Press release

Remotely Operated Vehicle Market to Reach USD 181 Million by 2031 Top 10 Company Globally

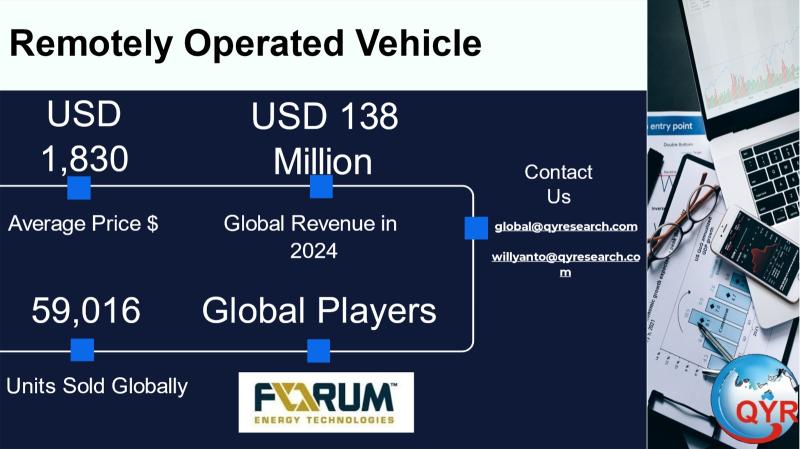

Remotely operated vehicles (ROVs) are tethered robotic platforms controlled from the surface and used for underwater inspection, intervention, construction support, scientific research, aquaculture monitoring and defense/surveillance tasks; they range from small consumer/inspection mini-ROVs to observation/inspection-class systems and heavy work-class ROVs capable of deepwater manipulation and tooling. The industry is function-driven: buyers choose tiny, low-cost inspection units to perform visual checks on shallow structures and aquaculture pens, inspection-class systems for detailed NDT-survey and cable/pipeline work, and work-class systems for heavy intervention such as valve turning, subsea construction, trenching and decommissioning. ROVs are sold as systems (vehicle + umbilical + topside control unit + tooling), as rental/contract services, and as integrated subsea solutions where fleet management, tooling packages and vessel mobilization are part of the commercial proposition. Technical differentiation across the product spectrum includes depth rating, thruster power and type (electric vs hydraulic), manipulator capability, integrated sonar and camera payloads, autonomous assistance (A.I. navigation / sonar interpretation), and fleet-management telematics that optimize utilization.The global remotely operated vehicle market in 2024 is approximately USD 138 million, and a prudent central growth assumption for planning is a CAGR of 3,9% to 2031. Blended average selling price (ASP) for 2024 across the whole ROV market could be placed in the USD 1,830 per unit. Dividing the reconciled USD 138 million 2024 market by that blended ASP implies on the order of 59,016 units sold worldwide in 2024.

Latest Trends and Technological Developments

The ROV sectors recent innovation themes are (a) electrification of work-class systems for lower maintenance and emissions, (b) tighter integration of AUV/ROV hybrid operations and autonomy-assist features, (c) fleet digitization and remote health/telemetry for higher utilization, and (d) expansion of rental-and-service business models that de-risk operator capex for large projects. On March 2025, The Chouest Group announced the acquisition of Kystdesign to bolster its subsea robotics manufacturing capability, signalling strategic consolidation and demand for in-house manufacturing. On June 2025 DeepOcean reported bolstering its subsea robotics fleet by adding eight new ROVs to support broader service offerings, illustrating fleet-expansion investment by service providers. On a larger commercial front, Oceaneerings recent multi-million-dollar subsea robotics contracts in 2025 (including significant Petrobras work) show continued demand for work-class intervention ROV services in deepwater oil and gas and decommissioning work. Industry press and trade coverage in 20242025 also highlight growing interest in electric work-class vehicles (noted in a Workboat article in mid-2025) and hybrid subsea toolchains combining ROVs and AUVs for efficient survey-to-intervention workflows trends that materially influence procurement and fleet planning.

