Press release

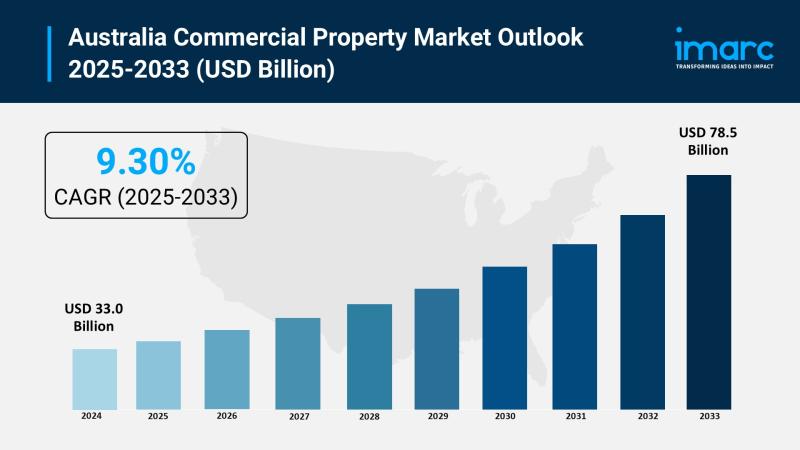

Australia Commercial Property Market Worth USD 78.5 Billion to 2025-2033 | Exhibit a 9.30% CAGR

The latest report by IMARC Group, "Australia Commercial Property Market Report by Type (Office, Retail, Industrial and Logistics, Hospitality, and Others), and Region 2025-2033," provides an in-depth analysis of the Australia commercial property market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia commercial property market size reached USD 33.0 billion in 2024 and is projected to grow to USD 78.5 billion by 2033, exhibiting a robust growth rate of 9.30% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 33.0 Billion

Market Forecast in 2033: USD 78.5 Billion

Growth Rate (2025-2033): 9.30%

Australia Commercial Property Market Overview:

The Australia commercial property market is experiencing remarkable transformation as favorable exchange rates, foreign investment flows, and economic recovery drive unprecedented growth. Investment into Australia's office, retail, and industrial markets topped $7 billion in Q2 2024, demonstrating strong investor confidence despite global uncertainties. The sector is benefiting from cautious optimism about inflation easing and potential Reserve Bank of Australia interest rate cuts, creating optimal conditions for property investment expansion. Strong population growth, urbanization trends, and limited new supply in key markets are supporting asset valuations while international buyers find Australian properties increasingly attractive due to favorable currency conditions.

Request For Sample Report: https://www.imarcgroup.com/australia-commercial-property-market/requestsample

Australia Commercial Property Market Trends:

• Foreign Investment Surge is accelerating, with favorable exchange rates making Australian commercial properties more affordable for international buyers seeking stable returns

• Interest Rate Optimization Expectations are creating market momentum, with experts predicting RBA cuts will boost commercial property investment activity throughout 2025

• Industrial Sector Leadership continues with 98.9% occupancy rates and strong e-commerce demand driving warehouse and logistics facility investments

• Office Market Recovery is gaining pace, with transaction volumes climbing 70% year-on-year to $4 billion during H1 2024 as foreign investors identify pricing opportunities

• Capitalization Rate Stabilization is improving investor confidence, particularly for quality retail assets with strong fundamentals or mixed-use development potential

• New South Wales Market Dominance persists with 37.0% market share in 2024, while Queensland emerges as the fastest-growing region with potential for continued expansion

• Mixed-Use Development Focus is trending as investors seek properties combining retail, office, and residential components for diversified income streams

Australia Commercial Property Market Drivers:

• Economic Recovery Momentum is supporting property valuations and investment confidence as inflation concerns moderate and economic stability improves

• Foreign Exchange Advantages are attracting international investors who find Australian commercial properties increasingly attractive relative to global alternatives

• Population Growth Pressure is creating sustained demand for commercial space across retail, office, and industrial sectors in major metropolitan areas

• Supply Constraint Benefits with limited new commercial development scheduled, existing properties are experiencing value appreciation and occupancy rate improvements

• E-commerce Infrastructure Demand is driving industrial property investment, particularly warehouse and distribution facilities supporting online retail growth

