Press release

Philippines Digital Payments Market Worth to Reach USD 1,733.50 Million During 2025-2033

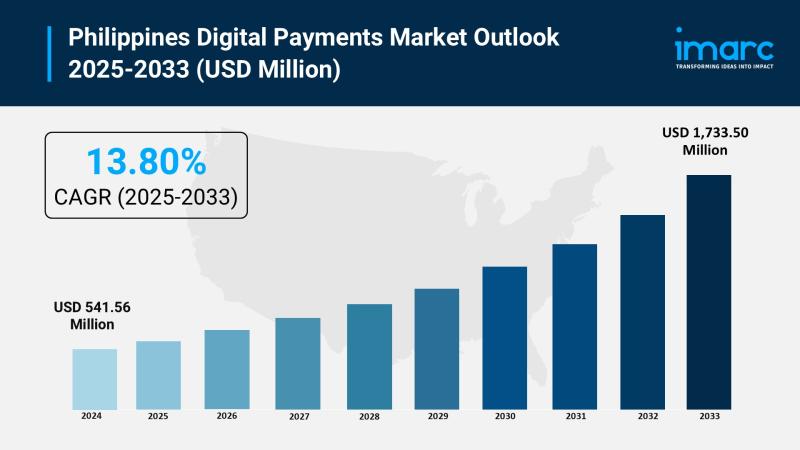

The latest report by IMARC Group, "Philippines Digital Payments Market Size, Share, Trends, and Forecast by Component, Payment Mode, Deployment Type, End Use Industry, and Region, 2025-2033," provides an in-depth analysis of the Philippines digital payments market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines digital payments market size reached USD 541.56 Million in 2024 and is projected to grow to USD 1,733.50 Million by 2033, exhibiting a 13.80% growth rate during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 541.56 Million

Market Forecast in 2033: USD 1,733.50 Million

Market Growth Rate 2025-2033: 13.80%

Philippines Digital Payments Market Overview:

The Philippines digital payments market is experiencing unprecedented transformation as digital transactions surpass cash-based payments, accounting for 59% of overall transaction value. The Bangko Sentral ng Pilipinas (BSP) leads this revolution through comprehensive financial inclusion programs and digital transformation roadmaps, supported by expanding smartphone penetration and internet accessibility. E-wallets like GCash and Maya dominate the landscape, while innovative solutions like NFC payments and super app integrations enhance user convenience. Government initiatives, including plans to issue four new digital bank licenses, demonstrate continued commitment to building a robust fintech ecosystem that serves both urban and rural populations across the archipelago.

Request For Sample Report: https://www.imarcgroup.com/philippines-digital-payments-market/requestsample

Philippines Digital Payments Market Trends:

• Mobile wallet dominance is accelerating with GCash and Maya leading adoption, while new entrants like Viber Pay prepare to launch in Q2 2025

• NFC contactless payments are expanding through GCash and Open Fabric's "Tap to Pay" system for merchant transactions

• Cash decline projection shows cash transactions dropping from 47% in 2019 to 27% by 2025, with mobile wallets growing from 16% to 27%

• Digital bank expansion with BSP planning to issue four new digital bank licenses in 2025, adding to the current six serving 8.7 million depositors

• QR code adoption through QR Ph enables seamless retail transactions and real-time fund transfers via InstaPay and PESONet systems

• Super app integration combines payments with social media, e-commerce, and lifestyle services for comprehensive digital experiences

Philippines Digital Payments Market Drivers:

• Government leadership through BSP's Digital Payments Transformation Roadmap and National Strategy for Financial Inclusion creates regulatory support

• Smartphone and internet penetration expansion enables widespread access to digital financial services across urban and rural areas

• E-commerce growth drives demand for seamless online payment solutions with integrated cashback and promotional incentives

• Financial inclusion initiatives target unbanked populations through simplified fintech apps and agent-assisted banking models

• Contactless payment preference continues post-pandemic as consumers prioritize hygiene, safety, and convenience in transactions

