Press release

Soy and Milk Protein Ingredients Market Size, Share And Forecast Report 2025-2033

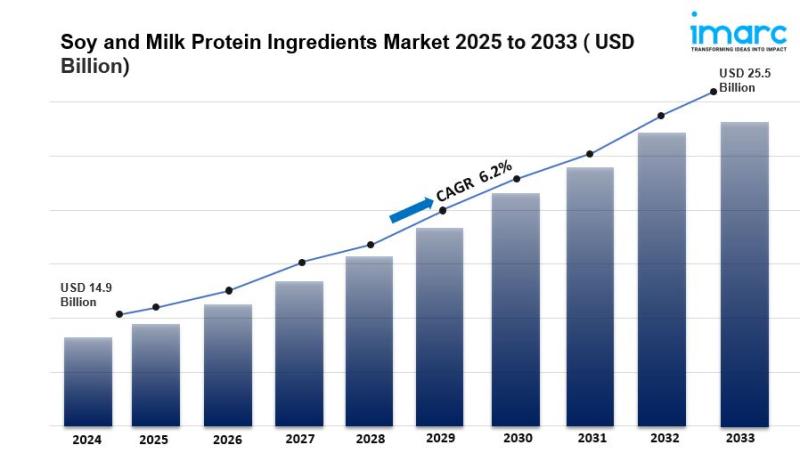

Soy and Milk Protein Ingredients Market Size and Outlook 2025 to 2033The global soy and milk protein ingredients market size was valued at USD 14.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.5 Billion by 2033, exhibiting a growth rate of 6.2% during 2025-2033. Asia Pacific leads the market with significant consumer demand for protein-rich foods, while North America maintains strong positions driven by health-conscious consumers and advanced food processing infrastructure. The market is experiencing steady growth driven by rising health consciousness, growing demand for plant-based alternatives, increasing adoption in sports nutrition, and expanding applications across food and beverage, pharmaceutical, and personal care industries.

Key Stats for Soy and Milk Protein Ingredients Market:

• Soy and Milk Protein Ingredients Market Value (2024): USD 14.9 Billion

• Soy and Milk Protein Ingredients Market Value (2033): USD 25.5 Billion

• Soy and Milk Protein Ingredients Market Forecast Growth Rate: 6.2%

• Leading Segment in Soy and Milk Protein Ingredients Market in 2024: Milk Protein Ingredients (dominant market share)

• Key Regions in Soy and Milk Protein Ingredients Market: Asia Pacific, North America, Europe, Latin America, Middle East and Africa

• Top companies in Soy and Milk Protein Ingredients Market: Archer Daniels Midland Company, Arla Foods, Cargill Inc., DMV International, DuPont, Kerry Group, Associated British Foods, Charotar Casein Company, Dean Foods, Fonterra Co-operative Group, Glanbia plc, Milk Specialties Global, Omega Protein Corporation

Request Sample URL: https://www.imarcgroup.com/soy-milk-protein-ingredients-market/requestsample

Why is the Soy and Milk Protein Ingredients Market Growing?

The soy and milk protein ingredients market is experiencing robust expansion as consumers worldwide prioritize health, wellness, and sustainable nutrition choices. Health-conscious consumers increasingly seek protein-rich foods that support muscle development, weight management, and overall wellness, driving demand across multiple industries from sports nutrition to functional foods.

Plant-based protein trends continue accelerating as more consumers adopt flexitarian, vegetarian, and vegan lifestyles for health and environmental reasons. Soy protein ingredients offer complete amino acid profiles comparable to animal proteins, making them attractive alternatives for manufacturers developing plant-based meat substitutes, dairy alternatives, and protein beverages.

The aging global population creates sustained demand for functional nutrition products that support healthy aging, muscle maintenance, and bone health. Milk protein ingredients, rich in calcium and essential amino acids, play crucial roles in senior nutrition products and medical nutrition formulations designed to address age-related health concerns.

Sports nutrition and fitness sectors fuel premium protein ingredient demand as athletes and fitness enthusiasts require high-quality protein supplements for performance enhancement and recovery. Both soy and milk proteins offer distinct advantages - soy for plant-based preferences and milk proteins for rapid absorption and muscle-building benefits.

AI Impact on the Soy and Milk Protein Ingredients Market:

Artificial intelligence is revolutionizing the soy and milk protein ingredients industry by optimizing production processes, enhancing quality control, and enabling personalized nutrition solutions. AI-powered systems analyze vast datasets from agricultural sources to predict optimal soybean varieties and milk sourcing strategies that maximize protein yield and nutritional quality.

Smart manufacturing systems utilize machine learning algorithms to optimize protein extraction and purification processes, reducing waste and improving efficiency by up to 25%. These systems continuously monitor temperature, pH, and processing parameters to ensure consistent product quality while minimizing energy consumption and environmental impact.

