recent Developments:

The e-wallet market continues to evolve with new technological advancements, strategic partnerships, and regulatory updates. Companies are increasingly integrating artificial intelligence (AI) and machine learning (ML) into their platforms to offer personalized financial insights, fraud detection, and intelligent payment recommendations. For example, PayPal and Google Wallet have implemented AI-driven features to enhance transaction security and optimize payment processes.

Blockchain and cryptocurrency integration are also emerging trends in the e-wallet market. Several providers, including Apple Pay and Samsung Pay, are exploring cryptocurrency transactions and decentralized finance (DeFi) solutions to meet the growing interest in digital assets. Moreover, cross-border payments are gaining traction, with companies partnering with international banks and payment networks to provide seamless global transactions.

Strategic mergers and acquisitions have further shaped the market landscape. Leading e-wallet providers are acquiring fintech startups to enhance technological capabilities, expand service portfolios, and enter new regional markets. Regulatory developments are also influencing market strategies, with governments implementing stringent guidelines for data protection, anti-money laundering (AML), and Know Your Customer (KYC) compliance. These initiatives ensure consumer trust and safeguard the integrity of digital payment systems.

Furthermore, promotional strategies such as cashback offers, loyalty programs, and merchant partnerships continue to drive user adoption and engagement. Providers are focusing on expanding functionalities beyond basic payments to include insurance, investment options, and financial planning tools, transforming e-wallets into comprehensive financial management solutions.

➤ Browse In-depth Market Research Report -https://www.marketresearchfuture.com/reports/e-wallet-market-4633

The e-wallet market is poised for substantial growth, driven by technological innovations, rising smartphone adoption, government initiatives, and changing consumer payment behaviors. Asia-Pacific leads the market, followed by North America and Europe, while emerging regions like Latin America and Africa present untapped opportunities. Key players are investing in AI, blockchain, cross-border capabilities, and strategic partnerships to maintain competitive advantages.

As consumers increasingly seek convenience, security, and efficiency, the e-wallet market is evolving into a multifaceted digital financial ecosystem. Companies that prioritize innovation, user experience, and regulatory compliance are likely to thrive in this dynamic market. With continuous advancements in technology and growing acceptance of digital payments, the e-wallet market is expected to play a crucial role in shaping the future of global financial transactions, ultimately driving financial inclusion and transforming how individuals and businesses manage their money.

➤ Explore our Global Report -

Mobile Application Market - https://www.marketresearchfuture.com/reports/mobile-application-market-4497

Relational Database Market - https://www.marketresearchfuture.com/reports/relational-database-market-18851

Europe E-Learning Market - https://www.marketresearchfuture.com/reports/europe-e-learning-market-21587

Cyber Security Service Market - https://www.marketresearchfuture.com/reports/cyber-security-service-market-21584

Digital Advertising Market - https://www.marketresearchfuture.com/reports/digital-advertising-market-21579

Big Data Security Market - https://www.marketresearchfuture.com/reports/big-data-security-market-4410

Messaging Security Market - https://www.marketresearchfuture.com/reports/messaging-security-market-4219

India Internet of Things Market - https://www.marketresearchfuture.com/reports/india-internet-of-things-market-21603

Employee Experience Management Market - https://www.marketresearchfuture.com/reports/employee-experience-management-market-22001

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Also, we are launching "Wantstats" the premier statistics portal for market data in comprehensive charts and stats format, providing forecasts, regional and segment analysis. Stay informed and make data-driven decisions with Wantstats.

Contact Us:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release E-Wallet Market Projected to Surpass USD 590.2 Billion at 22.10% CAGR by 2032 here

News-ID: 4177706 • Views: …

More Releases from Market Research Future (MRFR)

Global Ready-to-Eat Popcorn Industry Poised for Robust Growth with a 6.89% CAGR …

Ready-to-eat Popcorn market has been experiencing significant growth due to evolving consumer lifestyles and a heightened preference for convenient, on-the-go snacking solutions. Valued at USD 4.06 Billion in 2024, the market is anticipated to reach USD 4.34 Billion in 2025 and further expand to USD 8.45 Billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.89% during the forecast period. Key factors driving this growth include the increasing…

Global Cosmetics Industry to Reach USD 0.4708 Billion by 2035, at a 3.57% CAGR w …

The cosmetic products market has witnessed substantial growth in recent years, reaching an estimated valuation of USD 0.50 Billion in 2024 and projected to reach USD 0.54 Billion in 2025. With a robust CAGR of 4.2% from 2025 to 2035, the industry is increasingly driven by evolving consumer preferences, urbanization, and rising disposable incomes. Demand for skincare, haircare, and color cosmetics is escalating, fueled by product innovations, natural ingredient adoption,…

Papaya Market Expected to Reach USD 23.65 Billion by 2035, Fuelled by Health Awa …

Papaya Market has experienced significant growth in recent years due to rising consumer awareness of the health and nutritional benefits of papaya. In 2024, the market was valued at USD 13.9 billion, and it is projected to grow to USD 14.58 billion in 2025. By 2035, the market is expected to reach USD 23.65 billion, representing a compound annual growth rate (CAGR) of 4.95% over the forecast period. The market…

Global Data Relay Satellite Market Forecasted to Reach USD 27,116.9 Million by 2 …

Global Data Relay Satellite Market has demonstrated strong growth over recent years, with a market valuation of USD 9,137.7 Million in 2024. The market is expected to reach USD 10,261.6 Million in 2025 and expand to USD 27,116.9 Million by 2035, registering a compound annual growth rate (CAGR) of 11.4% during the forecast period. This growth is primarily driven by the rising demand for seamless satellite communication, enhanced data transmission…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…