• Institutional Investment Flows from superannuation funds and pension schemes are providing stable capital for large-scale commercial property acquisitions

• Government Infrastructure Investment is improving connectivity and accessibility, enhancing the value proposition of commercial properties in key corridors

Market Challenges:

• Interest Rate Uncertainty continues to influence investment timing decisions and financing costs for commercial property acquisitions

• Construction Cost Inflation affects new development feasibility and renovation project economics across all commercial property sectors

• Labor Shortage Constraints in construction and property management sectors can impact project delivery timelines and operational efficiency

• Regulatory Compliance Costs including environmental standards and building codes increase operational expenses for property owners

• Economic Sensitivity Risks from global market volatility can impact tenant demand and rental growth across different commercial sectors

Market Opportunities:

• Regional Market Expansion offers significant growth potential as infrastructure investment improves connectivity between major cities and regional centers

• Sustainability Premium Capture through green building certifications and energy-efficient properties appeals to environmentally conscious tenants

• Technology Integration including smart building systems and IoT connectivity can differentiate properties and command premium rents

• Build-to-Rent Commercial development opportunities in mixed-use projects combining residential and commercial components

• Data Center and Logistics Hubs expansion driven by digital economy growth and e-commerce infrastructure requirements

• Tourism and Hospitality Recovery supporting commercial property demand in key destinations as international travel normalizes

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/australia-commercial-property-market

Australia Commercial Property Market Segmentation:

By Property Type:

• Office Buildings

• Retail Properties

• Industrial/Warehouse

• Hotels and Hospitality

• Mixed-Use Developments

• Others

By End User:

• Corporates and Businesses

• Government Entities

• Institutional Investors

• Private Investors

• REITs

By Investment Category:

• Core Properties

• Value-Add Properties

• Opportunistic Investments

• Development Projects

By Geographic Distribution:

• New South Wales (37.0% market share)

• Victoria

• Queensland (fastest-growing region)

• Western Australia

• Other States and Territories

Major Market Competitors:

• Dexus Property Group

• Scentre Group

• Stockland Corporation

• Mirvac Group

• Lendlease Corporation

• Charter Hall Group

• Goodman Group

• GPT Group

• Vicinity Centres

• Shopping Centres Australasia

Australia Commercial Property Market News:

July 2025: KPMG's Commercial Property Market Update reported that capitalization rates have stabilized across major Australian markets, with investor demand growing significantly for quality retail assets featuring strong fundamentals or mixed-use potential. Industrial returns recovered to 3.3% after two consecutive positive quarters, with income growth continuing to offset previous capital losses.

January 2025: Market analysis revealed strong performance differentiation across commercial property sectors, with industrial properties maintaining exceptional 98.9% occupancy rates, retail achieving 97.8% occupancy, and office properties at 87.2%. The industrial sub-market continued outperforming due to e-commerce demand, tight supply conditions, and attractive cash flow generation capabilities.

Key Highlights of the Report:

• Comprehensive market analysis projecting dramatic growth from $33.0 billion in 2024 to $78.5 billion by 2033

• Detailed examination of $7 billion Q2 2024 investment flows across office, retail, and industrial property sectors

• Strategic assessment of foreign exchange advantages attracting international investors to Australian commercial properties

• In-depth analysis of regional market dynamics with New South Wales leading at 37.0% market share

• Occupancy rate analysis showing industrial sector strength at 98.9% versus office at 87.2%

• Interest rate impact evaluation and Reserve Bank of Australia policy implications for property investment

• Transaction volume trends including 70% year-on-year growth in office sector investments during H1 2024

Frequently Asked Questions (FAQs):

Q1: What factors are driving the strong growth projection for Australia's commercial property market?

A1: The market is driven by favorable exchange rates attracting foreign investment, $7 billion Q2 2024 investment flows, expected RBA interest rate cuts, and strong fundamentals including 98.9% industrial occupancy rates. Population growth and limited new supply are supporting asset valuations while international investors find Australian properties increasingly attractive.

Q2: Which commercial property sectors are performing best in the Australian market?

