Press release

Recyclable Aluminum Aerosol Cans Market to Reach CAGR 6,1% by 2031 Top 20 Company Globally

Recyclable aluminum aerosol cans are aluminum-bodied pressure containers used to dispense consumer and industrial products personal care (deodorants, hairsprays), household aerosols (cleaners, air fresheners), food aerosols, automotive sprays and specialist industrial sprays designed so the body and (where applicable) closures are compatible with standard aluminum recycling streams. Aluminum is widely preferred for aerosols when brand owners want a high-quality finish, light weight, and strong recyclability credentials versus mixed-material cans. The product family includes conventional two-piece aerosol cans, specialty drawn-and-ironed forms, and laminated/printed decorated finishes. Brand owners and regulators are increasingly focused on recyclability metrics, recycled-content targets and the life-cycle carbon implications of aerosol packaging, pushing aluminum can makers to document recycled-content, sort-ability and end-of-life circularity.The global recyclable aluminum aerosol can market value in 2024 is approximately USD 3,390 million, with global deliveries in the order of 7,37 billion aerosol cans using that baseline and the revenue range yields a blended ASP in the USD 0,46 per can for 2024. For forecasting, the recyclable aluminum aerosol can a compound annual growth rate (CAGR) of 6,1% to 2031, producing a projected market value of roughly USD 4,970 million by 2031.

Price per unit and total units sold (detail)

Price per finished aluminum aerosol can depends strongly on can size (50 ml deodorant versus 400 ml industrial spray), decoration (printed, shrink-sleeved, anodized), primer/liners, valve and actuator specification, and order quantity. Using the reconciled market value and Aerobal deliveries, the blended average selling price (ASP) for a finished aluminum aerosol can in 2024 sits in our estimate at USD 0.60 to 0.75 per unit. Applied to the 6.75 billion cans delivered in 2024, that yields a revenue band consistent with the USD 4.5 to 5.0 billion market estimate and implies ~6.7 to 6.8 billion units sold globally in 2024 (with a plausible sensitivity range of ~5.5 to 8.5 billion units depending on how much small-format retail aerosol versus larger industrial cans are in the mix). Retail/consumer-facing per-unit prices (what a brand pays to its packer) can move lower on very large beverage-like runs or higher for specialty-decorated premium packages; the ASP above averages those effects into a tractable planning figure for investors and procurement teams.

Latest Trends and Technological Developments

The aluminum aerosol-can industry in 2023 to 2025 has been dominated by sustainability commitments, recycled-content pledges, technology to improve recyclate access, and supply-chain adjustments to ensure post-consumer aluminium feedstock. AEROBALs member deliveries report (published in 2024) showed global aluminum aerosol deliveries rising and highlighted continuing constraints around access to high-quality aluminium recyclate, a key industry talking point for 2024. On February 2025, Ball Corporation published results and commentary noting resilient demand for aluminum packaging and ongoing investments in recycling and material-efficiency programs, underscoring can suppliers focus on circularity and scale. Packaging industry outlets in 2024 and 2025 have covered initiatives by large converters and beverage/can leaders to increase recycled content and support deposit-return schemes or collection partnerships. In product technology, brand owners and converters are investing in low-waste decorating (digital and UV printing that reduces solvent use), lighter-gauge body stock enabled by alloy and process improvements, and valve/actuator designs that simplify disassembly for metal recycling. Dates referenced above reflect the Aerobal 2024 delivery report and company news and industry press through early 2025 that document supply-side shifts toward recycled content and improved collection systems.

Asia Pacific is both a major production hub for aluminum aerosol cans and the largest demand region for many aerosol end uses personal care, household, and foodservice packaging so the region accounts for a substantial share of global volumes. China, India, Japan, South Korea and Southeast Asian manufacturing centers host can plants and converting capacity; Chinese and regional manufacturers serve domestic brands and export markets. Supply-chain dynamics in Asia show two dominant moves: expansion of high-volume, low-cost lines in China and India that serve mass-market aerosols, and selective investments in premium converting and decorating capacity in Japan and Korea for fashion and high-end personal-care SKUs. Regional recyclability challenges are salient: collection infrastructure varies widely across Asia, creating local variability in recycled-aluminum availability and recycled-content ambition. Nonetheless, brand-level sustainability commitments plus higher consumption of aerosol personal-care products make APAC the principal engine of unit growth and the region where converters are most actively investing in recyclate procurement and lightweighting projects.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/4945128

