Press release

Specialty Insurance Market Overview: Key Trends, Opportunities, and Global Growth Outlook

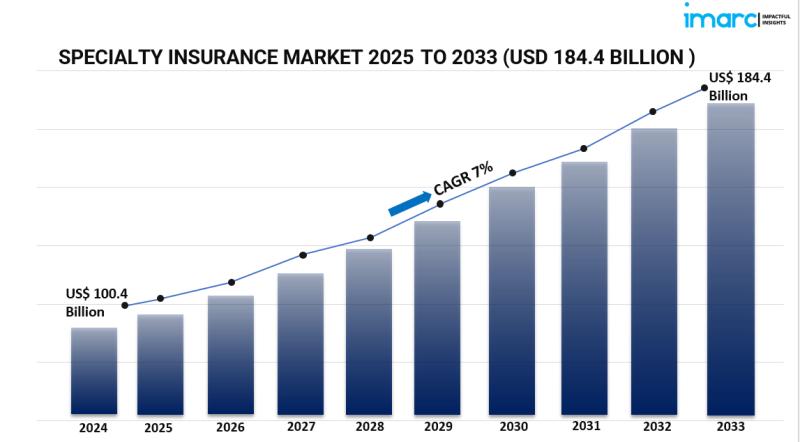

Specialty Insurance Market OverviewThe global specialty insurance market is expanding at a strong pace, fueled by rising exposure of enterprises to complex risks and continuous industrial advancements across multiple sectors. In 2024, the market reached USD 100.4 billion and is projected to climb to USD 184.4 billion by 2033, registering a CAGR of 7% during 2025-2033. This progress is underpinned by the rising demand for customized insurance offerings in industries such as healthcare, construction, marine, and aviation.

________________________________________

Study Assumption Years

• Base Year: 2024

• Historical Years: 2019-2024

• Forecast Years: 2025-2033

________________________________________

Specialty Insurance Market Key Takeaways

• Market Size and Growth: Valued at USD 100.4 billion in 2024, the market is expected to reach USD 184.4 billion by 2033, growing at a CAGR of 7%.

• Dominant Segment: Marine, Aviation, and Transport (MAT) insurance leads the market, supported by the logistical challenges of global trade and transport.

• Distribution Channels: Brokers dominate as the preferred distribution channel, offering expertise and tailored solutions for complex risks.

• End Users: Businesses represent the majority share, as they require protection for unique risks beyond standard policies.

• Regional Insights: Europe currently commands the largest market share, benefiting from its strong industrial foundation and regulatory focus on advanced risk management.

👉 Request for a sample copy of this report:

https://www.imarcgroup.com/specialty-insurance-market/requestsample

________________________________________

Market Growth Factors

1. Rising Coverage Needs

Companies are increasingly looking for specialized coverage to protect against cyberattacks, environmental risks, data breaches, climate change liabilities, and reputational threats-areas not addressed by traditional insurance policies.

2. Technological Transformation in Underwriting

Advanced technologies such as artificial intelligence (AI), machine learning (ML), blockchain, big data, and IoT are revolutionizing the insurance space. These tools improve underwriting precision, boost operational efficiency, and help insurers deliver more tailored products.

3. Regulatory and Demographic Influences

Factors such as aging populations, urbanization, and evolving lifestyles are creating demand for innovative insurance solutions. Additionally, stringent regulations, especially in Europe, are driving adoption of comprehensive specialty insurance products.

________________________________________

Market Segmentation

By Type

• Marine, Aviation, and Transport (MAT):

o Marine Insurance - Covers damages and losses linked to ships, cargo, and transport terminals.

o Aviation Insurance - Provides coverage for aircraft operations and aviation-related risks.

• Political Risk and Credit Insurance: Protects against political instability and credit defaults.

• Entertainment Insurance: Coverage for risks in film, live shows, and music tours.

• Art Insurance: Safeguards valuable artworks against theft or damage.

• Livestock and Aquaculture Insurance: Covers risks associated with animal health and aquaculture mortality.