Quality assurance benefits from AI-driven analytical tools that detect contaminants, assess protein purity, and verify amino acid profiles with greater accuracy and speed than traditional methods. Computer vision technology automatically inspects products for consistency and defects, ensuring only premium-quality ingredients reach customers.

Personalized nutrition platforms powered by AI analyze individual dietary needs, health goals, and genetic factors to recommend optimal protein combinations and dosages. This technology enables manufacturers to develop targeted products for specific consumer segments, from athletes requiring fast-absorbing proteins to seniors needing easily digestible formulations.

Segmental Analysis:

Analysis by Source:

• Soy Protein Ingredients

• Milk Protein Ingredients

Milk protein ingredients currently dominate the market with the largest share, driven by widespread consumer acceptance, excellent nutritional profiles, and versatile applications in food processing, sports nutrition, and infant formula manufacturing.

Analysis by Type:

• Soy Protein Concentrate

• Soy Protein Isolate

• Milk Protein Concentrate

• Milk Protein Isolate

• Whey Protein

• Casein Protein

Whey protein leads the milk protein segment due to its rapid absorption characteristics and high biological value, making it particularly popular in sports nutrition and functional food applications.

Analysis by Application:

• Food and Beverages

• Infant Nutrition

• Sports Nutrition

• Personal Care and Cosmetics

• Animal Feed

• Pharmaceuticals

Food and beverages represent the largest application segment, incorporating protein ingredients into products ranging from protein bars and beverages to bakery items and dairy alternatives for enhanced nutritional value and functionality.

Analysis by Form:

• Powder

• Liquid

• Others

Powder form dominates the market due to longer shelf life, easier handling, and versatile applications across multiple industries, from supplement manufacturing to food processing operations.

Analysis of Soy and Milk Protein Ingredients Market by Regions

• Asia Pacific

• North America

• Europe

• Latin America

• Middle East and Africa

Asia Pacific leads the global market, driven by large-scale soy production, growing middle-class populations with increasing protein consumption, and expanding food processing industries that incorporate protein ingredients into traditional and modern food products.

What are the Drivers, Restraints, and Key Trends of the Soy and Milk Protein Ingredients Market?

Market Drivers:

Rising health consciousness and fitness trends drive substantial demand for protein-rich foods and supplements across all age groups. Consumers increasingly understand protein's role in muscle maintenance, weight management, and overall wellness, creating sustained market growth for high-quality protein ingredients.

Plant-based nutrition trends accelerate soy protein adoption as consumers seek sustainable, environmentally friendly alternatives to animal proteins. The global shift toward flexitarian diets and reduced meat consumption creates opportunities for soy protein ingredients in meat alternatives, plant-based dairy products, and protein beverages.

Aging populations in developed markets require specialized nutrition products that support healthy aging, muscle preservation, and bone health. Milk protein ingredients, particularly rich in calcium and complete amino acids, become essential components in senior nutrition formulations and medical nutrition products.

Sports and fitness industry growth fuels premium protein ingredient demand as active consumers prioritize performance nutrition and recovery products. Both professional athletes and recreational fitness enthusiasts drive demand for high-quality protein supplements that support training goals and performance objectives.

Market Restraints:

Allergen concerns limit market accessibility as both soy and milk proteins rank among major food allergens, restricting their use in certain products and markets. Manufacturers must navigate complex labeling requirements and develop allergen-free alternatives to serve sensitive consumer segments.

Price volatility of raw materials affects profitability and pricing strategies, as soybean and milk prices fluctuate based on weather conditions, trade policies, and supply chain disruptions. These variations impact manufacturing costs and end-product pricing for protein ingredient suppliers.

Regulatory complexities across different markets create compliance challenges for international manufacturers. Varying food safety standards, protein content regulations, and labeling requirements increase operational costs and market entry barriers for global suppliers.

Competition from alternative protein sources intensifies as manufacturers explore insect proteins, algae proteins, and other novel ingredients. These emerging alternatives may capture market share in specific applications or consumer segments seeking innovative protein solutions.

Market Key Trends:

Sustainable sourcing practices gain importance as consumers and manufacturers prioritize environmental responsibility in protein production. Sustainable farming methods, renewable energy usage, and reduced water consumption become competitive advantages for protein ingredient suppliers committed to environmental stewardship.

Functional protein ingredients incorporate additional health benefits beyond basic nutrition, including probiotics, vitamins, and minerals that address specific health concerns. These value-added products command premium pricing and appeal to health-focused consumers seeking comprehensive nutrition solutions.

Clean label formulations drive demand for minimally processed protein ingredients with simple, recognizable ingredient lists. Consumers increasingly scrutinize food labels, preferring products free from artificial additives, preservatives, and complex chemical processing aids.