A2: Industrial properties lead with 98.9% occupancy rates driven by e-commerce demand, followed by retail at 97.8% occupancy. Office properties at 87.2% occupancy are recovering strongly, with transaction volumes up 70% year-on-year to $4 billion in H1 2024 as foreign investors identify pricing opportunities.

Q3: How is regional distribution affecting the Australian commercial property market?

A3: New South Wales dominates with 37.0% market share in 2024, while Queensland emerges as the fastest-growing region with strong expansion potential. This geographic concentration provides stability while regional growth offers diversification opportunities for investors seeking exposure beyond major metropolitan markets.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24736&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Commercial Property Market Worth USD 78.5 Billion to 2025-2033 | Exhibit a 9.30% CAGR here

News-ID: 4171144 • Views: …

More Releases from IMARC Group

Biosimilar Market Size, Share, Industry Trends and Forecast 2026-2034

IMARC Group, a leading market research company, has recently released a report titled "Biosimilar Market Size, Share, Trends and Forecast by Molecule, Indication, Manufacturing Type, and Region, 2026-2034." The study provides a detailed analysis of the industry, including the global biosimilar market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Biosimilar Market Key Highlights:

• The Biosimilar Market is…

Cost of Setting Up a PET Bottle Manufacturing Plant & DPR 2026

The global PET bottle industry is experiencing sustained growth propelled by rising packaged beverage consumption, pharmaceutical packaging expansion, increasing demand for ready-to-drink products, and the lightweight, recyclable advantages of PET packaging. As urbanization accelerates, consumer lifestyles shift toward convenience packaging, and regulatory frameworks increasingly mandate recyclable materials, establishing a PET bottle manufacturing plant positions investors in one of the most stable and essential segments of the consumer packaging value chain.

IMARC…

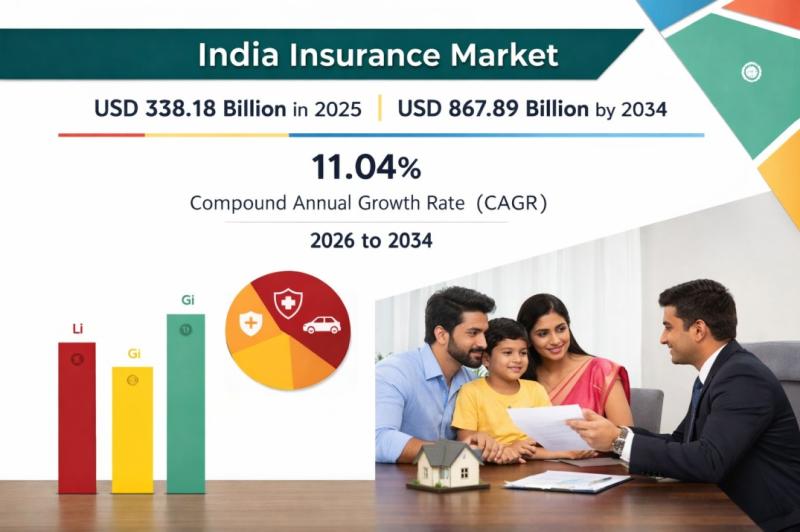

India Insurance Market Forecast 2026: Industry Size, Expansion & Future Scope 20 …

India Insurance Market Overview 2026-2034

According to IMARC Group's report titled India Insurance Market Size, Share, Trends and Forecast by Type of Product, Distribution Channel, End User, and Region, 2026-2034 the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The India insurance market size was valued at USD 338.18 Billion in 2025 and is projected to reach USD 867.89 Billion by 2034, growing at…

Global Diammonium Phosphate (DAP) Prices January 2026: Asia Gains, Europe Steady …

What is Diammonium Phosphate (DAP)?

Diammonium Phosphate (DAP) is a widely used phosphorus-based fertilizer crucial for global agriculture. Monitoring Diammonium Phosphate (DAP) prices helps manufacturers, distributors, and buyers make informed procurement decisions and manage costs amid fluctuating demand and supply conditions.

Global Price Overview

The global Diammonium Phosphate (DAP) market shows moderate stability with regional supply differences affecting prices. The Diammonium Phosphate (DAP) price trend has remained mixed, while the price index and…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…