Press release

Global Fintech Market Size to Reach USD 727.17 Billion by 2034, Growing at 15.60% CAGR

The global financial technology (fintech) market is a powerful and disruptive force, fundamentally reshaping the landscape of financial services worldwide. With an estimated valuation of USD 228.02 billion in 2024, the market is on an exceptional growth trajectory, projected to reach a staggering USD 727.17 billion by 2034. This represents a robust Compound Annual Growth Rate (CAGR) of approximately 15.60% during the forecast period from 2025 to 2034. This explosive growth is fueled by a confluence of factors: widespread smartphone penetration, rising consumer demand for seamless digital financial services, supportive regulatory frameworks, and significant venture capital investments. Fintech is no longer a niche sector; it is now a core driver of financial inclusion, innovation, and competition, pushing traditional institutions to adapt and collaborate.Access key findings and insights from our Report in this Free sample - https://www.zionmarketresearch.com/sample/fintech-market

This report provides a granular analysis of the market, dissecting it by service type, technology, application, end-user, and geography. It further offers a detailed competitive landscape profiling the key players, their strategic initiatives, and market positioning. The insights herein are designed to equip financial institutions, technology providers, investors, and regulators with the intelligence needed to navigate the opportunities and challenges in this dynamic and transformative market.

1. Introduction and Market Definition

Fintech, a portmanteau of "financial technology," refers to the integration of technology into offerings by financial services companies to improve their use and delivery to consumers. It encompasses a rapidly expanding range of applications, from mobile banking and investment apps to cryptocurrency, blockchain, and AI-driven risk management. Fintech disrupts traditional financial methodologies by being more agile, serving underserved segments, and providing faster and more convenient services.

This report defines the market based on the revenue generated by fintech firms from service fees, subscriptions, interest, and commissions. The scope includes pure-play fintech startups, technology solutions providers, and the digital transformation initiatives of incumbent financial institutions. The analysis is global, encompassing major regional markets and their unique regulatory and adoption environments.

2. Market Dynamics: Drivers, Restraints, and Opportunities

2.1. Market Drivers

High Smartphone Penetration and Internet Access: The global ubiquity of smartphones is the primary enabler for fintech adoption, providing a platform for mobile-first financial services for billions of users.

Shifting Consumer Expectations: Customers, especially millennials and Gen Z, demand digital-first, personalized, and on-demand financial services, favoring the user experience offered by fintechs over traditional banks.

Supportive Regulatory Initiatives (Open Banking/Finance): Regulations like PSD2 in Europe and similar frameworks worldwide mandate banks to share customer data (with consent) with third-party providers. This has catalyzed innovation, allowing fintechs to build services on top of banking infrastructure.

Financial Inclusion in Emerging Economies: Fintech solutions, particularly mobile money and digital wallets, are providing financial services to unbanked and underbanked populations in regions where traditional banking infrastructure is lacking.

Venture Capital and Strategic Investments: Massive inflows of capital from VC firms, corporate venture arms, and traditional financial institutions are fueling rapid innovation and scaling of fintech companies.

2.2. Market Restraints

Data Security and Privacy Concerns: As fintechs handle sensitive financial and personal data, they are prime targets for cyberattacks. Data breaches can severely erode consumer trust and lead to significant regulatory penalties.

Stringent and Evolving Regulatory Compliance: Navigating the complex web of global financial regulations (e.g., AML, KYC, GDPR) is challenging and costly for fintechs, potentially stifling innovation and creating barriers to entry.

Trust Deficit and Customer Acquisition: Despite growth, many consumers still place higher trust in established, incumbent banks due to their long history and deposit insurance schemes. Acquiring customers and building this trust is expensive and time-consuming.

Integration Challenges with Legacy Systems: For B2B fintechs selling to traditional banks, integrating agile, modern technology with outdated legacy core banking systems can be complex and a major hurdle to adoption.

2.3. Market Opportunities

Embedded Finance: The integration of financial services into non-financial platforms (e.g., buy-now-pay-later at checkout, banking within social media apps, insurance offered by car manufacturers) represents a massive, untapped revenue opportunity.

Artificial Intelligence and Machine Learning: Advanced AI/ML applications for hyper-personalization, fraud detection, algorithmic trading, and automated customer service (chatbots) are key differentiators.

Blockchain and Decentralized Finance (DeFi): Beyond cryptocurrency, blockchain technology offers opportunities for revolutionizing cross-border payments, trade finance, smart contracts, and creating a new, open financial architecture.

Expansion of Insurtech and Wealthtech: Specific sub-verticals within fintech-technology for insurance (Insurtech) and investment/wealth management (Wealthtech)-are experiencing accelerated growth and present significant opportunities.

Strategic Partnerships (BaaS - Banking-as-a-Service): Traditional banks are increasingly partnering with fintechs via BaaS models, allowing fintechs to offer regulated products while banks gain revenue and access to innovation.

3. Market Segmentation Analysis

The global fintech market can be segmented to understand its diverse service offerings and technological foundations.

3.1. By Service Type

Digital Payments: The largest segment, including digital wallets, P2P payments, mobile POS, and remittances. (e.g., PayPal, Stripe, Square, Alipay).

Digital Lending: Platforms offering streamlined loans, crowdfunding, and BNPL (Buy-Now-Pay-Later) services. (e.g., LendingClub, Affirm, SoFi).

WealthTech (Investment Tech): Robo-advisors, digital brokerage platforms, and crypto asset management. (e.g., Robinhood, Betterment, Coinbase).

InsurTech: Technology-driven insurance products, from comparison websites to fully digital insurers using IoT and telematics. (e.g., Lemonade, Root Insurance).

RegTech: Solutions that help companies comply with financial regulations efficiently through automation. (e.g., Chainalysis, Onfido).

Neo-Banks/Challenger Banks: Digital-only banks without traditional physical branch networks. (e.g., Chime, N26, Revolut).

3.2. By Technology

API: The foundational technology enabling open banking and integration between systems.

AI, ML, & Big Data Analytics: Used for credit scoring, personalization, fraud prevention, and risk management.

Blockchain & Distributed Ledger Technology (DLT): Underpins cryptocurrencies and is exploring use cases in settlements and identity management.

Robotic Process Automation (RPA): Automates repetitive back-office tasks in finance.

Cloud Computing: Provides the scalable, flexible infrastructure for fintech operations.

3.3. By Application

Banking

Insurance

Securities & Investments

Payments & Transfers

Others

3.4. By End-User

Business-to-Business (B2B)

Business-to-Business-to-Consumer (B2B2C)

Business-to-Consumer (B2C)

4. Regional Analysis

The market landscape exhibits distinct characteristics across different geographies.

Asia-Pacific (APAC):

Market Character: The largest and fastest-growing regional market. A hotbed of innovation and adoption.

Growth Drivers: Massive unbanked population adopting mobile-first solutions, strong government support (e.g., India's UPI, China's digital yuan), dominance of super-apps (WeChat, GoJek, Grab), and a tech-savvy population.

Challenges: Highly diverse regulatory environments across countries.

North America:

Market Character: A mature and technologically advanced market, led by the U.S.

Growth Drivers: Presence of global tech and financial hubs (Silicon Valley, New York), high consumer spending power, abundant venture capital, and a strong culture of entrepreneurship.

Challenges: Regulatory complexity with state and federal laws, and high competition.

Europe:

Market Character: A highly innovative and regulated market.

Growth Drivers: Pioneering regulatory framework with PSD2 (Open Banking), a single market facilitating scaling, and high consumer trust in digital finance in regions like the UK and Scandinavia.

Challenges: Navigating GDPR for data privacy and still-varying adoption rates across Eastern and Western Europe.

Latin America, Middle East, and Africa (LAMEA):

Market Character: An emerging market with high growth potential, led by countries like Brazil, Mexico, Nigeria, and UAE.

Growth Drivers: High rates of financial exclusion creating a greenfield opportunity, rapid mobile phone adoption, and solutions tailored to local needs (e.g., mobile money in Africa).

Challenges: Political and economic instability in some regions and underdeveloped financial infrastructure.

