Press release

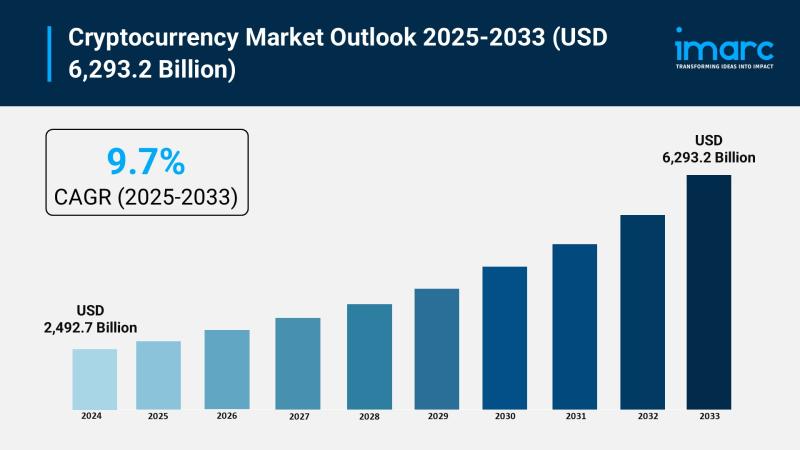

Cryptocurrency Market Size to Hit USD 6,293.2 Billion in 2033 | Grow CAGR by 9.7%

Market Overview:The cryptocurrency market is experiencing rapid growth, driven by regulatory clarity boosting confidence, institutional adoption and integration, and surge in Stablecoins and DeFi. According to IMARC Group's latest research publication, "Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033", the global cryptocurrency market size reached USD 2,492.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6,293.2 Billion by 2033, exhibiting a growth rate (CAGR) of 9.7% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/cryptocurrency-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Cryptocurrency Market

● Regulatory Clarity Boosting Confidence

You know, one big thing pushing the cryptocurrency world forward right now is clearer regulations from governments, which is making everyone feel a bit more secure about jumping in. Take the Stablecoin Trust Act in the US-it's set to create federal licenses for stablecoin issuers, with tough rules on reserve transparency to prevent mishaps. This kind of framework is encouraging more players to enter the space without fearing crackdowns. For instance, countries like India and the US top the global crypto adoption index, with places like Pakistan, Vietnam, and Brazil not far behind, showing how policy support drives usage. Stats-wise, around 24% of folks in the UK report owning crypto, a solid jump that reflects growing trust. Companies are responding too; think of how firms like Gemini are highlighting these shifts in their reports. Overall, this regulatory push is cutting down risks and opening doors for mainstream integration, fueling broader acceptance and investment.

● Institutional Adoption and Integration

It's exciting to see big institutions really embracing crypto, which is a huge driver for the industry's expansion. Major players like traditional banks are setting up dedicated crypto trading desks and custody services, blending old-school finance with blockchain tech. For example, partnerships between companies such as Dell and Nutanix might not be crypto-specific, but they echo the tech infrastructure supporting this shift-wait, actually, in crypto, we've got firms like Kraken pointing out how DeFi is merging with traditional finance institutions. The total market cap sits at about $2.78 trillion, underscoring this massive influx of capital. Government schemes play a role too; in the US, friendlier policies toward tokenization are attracting companies, with advisors like Bessent noting how it improves financial services. Real-world news includes Bitcoin stabilizing around $112,000 to $116,000, drawing in more investors. This institutional wave isn't just hype-it's bringing stability, liquidity, and credibility, making crypto a go-to asset class for serious money.

● Surge in Stablecoins and DeFi

Stablecoins and decentralized finance, or DeFi, are exploding and really powering crypto's growth by offering practical, everyday uses beyond just speculation. Stablecoins alone have hit a market cap of around $400 billion, providing a steady bridge between fiat and crypto for things like payments and remittances. Governments are getting involved; schemes like the US's upcoming stablecoin regulations ensure better oversight, which boosts adoption. On the company side, outfits like Mastercard are eyeing bank blockchains to unlock cash deposits through crypto, while RBL Bank in India partnered with Nutanix for agile cloud setups that support digital banking via HCI-tying into broader DeFi efficiency. Stats show high remittance charges in traditional systems are pushing people toward crypto's transparency and low costs. In places like Nigeria, ranking sixth in global adoption, this is evident. DeFi's integration with real-time analytics and scalable platforms is simplifying finance, cutting hardware needs, and driving efficiency gains that attract users worldwide.

Key Trends in the Cryptocurrency Market

● AI Integration in Crypto Platforms

One trend that's really taking off in the crypto space is the blend of AI with blockchain, making trading and analytics way smarter and more accessible. Picture AI-powered tools that predict market moves or automate trades-platforms like those from Cherry Bekaert are highlighting AI-driven trading as a game-changer. For example, projects merging AI with crypto tokens are popping up, with funding and mergers in the sector hitting new highs. Numerical insights show robotics as a tracked category on CoinGecko, linking machines to blockchains for things like DePIN and tokenized fleets. Real-world apps include AI agents for predictive trading, as seen in DeFi narratives from builders like Saurav369. This isn't just tech jargon; it's helping everyday investors spot opportunities faster, reducing risks through data insights. As AI evolves, it's democratizing crypto, from on-chain intel to personalized strategies, and even influencing memecoins with smarter algorithms. Expect this to reshape how we interact with digital assets.

