Press release

Top 8 Tyre Companies in India : Leading Manufacturers and Top Brands [2025]

Market Dynamics of Top Tyre Companies in India 2025Industry Expansion:

The Indian tyre industry has witnessed strong expansion in recent years, driven by rising automobile sales, growing replacement demand, and government initiatives supporting infrastructure and mobility growth. Companies such as MRF Limited, Apollo Tyres, JK Tyre & Industries, and CEAT Limited dominate the domestic market, with each brand leveraging innovation, extensive distribution networks, and strong product portfolios.

MRF continues to lead the segment with its wide range of passenger, two-wheeler, and commercial tyres, recognized for durability and performance. Apollo Tyres has expanded its footprint both domestically and globally, with an emphasis on premium passenger and truck tyres. JK Tyre has strengthened its position in the commercial vehicle and bus segment, introducing fuel-efficient and smart tyres, while CEAT focuses on affordable and sustainable solutions, particularly in the two-wheeler and passenger car markets.

The replacement tyre market remains the key revenue driver, supported by India's rapidly growing vehicle population. With increasing demand for high-performance and radial tyres, these top companies are investing heavily in R&D, automation, and green technologies. Meanwhile, rural and semi-urban markets continue to offer strong growth potential, as affordable models cater to mass adoption.

Despite challenges such as raw material price fluctuations and import competition, the industry's outlook remains robust. With localization, technological upgrades, and exports gaining traction, the top 8 tyre companies are well-positioned to strengthen India's role as a global tyre manufacturing hub.

Strategic Approaches:

Leading Indian tyre manufacturers are adopting diverse strategies to retain market leadership and enhance profitability. MRF emphasizes premiumisation and motorsport branding, reinforcing its reputation as a high-performance tyre maker. Apollo Tyres focuses on global expansion, operating advanced plants in India and Europe, while developing smart tyre technologies to enhance safety and efficiency.

JK Tyre has pioneered "Smart Tyres" with IoT-enabled sensors, offering real-time monitoring of tyre health, which is especially useful for fleet operators. This innovation caters to the logistics sector's need for efficiency and reduced downtime. CEAT, on the other hand, is aligning with sustainability trends by producing fuel-efficient tyres and investing in eco-friendly manufacturing processes.

Market segmentation plays a crucial role, with MRF and Apollo targeting premium categories, JK Tyre catering strongly to commercial fleets, and CEAT offering affordable solutions to middle-class consumers. Strategic OEM (Original Equipment Manufacturer) tie-ups with major automobile companies further consolidate their market share. By combining innovation, affordability, and sustainability, the top 8 tyre companies are ensuring long-term competitiveness in both domestic and global markets.

How Big is the India Tyre Market ?

• Market Size Value in 2024: USD 13.4 Billion

• Industry Revenue Forecast in 2033: USD 22,680.55 Million

• Growth Rate: CAGR of 8.97%

• Base Year of Estimation: 2024

• Historical Data: 2019-2024

• Future Forecast Period: 2025-2033

Request Free Sample Report: https://www.imarcgroup.com/india-tyre-market/requestsample

Emerging Trends:

The Indian tyre industry is undergoing a transformation shaped by new technologies and evolving consumer preferences. Smart tyres embedded with sensors are gaining momentum, offering real-time updates on tyre pressure, temperature, and wear conditions. This is particularly beneficial for logistics and fleet operators, driving safety and operational efficiency.

Sustainability is another key trend, with companies like CEAT and Apollo adopting green manufacturing practices and experimenting with eco-friendly raw materials. The adoption of fuel-efficient and low-rolling-resistance tyres aligns with India's carbon-reduction goals, while retreaded tyres are gaining acceptance in commercial vehicles due to cost efficiency.

Digitalization is also reshaping the aftermarket segment, with leading tyre brands offering online tyre sales and doorstep fitment services to enhance customer convenience. In addition, the premiumisation trend is accelerating, with MRF and Apollo launching high-performance tyres catering to SUVs and luxury cars.

Exports remain a significant growth driver, as Indian tyre brands strengthen their presence in Europe, Africa, and Latin America. Together, these trends highlight the industry's move towards technology, sustainability, and global competitiveness.

By IMARC Group, the Top 8 Indian Tyre Companies in 2025:

• Apollo Tyres Ltd

• Bridgestone India Private Limited

• CEAT Ltd

• Continental Tyres

• JK Tyre & Industries Ltd.

