Press release

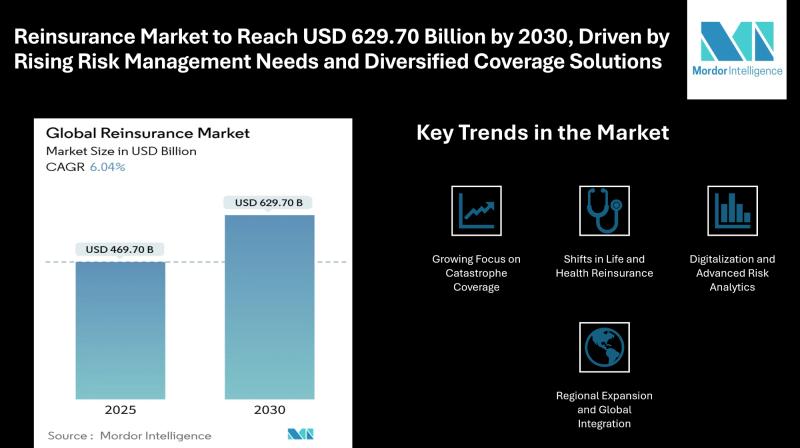

Reinsurance Market to Reach USD 629.70 Billion by 2030, Driven by Rising Risk Management Needs and Diversified Coverage Solutions

Mordor Intelligence has published a new report on the "Reinsurance Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction

The global reinsurance market size was valued at USD 469.70 billion in 2025 and is forecast to climb to USD 629.70 billion by 2030, reflecting a 6.04% CAGR. This growth highlights the importance of reinsurance as insurers worldwide seek stronger balance sheets, broader geographic reach, and tools to manage an expanding spectrum of risks. From natural catastrophes to life expectancy shifts, reinsurance continues to underpin the global insurance ecosystem by providing financial stability and resilience.

The industry's relevance has grown further in the wake of unpredictable climate patterns, emerging health risks, and evolving liability scenarios. These factors are reshaping strategies for both established and regional insurers, making reinsurance a cornerstone of risk transfer mechanisms across lines of business. This press release provides a reinsurance industry overview, covering key trends, segmentation, major players, and long-term outlook.

Report overview: https://www.mordorintelligence.com/industry-reports/global-reinsurance-market?utm_source=openpr

Key Trends in the Reinsurance Market

Growing Focus on Catastrophe Coverage

One of the most visible reinsurance market trends is the heightened demand for catastrophe coverage. Rising frequency and severity of natural disasters-storms, wildfires, and floods, have placed significant pressure on primary insurers. Reinsurers provide a critical backstop by absorbing large-scale losses, enabling insurers to protect solvency while ensuring claims are met.

Shifts in Life and Health Reinsurance

Life and health reinsurance is expanding as demographic changes and medical advancements alter the insurance landscape. Reinsurers are helping insurers manage longer life spans, pandemic-related claims, and the financial risks tied to healthcare costs. This segment also sees increasing use of predictive modeling to price risks more accurately and to structure coverage that balances affordability with protection.

Digitalization and Advanced Risk Analytics

Technology is reshaping how reinsurers assess and manage risks. Data-driven modeling, artificial intelligence applications, and blockchain-enabled contract execution are improving underwriting efficiency and transparency. While traditional methods remain central, the incorporation of digital solutions is allowing for more granular risk assessment, especially in property and casualty reinsurance.

Rise of Alternative Capital and New Structures

Beyond traditional treaties and facultative arrangements, alternative capital sources, such as insurance-linked securities, are entering the picture. This trend diversifies the capital pool available to absorb risk, broadening the appeal of reinsurance for investors seeking exposure to non-correlated assets. It is also pushing reinsurers to innovate product structures and adapt to new forms of competition.

Regional Expansion and Global Integration

Emerging economies are driving new demand for reinsurance, as insurers in regions like Asia-Pacific and Latin America increase penetration rates. Multinational reinsurers are expanding their footprints, while regional players are entering partnerships to access expertise and capital. This cross-border collaboration ensures risk is shared more effectively and mitigates concentration in any single geography.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/global-reinsurance-market?utm_source=openpr

Market Segmentation

The global reinsurance market is structured across several categories, reflecting diverse client needs and risk profiles:

By Reinsurance Type

Facultative

Treaty

By Line of Business

Property and Casualty

Life and Health

Other Specialized Lines

By Distribution Channel

Direct Writing

Broker-Mediated

Each segment plays a distinct role. Facultative reinsurance addresses individual or large-scale risks, offering flexibility, while treaty reinsurance covers entire portfolios, delivering consistency and scale. Property and casualty lines continue to dominate due to the prevalence of catastrophe risks, while life and health reinsurance grows steadily with demographic shifts. Broker-mediated channels remain vital, connecting insurers with global reinsurers, though direct writing retains importance in established relationships.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players in the Reinsurance Market

The reinsurance sector is characterized by a small number of global leaders complemented by regional and specialized providers. Major players include:

Munich Re - A global leader with a broad portfolio spanning life, health, and property reinsurance, leveraging deep expertise and advanced risk modeling.

Swiss Re - Known for its global reach and innovative solutions, Swiss Re continues to expand digital platforms and sustainability-linked coverage.

Hannover Re Group - Focuses on strong partnerships and tailored reinsurance solutions, with an emphasis on efficiency and profitability.

Berkshire Hathaway Inc. - Operates one of the largest reinsurance arms worldwide, with significant capacity to take on large-scale risks across multiple industries.

SCOR SE - A France-based reinsurer with a balanced portfolio across geographies and a strong presence in both life and property reinsurance.

These companies are shaping the reinsurance industry overview, using their capital strength, global reach, and expertise to support insurers in navigating increasingly complex risks. They also continue to explore opportunities in digital solutions, sustainability-linked products, and alternative risk transfer mechanisms.

Explore more insights on reinsurance market competitive landscape: https://www.mordorintelligence.com/industry-reports/global-reinsurance-market/companies?utm_source=openpr

Conclusion

The reinsurance market continues to evolve in response to changing global risk dynamics, economic cycles, and regulatory frameworks. While catastrophe risks remain a significant driver, other factors, including aging populations, healthcare demands, and digital transformation are equally influential in shaping strategies. The industry's ability to adapt to new forms of capital, explore alternative structures, and expand regionally underscores its resilience and long-term relevance.

Looking ahead, reinsurers are expected to deepen their role not just as risk absorbers but as strategic partners for insurers, governments, and businesses. Their capacity to provide stability in uncertain times makes them a cornerstone of the broader financial ecosystem. With expanding demand across geographies and lines of business, the reinsurance sector is positioned to remain vital in supporting the growth and security of global insurance markets.

For complete market analysis, please visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/global-reinsurance-market?utm_source=openpr

Industry Related Reports

Travel Insurance Market: The Global Travel Insurance Market Report is Segmented by Cover Type (Single-Trip Travel Insurance, Annual Multi-Trip Travel Insurance, and More), Distribution Channel (Insurance Companies, Insurance Intermediaries, and More), End User/Traveller Type (Family Travellers, Business Travellers, and More), and Geography (North America, Europe, Asia-Pacific, and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/travel-insurance-market?utm_source=openpr

Insurtech Market: The Insurtech Market is Segmented by Product Line (Insurance Type) (Life Insurance, Health Insurance, and More), Distribution Channel (Direct-To-Consumer (D2C) Digital, Aggregators/Marketplaces, and More), End User (Retail/Individual, SME/Commercial, and More), and Geography (North America, South America, and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/global-insurtech-market?utm_source=openpr

Specialty Insurance Market: The Global Specialty Insurance Market is Segmented by Type (Marine, Aviation, and Transport (MAT), Political Risk and Credit Insurance, Entertainment & Media Insurance, and More), End-User (Large Enterprises, Small & Medium Enterprises (SMEs), and High-Net-Worth Individuals), Distribution Channel (Direct-To-Consumer (DTC), Intermediated, and Embedded), and Geography.