● Tokenization of Real-World Assets

Tokenizing real-world assets, or RWAs, is emerging as a hot trend, turning things like real estate or art into digital tokens on the blockchain for easier trading and ownership. This is gaining traction with insights from firms like Exploding Topics, where RWAs are seen as a core driver. Concrete examples include tokenizing fleets or infrastructure via DePIN, with numerical boosts from stablecoin integrations that enhance liquidity. In practice, projects like those on peaq are bridging machines and blockchains, creating a machine economy tracked by CoinGecko. Governments and companies are on board; think of how geopolitical shifts via Mastercard are pushing institutional uses. Stats-wise, this trend is part of the broader $2.78 trillion market cap, with apps in agriculture via tokens like HECTR on Coinstore, merging finance and real sectors. It's making investments more fractional and accessible, unlocking value in illiquid assets and attracting diverse investors looking for tangible returns.

● Expansion of Memecoins and Community-Driven Projects

Memecoins are blowing up as a fun yet influential trend in crypto, driven by community hype and viral appeal rather than just utility. Look at coins like Dogecoin, which have seen price swings but maintain strong followings-Margex reports them as one of the top seven trends shaping the market. Numerical insights include massive token burns, like Shiba Inu's 3.5 trillion tokens igniting growth in just 24 hours, boosting scarcity and value. Real-world applications show up in play-to-earn games and NFTs, with platforms like Delabs Games integrating blockchain for rewards. Company news from a16z crypto highlights decentralized governance in these projects, empowering users. In places like Nigeria or India, high adoption indexes tie into this, as accessible entry points draw in new users. It's not all memes; underlying tech like AI and Web3 adds layers, making these coins a gateway for broader crypto engagement and innovation.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=2546&flag=E

Leading Companies Operating in the Global Cryptocurrency Industry:

● Advanced Micro Devices Inc.

● Alphapoint Corporation

● Bitfury Holding B.V.

● Coinbase Inc.

● Cryptomove Inc.

● Intel Corporation

● Microsoft Corporation

● Quantstamp Inc.

● Ripple Services Inc.

Cryptocurrency Market Report Segmentation:

By Type:

● Bitcoin

● Ethereum

● Bitcoin Cash

● Ripple

● Litecoin

● Dashcoin

● Others

Bitcoin dominates the market with approximately 72.9% share, serving as a primary entry point for various investors and regarded as digital gold.

By Component:

● Hardware

● Software

Software leads with around 70.0% market share, facilitating applications and protocols essential for managing digital assets and driving innovation in the cryptocurrency ecosystem.

By Process:

● Mining

● Transaction

Transactions account for about 67.6% of the market, representing the primary function of cryptocurrencies as mediums of exchange with high liquidity and fast settlement times.

By Application:

● Trading

● Remittance

● Payment

● Others

Trading leads the market with approximately 40.6% share, encompassing exchanges and speculative activities, characterized by high volumes and dynamic trading strategies.

Regional Insights:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Europe holds over 39.5% of the market share, driven by regulatory frameworks and increasing blockchain adoption, particularly in countries like Germany and the UK.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cryptocurrency Market Size to Hit USD 6,293.2 Billion in 2033 | Grow CAGR by 9.7% here

News-ID: 4172844 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Crypto

Next 100x Crypto Analysis: ZKP Crypto & Mutuum Finance Compete for Best Presale …

The crypto market stands at a turning point. Bitcoin's 21 Week EMA has moved below its 50 Week EMA, a rare bearish signal last seen in April 2022 before a long bear market phase. Bitcoin is trading near $78,800. Additional strain came from inflation data released this morning, which shifted expectations away from a pause in rate policy and toward possible hikes.

Ethereum continues to lag around $2,300 and remains…

Top 10 Crypto Watchlist: Apeing's Upcoming Crypto Presale

Crypto Watchlist: 10 Altcoins Gain Momentum as Apeing's Upcoming Crypto Presale Climbs Search Rankings

The market never announces its turning points. One week feels unstoppable, the next feels empty. Charts still exist, indicators still flash, and opinions still flood timelines. Yet when fear creeps in, action disappears. People wait. They hesitate. They promise themselves clarity will arrive tomorrow.

That pause is where most losses begin. Crypto does not reward comfort. It rewards…

Top 10 Crypto Watchlist: Apeing's Upcoming Crypto Presale

Crypto Watchlist: 10 Altcoins Gain Momentum as Apeing's Upcoming Crypto Presale Climbs Search Rankings

The market never announces its turning points. One week feels unstoppable, the next feels empty. Charts still exist, indicators still flash, and opinions still flood timelines. Yet when fear creeps in, action disappears. People wait. They hesitate. They promise themselves clarity will arrive tomorrow.

That pause is where most losses begin. Crypto does not reward comfort.…

7 Breakthrough Crypto Stars: $APEING Dominates 1000x Crypto

Time is running out for anyone serious about catching the next 1000x crypto rocket. Apeing ($APEING) https://www.apeing.com/ is making waves for early movers, offering whitelist access that could define who wins big and who watches from the sidelines. This isn't a drill. Phase 1 entry is still open, and history has proven that hesitation is the kryptonite of crypto gains. Savvy investors and meme-lovers alike are already strategizing their moves,…

Crypto Asset Management Service Market Next Big Thing | Barracuda, Crypto Financ …

Latest Study on Industrial Growth of Crypto Asset Management Service Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Crypto Asset Management Service market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the…

Crypto Consulting Services Market Key Players: Crypto Greeks, Crypto Consulting …

The crypto consulting services market refers to the industry that provides advice, guidance, and support to individuals and organizations that are involved in the cryptocurrency and blockchain space. This market has emerged in response to the increasing demand for expertise in this area, as more and more people are becoming interested in cryptocurrencies and blockchain technology.

Download a FREE Sample Report at https://www.reportsnreports.com/contacts/requestsample.aspx?name=6994775

The below companies that are profiled have been…