Recyclable Aluminum Aerosol Cans by Type:

Small Size Cans

Medium Size Cans

Large Size Cans

Recyclable Aluminum Aerosol Cans by Application:

Personal Care and Cosmetic

Pharmaceuticals

Food

Household Goods

Others

Global Top 20 Key Companies in the Recyclable Aluminum Aerosol Cans Market

Ball

CCL Container

ALLTUB

Alucon

Trivium Packaging

TUBEX GmbH

Tecnocap Group

Aryum

Bispharma

Montebllo Packaging

Impacta SA

Bharat Containers

Linhardt Group

Condensa

Casablanca Industries

Jamestrong Packaging

Nussbaum Group

Nampak

Printal Oy

Shantou Oriental Technology

Regional Insights

Within Southeast Asia, demand for aluminum aerosol cans is increasing with urbanization, expanding personal-care penetration and growth in foodservice and household-spray categories. Indonesia stands out by population scale and strong growth in personal-care and retail channels; local converters and regional suppliers serve both domestic brands and multinational fmcg contract-filling needs. Singapore and Malaysia typically absorb more premium-decorated cans and are hubs for regional branding and finishing; Thailand and Vietnam host converting and alloy suppliers that feed regional packaging chains. Distribution and post-consumer collection systems in ASEAN are uneven: some markets function with established municipal collection and pilot deposit/return initiatives, while others have limited formal collection, which constrains local recycled-aluminum availability and influences the economics of recyclable-content claims. The practical implication is that brand owners targeting recyclable aluminum content in ASEAN must either secure imported recycled aluminium or invest in local collection/ASC (aluminum waste collection) partnerships to meet pledges without incurring steep premiums.

The aluminum aerosol-can industry faces a cluster of interrelated operational and strategic challenges. First, recycle feedstock availability: while aluminum is highly recyclable, consistent access to high-grade aluminium waste (low contamination) is not uniform globally and is a recurring constraint flagged by AEROBAL members and industry press. Second, regulatory and material-policy pressure: evolving definitions of recyclability, recycled-content mandates and deposit-return schemes add complexity for converters and brand owners and can increase landed costs in markets with nascent collection systems. Third, decoration and closure complexity: premium decoration and multi-material actuators can hamper recyclability unless designs are simplified or collection/separation is improved. Fourth, input-cost volatility: aluminium premiums, energy and transport costs materially affect mill and converter margins public packager earnings calls in 20242025 show input cost pass-through discussions are ongoing. Fifth, competition from alternative packaging (recyclable PET aerosols, compressed gas systems, refill systems) creates product-development pressure as brands weigh carbon and cost tradeoffs. These structural frictions increase the importance of supply-chain partnerships, deposit-scheme engagement and technical innovation to maintain the recyclable-aluminum value proposition.

Market leaders will combine three capabilities: secure recycled-aluminum supply (via long-term contracts or investment in collection), efficient converting and light-gauge manufacturing to lower embodied carbon per can, and product/design services that enable easy recycling (single-material closures, standardized actuators). For brand owners, switching to aluminum aerosol cans delivers strong circularity messaging only if backed by visible collection or recycled-content percentages. Regional go-to-market strategies should differ: in APAC, prioritize scale and cost efficiency with investments in local converting; in ASEAN prioritize upstream partnerships for waste collection and selective premium decoration lines for higher-margin personal-care SKUs. Investors and strategic buyers should look for vertically integrated players (casters + converters) or converters with robust offtake agreements and traceable recycled-content commitments these characteristics reduce raw-material price exposure and improve the defensibility of sustainability claims.

Product Models

Recyclable aluminum aerosol cans are widely used across personal care, household, and industrial sectors due to their lightweight, corrosion-resistant, and infinitely recyclable properties.

Small-size cans commonly used for deodorants and travel-size products. Notable products include:

Ball Corporation Small Aluminum Can Ball Corporation: Travel-size recyclable can for deodorants and perfumes.

Trivium Packaging Mini Can Trivium Packaging: Compact aerosol cans designed for cosmetics and personal care.

Nampak Small Aerosol Can Nampak Plastics & Metals: Eco-friendly mini aluminum cans for fragrance mists.