Personalized nutrition solutions utilize genetic testing and health assessments to recommend optimal protein types and dosages for individual needs. This trend creates opportunities for customized protein blends and targeted formulations that address specific health goals and dietary requirements.

Leading Players of Soy and Milk Protein Ingredients Market:

According to IMARC Group's latest analysis, prominent companies shaping the global Soy and Milk Protein Ingredients landscape include:

• Archer Daniels Midland Company

• Arla Foods

• Cargill Inc.

• DMV International

• DuPont

• Kerry Group

• Associated British Foods

• Charotar Casein Company

• Dean Foods

• Fonterra Co-operative Group

• Glanbia plc

• Milk Specialties Global

• Omega Protein Corporation

• International Flavors & Fragrances Inc.

These leading providers are expanding their footprint through strategic partnerships, sustainable sourcing initiatives, and advanced processing technologies to meet growing consumer demand for high-quality, functional protein ingredients across food and beverage, sports nutrition, infant formula, and pharmaceutical applications.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=1250&flag=C

Key Developments in Soy and Milk Protein Ingredients Market:

• January 2025: Major protein ingredient manufacturers announced significant investments in sustainable production facilities that reduce environmental impact while increasing processing capacity to meet growing global demand for plant-based and dairy protein ingredients.

• December 2024: Leading companies introduced AI-powered quality control systems that enhance protein purity testing and amino acid profiling, ensuring consistent product quality and reducing processing time by up to 30% across manufacturing operations.

• November 2024: Strategic partnerships formed between protein ingredient suppliers and sports nutrition brands to develop specialized formulations for professional athletes and fitness enthusiasts, combining rapid-absorption proteins with performance-enhancing compounds.

• October 2024: Breakthrough innovations in protein extraction technology enabled manufacturers to produce higher-purity protein ingredients with improved solubility and functionality for use in clear protein beverages and advanced food applications.

• September 2024: Sustainability certifications and carbon-neutral production commitments announced by major suppliers, responding to consumer and regulatory demands for environmentally responsible protein ingredient sourcing and manufacturing practices.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Soy and Milk Protein Ingredients Market Size, Share And Forecast Report 2025-2033 here

News-ID: 4170162 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Protein

Cell-Free Protein Synthesis Market Forecast: Opportunities in High-Throughput Pr …

"Cell-Free Protein Synthesis Market" in terms of revenue was estimated to be worth USD 299.9 million in 2024 and is poised to reach USD 585.3 Million by the year 2034, growing at a CAGR of 7.0% from 2025 to 2034 according to a new report by InsightAce Analytic.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/1445

Latest Drivers Restraint and Opportunities Market Snapshot:

Key factors influencing the global cell-free…

Plant Protein Market : Latest Market Research Report for Strategic Advantage | S …

Global Plant Protein Market

Market Overview:

Global Plant Protein Market Report 2022 comes with the extensive industry analysis by Introspective Market Research with development components, patterns, flows and sizes. The report also calculates present and past market values to forecast potential market management through the forecast period between 2022-2028.This research study of Plant Protein involved the extensive usage of both primary and secondary data sources. This includes the study of various parameters…

Pea Protein Ingredients Market Prospects, Consumption, Cost Structure, Competiti …

The food industry is continuously searching for healthier and cheaper protein ingredients that can be replaced by animal-based and gluten-based proteins. Pea protein is beneficial due to its low allergenicity, availability, and high nutritional value. The Global Pea Protein Ingredients Market is witnessing a major rise in its revenue from US$ 2.35 Bn in 2021 to US$ 6.78 Bn by 2030. The market is recording a CAGR of 12.5% during…

Astonishing growth in Dairy Protein Market Growth? Milk Protein Isolates (MPIs), …

Dairy Protein Market Business Insights and Updates:

The latest Market report by a Data Bridge Market Research with the title [Global Dairy Protein Market - Industry Trends and Forecast to 2026] . Dairy Protein Market research analysis and data lend a hand to businesses for the planning of strategies related to COVID-19 impact on industry, investment, revenue generation, production, product launches, costing, inventory, purchasing and marketing. Dairy Protein market insights with…

Global Plant Protein Market 2019 – Soy Protein, Wheat Protein, Pea Protein | K …

The Global Pea Protein Market Research Report conducts a deep estimation on the present state of Pea Protein Industry with the definition, classification and market scope. The fundamental Pea Protein Industry aspects like competitive landscape structure, eminent industry players, Pea Protein Market size and value is studied. The Pea Protein Market growth trends, development plans, dynamic market driving factors and risk assessment is conducted. All the traders, dealers, distributors of…

Protein Packaging Market Report 2018: Segmentation by Product (Rigid packaging, …

Global Protein Packaging market research report provides company profile for Amcor Limited, DuPont, Flexifoil Packaging Pvt., Swiss Pac Private Ltd. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed…