Press release

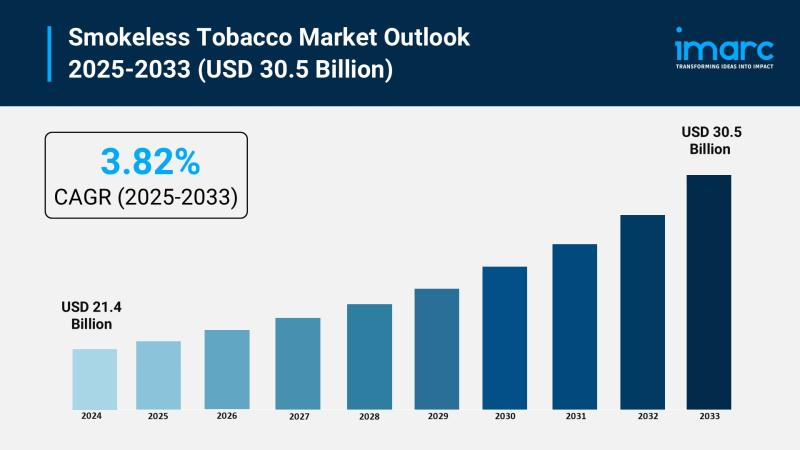

Smokeless Tobacco Market Set to Surge to USD 30.5 Billion by 2033 at a 3.82% CAGR

Market Overview:According to IMARC Group's latest research publication, "Smokeless Tobacco Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global smokeless tobacco market size reached USD 21.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 30.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.82% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Smokeless Tobacco Market

● AI optimizes nicotine extraction processes in smokeless tobacco production, improving product consistency by 15% while reducing waste through precision manufacturing techniques.

● Smart analytics help manufacturers track consumer preferences for flavored products, with 85.6% of users preferring mint and fruit flavors according to 2024 Youth Tobacco Survey data.

● Companies leverage AI for regulatory compliance monitoring, ensuring adherence to packaging and labeling requirements across different markets, supporting the 22.4% daily user base.

● AI-driven supply chain management reduces inventory costs by 12% and ensures timely distribution to tobacco stores, which account for 44.7% of market share.

● Machine learning algorithms enhance product development for nicotine pouches, with shipment volumes growing 32% in Q1 2024, driving innovation in tobacco-free alternatives.

Download a sample PDF of this report: https://www.imarcgroup.com/smokeless-tobacco-market/requestsample

Key Trends in the Smokeless Tobacco Market

● Rising Health Perception as Safer Alternative: Consumers increasingly view smokeless tobacco as a safer option than traditional smoking, driven by awareness that it doesn't produce second-hand smoke. The World Health Organization reports smoking causes over 70% of COPD cases in developed countries, pushing users toward smokeless alternatives for discrete consumption in smoke-free environments.

● Product Innovation and Flavor Diversification: Continuous R&D investments are expanding product offerings with nicotine pouches leading innovation. Sales for nicotine pouches surged 32% in Q1 2024, with flavors like mint, berry, and coffee attracting younger demographics. Swedish companies are introducing new Black Cherry and Citrus Cooling variants priced at £5.50.

● Regulatory Advantages and Taxation Benefits: Smokeless tobacco products face lower taxes compared to cigarettes in many regions, making them cost-effective alternatives. Countries like Malaysia implemented the Control of Smoking Products for Public Health Act 2024, emphasizing proper registration while maintaining favorable conditions for smokeless tobacco growth.

● Cultural Acceptance and Regional Preferences: Strong cultural integration drives consumption, particularly in Asia Pacific which holds 37.5% market share. Countries like India show 21.4% adult usage rates, while Scandinavia leads European consumption with Sweden reporting 30% male population using snus products.

● Digital Distribution and Accessibility: Online retail channels are expanding market reach, complementing traditional tobacco stores that dominate with 44.7% market share. E-commerce platforms provide convenient access to diverse product ranges, supporting the 84.4% oral route consumption preference.

Growth Factors in the Smokeless Tobacco Market

● Shift from Smoking to Smokeless Alternatives: Health-conscious consumers are switching from combustible tobacco, with 1.8% (480,000) students using nicotine pouches according to 2024 National Youth Tobacco Survey. This transition supports market growth as users seek less harmful nicotine delivery methods.

● Increasing Disposable Income in Emerging Markets: Rising economic prosperity in developing countries drives smokeless tobacco adoption. Asia Pacific's dominance with 37.5% market share reflects growing purchasing power, particularly in India and Bangladesh where traditional products like gutka and khaini remain popular.

● Product Dominance: leads the market with 54.6% share due to convenience, quick nicotine absorption, and cultural acceptance. Its fine texture allows rapid nicotine delivery, appealing to users seeking discreet and immediate satisfaction across diverse regional preferences.

● Dry Form Market Leadership: The dry form represents the highest market share due to longer shelf life, cost-effectiveness, and convenience. Its lightweight, compact packaging appeals to consumers seeking portable options without moisture-related spoilage risks, ensuring consistent product quality.