Exal Mini Aerosol Can Exal Corporation (now Trivium): Custom-designed small can with branding options.

EuroAsia Packaging Small Can EuroAsia Packaging: Compact can for deodorants and hair sprays in travel kits.

Medium-size cans for hairsprays, shaving foams, and household sprays. Examples include:

Exal Standard Medium Can Exal (Trivium): Versatile mid-range aluminum aerosol for cosmetics.

Tecnocap 200 ml Aerosol Can Tecnocap Group: Customizable recyclable can for global brands.

Envases Medium Recyclable Can Envases Europe: Designed for personal care and pharmaceutical aerosols.

Matrametal 200 ml Can Matrametal: Medium-sized recyclable aluminum can for household sprays.

China Baosteel Packaging Medium Can Baosteel Packaging: Mid-range aluminum can tailored for the Asian market.

Large-size cans for industrial, automotive, and multi-use sprays. Notable products include:

Ball 500 ml Aluminum Can Ball Corporation: Large recyclable can for industrial and multipurpose sprays.

Trivium Large Aerosol Can Trivium Packaging: Oversized can for automotive sprays and household cleaners.

Nampak Large Aerosol Can Nampak: Sturdy large-sized can for disinfectants and room sprays.

CROWN 400 ml Aerosol Can Crown Holdings Inc.: Industrial-grade recyclable can for chemical sprays.

Envases 500 ml Can Envases Europe A/S: High-volume can for household and automotive care products.

Recyclable aluminum aerosol cans form a sizeable, mature packaging niche with an estimated global value of around USD 3,390 million in 2024, roughly 7,370 million units delivered that year, and a central projected CAGR near 6.1% to 2031 driven by premium personal-care growth, lightweighting, and regulatory pressure favoring recyclable metal packaging. Asia-Pacific will remain the largest regional source of both supply and demand while ASEAN markets led by Indonesia provide accelerated unit growth but present collection and recycled-content challenges that converters and brand owners must manage. The practical investment and commercial opportunities center on securing recycled input, lowering per-unit embodied carbon, and offering product designs that are demonstrably recyclable in end-market collection systems.

Investor Analysis

For investors the what is a durable packaging segment tied to high-frequency consumer purchases and growing sustainability mandates. The how to capture value is to invest in scale converters with secure waste/recyclate supply, in finishing technologies (digital/UV printing that command premium), or in circular-infrastructure plays (collection, sorting, recycling facilities) that reduce feedstock cost and enable guaranteed recycled-content claims. The why hinges on the combination of regulatory momentum (recycled-content and deposit schemes), brand-level commitments to reduce plastic, and the intrinsic recyclability and embodied-carbon advantages of aluminum when collection systems work. Key diligence points include validated recycled-content claims, long-term alumina/aluminium waste purchase agreements, energy-efficiency of converting plants, and the degree to which a target has commercial relationships with major FMCG or personal-care brands that will sustain volume demand and margin.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/4945128

5 Reasons to Buy This Report

It reconciles public production and delivery statistics with market-value estimates to produce a defensible 2024 baseline for aluminum aerosol cans and a transparent CAGR to 2031.

It converts dollars into meaningful operating inputs blended ASP ranges and unit volumes so procurement and capacity planners can run sensitivity scenarios for price and feedstock shocks.

It summarizes dated, actionable industry developments and company signals in 20232025 that bear directly on recyclability and supply-chain risk.

It provides regionally specific intelligence for Asia and ASEAN go-to-market and localization choices can be prioritized.

It profiles the competitive landscape and strategic playbooks (vertical integration, recycled-content contracting, premium finishing) that enable margin capture and defensible sustainability claims.

5 Key Questions Answered

What was the best-supported global market size for recyclable aluminum aerosol cans in 2024 and what CAGR should be used to 2031?

What are realistic ASP ranges per finished aluminum aerosol can and what unit volumes did 2024 shipments imply?

Which recent dated supplier and industry developments in 20232025 most materially affect recyclate availability and pricing?

How do Asia and ASEAN differ in supply, decoration capability and post-consumer collection, and what are the consequences for recycled-content strategies?

