Press release

Australia Public Cloud Market Size, Share and Growth Analysis Report 2024-2033

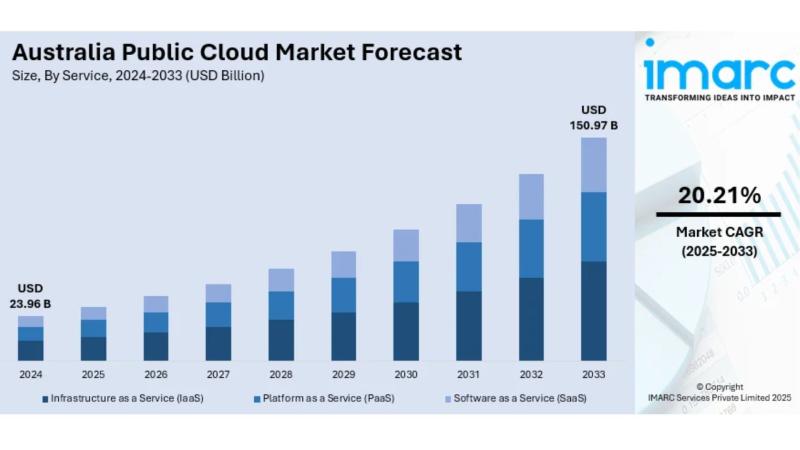

The latest report by IMARC Group, titled "Australia Public Cloud Market Size, Share, Trends and Forecast by Service, Enterprise Size, End Use, and Region, 2025-2033," offers a comprehensive analysis of the Australia public cloud market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia public cloud market size reached USD 23.96 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 150.97 billion by 2033, exhibiting a growth rate of 20.21% during 2025-2033.Report Attributes:

• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: USD 23.96 Billion

• Market Forecast in 2033: USD 150.97 Billion

• Market Growth Rate 2025-2033: 20.21%

For an in-depth analysis, you can refer to a sample copy of the report: https://www.imarcgroup.com/australia-public-cloud-market/requestsample

How Is AI Transforming the Public Cloud in Australia?

• Government AI trials are demonstrating significant productivity gains, with Microsoft 365 Copilot saving participants approximately one hour daily on routine tasks, while 70% report increased speed and 61% observe quality improvements

• AI-enabled platforms are unlocking an estimated AUD $5 billion in additional productivity gains through cloud deployment, representing a 63% increase compared to current estimates if legacy networks remain in place

• Machine learning integration is revolutionizing data management capabilities, with cloud providers incorporating AI and ML services to offer more efficient and personalized data processing solutions

• Digital transformation acceleration is being driven by AI adoption, with the Australian Government's $17 million AI Adopt Programme establishing centers nationwide to expand AI usage among businesses

• Automated infrastructure management through AI is reducing operational costs significantly, with intelligent resource allocation and predictive maintenance improving cloud efficiency by up to 40%

Australia Public Cloud Market Overview

• Government digitalization initiatives are driving massive cloud adoption, with potential savings of AUD $13.5 billion by 2035 as agencies transition from legacy systems to modern cloud infrastructure

• Enterprise digital transformation is accelerating across sectors, with organizations embracing cloud technologies to modernize legacy systems, streamline operations, and enhance customer engagement capabilities

• Major provider investments are expanding local infrastructure, with AWS, Microsoft Azure, and Google Cloud significantly investing in new availability zones, dedicated support teams, and compliance solutions

• Cybersecurity enhancement is becoming critical, with cloud adoption potentially preventing AUD $178 million in breach-related costs over the next decade as 163 data breaches were reported in 2024

• Remote work acceleration continues driving cloud demand, with businesses requiring scalable, secure, and flexible infrastructure to support hybrid work models and distributed teams

Key Features and Trends of Australia Public Cloud

• Sovereign data solutions are gaining prominence as organizations demand secure, locally-hosted cloud services that comply with Australian data sovereignty requirements and regulatory frameworks

• Multi-cloud strategies are becoming standard practice, with enterprises adopting diversified cloud approaches to avoid vendor lock-in while optimizing costs and performance across different platforms

• Industry-specific cloud offerings are expanding rapidly, with providers developing tailored solutions for banking, healthcare, government, and manufacturing sectors to meet specific compliance and operational needs

• Edge computing integration is transforming cloud architecture, with edge services bringing processing closer to data sources to reduce latency and improve real-time application performance

• Sustainability initiatives are influencing cloud adoption decisions, with organizations prioritizing providers offering carbon-neutral services and energy-efficient data center operations

Growth Drivers of Australia Public Cloud

Market Growth Drivers:

1. Government Digital Transformation - Public sector modernization initiatives are driving massive cloud adoption, with government IT spending representing over 70% legacy systems and only 10% on public cloud, creating enormous growth potential

2. Cybersecurity and Risk Management - Rising cyber threats with 163 data breaches reported in 2024 are pushing organizations toward secure cloud platforms, with potential savings of AUD $178 million in breach-related costs driving adoption

3. AI and Analytics Integration - Growing demand for AI-powered services and advanced analytics is accelerating cloud adoption, with AI deployment requiring cloud infrastructure as a prerequisite for scale and functionality

4. Cost Optimization and Efficiency - Organizations are achieving significant cost reductions through cloud migration, with potential government savings of AUD $1.4 billion annually representing 13% reduction in IT costs

5. Remote Work and Hybrid Models - Continued demand for flexible, scalable infrastructure supporting distributed workforces is driving cloud adoption across all enterprise sizes and industries

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/australia-public-cloud-market

Innovation & Market Demand of Australia Public Cloud

• Generative AI integration is reshaping cloud service offerings, with providers embedding advanced AI capabilities into their platforms to support content creation, data analysis, and automated decision-making processes

• Quantum computing preparation is emerging as cloud providers begin offering quantum-ready services and hybrid quantum-classical computing environments to prepare enterprises for next-generation computing capabilities

• Serverless computing adoption is accelerating among developers, with function-as-a-service offerings enabling more efficient resource utilization and automatic scaling without infrastructure management overhead

• Data analytics as a service is expanding rapidly, with cloud platforms offering sophisticated analytics tools, real-time processing capabilities, and AI-powered insights to help organizations extract value from their data

• Industry 4.0 enablement through cloud platforms is supporting smart manufacturing, IoT integration, and digital twin technologies, with cloud infrastructure providing the computational power and connectivity required for industrial transformation

Australia Public Cloud Market Opportunities

• Government cloud-first policies are creating substantial opportunities, with public sector modernization potentially generating AUD $13.5 billion in savings by 2035 while requiring comprehensive cloud infrastructure development

• Indigenous and regional connectivity initiatives present growth opportunities through government programs expanding digital infrastructure to remote areas, requiring specialized cloud services and edge computing solutions

• Healthcare digitalization offers significant expansion potential, with telehealth adoption and electronic health records requiring secure, compliant cloud platforms capable of handling sensitive medical data

• Financial services modernization is driving demand for specialized cloud solutions supporting open banking, digital payments, and regulatory compliance requirements in the highly-regulated BFSI sector

• Climate tech and sustainability solutions are emerging as growth areas, with cloud platforms supporting carbon tracking, environmental monitoring, and sustainable business practices across industries

Australia Public Cloud Market Challenges

• Data sovereignty concerns are creating complexity for multinational organizations, requiring cloud providers to establish local data centers and comply with Australian data residency requirements while maintaining global connectivity

• Legacy system integration remains challenging for large enterprises, with over 70% of government technology infrastructure still using legacy systems that require costly and complex migration strategies

• Skills shortage and digital literacy are limiting adoption speed, with only 25% of organizations currently providing digital transformation training to staff, creating workforce capability gaps

• Regulatory compliance complexity is increasing costs and deployment timeframes, particularly for organizations in heavily regulated industries requiring specialized compliance frameworks and security certifications

• Cost management and optimization challenges are emerging as organizations struggle to control cloud spending, with complex pricing models and resource optimization requiring specialized expertise and ongoing monitoring

Australia Public Cloud Market Analysis

• Market consolidation trends are accelerating as larger cloud providers acquire smaller competitors and specialized service providers to expand their capabilities and market reach across different industry verticals

• Pricing competition intensification is benefiting customers but pressuring provider margins, with major providers offering increasingly competitive rates and value-added services to capture market share

• Partner ecosystem expansion is strengthening through strategic alliances between cloud providers and local systems integrators, creating comprehensive service offerings that combine global capabilities with local expertise

• Compliance and certification investments are increasing as providers seek to meet Australian regulatory requirements, with significant resources dedicated to achieving certifications for government and enterprise customers

• Innovation acceleration through research and development partnerships with Australian universities and research institutions is driving breakthrough technologies in areas like quantum computing, AI, and cybersecurity

Australia Public Cloud Market Segmentation:

1. By Service:

o Infrastructure as a Service (IaaS)

o Platform as a Service (PaaS)

o Software as a Service (SaaS)

2. By Enterprise Size:

o Large Enterprise

o Small and Medium-sized Enterprises

3. By End Use:

o BFSI

o IT and Telecom

o Retail and Consumer Goods

o Manufacturing

o Energy and Utilities

o Healthcare

o Media and Entertainment

o Government and Public Sector

o Others

4. By Region:

o Australia Capital Territory & New South Wales

o Victoria & Tasmania

o Queensland

o Northern Territory & Southern Australia

o Western Australia

Australia Public Cloud Market News & Recent Developments:

September 2025: Microsoft and Mandala released groundbreaking research revealing that accelerating cloud adoption in government could save the Australian Government AUD $3.4 billion over four years and AUD $13.5 billion by 2035, with findings showing digital transformation could deliver average annual savings of AUD $1.4 billion.