• MRF Tyres

• The Goodyear Tire & Rubber Company

• Yokohama India Pvt Ltd

Explore Complete Blog for Detailed Information About Companies, Shares, and Data: https://www.imarcgroup.com/india-tyre-manufacturers-companies

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas: +1-201971-6302 | Africa and Europe: +44-702-409-7331

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 8 Tyre Companies in India : Leading Manufacturers and Top Brands [2025] here

News-ID: 4169305 • Views: …

More Releases from imarc group

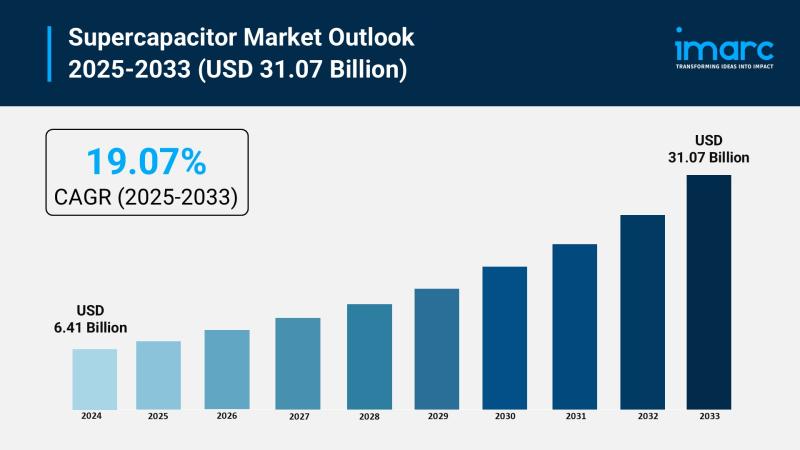

Supercapacitor Market Size to Reach $31.07B by 2033: Trends & Opportunities

Market Overview:

The supercapacitor market is experiencing rapid growth, driven by electrification of automotive systems, renewable energy and grid stabilization, and expansion of industrial automation and robotics. According to IMARC Group's latest research publication, "Supercapacitor Market Size, Share, Trends and Forecast by Product Type, Module Type, Material Type, End Use Industry, and Region, 2025-2033", the global supercapacitor market size was valued at USD 6.41 Billion in 2024. Looking forward, IMARC Group…

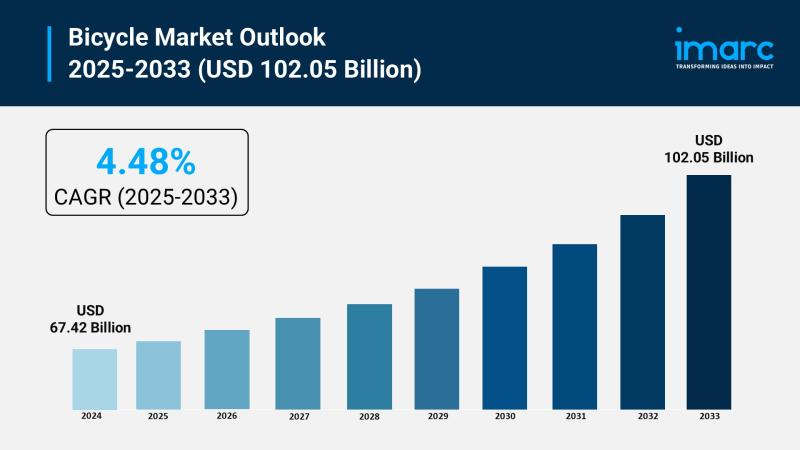

Bicycle Market Size to Surpass $102.05B by 2033: Growth & Insights

Market Overview:

The bicycle market is experiencing rapid growth, driven by global expansion of cycling infrastructure, rising health consciousness and preventative wellness, and technological advancements in e-bike propulsion. According to IMARC Group's latest research publication, "Bicycle Market Size, Share, Trends and Forecast by Type, Technology, Price, Distribution Channel, End User, and Region, 2025-2033", The global bicycle market size was valued at USD 67.42 Billion in 2024. Looking forward, IMARC Group estimates…

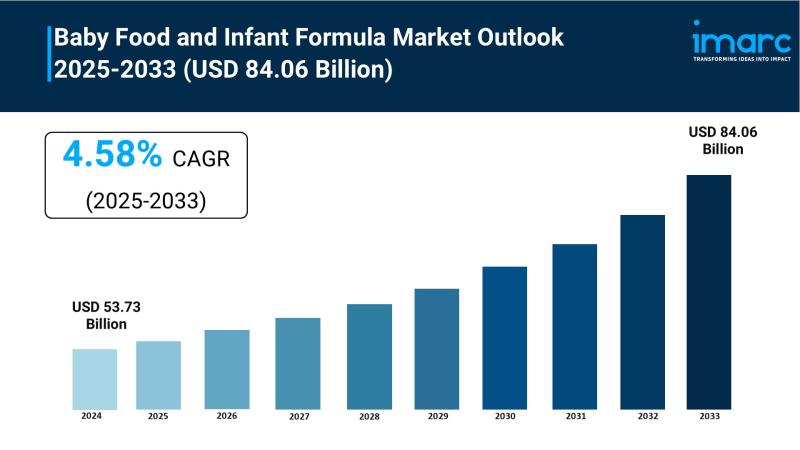

Baby Food and Infant Formula Market to Reach USD 84.06 Billion by 2033, Growing …

Market Overview:

The Baby Food and Infant Formula Market is experiencing steady expansion, driven by Increasing Awareness of Nutritional Needs for Infants, Rising Number of Working Women, and Technological Advancements and Product Innovation. According to IMARC Group's latest research publication, "Baby Food and Infant Formula Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global baby food and infant formula market size reached USD 53.73 Billion in 2024.…