Access our report for a comprehensive look at key insights -https://www.zionmarketresearch.com/report/fintech-market

5. Key Player Landscape and Competitive Analysis

The competitive landscape is incredibly diverse, featuring pure-play fintech unicorns, Big Tech companies, and incumbent financial institutions.

The major operating players in the global fintech market include:

PayPal

Stripe

Square (Block Inc.)

Robinhood

Revolut

Adyen

Ant Group

Plaid

Klarna

SoFi Technologies

Nubank

Wise (formerly TransferWise)

Coinbase

Affirm

Marqeta

Other Notable Players: Stripe (online payments infrastructure), Chime (US neobank), Revolut (global neobank), Robinhood (commission-free trading), Klarna (BNPL leader), and traditional banks like Goldman Sachs (with its Marcus platform) and JPMorgan Chase (heavy digital investment).

6. Strategic Recommendations

For Fintech Startups: Focus on solving a specific pain point exceptionally well. Prioritize security and compliance from day one. Consider a B2B2C model to leverage the existing customer base and trust of established players. Cultivate a strong, transparent brand to build user trust.

For Incumbent Banks: Embrace a "collaborate and compete" strategy. Invest heavily in digital transformation and modernizing legacy systems. Partner with or acquire fintechs to accelerate innovation and fill capability gaps. Leverage your vast customer data and trust advantage to offer personalized services.

For Investors: The market remains attractive but requires a focused strategy. Opportunities exist in: 1) B2B fintech and Enabling Technology, 2) Emerging markets with high financial exclusion, and 3) Specific high-growth sub-verticals like InsurTech and WealthTech. Conduct deep due diligence on regulatory compliance.

For Regulators: Foster innovation through regulatory sandboxes that allow for testing new products in a controlled environment. Develop clear, agile, and risk-based regulatory frameworks that protect consumers without stifling innovation. Promote international regulatory cooperation to manage cross-border fintech activities.

7. Conclusion

The global fintech market is at the forefront of a financial revolution. The projected growth to USD 727.17 billion by 2034 underscores its role as a permanent and dominant feature of the financial services landscape. The future of fintech will be defined by deeper integration (embedded finance), smarter technology (AI/ML), and more open and inclusive systems (DeFi, Open Banking). Success will belong to those who can navigate the complex regulatory environment, build unwavering consumer trust, and continuously innovate to meet the evolving demands of both businesses and consumers. While challenges around security and regulation persist, the overarching trend is clear: technology will continue to democratize, personalize, and redefine the world of finance, and the fintech market will be the engine of this transformation.

Browse Other Related Research Reports from Zion Market Research-

Cider Packaging Market-https://www.zionmarketresearch.com/report/cider-packaging-market

Grease Cartridges Market-https://www.zionmarketresearch.com/report/grease-cartridges-market

Active, Smart, and Intelligent Packaging Market-https://www.zionmarketresearch.com/report/active-smart-and-intelligent-packaging-market

Linerless Labels Market-https://www.zionmarketresearch.com/report/linerless-labels-market

Packaging Adhesives Market-https://www.zionmarketresearch.com/report/packaging-adhesives-market

Asia Pacific Office

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1-855-465-4651

Email: sales@zionmarketresearch.com

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client's needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us-after all-if you do well, a little of the light shines on us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Fintech Market Size to Reach USD 727.17 Billion by 2034, Growing at 15.60% CAGR here

