Press release

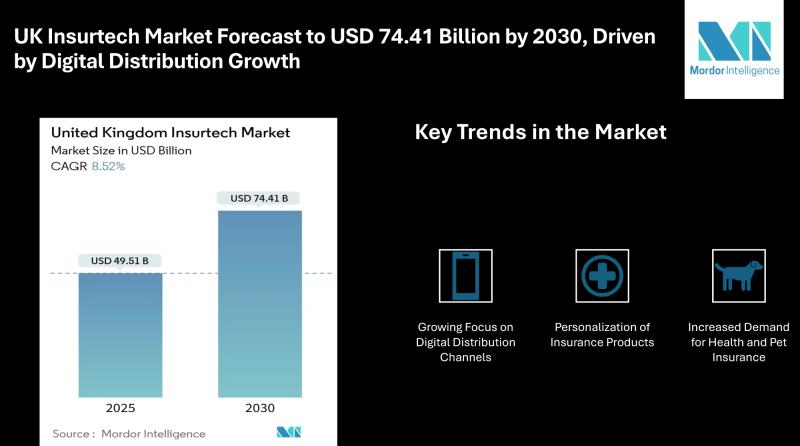

UK Insurtech Market Forecast to USD 74.41 Billion by 2030, Driven by Digital Distribution Growth

Mordor Intelligence has published a new report on the "UK Insurtech Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction: Expanding Digital Insurance Ecosystem in the UK

The UK insurtech market size is valued at USD 49.51 billion in 2025 and is projected to grow to USD 74.41 billion by 2030, recording a compound annual growth rate (CAGR) of 8.52% during the forecast period. This growth reflects the country's rapid adoption of technology-driven insurance solutions, ranging from personalized health plans to on-demand motor coverage. As traditional insurers adapt to digital competition, the insurtech industry in the United Kingdom continues to attract both investment and customer attention, reshaping how policies are distributed, managed, and experienced.

The demand for flexible and user-centric insurance products has created opportunities for new entrants while encouraging established players to collaborate with digital platforms. With consumers increasingly seeking transparency, cost savings, and convenience, the UK insurtech market has become one of Europe's most dynamic financial technology ecosystems.

Report Overview: https://www.mordorintelligence.com/industry-reports/uk-insurtech-market?utm_source=openpr

Key Trends Shaping the UK Insurtech Market

Growing Focus on Digital Distribution Channels

A defining trend in the UK Insurtech industry is the rise of digital-only distribution models. Direct-to-consumer (D2C) platforms and aggregators are simplifying the process of comparing, purchasing, and renewing policies. These channels cater to customers who prefer digital self-service experiences over traditional face-to-face interactions. Digital brokers, supported by automated advisory tools, are further enabling seamless access to tailored insurance offerings.

Personalization of Insurance Products

The Insurtech industry in the UK is witnessing growing demand for personalized products. By leveraging advanced data analytics and behavioral insights, companies are designing insurance plans that adapt to individual lifestyles and risk profiles. Examples include pay-per-mile car insurance or pet insurance with customizable coverage. This personalization not only enhances customer satisfaction but also allows insurers to differentiate themselves in a competitive landscape.

Partnerships Between Insurtech Startups and Traditional Insurers

Collaboration between startups and established insurance companies is becoming more common, bridging the gap between innovation and scale. Traditional insurers benefit from the agility of insurtech platforms, while startups gain market credibility and resources. These partnerships enable hybrid models where digital tools are integrated into legacy operations, improving efficiency and customer engagement across multiple product lines.

Increased Demand for Health and Pet Insurance

The rising cost of healthcare and growing awareness of wellness have strengthened demand for digital health insurance services. Similarly, the popularity of pet ownership in the UK has driven rapid expansion in digital pet insurance solutions. Many startups are targeting these segments by offering easy claims processes, transparent pricing, and subscription-based models that resonate with younger consumers.