● Strategic Industry Investments: Major players like Altria Group and British American Tobacco are expanding portfolios through innovation and marketing. Companies focus on harm-reduction alternatives while maintaining compliance with evolving regulations, supporting sustained market development.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=6887&flag=E

Leading Companies Operating in the Global Smokeless Tobacco Industry:

● Altria Group Inc.

● British American Tobacco plc

● DS Group

● Imperial Brands PLC

● Japan Tobacco Inc.

● Mac Baren Tobacco Company A/S

● Swedish Match AB

● Swisher

Smokeless Tobacco Market Report Segmentation:

Breakup By Type:

● Chewing Tobacco

● Dipping Tobacco

● Dissolvable Tobacco

● Others

accounts for the majority of shares with 54.6% market share on account of its convenience, rapid nicotine absorption, and strong cultural acceptance.

Breakup By Form:

● Dry

● Moist

Dry dominates the market due to its ease of use, longer shelf life, and cost-effectiveness.

Breakup By Route:

● Oral

● Nasal

Oral dominates the market with 84.4% share due to convenience, discreet usage, and efficient nicotine delivery.

Breakup By Distribution Channel:

● Supermarkets and Hypermarkets

● Tobacco Stores

● Online Stores

● Others

Tobacco stores lead the market with 44.7% share due to specialized expertise, wide product selection, and personalized shopping experience.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Asia Pacific enjoys the leading position with over 37.5% market share owing to high consumption rates, cultural acceptance, and large population base.

Recent News and Developments in Smokeless Tobacco Market

● January 2025: Scandinavian Tobacco Group UK (STG) expanded its XQS nicotine pouch range with new Black Cherry and Citrus Cooling flavors, priced at £5.50, enhancing the fast-growing XQS brand launched in May 2024.

● Q1 2024: Global nicotine pouch shipment volumes surged 32% year-over-year, driven by increasing consumer adoption and product innovation in tobacco-free alternatives.

● 2024: Malaysia implemented the Control of Smoking Products for Public Health Act 2024, establishing comprehensive regulations for tobacco product registration, sale, packaging, and labeling while prohibiting sales to minors.

● 2024: The National Youth Tobacco Survey revealed that 1.8% (480,000) of students use nicotine pouches, with 22.4% being daily users and 85.6% preferring flavored options, particularly mint and fruit variants.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Smokeless Tobacco Market Set to Surge to USD 30.5 Billion by 2033 at a 3.82% CAGR here

News-ID: 4174722 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Tobacco

Hookah Tobacco Market Scenario: What strengthening In Key Areas| Haze Tobacco, U …

Latest Study on Industrial Growth of Global Hookah Tobacco Market 2023-2029. A detailed study accumulated to offer the Latest insights about acute features of the Hookah Tobacco market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends…

Narghile Tobacco Market Trends, Insights to 2028 | Starbuzz, Eastern Tobacco, Cl …

Latest Study on Industrial Growth of Narghile Tobacco Market 2023-2029. A detailed study accumulated to offer Latest insights about acute features of the Narghile Tobacco market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…

Tobacco Products Market Shaping From Growth To Value | Imperial Tobacco, Gulbaha …

The Latest survey report on COVID-19 Outbreak-Global Tobacco Products Market sheds lights on changing dynamics in Food & Beverages Sector and elaborates market size and growth pattern of each of COVID-19 Outbreak- Tobacco Products segments. As the shift to value continues, the producers are tackling challenges to personalized nutrition and match taste profiles. A wide list of manufactuerers were considered in the survey; to include mix bag of leaders and…

Top Trends in Tobacco and Anti-Smoking Products Market | Phillip Morris, British …

A new research document is added in HTF MI database of 41 pages, titled as 'Top Trends in Tobacco and Anti-Smoking Products 2020' with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like Inperial Tobacco, KT&G, Sweedish Match, Juul etc. and important players/vendors such as North America, Europe, Asia-Pacific, South America, Middle East and Africa. The Study will help you gain market insights,…

Shisha Tobacco Market Distribution Channel with Current Trend 2019: Fumari, INC, …

Global shisha tobacco market is highly fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. The report includes market shares of shisha tobacco market for global, Europe, North America, Asia Pacific, South America and Middle East & Africa.

This report studies the Global Shisha Tobacco Market size, industry status and forecast,…

Advanced Technologies| Smoking Tobacco in Denmark, 2019: STGD, Mac Baren Tobacco …

Researchmoz added Most up-to-date research on "Smoking Tobacco in Denmark, 2019" to its huge collection of research reports.

Smoking Tobacco in Denmark, 2019

Summary

"Smoking Tobacco in Denmark, 2019", is an analytical report by GlobalData that provides extensive and highly detailed current and future market trends in the Danish tobacco market. It covers market size and structure along with per capita and overall consumption. Additionally, it focuses on brand data, retail pricing, prospects,…