Who are the leading manufacturers and converters to consider for partnerships, M&A or supply agreements, and which strategic capabilities matter most?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Recyclable Aluminum Aerosol Cans Market to Reach CAGR 6,1% by 2031 Top 20 Company Globally here

News-ID: 4176434 • Views: …

More Releases from QY Research

Top 30 Indonesian Beverages Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Multi Bintang Indonesia Tbk (MLBI) Beer & alcoholic beverages

PT Delta Djakarta Tbk (DLTA) Beer brands like Anker & Carlsberg

PT Sariguna Primatirta Tbk (CLEO) Non-alcoholic beverages

PT Akasha Wira International Tbk (ADES) Beverage producer including water & drinks

PT Ultrajaya Milk Industry & Trading Company Tbk (ULTJ) Milk products, juices & drinks

PT Mayora Indah Tbk (MYOR) Coffee,…

Behind the Paint: Cost Structures, Technology Trends, and Strategic Growth in An …

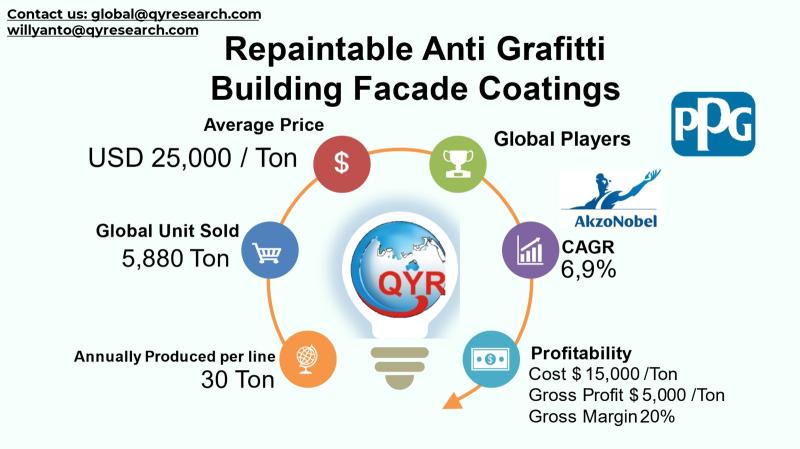

The global repaintable anti-graffiti building facade coatings industry is a specialized segment of the broader protective coatings market concentrating on products that protect exterior architectural surfaces from vandalism and urban environmental wear. Repaintable anti-graffiti coatings are engineered to allow repeated graffiti removal and overpainting without degrading the underlying surface, making them critical for durable facade protection in urban environments that demand aesthetic preservation and reduced lifecycle maintenance costs. Against a…

Ensuring Compliance and Growth: Asia Pacifics Role in the Future of Food Contact …

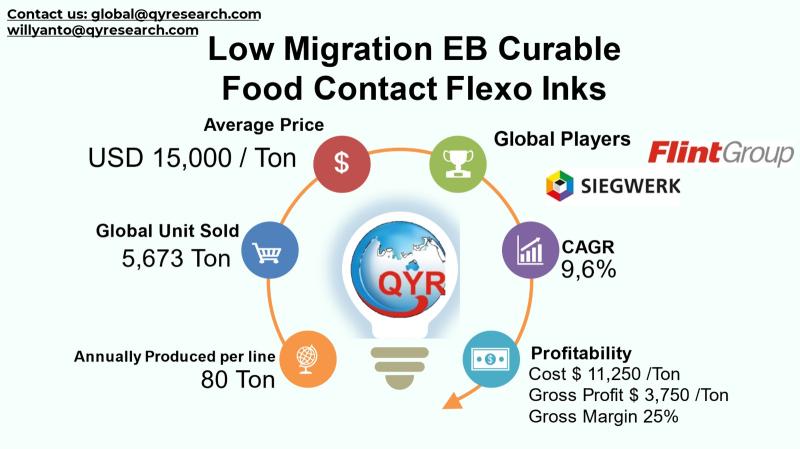

The global Low-Migration Electron Beam (EB) Curable Food Contact Flexo Inks industry encompasses specialized flexographic ink formulations that are designed to minimize chemical migration into food packaging, satisfying stringent regulatory safety standards. These inks cured via electron beam technology eliminate the need for photoinitiators and solvents that could potentially transfer into food or sensitive products, thereby addressing both regulatory and consumer safety concerns. The industry supports a broad range of…