Asia-Pacific is the dominant regional consumption and deployment hub for ROVs when AUV/ROV and offshore IRM markets are combined; multiple regional market reports show APAC commanding the largest share due to heavy offshore activity in China, Southeast Asia and growing offshore wind and oil & gas projects around India, Australia and the Asia-Pacific rim. Large APAC-based fleet operators and integrators (and global players with strong local presence) are investing in regionally based assets, spares and service hubs to shorten mobilization times and comply with local content rules. Country-level signals include Chinas fast-growing inspection and aquaculture ROV adoption, Indias expanding offshore survey activity tied to energy projects, and Japan and Koreas premium market for advanced observation and defense-adapted ROVs. Research that separates AUV+ROV in APAC indicates the region represented roughly 4045%+ of relevant market value in 2024, reinforcing the regions centrality for both equipment sales and high-value ROV services.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5032100

Remotely Operated Vehicle by Type:

Electric - Driven ROV Winches

Hydraulic - Driven ROC Winches

Others

Remotely Operated Vehicle by Application:

Marine Engineering

Military

Scientific Research

Others

Global Top 10 Key Companies in the Remotely Operated Vehicle Market

Ouco

MacGregor

Karui Lifting Equipment Co., Ltd

Forum Energy Technologies

Hawboldt Industries

MacArtney Offshore Solutions

Dromec

Okeanus

HPA Subsea

Dynacon Inc

Regional Insights

ASEAN is an accelerating demand pool driven by offshore energy activity (exploration, production and decommissioning), nascent offshore wind and the rapid expansion of aquaculture and port/underwater infrastructure inspection programs; Indonesia stands out because of its large offshore oil & gas footprint, archipelagic geography that benefits from remote inspection capabilities, and growing adoption of aquaculture ROV systems for fish-pen monitoring. Local market work tenders and service contracts reported to market researchers shows increasing demand for smaller inspection-class ROVs in Indonesias oil & gas and aquaculture sectors while larger-capability intervention ROVs are primarily supplied by global fleet operators on a rental/contract basis. Regional distributors and integrators are expanding reseller networks and local service hubs to support faster turnaround times and lower landed costs; expect ASEAN to remain a strong unit-volume growth area for low- to mid-cost observation-class systems and to show growing rental demand for work-class services on larger projects.

The ROV market faces multiple structural challenges that affect pricing, delivery and adoption. First, heavy dependence on the offshore oil & gas sector creates demand cyclicality: booms in deepwater projects can rapidly lift work-class demand while downturns depress utilization and new-build orders. Second, high equipment capex and long delivery lead times for work-class ROVs plus the costs of tooling and vessel mobilization push many buyers toward rental/service models, compressing straightforward equipment-sales margins. Third, supply-chain complexity especially for specialized hydraulic components, high-reliability umbilicals, fiber-optic topside units and advanced sonar/manipulator payloads can cause delays and escalate costs. Fourth, operational safety and regulatory regimes (flag-state and subsea-operational rules) impose stringent qualification requirements that lengthen sales cycles. Finally, the sector faces a skilled-operator shortage for subsea operations in some markets, which increases the value of service models that include trained crew and fleet-management offerings. These constraints are visible in vendor-quarterly disclosures and industry reports assessing fleet utilization and contract tendering.

Suppliers and investors should prioritize three strategies to capture durable share: build flexible commercial models that combine equipment sales with rental and long-term service contracts to monetize utilization and reduce buyer capex friction; invest in fleet digitalization and remote-health telematics to improve uptime and justify premium day-rates; and expand local service and spare-part footprints in Asia and ASEAN to minimize mobilization time and satisfy local-content expectations on large projects. Product strategies that will win include pushing electrified work-class platforms (to lower maintenance and emissions), modular tooling ecosystems (faster reconfiguration between survey and intervention tasks), and observation-class units optimized for aquaculture, port and infrastructure inspection where recurring unit volumes are stronger and procurement cycles are shorter. For investors, the most attractive avenues are (a) platform providers with long-term contracts and recurring service revenue, (b) rental/service operators with modernized fleets, and (c) metric-based fleet-management software that can be scaled across rented and owned assets.