• Others: Includes niche insurance solutions catering to specialized needs.

By Distribution Channel

• Brokers: Deliver expertise and custom coverage for specialized risks.

• Non-Brokers: Includes direct insurer networks and digital sales platforms.

By End User

• Businesses: Require protection against complex operational risks.

• Individuals: Opt for coverage to safeguard personal assets and unique activities.

________________________________________

Breakup by Region

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

________________________________________

Regional Insights

Europe maintains a leading role in the specialty insurance industry. The region's dominance stems from its strong industrial sector, strict regulatory structure, and extensive adoption of advanced risk management practices. Demand is further bolstered by industries such as marine, aviation, and art, which require highly specialized policies. Additionally, growing integration of technology and development of new niche markets are supporting long-term growth.

________________________________________

Recent Developments & News

The specialty insurance landscape is rapidly evolving with the adoption of cutting-edge technologies. Insurers are increasingly turning to AI, blockchain, and predictive analytics to enhance customization and risk assessment processes. Key developments include growing popularity of cyber insurance, aquaculture coverage, and art protection, highlighting the shifting needs of clients. Furthermore, global insurers are pursuing strategic partnerships to expand their international presence and introduce innovative specialty solutions.

________________________________________

Key Players

• American International Group Inc.

• Assicurazioni Generali S.P.A.

• Axa XL (Axa S.A)

• Hiscox Ltd.

• Manulife Financial Corporation

• Mapfre S.A.

• Munich Reinsurance Company

• Nationwide Mutual Insurance Company

• RenaissanceRe Holdings Ltd.

• Selective Insurance Group Inc.

• The Hanover Insurance Group Inc.

• Zurich Insurance Group Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

👉 Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5085&flag=C

________________________________________

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

________________________________________

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Specialty Insurance Market Overview: Key Trends, Opportunities, and Global Growth Outlook here

News-ID: 4169789 • Views: …

More Releases from IMARC Group

Methyl Cyclohexane Production Plant DPR 2026: CapEx/OpEx Analysis with Profitabi …

Setting up a methyl cyclohexane production plant positions investors within a strategically important segment of the global petrochemical and specialty chemicals industry, supported by rising demand across fuel blending, chemical intermediates, and hydrogen storage applications. Methyl cyclohexane is widely used as a solvent, a precursor in organic synthesis, and increasingly as a liquid organic hydrogen carrier in clean energy systems. Its role in supporting energy transport, advanced chemical processing, and…

Dacarbazine Production Plant DPR & Unit Setup 2026: Machinery Cost, Business Pla …

Setting up a dacarbazine production plant positions investors within a strategically important segment of the global agrochemical and industrial chemicals industry, driven by increasing demand for high-efficiency fertilizers, water-soluble nutrient formulations, and specialty industrial applications. As modern farming practices advance, precision agriculture expands, and the need for balanced nitrogen and phosphorus fertilization grows, dacarbazine continues to gain traction across horticulture, fertigation systems, and drip irrigation networks worldwide. Rising food production…

Industrial Adhesive Manufacturing Plant DPR 2026: Investment Cost, Market Growth …

Setting up an industrial adhesive manufacturing plant positions investors within a vital and high-demand segment of the global specialty chemicals industry, supported by expanding applications across construction, automotive, packaging, electronics, woodworking, and aerospace sectors. Industrial adhesives play a critical role in modern manufacturing by enabling strong, durable bonding solutions that enhance structural integrity, reduce mechanical fastening requirements, and improve production efficiency.

As industries shift toward lightweight materials, advanced composites, and automated…

Denim Fabric Manufacturing Plant DPR & Unit Setup 2026: Machinery Cost, CapEx/Op …

Setting up a denim fabric manufacturing industry is witnessing robust growth driven by the increasing demand from the apparel and fashion industry, growing preference for durable and versatile textiles, and the rising popularity of casual and workwear clothing across global markets. At the heart of this expansion lies a critical textile material-denim fabric. As fashion and lifestyle markets continue to evolve, establishing a denim fabric manufacturing plant presents a strategically…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…