August 2023: Oracle opened a new cloud region specifically for the Government of Australia, unveiling the Oracle Cloud for Australian Government and Defense in Canberra with over 100 services, geographically separate from public regions to ensure enhanced security and sovereignty.

Australia Public Cloud Market Key Players:

• Amazon Web Services (AWS)

• Microsoft Azure

• Google Cloud Platform

• Oracle Corporation

• IBM Cloud

• Alibaba Cloud

• Salesforce

• ServiceNow

• Adobe Systems

• SAP SE

• VMware

• Citrix Systems

Key Highlights of the Report:

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=33974&flag=E

FAQs: Australia Public Cloud Market

Q1: What factors are driving the rapid growth in Australia's public cloud market?

A: Key growth drivers include government digital transformation initiatives with potential AUD $13.5 billion savings by 2035, cybersecurity concerns following 163 data breaches in 2024, AI integration requiring cloud infrastructure as a prerequisite, cost optimization opportunities with 13% IT cost reductions, and continued remote work adoption requiring scalable infrastructure solutions.

Q2: How is artificial intelligence impacting Australia's public cloud adoption?

A: AI is fundamentally transforming cloud adoption through government trials showing one hour daily productivity gains with Microsoft 365 Copilot, unlocking an estimated AUD $5 billion in additional productivity gains through cloud deployment, requiring cloud infrastructure for AI scale deployment, and the government's $17 million AI Adopt Programme driving nationwide AI center establishment for business expansion.

Q3: What challenges does Australia's public cloud market face?

A: Major challenges include data sovereignty concerns requiring local infrastructure development, legacy system integration with over 70% of government systems still using outdated technology, skills shortage with only 25% of organizations providing digital transformation training, regulatory compliance complexity in heavily regulated industries, and cost management difficulties with complex pricing models.

Q4: Which cloud service segments show the strongest growth potential?

A: Infrastructure as a Service (IaaS) demonstrates the strongest growth as organizations migrate from legacy systems, Platform as a Service (PaaS) benefits from AI and analytics integration demand, Software as a Service (SaaS) continues expanding across all enterprise sizes, while government and public sector end-use segments show exceptional potential with massive digitalization initiatives underway.

Q5: What opportunities exist for new entrants in Australia's public cloud market?

A: Emerging opportunities include government cloud-first policies creating AUD $13.5 billion market potential, Indigenous and regional connectivity initiatives requiring specialized solutions, healthcare digitalization demanding secure compliant platforms, financial services modernization supporting open banking, and climate tech solutions enabling carbon tracking and environmental monitoring capabilities.

Conclusion of Report:

Australia's public cloud market stands at an unprecedented inflection point, where massive government digitalization initiatives and AI integration are driving extraordinary growth from USD 23.96 billion to USD 150.97 billion over the next decade. With the government's potential to save AUD $13.5 billion by 2035 through cloud adoption and only 10% of current IT spending allocated to public cloud, the transformation opportunity is immense. The market is benefiting from major provider investments in local infrastructure, growing cybersecurity awareness following 163 data breaches in 2024, and the imperative for AI deployment requiring cloud-first strategies. While challenges including data sovereignty requirements, legacy system integration, and skills shortages persist, the fundamental drivers of digital transformation, cost optimization delivering 13% IT cost reductions, and the government's $17 million AI Adopt Programme are positioning Australia as a global leader in cloud adoption. The convergence of government policy support, enterprise digital transformation needs, and technological innovation is creating a robust ecosystem that promises sustained growth and competitive advantage for organizations embracing cloud-first strategies in an increasingly digital economy.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Public Cloud Market Size, Share and Growth Analysis Report 2024-2033 here