Regulatory Support for Digital Insurance Innovation

The UK's regulatory environment continues to support digital experimentation in the insurance sector. Sandboxes and innovation programs provide insurtech firms with an opportunity to test products under supervision, helping to strike a balance between consumer protection and innovation. This supportive framework enhances investor confidence and accelerates the adoption of emerging technologies.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/uk-insurtech-market?utm_source=openpr

UK Insurtech Market Segmentation: Diverse Coverage Across Products and Channels

The UK insurtech market is broadly segmented by product line and distribution channel, highlighting the varied opportunities for companies operating in this space.

By Product Line

Life Insurance

Health Insurance

Property & Casualty (P&C)

Other Insurance Products

By Distribution Channel

Direct-to-Consumer (D2C) Digital Platforms

Aggregators

Digital Brokers

Other Distribution Models

This segmentation demonstrates the market's adaptability to different consumer needs. While life and health insurance are witnessing stronger digital adoption due to personalization trends, property and casualty insurance continues to evolve with telematics and smart-home integrations. Distribution is increasingly dominated by online platforms, reflecting the broader shift toward digital financial services across the UK economy.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players in the UK Insurtech Market

The competitive landscape of the UK insurtech market is characterized by a mix of established startups and rapidly scaling firms. Several companies have emerged as leaders by focusing on niche offerings, intuitive customer experiences, and technology-enabled policy management.

Zego - Known for flexible motor and commercial vehicle insurance tailored to gig-economy workers and small businesses.

Marshmallow - Specializes in car insurance using alternative data sources to better serve diverse consumer groups.

ManyPets (Bought By Many) - A market leader in digital pet insurance, recognized for innovative coverage and customer loyalty.

By Miles - Offers pay-per-mile car insurance, a unique model attracting urban drivers who seek cost efficiency.

Urban Jungle - Focuses on affordable and digital-first home and renters' insurance, appealing to younger demographics.

These players illustrate the breadth of the insurtech industry growth in the UK, from mobility and pet care to housing and lifestyle. Their continued innovation and ability to scale across different segments underline the resilience of the digital insurance model in a highly regulated market.

Explore more insights on UK insurtech market competitive landscape: https://www.mordorintelligence.com/industry-reports/uk-insurtech-market/companies?utm_source=openpr

Conclusion: Strong Growth Outlook for the UK Insurtech Market

The outlook for the UK insurtech market is defined by consistent expansion, fueled by consumer preference for digital experiences, the personalization of policies, and strong collaboration between startups and traditional insurers. With supportive regulation and steady investment flows, the UK is well-positioned to remain one of Europe's leading hubs for insurtech solutions.

As more customers embrace digital insurance services across life, health, property, and specialty products, companies that prioritize transparency, flexibility, and convenience are expected to thrive. The role of online platforms, aggregators, and digital brokers will continue to grow, solidifying their importance in the insurance value chain.

Overall, the UK insurtech market is on track to deliver significant growth through 2030, offering opportunities for both emerging players and established institutions to tap into a digitally driven future of insurance.

For complete market analysis, please visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/uk-insurtech-market?utm_source=openpr

Industry Related Reports

Europe Insurtech Market: The Europe Insurtech Market is Segmented by Business Model (Carrier, Enabler, and Distributor) and Geography (United Kingdom, Germany, France, Italy, Switzerland, Sweden, Netherlands, and Other Countries).

Get more insights: https://www.mordorintelligence.com/industry-reports/europe-insurtech-market?utm_source=openpr

Asia-Pacific Insurtech Market: APAC Insurtech Market Report is Segmented by Insurance Line (Health, Life, and Non-Life) and Country (China, India, Japan, Hong Kong, Singapore, Indonesia, and Rest of Asia-Pacific).

Get more insights: https://www.mordorintelligence.com/industry-reports/asia-pacific-insurtech-market?utm_source=openpr

US Insurtech Market: The United States Insurtech Market is Segmented by Business Model (Carrier, Enabler, and Distributor), Insurance Line (Life Insurance, Non-Life Insurance), Distribution Channel (Direct To Consumer, Intermediate, and Embedded), and Region (South, West, Midwest, and Northeast).

