Press release

eSIM Market Size, Share, Growth And Trends Report 2025-2033

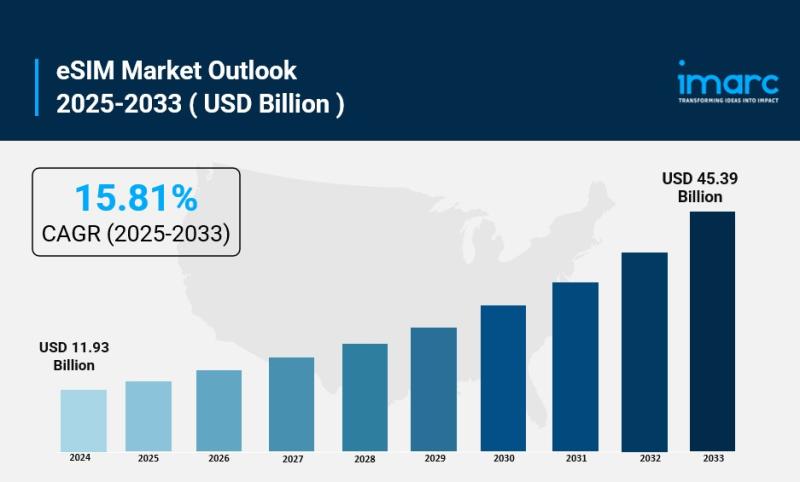

eSIM Market Size and Outlook 2025 to 2033:The global eSIM market size reached USD 11.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 45.4 Billion by 2033, exhibiting a CAGR of 15.81% during 2025-2033. The market is experiencing unprecedented growth driven by the rapid expansion of IoT ecosystems, increasing smartphone penetration, growing adoption of connected vehicles, and the rising demand for seamless connectivity solutions across multiple devices and networks.

Key Stats for eSIM Market:

• eSIM Market Value (2024): USD 11.9 Billion

• eSIM Market Value (2033): USD 45.4 Billion

• eSIM Market Forecast CAGR: 15.81%

• Leading Segment in eSIM Market in 2024: Consumer Electronics (52.3%)

• Key Regions in eSIM Market: North America, Europe, Asia Pacific, Latin America, Middle East and Africa

• Top Companies in eSIM Market: AT&T Inc., IDEMIA, Giesecke+Devrient GmbH, Infineon Technologies AG, Kigen, KORE Wireless, STMicroelectronics, Thales Group, Trasna, Valid S.A., Apple Inc., Samsung Electronics, Qualcomm Inc.

Request Sample Report: https://www.imarcgroup.com/esim-market/requestsample

Why is the eSIM Market Growing?

The eSIM market is experiencing explosive growth as digital transformation accelerates across industries and consumers demand more flexible, secure connectivity solutions. The technology eliminates the need for physical SIM cards, enabling remote provisioning and multiple network profiles on a single device. With over 2.4 billion devices expected to feature eSIM connectivity by 2025, compared to just 36 million in 2019, the market is witnessing unprecedented adoption rates.

Consumer electronics manufacturers are driving significant growth, with major smartphone brands like Apple, Samsung, and Google making eSIM standard across their premium device lineups. The automotive industry represents another massive growth driver, as connected car sales surge with manufacturers integrating eSIM technology for navigation, entertainment, emergency services, and over-the-air software updates. Tesla alone has deployed eSIMs in over 2 million vehicles globally, demonstrating the technology's reliability and scalability.

The rollout of 5G networks worldwide is creating new opportunities for eSIM adoption, particularly in IoT applications where devices need to connect to multiple networks seamlessly. Industrial IoT deployments are accelerating, with logistics companies using eSIM-enabled tracking devices that can switch between carriers automatically as shipments cross borders, eliminating connectivity interruptions and reducing operational complexity.

Enterprise adoption is surging as companies recognize eSIM's ability to simplify device management, reduce procurement costs, and enhance security through remote provisioning capabilities. Major enterprises report 40-60% cost savings on device deployment and management when switching from traditional SIM cards to eSIM solutions, while significantly reducing the time required for activating new devices from days to minutes.

AI Impact on the eSIM Market:

Artificial intelligence is revolutionizing the eSIM ecosystem by enabling intelligent network selection, predictive connectivity management, and automated provisioning processes that optimize performance and user experience. AI-powered eSIM management platforms analyze real-time network conditions, device usage patterns, and cost structures to automatically switch between carriers and data plans, ensuring optimal connectivity at the lowest cost.