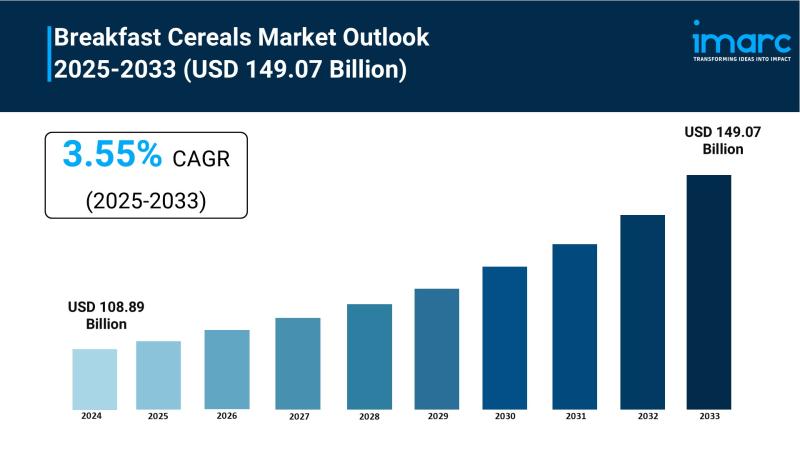

Breakfast Cereals Market to Reach USD 149.07 Billion by 2033, Growing at a CAGR …

Market Overview:

The Breakfast Cereals Market is experiencing rapid growth, driven by Health and Wellness Awareness, Busy Lifestyles and On-the-Go Demand and Rising Disposable Incomes and Global Market Expansion . According to IMARC Group's latest research publication, "Breakfast Cereals Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global breakfast cereals market size was valued at USD 108.89 Billion in 2024. Looking forward, IMARC Group estimates…

More Releases for Tyre

Pakistan Rubber Tyre Market : Pneumatic Rubber Tyre, Retreaded Rubber Tyre, Cush …

According to a recent report published by Allied Market Research, titled, "Pakistan rubber tyre Market by Tyre, Component, Design, and Vehicle Type: Opportunity Analysis and Industry Forecast, 2018 - 2025," Pakistan rubber tyre market size was valued at $272.10 million in 2017, and is projected to reach $1,592.90 million by 2025, registering a CAGR of 24.8% from 2018 to 2025. The radial type design segment was the highest contributor to…

Pakistan Rubber Tyre Market : Pneumatic Rubber Tyre, Retreaded Rubber Tyre, Cush …

The global Pakistan rubber tyre market size was valued at $272.10 million in 2017, and is projected to reach $1,592.90 million by 2025, registering a CAGR of 24.8% from 2018 to 2025. The radial type by design segment was the highest revenue contributor in 2017, accounting for $207.7 million, and is estimated to reach $1,196.4 million by 2025, registering a CAGR of 24.6% during the forecast period.

Download Sample Report at…

Pakistan Rubber Tyre Market : Pneumatic Rubber Tyre, Retreaded Rubber Tyre, Cush …

According to a recent report published by Allied Market Research, titled, "Pakistan rubber tyre Market by Tyre, Component, Design, and Vehicle Type: Opportunity Analysis and Industry Forecast, 2018 - 2025," Pakistan rubber tyre market size was valued at $272.10 million in 2017, and is projected to reach $1,592.90 million by 2025, registering a CAGR of 24.8% from 2018 to 2025. The radial type design segment was the highest contributor to…

Off-road Tyre Market See Huge Growth for New Normal | AEOLUS TYRE, TOYO Tyre, Co …

The latest report on the "Off-road Tyre Market" study has evaluated the future growth potential and provides information and useful stats on market structure and size. The research provides a comprehensive analysis of development trends, revenue growth, and market share for the forecast period of 2022 to 2028. It highlights an overview of the market dynamics of the Off-road Tyre market, which includes drivers, restraints, and opportunities that are influencing…

Rubber Tyre and Tube Market 2020: Key Players – General Tyre and Rubber, Servi …

Rubber Tyre and Tube Industry

Description

Wiseguyreports.Com Adds “Rubber Tyre and Tube -Market Demand, Growth, Opportunities and Analysis Of Top Key Player Forecast To 2025” To Its Research Database

Rubber Tyre and Tube market is segmented by Type, and by Application. Players, stakeholders, and other participants in the global Rubber Tyre and Tube market will be able to gain the upper hand as they use the report as a powerful resource. The segmental…

Pakistan Rubber Tyre and Tube Market Players to See Huge Investments Opportuniti …

Key Findings of the Pakistan Rubber Tyre and Tube Market:

o In 2017, based on channel, aftermarket generated the highest revenue.

o In 2017, by vehicle type, the commercial vehicles type was the highest revenue contributor.

o In 2017, by design, the radial segment was the highest revenue contributor.

Download Report Sample (177 Pages PDF with Insights): https://www.alliedmarketresearch.com/request-sample/6242

The key players analyzed in this pakistan rubber tyre and tube market report include General Tyre and Rubber Co. Ltd.,…