Product Models

Remotely Operated Vehicles are essential underwater robots used in offshore oil & gas, marine research, defense, and subsea infrastructure inspection. To operate effectively, they rely on ROV winches that deploy and retrieve tether management systems and cables, and lubricating properties.

Electric-Driven ROV Winches which are energy-efficient, low-maintenance, and suitable for smaller work-class or observation-class ROV. Notable products include:

Dynacon Electric Winch Dynacon Inc.: Robust electric ROV winches for light to medium-class subsea tasks.

Schilling Robotics Electric Winch TechnipFMC: Used in Schilling ROV systems for precise cable management.

Rovtech Electric TMS Winch Rovtech Solutions: Lightweight electric winch ideal for inspection ROV tether deployment.

Seascape Subsea Electric Winch Seascape Subsea BV: Compact, portable winch for shallow-water survey-class ROVs.

Innova ROV Electric Winch Innova AS: Norwegian-built electric-driven winch for small work-class ROVs.

Hydraulic-Driven ROV Winches which deliver higher torque and ruggedness, making them ideal for heavy-duty and deepwater ROV operations. Examples include:

Schilling Robotics Hydraulic Winch TechnipFMC: High-performance winch built for deepwater subsea construction ROVs.

Hawboldt Industries Hydraulic Winch Hawboldt Industries: Canadian-built hydraulic winches tailored for offshore oil & gas ROVs.

Innova ROV Hydraulic Winch Innova AS: Hydraulic-driven winches used in deepwater ROV support vessels.

Hawkins Subsea Hydraulic Winch Hawkins Subsea Engineering: Custom-engineered hydraulic winch for offshore survey and pipeline inspection ROVs

Seatec ROV Hydraulic Winches Seatec: Hydraulic winches custom-designed for inspection-class and Survey ROVs adaptable to various operational needs

The ROV market in 2024 is a multi-segment industry bridging consumer/inspection tools, professional observation systems and heavy intervention work-class fleets; our reconciled estimate of about USD 138 million in 2024 with a central CAGR of 3,9% to 2031 reflects equipment sales plus the important rental/service layer that dominates high-value subsea work. Asia-Pacific is the largest regional market by value and fleet activity, while ASEAN (with Indonesia prominent) offers growing unit volumes in inspection-class systems and rising service opportunities for work-class deployments on energy and infrastructure projects. Market winners will be those that combine modern, efficient vehicles with robust service models, local logistics, and digital fleet-management capabilities that improve utilization and margins.

Investor Analysis

what, how and why this benefits investors. What matters is that ROVs are not only capital hardware but increasingly subscription-like assets: long multi-year service contracts, high day-rates for work-class operations and repeatable inspection sales in aquaculture/ports create recurring revenue that de-risks pure-capex exposure. How investors can benefit is by favoring business models with large, modern fleets tied to anchored contract pipelines (e.g., multi-year subsea support contracts), by backing rental/service operators that can scale utilization, or by investing in software/telemetry platforms that capture operational data and create sticky customer relationships. Why this is compelling now is twofold: (1) oil & gas redevelopment, decommissioning and offshore-wind cable work are driving multi-year demand for both survey/inspection and heavy-intervention ROV capacity, and (2) adjacent markets such as aquaculture, port infrastructure and civil-inspection are producing steady high-volume demand for observation-class vehicles that expand unit sales and recurring aftermarket revenue. Key diligence items are fleet utilization rates, contract backlog, vessel-mobilization agreements, spare-parts inventory strategy, and the capex/replacement schedule and associated depreciation profile for heavy ROVs.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5032100

5 Reasons to Buy This Report

It reconciles multiple published market estimates into a defensible 2024 baseline and provides an explicit, transparent CAGR scenario to 2031 so investors and procurement teams can model revenue and unit outcomes reliably.

It translates market dollars into a price-per-unit sensitivity framework and implied unit shipment ranges for 2024, enabling capex and manufacturing planning.