Get more insights: https://www.mordorintelligence.com/industry-reports/united-states-insurtech-market?utm_source=openpr

Singapore Insurtech Market: Singapore is Segmented by Types of Insurance Offered (Life and Non-Life) and by Business Model (Enabler, Carrier, and Distributor).

Get more insights: https://www.mordorintelligence.com/industry-reports/singapore-insurtech-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Raja Pushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UK Insurtech Market Forecast to USD 74.41 Billion by 2030, Driven by Digital Distribution Growth here

News-ID: 4172006 • Views: …

More Releases from Mordor Intelligence

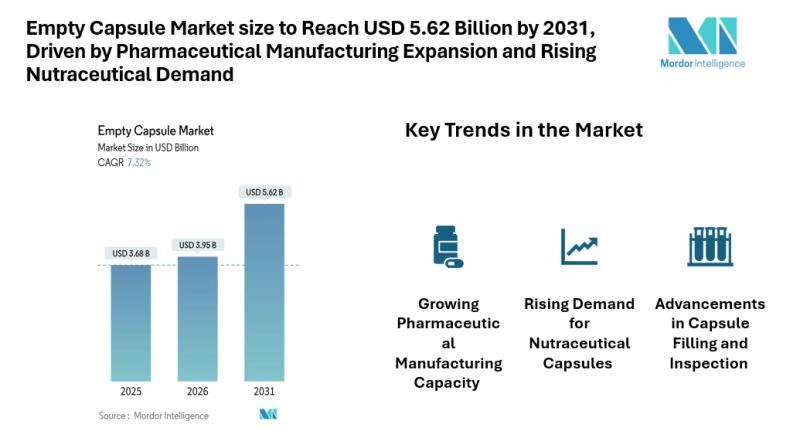

Empty Capsule Market size to Reach USD 5.62 Billion by 2031, Driven by Pharmaceu …

Mordor Intelligence has published a new report on the empty capsule market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the empty capsule market size was valued at USD 3.95 billion in 2026, projected to reach USD 5.62 billion by 2031, growing at a CAGR of 7.32% during the forecast period. The steady rise in the empty capsule market reflects higher…

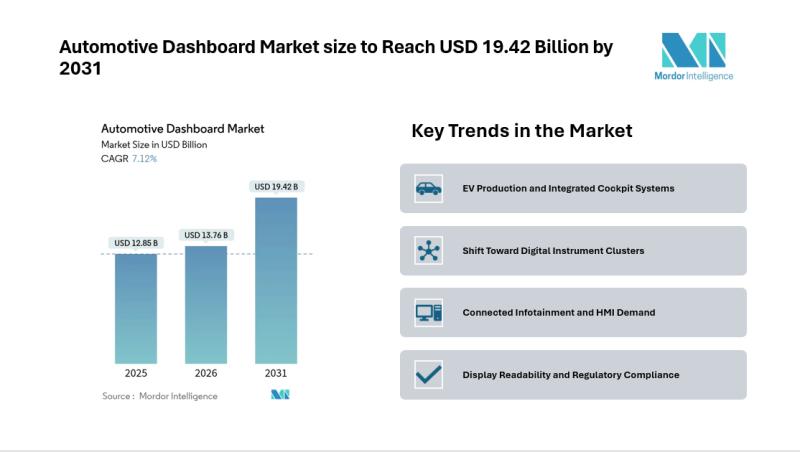

Automotive Dashboard Market size to Reach USD 19.42 Billion by 2031 Amid Rising …

Automotive Dashboard Market Overview

According to Mordor Intelligence, the automotive dashboard market is projected to grow from USD 12.85 billion in 2025 to USD 13.76 billion in 2026 and is forecast to reach USD 19.42 billion by 2031, registering a CAGR of 7.12% during the forecast period. The rising shift toward fully digital cockpits, stronger global safety regulations for display readability, and increasing electric vehicle production are shaping the…

Cat Litter Market Size to Reach USD 7.66 Billion by 2031, Driven by Premium Prod …