News-ID: 4169005 • Views: …

More Releases from IMARC Services Private Limited

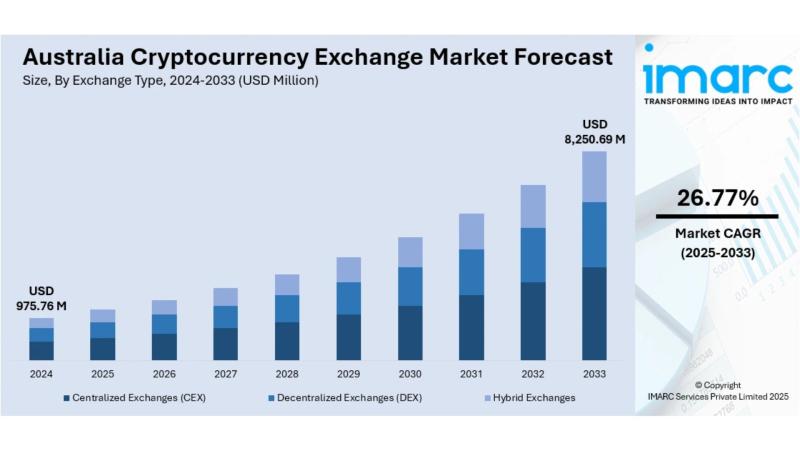

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

Australia Cryptocurrency Exchange Market Overview

Market Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a…

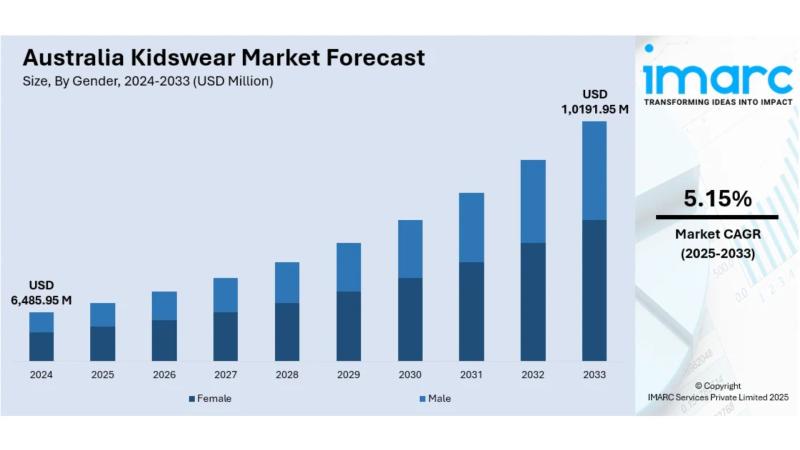

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

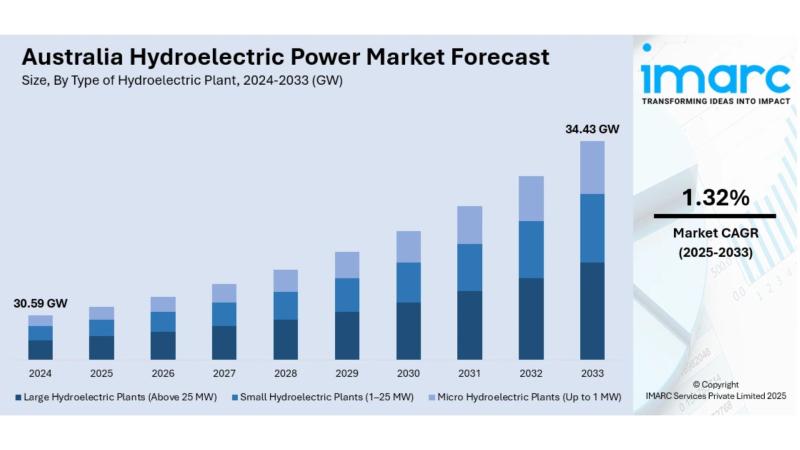

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

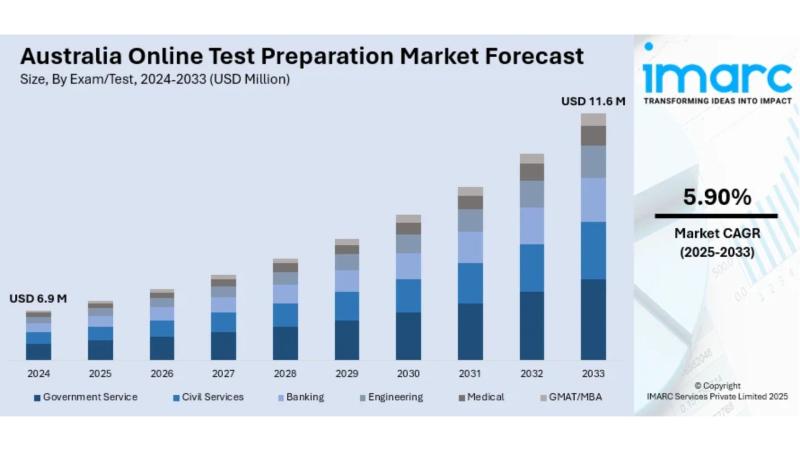

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…