Press release

Illinois Divorce Lawyer Russell D. Knight Breaks Down How Interest and Dividend Income is Handled in Divorce Cases

Understanding how interest and dividend income is divided during a divorce can be a complex issue, especially under Illinois law. Illinois divorce lawyer Russell D. Knight (https://rdklegal.com/interest-and-dividend-income-in-an-illinois-divorce/) of the Law Office of Russell D. Knight offers a comprehensive breakdown of how this type of income is handled during divorce proceedings in his most recent article. His work highlights how interest, dividends, and other forms of passive income can significantly impact the financial outcomes of both spouses.Illinois divorce lawyer Russell D. Knight emphasizes that dividing the assets themselves is only part of the process; income generated from those assets must also be considered when calculating child support and spousal maintenance. This includes income from investments, businesses, and rental properties. "If those assets generate some kind of income via rents, interest, dividends, etc., then that income must be factored into any maintenance or child support calculations," Knight writes.

Illinois divorce lawyer Russell D. Knight also explains that the Illinois courts use the totality of a party's gross income - not just their salary - to determine support obligations. This means income from stocks, bonds, S-corporations, and other financial assets are part of the equation. He clarifies that the law in Illinois defines income broadly: "All income is income under Illinois law," meaning even passive gains must be included in financial disclosures and court determinations.

Russell D. Knight outlines the tools divorcing spouses can use to uncover hidden streams of interest or dividend income. These include reviewing tax documents like 1099-INT and 1099-DIV forms and submitting formal legal requests such as a Notice To Produce. These steps ensure that all sources of income are accounted for and fairly addressed in court proceedings.

One unique aspect of Knight's analysis is his discussion of imputed income - income courts can attribute to a spouse even if it's not actively received. Courts have wide discretion in Illinois and may assign a hypothetical income to an asset based on its fair earning potential. Knight references past cases in which courts have included projected interest income from cash assets when calculating spousal support. However, he also notes the limitations and legal challenges that can arise when this tactic is used.

In high-asset divorces, the issue of asset appreciation also plays a critical role. Russell D. Knight addresses whether unrealized gains - such as the increasing value of stock or property - should be considered income for support purposes. Citing Illinois case law, he explains that courts have recognized increases in wealth as qualifying income in some situations. "[The money received] represented a valuable benefit to the father that enhanced his wealth and facilitated his ability to support [the child]," one case reads.

Knight also explores the complications surrounding S-corporations. In these cases, the owner of the corporation controls whether profits are distributed or retained. This means a spouse may deliberately suppress their income by not releasing corporate profits during a divorce. Russell D. Knight warns readers to scrutinize S-corporation earnings closely, especially if one spouse has the power to manipulate those figures for legal advantage. Courts may only consider retained corporate earnings as income if there's evidence that they were used to avoid paying proper support.

In addition, Knight explains how courts evaluate income generated by a business's goodwill - the intangible value a business may have due to reputation or unique skill. If that goodwill has already been divided during the divorce, then any future income stemming from it may not be subject to support calculations, a point that can significantly affect settlement negotiations and outcomes.

This detailed guidance shows that interest and dividend income - along with other passive income streams - can carry weight in determining how property is divided and what support payments will look like. For individuals going through a divorce in Illinois, failing to disclose or account for this income could lead to unfair outcomes or further legal complications.

Russell D. Knight's insights help clarify a complex part of Illinois family law, giving individuals a clearer picture of how financial assets and income types are considered in court. His practical, case-law-backed explanations show why it's important for divorcing spouses to take a full inventory of all financial sources, not just traditional paychecks.

Anyone navigating an Illinois divorce should be aware that income from interest, dividends, and businesses can influence child support and spousal maintenance. Misreporting or failing to properly value these sources can result in unjust rulings or later modifications.

Russell D. Knight continues to make Illinois divorce law more understandable by tackling challenging financial topics with transparency and clarity. His article is a must-read for those dealing with income-generating assets during a divorce.

About Law Office of Russell D. Knight:

The Law Office of Russell D. Knight is dedicated to helping clients navigate divorce and family law matters in Illinois. With hundreds of published articles and a commitment to simplifying complex legal issues, the firm provides practical legal guidance rooted in real courtroom experience.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=N3DH9XFHhT8

GMB: https://www.google.com/maps?cid=13056420905624162796

Email and website

Email: russell@rdklegal.com

Website: https://rdklegal.com/

Media Contact

Company Name: Law Office of Russell D. Knight

Contact Person: Russell D. Knight

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=illinois-divorce-lawyer-russell-d-knight-breaks-down-how-interest-and-dividend-income-is-handled-in-divorce-cases]