• Cross-border payment solutions like Alipay+ partnerships enable international tourist transactions and support local business growth

Market Challenges:

• Cybersecurity concerns, including online fraud, phishing, and data privacy issues, create user hesitation and trust barriers

• Infrastructure gaps in rural areas with inconsistent internet connectivity and limited access to digital tools restrict adoption

• Financial literacy limitations among older demographics and rural populations require targeted education campaigns and support programs

• Interoperability issues between fragmented platforms disrupt user experience and complicate financial management across services

• Regulatory complexity requires ongoing compliance with evolving BSP guidelines and data protection requirements

Market Opportunities:

• Rural market expansion through simplified fintech apps, local language support, and agent-assisted banking models

• B2B and SME solutions including automated invoicing, payroll systems, and inventory management for small business digitization

• Transport and public service integration with contactless cards and QR code systems for routine transaction habit building

• Buy-now-pay-later services growth makes high-value purchases accessible to Filipino consumers across income segments

• Cross-platform integration between social commerce, messaging apps, and payment systems for streamlined user experiences

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/philippines-digital-payments-market

Philippines Digital Payments Market Segmentation:

Component Insights:

• Solutions (API, Payment Gateway, Payment Processing, Payment Security and Fraud Management, Transaction Risk Management, Others)

• Services (Professional Services, Managed Services)

Payment Mode Insights:

• Bank Cards

• Digital Currencies

• Digital Wallets

• Net Banking

• Others

Deployment Type Insights:

• Cloud-based

• On-premises

End Use Industry Insights:

• BFSI

• Healthcare

• IT and Telecom

• Media and Entertainment

• Retail and E-commerce

• Transportation

• Others

Regional Insights:

• Luzon

• Visayas

• Mindanao

Major Market Competitors:

• GCash (Globe Fintech Innovations)

• Maya (PayMaya Philippines)

• GrabPay Philippines

• PayPal Philippines

• Union Bank of the Philippines

• BPI (Bank of the Philippine Islands)

• BDO Unibank

• ShopeePay Philippines

• Coins.ph

• Paymongo

Philippines Digital Payments Market News:

February 2025: Rakuten Viber announced the upcoming launch of the Viber Pay digital wallet in the Philippines by Q2 2025, enabling peer-to-peer transactions within the messaging app and supporting transfers from banks and e-wallets like GCash and Maya via InstaPay, with over one million users already signed up.

July 2025: BSP reported that digital payments have overtaken cash-based transactions, accounting for 59% of overall transaction value in 2024, while announcing plans to issue four new digital bank licenses in 2025 to enhance financial inclusion beyond the current six digital banks serving 8.7 million depositors.

Key Highlights of the Report:

• Market valued at USD 541.56 million in 2024, projected to reach USD 1,733.50 million by 2033

• Digital payments surpass cash transactions, reaching 59% of overall transaction value in 2024

• BSP planning to issue four new digital bank licenses in 2025 adding to current six serving 8.7 million depositors

• Cash transactions projected to drop from 47% to 27% by 2025, with mobile wallets growing from 16% to 27%

• GCash and Open Fabric launching NFC "Tap to Pay" contactless payment system for merchants

• Viber Pay digital wallet launching Q2 2025 with over one million users already registered

• Comprehensive government support through BSP's Digital Payments Transformation Roadmap

• Strong growth in QR Ph adoption enabling seamless retail transactions and real-time transfers

Frequently Asked Questions (FAQs):

Q1: What is driving the growth of the Philippines digital payments market?

The market is driven by BSP's financial inclusion initiatives, expanding smartphone and internet penetration, e-commerce growth, government support through digital transformation roadmaps, and increasing consumer preference for contactless transactions following the pandemic.

Q2: Which payment methods are most popular in the Philippines?

Digital wallets like GCash and Maya dominate the market, followed by bank cards and QR code payments. Mobile wallets are projected to grow from 16% to 27% of transaction value by 2025, while cash usage declines from 47% to 27%.