From Flavor to Fortune: Market Dynamics in Global Fruit Syrups Explained

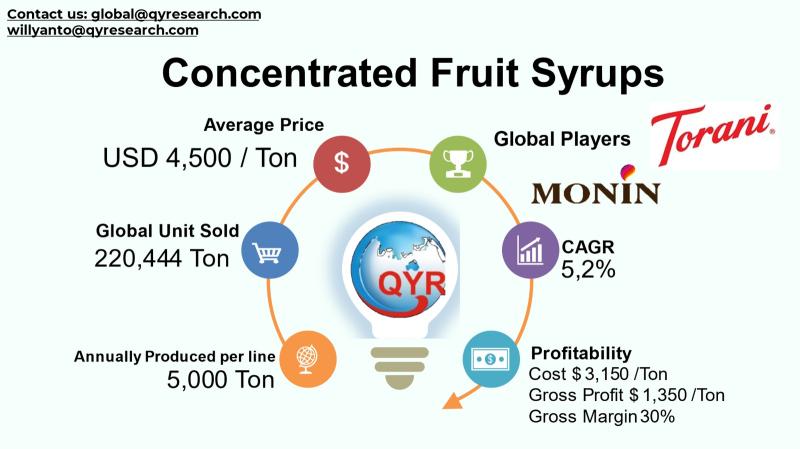

The global concentrated fruit syrups market represents a crucial niche within the broader non-alcoholic concentrated syrup and flavorings industry. These syrups, made by reducing fruit juice to a dense, highly flavorful liquid, serve as key ingredients across beverages, confectionery, bakery, dairy, and sauces, enhancing sweetness, flavor, and product versatility. The industry is influenced by rising consumer demand for natural, clean-label ingredients and the rapid expansion of the global food and…

More Releases for Aerosol

Aerosol Packaging Industry Set for Major Growth (2024-2031) | Aryum Aerosol Cans …

Global Aerosol Packaging Market shares, recent trends, and market player analysis. Asia Pacific dominates the market regions and is expected to register a healthy CAGR over the forecast period 2024-2031.

Aerosol Packaging Market analysis, according to DataM Intelligence, offers more than just an overview, it investigates the underlying aspects of the sector. The study provides an overview, the research explores the hidden aspects of the sector, breaking down its intricate…

Aerosol Delivery Devices Market 2030

The Aerosol Delivery Devices Market stands as a cornerstone within the pharmaceutical and healthcare sectors, offering crucial solutions for managing respiratory disorders. As technological advancements continue to reshape the landscape, the market is poised for substantial growth, catering to diverse patient needs and enhancing treatment efficacy.

Download Sample Report Copy Of This Report From Here: https://www.amecoresearch.com/sample/276740

Key Points and Statistical Data:

• The Global Aerosol Delivery Devices Market is projected to soar from…

Global Aerosol Market Size & Trends

According to a new market research report published by Global Market Estimates, the Global Aerosol Market is projected to grow from USD 95.4 Billion in 2022 to USD 134.8 Billion in 2027 at a CAGR value of 6.4% from 2022 to 2027.

The market is experiencing revenue growth as a result of rising demand from end-use sectors such as personal care and wellness, pharmaceuticals, automotive, and coating. Eco-friendly packaging made…

Aerosol Filling Machines Market to Show Incredible Growth by 2027 Covid-19 Analy …

This informative Aerosol Filling Machines market report covers small bunch of information for a scope of period including from 2021 to 2027. This figure ends up being exceptionally gainful for the forthcoming business sector business people. This information in a factual structure offers numerous modern boundaries that cover speculations, valuing structure, market development rate and deals approach. This Aerosol Filling Machines market report centers around modern solutions at organization level,…

Automatic Aerosol Filling Machine Market Pegged for Robust Expansion by 2027 | R …

This Automatic Aerosol Filling Machine market analysis adds the potential to impact its readers and users as the market growth rate is affected by innovative products, increasing demand of the product, raw material affluence, increasing disposable incomes and altering consumption technologies. It also covers the effect of COVID-19 virus on the growth and development of the market. Market players can study the report briefly before investing in the market and…

Aerosol Propellants Market Disclosing Latest Advancement 2021 to 2027 | Aeropres …

This Aerosol Propellants market report depicts the global market scenario in terms of market size and revenue. Real time market condition and industry data is covered in the report. It begins with a goal to enhance the business strategy. It combines different techniques to help new key players in getting high potential opportunities. These techniques will also guide them in making gainful business decision. Aerosol Propellants market Analysis outlines crucial…