Phone: (773) 334-6311

Address:1165 N Clark St #700

City: Chicago

State: Illinois 60610

Country: United States

Website: https://rdklegal.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Illinois Divorce Lawyer Russell D. Knight Breaks Down How Interest and Dividend Income is Handled in Divorce Cases here

News-ID: 4170717 • Views: …

More Releases from ABNewswire

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

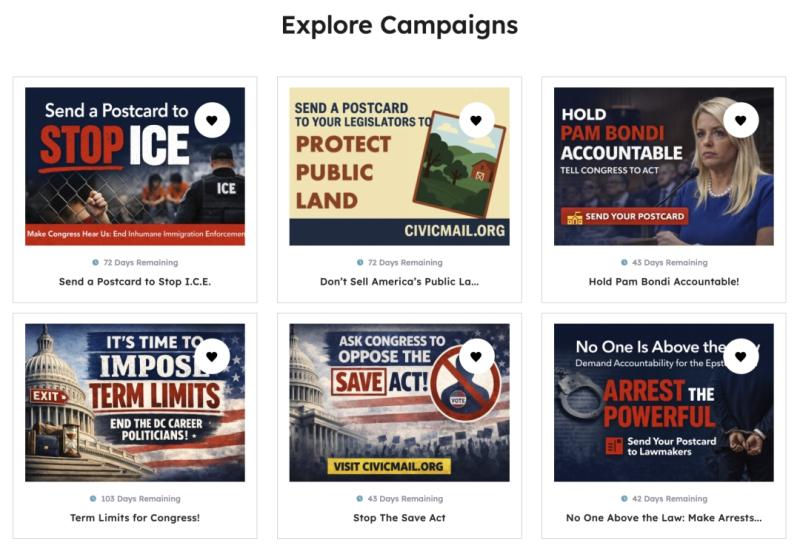

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

Fast-Growing Newman's Brew Combines Organic Coffee Excellence with Abandoned Ani …

Newman's Brew is experiencing rapid expansion by delivering on dual commitments that resonate with today's conscious consumers: exceptional fresh-roasted organic coffee and meaningful support for abandoned animals. The company's growing inventory and ethical business practices demonstrate that quality and social responsibility can drive sustainable business success in the competitive specialty coffee market.

Newman's Brew is riding a wave of growth that reflects fundamental shifts in how consumers approach coffee purchasing decisions.…

More Releases for Knight

Noah The Brave Knight

Are you ready for a thrilling adventure that will leave you on the edge of your seat? 'Noah the Bright Knight' by Eric Capone is a brave knight story that will take the readers on an epic quest and experience the magic of adventure like never before. This thrilling tale of bravery, friendship, and the pursuit of justice will keep you hooked from start to finish.

Embark on a thrilling…

Wedding Venue Service Market Next Big Thing | Events by Knight, Wedding Wire, Ev …

Latest Study on Industrial Growth of Wedding Venue Service Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Wedding Venue Service market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends…

Thompson & Knight Opens LA Office

The law firm of Thompson & Knight LLP is pleased to announce the opening of its newest office in Los Angeles, California. The Firm has landed noted litigator Bruce J. Zabarauskas, who joins Thompson & Knight Partner, Shelly A. Youree, to launch operations. Opening October 1, 2012, the new office will be located in Century City at 10100 Santa Monica Boulevard, Suite 950, Los Angeles, California 90067.

“The opening…

Thompson & Knight Elects 2012 Management Committee

FOR IMMEDIATE RELEASE

February 16, 2012

For additional information:

Becky S. Jackson

Chief Client Services Officer

214.969.1478

TEXAS – The law firm of Thompson & Knight LLP is proud to announce the Firm has elected 11 lawyers to serve on the Firm’s Management Committee for 2012. As previously announced, Emily Parker was confirmed as the Firm’s Managing Partner, becoming the first female to serve in this role in the 125-year history of the Firm. …

Thompson & Knight Expands Trial Practice

Dallas (August 15, 2011) – The global law firm of Thompson & Knight LLP is pleased to announce that Nathan H. Aduddell* has joined the Firm’s Trial Department as an Associate in the Dallas office.

“Nathan comes to us with an excellent record of scholastic achievement and success in trial-related competitions, all accomplishments we believe will enhance his trial skills. We are very pleased to have him join…

Thompson & Knight Expands Tax Practice

HOUSTON – The global law firm of Thompson & Knight LLP is pleased to announce Roger D. Aksamit has joined the Firm as a Partner in the Tax Practice Group of the Firm’s Houston office. He brings more than 25 years of legal experience to Thompson & Knight.

“We are thrilled to have Roger join the Firm,” says Pete Riley, Managing Partner of the Firm. “Houston\'s energy economy…