Q3: What are the main challenges facing digital payment adoption?

Key challenges include cybersecurity concerns with fraud and data privacy, infrastructure gaps in rural areas, limited financial literacy among certain demographics, interoperability issues between platforms, and ongoing regulatory compliance requirements.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=28731&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Digital Payments Market Worth to Reach USD 1,733.50 Million During 2025-2033 here

News-ID: 4167801 • Views: …

More Releases from IMARC Group

Cost of Setting Up a PET Bottle Manufacturing Plant & DPR 2026

The global PET bottle industry is experiencing sustained growth propelled by rising packaged beverage consumption, pharmaceutical packaging expansion, increasing demand for ready-to-drink products, and the lightweight, recyclable advantages of PET packaging. As urbanization accelerates, consumer lifestyles shift toward convenience packaging, and regulatory frameworks increasingly mandate recyclable materials, establishing a PET bottle manufacturing plant positions investors in one of the most stable and essential segments of the consumer packaging value chain.

IMARC…

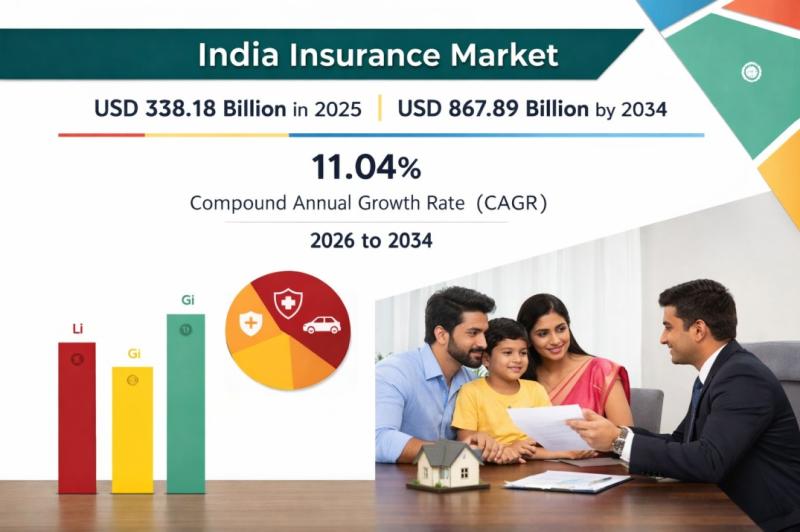

India Insurance Market Forecast 2026: Industry Size, Expansion & Future Scope 20 …

India Insurance Market Overview 2026-2034

According to IMARC Group's report titled India Insurance Market Size, Share, Trends and Forecast by Type of Product, Distribution Channel, End User, and Region, 2026-2034 the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The India insurance market size was valued at USD 338.18 Billion in 2025 and is projected to reach USD 867.89 Billion by 2034, growing at…

Global Diammonium Phosphate (DAP) Prices January 2026: Asia Gains, Europe Steady …

What is Diammonium Phosphate (DAP)?

Diammonium Phosphate (DAP) is a widely used phosphorus-based fertilizer crucial for global agriculture. Monitoring Diammonium Phosphate (DAP) prices helps manufacturers, distributors, and buyers make informed procurement decisions and manage costs amid fluctuating demand and supply conditions.

Global Price Overview

The global Diammonium Phosphate (DAP) market shows moderate stability with regional supply differences affecting prices. The Diammonium Phosphate (DAP) price trend has remained mixed, while the price index and…

Titanium Prices, Index, Supply Factors & Uses | Jan 2026

North America Titanium Prices Movement Jan 2026

In January 2026, Titanium prices in North America reached USD 7.09/KG, reflecting a 3.1% increase. The upward movement was supported by firm demand from aerospace, automotive, and defense industries. Stable raw material supply and improving manufacturing activity strengthened market sentiment, contributing to positive pricing momentum across the region.

Regional Analysis: The price analysis can be extended to provide detailed Titanium price information for the following…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…