Cat Litter Market Overview and Introduction

According to a research report by Mordor Intelligence, the cat litter market size continues to show steady expansion as pet ownership patterns change worldwide. According to Mordor Intelligence, the market is valued at USD 6.26 billion in 2026, up from USD 6.01 billion in 2025, and is expected to reach USD 7.66 billion by 2031, registering a CAGR of 4.14% during the forecast period.…

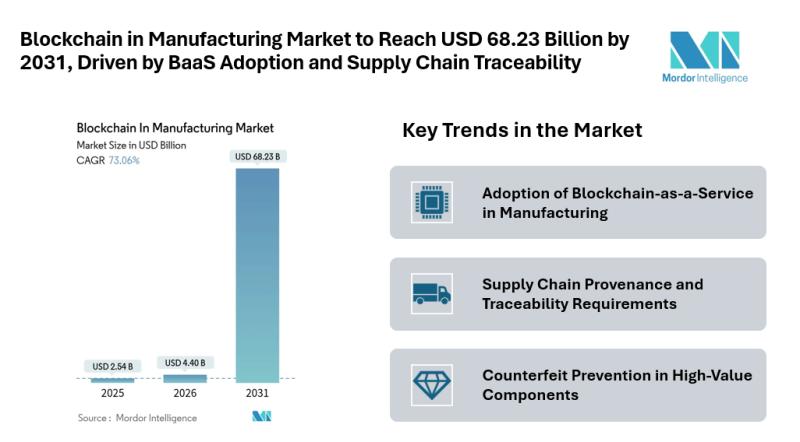

Blockchain in Manufacturing Market to Reach USD 68.23 Billion by 2031, Driven by …

Mordor Intelligence has published a new report on the blockchain in manufacturing market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Blockchain in Manufacturing Market Overview

According to Mordor Intelligence, the blockchain in manufacturing market was valued at USD 2.54 billion in 2025 and is estimated to grow from USD 4.4 billion in 2026 to reach USD 68.23 billion by 2031, registering a CAGR of 73.06%…

More Releases for Insurtech

Insurtech Accelerators Market Hits New High | Major Giants Plug and Play, Startu …

HTF MI just released the Global Insurtech Accelerators Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Insurtech Accelerators Market are: Plug and Play,…

Insurtech Market: A Comprehensive Overview

The global insurtech market was valued at approximately USD 10.3 billion in 2024 and is projected to reach around USD 152.9 billion by 2033, growing at a compound annual growth rate (CAGR) of about 31.5% from 2025 to 2033.

Insurtech Market Overview

The global Insurtech market is undergoing explosive growth, fueled by the insurance industry's rapid digitization and rising customer demand for seamless, personalized digital experiences. Advanced technologies like artificial intelligence (AI),…

Top Trends Transforming the InsurTech (Insurance Technology) Market Landscape in …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the InsurTech (Insurance Technology) Industry Market Size Be by 2025?

The volume of the insurtech (insurance technology) market has expanded significantly in the past few years. The market, currently valued at $19.23 billion in 2024, is projected to reach $25.95 billion in 2025, demonstrating a compound annual…

Emerging Trends Influencing The Growth Of The Insurtech Market: Innovative AI-Po …

The Insurtech Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Insurtech Market Size Expected to Be by 2034?

In recent times, the insurtech market has seen substantial expansion. The projected growth indicates an increase from $17.08 billion in 2024 to $22.08 billion…

Top Factor Driving Insurtech Market Growth in 2025: Rising Tide Of Insurance Cla …

How Are the key drivers contributing to the expansion of the insurtech market?

The expected surge in insurance claims is projected to directly contribute to the expanded growth of the insurtech market. Insurtech plays a critical role in claim management, risk assessment, contract processing, and policy underwriting. The increase in hospitalizations during the COVID-19 pandemic has resulted in a steep rise in insurance claims. An illustrative example of this could be…

Insurtech, Market Dynamics, Global Opportunities, Forecast 2024

The Business Research Company recently released a comprehensive report on the Global Insurtech Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…