Machine learning algorithms are enhancing eSIM security by detecting anomalous usage patterns, identifying potential fraud attempts, and automatically implementing protective measures without user intervention. These systems can process millions of connection events daily, identifying threats that would be impossible to detect through traditional monitoring methods.

AI-driven analytics platforms help mobile network operators optimize their eSIM offerings by analyzing customer behavior, predicting churn risk, and personalizing service recommendations. These insights enable carriers to develop targeted retention strategies and create customized data plans that better meet individual customer needs, resulting in higher customer satisfaction and reduced acquisition costs.

Smart device manufacturers are leveraging AI to enhance eSIM functionality through intelligent connectivity management that learns user preferences and automatically configures optimal network settings based on location, time of day, and application usage patterns. This creates seamless user experiences while maximizing battery life and data efficiency.

Predictive maintenance powered by AI helps eSIM service providers identify potential connectivity issues before they impact users, enabling proactive network optimization and reducing service disruptions. These systems analyze network performance data, device behavior, and environmental factors to predict and prevent connectivity problems.

Segmental Analysis:

Analysis by Type:

• Data-Only eSIM

• Voice, SMS and Data eSIM

Voice, SMS and Data eSIM solutions dominate the market with a 67.8% share, providing comprehensive communication capabilities that make them ideal for consumer devices like smartphones, tablets, and smartwatches where users need full-featured connectivity.

Analysis by Solution:

• Hardware

• Connectivity Services

Connectivity services lead the market with a 58.4% share, as mobile network operators and service providers generate recurring revenue through data plans, roaming services, and managed connectivity solutions that support the growing ecosystem of eSIM-enabled devices.

Analysis by Application:

• Connected Car

• Smartphone and Tablet

• Wearable Device

• M2M (Machine-to-Machine)

• Others

Smartphone and tablet applications command the largest market segment at 43.7%, driven by major manufacturers adopting eSIM as standard technology and consumers embracing the convenience of managing multiple carrier profiles digitally without physical SIM card swapping.

Analysis by Industry Vertical:

• Automotive

• Consumer Electronics

• Manufacturing

• Telecommunication

• Transportation and Logistics

• Others

Consumer electronics dominates with a 52.3% market share, as smartphone, tablet, smartwatch, and laptop manufacturers integrate eSIM technology to offer users enhanced flexibility, improved device design, and seamless connectivity experiences.

Analysis of eSIM Market by Regions

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East and Africa

North America leads the global eSIM market with a 38.9% share, supported by advanced telecommunications infrastructure, high smartphone penetration rates, early 5G deployment, and strong consumer adoption of connected devices and IoT applications across both enterprise and consumer segments.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=5336&flag=C

What are the Drivers, Restraints, and Key Trends of the eSIM Market?

Market Drivers:

The eSIM market is propelled by powerful technological and business forces that are reshaping how devices connect to networks worldwide. The explosive growth of IoT deployments drives significant demand, with billions of connected devices requiring flexible, secure connectivity that traditional SIM cards cannot efficiently provide. Manufacturing companies are adopting eSIM-enabled sensors and equipment monitoring systems that can connect to multiple networks automatically, ensuring continuous operations even when primary networks fail.

Consumer demand for device miniaturization and enhanced functionality is accelerating eSIM adoption, as manufacturers can eliminate SIM card slots to create thinner devices with improved water resistance and additional space for batteries or features. The global shift toward 5G networks creates new opportunities, with eSIM technology enabling devices to access multiple 5G carriers seamlessly and take advantage of network slicing capabilities for optimized performance.

Cost reduction pressures drive enterprise adoption, as companies can eliminate the logistics complexity of managing physical SIM inventories, reduce device activation times, and centrally manage connectivity policies across global deployments. Environmental sustainability initiatives favor eSIM technology, which eliminates plastic SIM card production and reduces electronic waste associated with SIM card replacements and upgrades.

Government digitization initiatives worldwide are creating regulatory frameworks that support eSIM adoption, with countries like India mandating eSIM support for new device approvals and the European Union promoting eSIM technology as part of digital sovereignty initiatives.