It highlights dated, high-impact commercial and fleet events from 20242025 that materially affect available capacity and day-rates.

It delivers regionally actionable intelligence for Asia and ASEAN (including Indonesia) so go-to-market plans can prioritize local service hubs, rental fleet staging and regulatory compliance.

It profiles the top vendor and operator types manufacturers, fleet owners, software/telemetry providers so acquirers can target the highest-value M&A or partnership candidates.

5 Key Questions Answered

What is a defensible global market size for ROVs in 2024 once equipment and service definitions are reconciled, and what CAGR should be used to 2031 for financial modelling?

What are realistic ASP ranges by ROV class?

Which recent dated company moves and fleet expansions (20242025) will change supply dynamics and day-rate economics in the near term?

How do Asia and ASEAN differ in demand profile and procurement behaviour, and what logistics/service footprint is required to win in Indonesia and neighboring countries?

Which business models create the most predictable cash flow and how should an investor prioritize exposure?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Remotely Operated Vehicle Market to Reach USD 181 Million by 2031 Top 10 Company Globally here

News-ID: 4174633 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for ROV

Observation Mini ROV Market Size 2024 to 2031.

Market Overview and Report Coverage

An Observation Mini ROV, also known as a Remotely Operated Vehicle, is a small underwater robot equipped with cameras and sensors to explore and inspect underwater environments. These compact and maneuverable vehicles are commonly used for various applications such as marine research, offshore oil & gas exploration, and underwater inspections.

The current outlook of the Observation Mini ROV Market is highly promising, with the market…

Global Cable ROV Market Research Report 2023-2029

Cable ROV report published by QYResearch reveals that COVID-19 and Russia-Ukraine War impacted the market dually in 2022. Global Cable ROV market is projected to reach US$ million in 2029, increasing from US$ million in 2022, with the CAGR of % during the period of 2023 to 2029. Demand from Safety Search and Rescue and Pipeline Inspection are the major drivers for the industry.

North America, Europe and Asia Pacific are…

ROV/AUV Video Cameras Market 2022 | Detailed Report

According to Market Study Report, ROV/AUV Video Cameras Market provides a comprehensive analysis of the ROV/AUV Video Cameras Market segments, including their dynamics, size, growth, regulatory requirements, competitive landscape, and emerging opportunities of global industry. An exclusive data offered in this report is collected by research and industry experts team.

Download FREE Sample Report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=5334915

The report provides a comprehensive analysis of company profiles listed below:

- Ageotec

- Argus Remote Systems…

AUV and ROV Market (2021-2025) | Oligopolistic Conditions Pose Challenges for En …

The extraction of oil & gas (O&G) has shifted away from conventional towards subsea sources. The subsea environment is the most remote and unexplored region on the planet and holds limitless resource potential. Numerous challenges must be overcome to extract O&G from undersea methods with autonomous underwater vehicles (AUV) and remotely operated vehicles (ROV) technology entering conversations. AUV’s and ROV’s are deployed for the maintenance, repair, and inspection of offshore…

Global Offshore AUV & ROV Market Research

The Global Offshore AUV & ROV Market is ready to become solid amid the estimate time frame. A portion of the conspicuous patterns that the market is seeing incorporate progressions in electrical engine innovation, flow drift in the sustainable area including the establishment of seaward breeze cultivate locales and expanding vitality utilization.

Get sample copy of report :

https://www.marketdensity.com/contact?ref=Sample&reportid=6261

Table of Contents

1 Offshore AUV & ROV Market Overview

1.1 Product…

Global Observation Mini ROV Market Research Report 2017

Product Description

In this report, the global Observation Mini ROV market is valued at USD XX million in 2016 and is expected to reach USD XX million by the end of 2022, growing at a CAGR of XX% between 2016 and 2022.

Request Report Sample: https://goo.gl/Zn7SxL

Geographically, this report is segmented into several key Regions, with production, consumption, revenue (million USD), market share and growth rate of Observation Mini ROV in these regions,…