News-ID: 4177499 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

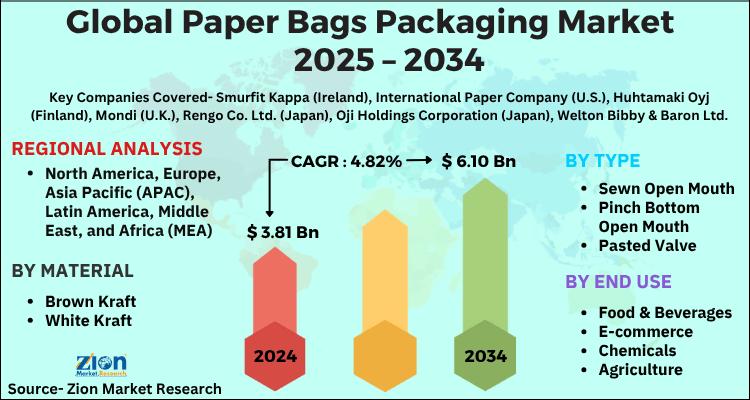

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

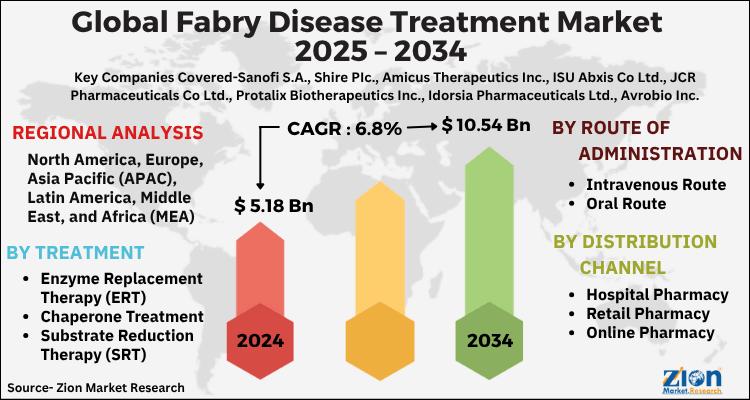

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Tech

Kitimat's Quiet Tech Revolution: Retired Tech Founder Launches Kitimat Digital

Image: https://www.globalnewslines.com/uploads/2025/05/fe744bd61d32383b1190af80ca522635.jpg

KITIMAT, BC - In a town shaped by industry and community, one digital venture is quietly helping small businesses step into the modern age.

Kitimat Digital, incorporated in British Columbia in 2024, was founded by a retired tech professional with a background in operating digital firms in Calgary and Houston. After settling in Kitimat for a slower pace of life, he noticed a clear need: many businesses in the area…

Tech Cuboid: Revolutionizing the Tech Landscape

In an era where technology evolves at breakneck speed, staying ahead of the curve is no longer optional-it's essential. If you're navigating the dynamic world of tech in the USA, you've likely heard of Tech Cuboid, a name that's rapidly becoming synonymous with innovation, reliability, and cutting-edge solutions. But what exactly is Tech Cuboid, and why should it matter to you? Let's dive into how this groundbreaking platform is reshaping…

Evan Ceron: Pioneering Tech Solutions With Tech Remedies

Image: https://www.getnews.info/uploads/a067156d14b9c9aaa532de3166992962.jpg

Since embarking on his technical journey in 2009, Evan Ceron has steadily built a reputation as a seasoned professional in the tech industry. His journey began with a solid foundation in technical education at Bellevue College in Washington, where he acquired the skills and knowledge that would later serve as the bedrock of his entrepreneurial aspirations. This period of education not only equipped him with critical technical expertise but…

GAM Tech Acquires Cyber Tech 360: Expanding Expertise and Innovation

GAM Tech, a leading provider of managed IT solutions and professional services, is thrilled to announce its acquisition of Cyber Tech 360, a recognized leader in cybersecurity services and advanced managed IT solutions. This strategic acquisition broadens GAM Tech's service offerings, resulting in a comprehensive portfolio to better service small and medium-sized businesses across Canada.

The combined company will operate under the GAM Tech brand. Cyber Tech 360 will be…

Girls in Tech Singapore rebranding to Sponsors in Tech

SINGAPORE - 16th JULY 2024 -

With the closure of Girls in Tech, Inc., the local Girls in Tech - Singapore chapter is proud to announce its rebranding as "Sponsors of Tech - Empowering Her Journey." This new identity marks a significant milestone for the organization and our community, reflecting our ongoing commitment to supporting girls and women in tech throughout their careers.

As a non-profit organization, Sponsors of Tech - Empowering…

3-Axis Handheld Gimbal Stabilizers Market Analysis and Growth by Top Manufacture …

A report added to the rich database of Qurate Business Intelligence, titled “3-Axis Handheld Gimbal Stabilizers Market - Global Industry Analysis and Forecast to 2023”, provides a 360-degree overview of the Global market. Approximations associated with the market values over the forecast period are based on empirical research and data collected through both primary and secondary sources. The authentic processes followed to exhibit various aspects of the market makes the…