Market Restraints:

The market faces implementation challenges that can slow adoption in certain segments and regions. Network infrastructure limitations in developing markets may restrict eSIM functionality, as remote provisioning requires robust internet connectivity and carrier support systems that may not be universally available. Legacy device ecosystems create compatibility challenges, particularly in enterprise environments where existing hardware investments make immediate eSIM migration financially challenging.

Security concerns about over-the-air provisioning and remote SIM management create hesitation among some enterprises and consumers, particularly in industries with strict data protection requirements. Regulatory variations between countries create complexity for global deployments, as different markets have varying eSIM standards and approval processes that manufacturers must navigate.

Consumer awareness and education gaps limit adoption, as many users remain unfamiliar with eSIM benefits and capabilities, preferring familiar physical SIM card experiences. Technical complexity in multi-carrier environments can create user experience challenges, particularly when devices need to switch between networks or manage multiple active profiles simultaneously.

Market Key Trends:

Transformative trends are revolutionizing the eSIM landscape toward more intelligent, integrated, and user-centric solutions. The emergence of iSIM (integrated SIM) technology represents the next evolution, embedding SIM functionality directly into device processors for even greater miniaturization and enhanced security. Early implementations show iSIM reducing component costs by 70% while improving tamper resistance.

Multi-profile management is becoming sophisticated, with devices supporting 10 or more carrier profiles simultaneously and AI-powered algorithms automatically selecting optimal networks based on cost, performance, and application requirements. Enterprise mobility management platforms now integrate eSIM provisioning with device management systems, enabling IT departments to control connectivity policies alongside security and application management.

Cross-industry partnerships are expanding eSIM ecosystems, with automotive manufacturers partnering with telecommunications providers to offer integrated connectivity services, and consumer electronics brands collaborating with travel companies to provide automatic international roaming solutions. Blockchain technology is being explored for secure eSIM profile management, potentially enabling decentralized carrier switching without traditional network operator control.

Sustainability-focused implementations are growing, with manufacturers using eSIM technology to create circular economy models where devices can be easily repurposed across different markets and use cases through remote provisioning. Edge computing integration enables eSIM-equipped devices to make intelligent connectivity decisions locally, reducing network dependency and improving response times for critical applications.

Leading Players of eSIM Market:

According to IMARC Group's latest analysis, prominent companies shaping the global eSIM landscape include:

• AT&T Inc.

• IDEMIA

• Giesecke+Devrient GmbH

• Infineon Technologies AG

• Kigen

• KORE Wireless

• STMicroelectronics

• Thales Group

• Trasna

• Valid S.A.

• Apple Inc.

• Samsung Electronics

• Qualcomm Inc.

• Gemalto (Thales)

• NTT Communications

These leading providers are expanding their footprint through strategic partnerships, technological innovation, and comprehensive platform development to meet growing demand from automotive manufacturers, consumer electronics companies, IoT solution providers, and enterprise customers seeking reliable, secure, and scalable eSIM solutions.

Key Developments in eSIM Market:

• February 2025: Apple announced the expansion of its eSIM ecosystem to support dual eSIM functionality across all iPhone models globally, enabling users to maintain separate business and personal lines without physical SIM cards. The update includes enhanced carrier switching capabilities and improved international roaming management through Apple's unified platform. Early adoption data shows 78% user satisfaction rates with the simplified carrier switching process.

• January 2025: Qualcomm Technologies unveiled its next-generation Snapdragon X80 5G modem featuring integrated iSIM technology that embeds SIM functionality directly into the chipset. The solution reduces component costs by 65% while improving security and enabling manufacturers to create even thinner device designs. Major smartphone manufacturers have committed to incorporating the technology in devices launching throughout 2025.

• December 2024: BMW Group announced the deployment of eSIM technology across its entire vehicle lineup, enabling seamless connectivity for navigation, entertainment, and safety services in over 40 countries. The implementation includes partnerships with multiple mobile network operators to ensure optimal coverage and automatic carrier switching based on location and network performance. The system has processed over 500 million connectivity switches since launch.

• November 2024: GSMA released the final specification for SGP.32, the IoT eSIM standard that streamlines device management for industrial applications. The specification enables simplified device onboarding, remote carrier switching, and enhanced security protocols specifically designed for machine-to-machine communications. Over 150 IoT device manufacturers have committed to supporting the new standard in their 2025 product releases.