Get more insights: https://www.mordorintelligence.com/industry-reports/specialty-insurance-market?utm_source=openpr

Livestock Insurance Market: The Global Livestock Insurance Market is Segmented by Type (Commercial Mortality, Non-Commercial Mortality), Application (Dairy, Cattle, Swine, Poultry, and More), Distribution Channel (Direct To Customer, Intermediated, and Embedded), and Region (North America, Europe, Asia-Pacific, Middle East and Africa, South America).

Get more insights: https://www.mordorintelligence.com/industry-reports/livestock-insurance-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Raja Pushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Reinsurance Market to Reach USD 629.70 Billion by 2030, Driven by Rising Risk Management Needs and Diversified Coverage Solutions here

News-ID: 4173213 • Views: …

More Releases from Mordor Intelligence

Corn Starch Market Size to Reach USD 40.25 Billion by 2031 as Clean-Label Demand …

Corn Starch Market Overview and Growth Forecast

According to a research report by Mordor Intelligence, the global corn starch market size is projected to grow from USD 30.12 billion in 2026 to USD 40.25 billion by 2031, registering a CAGR of 6.89% during the forecast period. The latest corn starch market forecast reflects expanding demand across food processing, pharmaceuticals, personal care, and industrial bio-based applications.

The Corn Starch Industry benefits from rising…

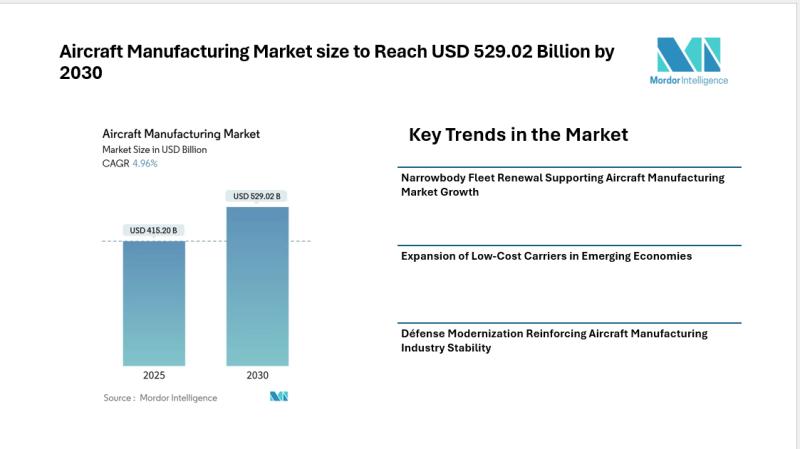

Aircraft Manufacturing Market size to Reach USD 529.02 Billion by 2030 Amid Flee …

Market Overview

According to Mordor Intelligence, the aircraft manufacturing market size was valued at USD 415.2 billion in 2025 and is projected to reach USD 529.02 billion by 2030, reflecting steady aircraft manufacturing market growth at a CAGR of 4.96% during the forecast period. The aircraft manufacturing industry is witnessing sustained demand supported by commercial fleet renewal, defence procurement programs, and ongoing investments in next-generation propulsion platforms.

The aircraft manufacturing…

Corn Oil Market Size to Reach USD 8.77 Billion by 2030 as Health-Focused Reformu …

Corn Oil Market Forecast and Industry Outlook

The global corn oil market size is projected to grow from USD 6.29 billion in 2025 to USD 8.77 billion by 2030, registering a CAGR of 6.76% during the forecast period. The latest corn oil market forecast reflects rising demand from health-conscious food manufacturers, expanding renewable diesel production, and increasing use in high-temperature frying applications.

The corn oil industry is benefiting from its neutral flavor…

Educational Consulting and Training Market to Reach USD 144.14 Billion by 2031 A …

Mordor Intelligence has published a new report on the educational consulting and training market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Educational Consulting and Training Market Overview

According to Mordor Intelligence, the educational consulting and training market size is estimated at USD 81.72 billion in 2026, growing from USD 72.93 billion in 2025, and projected to reach USD 144.14 billion by 2031, registering a 12.02% CAGR.…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…