• October 2024: Google introduced enhanced eSIM management capabilities in Android 15, featuring AI-powered network selection that automatically chooses optimal carriers based on location, usage patterns, and cost considerations. The platform integrates with Google's travel services to provide automatic international roaming solutions and transparent pricing information. Beta testing demonstrates 45% average cost savings on international data usage through intelligent carrier selection.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release eSIM Market Size, Share, Growth And Trends Report 2025-2033 here

News-ID: 4174719 • Views: …

More Releases from IMARC Group

India Digital Health Market is Expected to Reach USD 84,076.5 Million by 2034 | …

Introduction

According to IMARC Group's report titled "India Digital Health Market Size, Share, Trends and Forecast by Type, Component, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including India digital health market share, growth, trends, and regional insights.

How Big is the India Digital Health Market?

The India digital health market size reached USD 19,145.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 84,076.5…

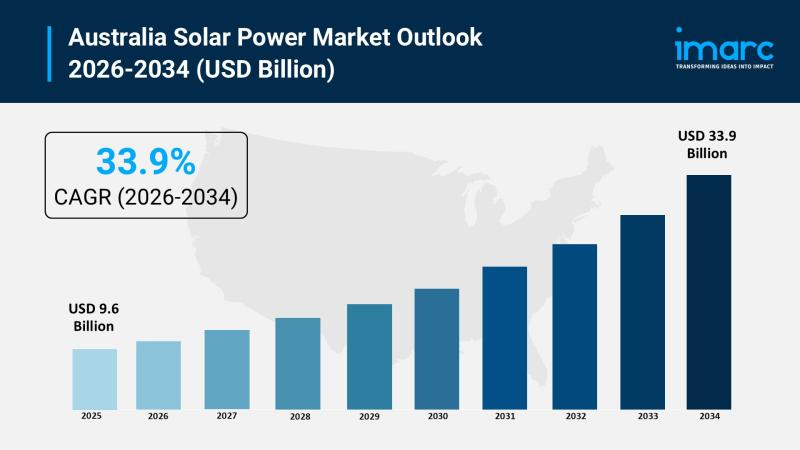

Australia Solar Power Market 2026 | Projected to Reach USD 33.9 Billion by 2034

Market Overview

The Australia solar power market reached USD 9.6 Billion in 2025 and is forecast to grow to USD 33.9 Billion by 2034. The market exhibits a robust growth rate of 15.00% during the forecast period 2026-2034. This expansion is driven by supportive government policies, technological advancements, and increasing adoption across residential, commercial, and utility sectors, positioning solar energy as a cornerstone of Australia's clean energy future.

Grab a sample PDF…

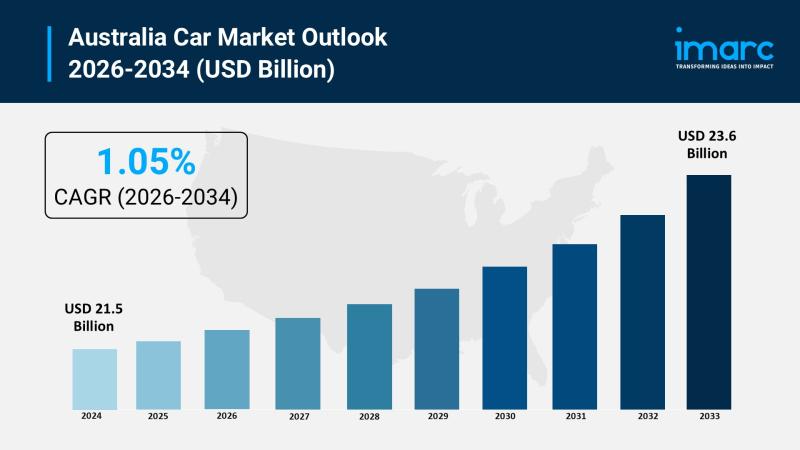

Australia Car Market 2026 | Surge to Grow to USD 23.6 Billion by 2034

Market Overview

The Australia car market reached a size of USD 21.5 Billion in 2025 and is forecasted to grow to USD 23.6 Billion by 2034. The market is expected to expand at a CAGR of 1.05% throughout the forecast period from 2026 to 2034. Growth is driven primarily by increasing demand for electric vehicles, SUVs, and connected car technologies, spurred by environmental awareness, lifestyle changes, and technological innovation toward sustainable…

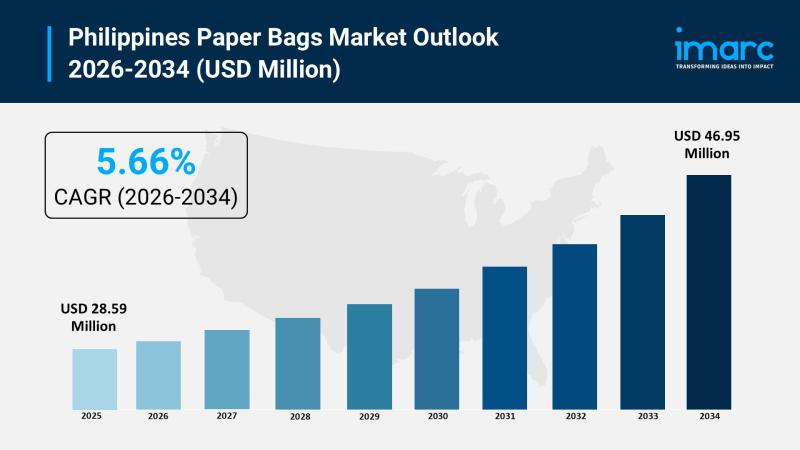

Philippines Paper Bags Market 2026 | Expected to Reach USD 46.95 Million by 2034

Market Overview

The Philippines paper bags market size was valued at USD 28.59 Million in 2025 and is expected to reach USD 46.95 Million by 2034, with a growth rate of 5.66% CAGR from 2026 to 2034. This growth is driven by increasing environmental concerns, government bans on single-use plastics, and rising adoption by retailers and foodservice providers. The expanding food and beverage sector, coupled with heightened awareness of plastic pollution,…

More Releases for SIM

TM SIM Registration 2026 - Register Your TM SIM Online

TM SIM registration is mandatory in the Philippines under the SIM Registration Act. If your TM SIM is not registered, it may get deactivated, which means no calls, no texts, and no mobile data. Many users face issues during registration because they don't understand the process properly or miss small requirements.

I've personally gone through the SIM registration TM https://tmsimsregister.com/ process, checked official portals, and reviewed common user problems.…

Embedded SIM IC Market

Embedded SIM IC Market Overview

Embedded SIM chip refers to embedding the SIM card into the device and updating its configuration through wireless remote download. Compared with the traditional pluggable SIM card, the embedded SIM card greatly reduces the card space on the device, and its volume is reduced to 10% of the traditional SIM card. In addition, it is directly embedded in the device in form, realizing the card-free nature…

E-SIM Card (Embedded SIM) Market Size, Share, Growth & Trends, Analysis by 2029

This comprehensive report thoroughly assesses various regions, estimating the volume of the global E-SIM Card (Embedded SIM) market within each region during the projected timeframe. The report is meticulously crafted and includes valuable information on the current market status, historical data, and projected outlook. Furthermore, it presents a detailed market analysis, segmenting it based on regions, types, and applications. The report closely monitors key trends that play a crucial role…

E-Sim Market

According to the Market Statsville Group, the global e-sim market size is expected to grow from USD 702.2 million in 2021 to USD 6673.8 million by 2030, at a CAGR of 32.5% from 2022 to 2030. Embedded Subscriber Identity Module (eSIM) or Embedded Universal Integrated Circuit Card (eUICC) is a reprogrammable chip that can be soldered or removed. It's a small chip that the user uses to verify their identity…

MRRSE : Current Market Scenario of E-SIM Card Market |Key Players - Apple Inc., …

An insightful study, titled “E-SIM Card Market” has been freshly broadcasted to the vast research repository of Market Research Reports Search Engine (MRRSE). The research study provides detailed comprehensions and forecasts future growth of the global market with an in-depth study of the factors impacting revenue growth throughout the mentioned forecast period. Further, a deep analysis on the major players from diverse regions is also present in the report.

Get Report…

E-SIM Card Market |Key Players - Apple Inc., Samsung, Gemalto NV, Giesecke & Dev …

An insightful study, titled “E-SIM Card Market” has been freshly broadcasted to the vast research repository of Market Research Reports Search Engine (MRRSE). The research study provides detailed comprehensions and forecasts future growth of the global market with an in-depth study of the factors impacting revenue growth throughout the mentioned forecast period. Further, a deep analysis on the major players from diverse regions is also present in the report.

Get Free…