Press release

Emerging Post Investment Management Market Trends: Real-Time Insights Boost Efficiency In Investment Processes Shaping the Future of the Industry

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Post Investment Management Market Size Growth Forecast: What to Expect by 2025?

The size of the post investment management market has seen robust growth in the past few years. It is predicted to expand from a value of $10.20 billion in 2024 to reach $11.17 billion in 2025, showcasing a compound annual growth rate (CAGR) of 9.4%. The significant growth observed in the previous period can be traced back to the heightened demand from investors for clarity, the growing stress on optimizing portfolio performance, the escalating requirement for risk management, an intensified focus on creating value, and the rise in the use of digital reporting tools.

How Will the Post Investment Management Market Size Evolve and Grow by 2029?

The market size of post-investment management is predicted to witness robust growth in the coming years, with a forecast of $15.80 billion by 2029, growing at a Compound Annual Growth Rate (CAGR) of 9.1%. The growth during this projected period is driven by factors such as an increasing need for data-driven decision-making, increased requirements for transparent reporting, an escalating focus on long-term value creation, rising demand for real-time performance tracking, and higher investor expectations for active involvement. The key trends anticipated for this period involve advancements in AI-based monitoring tools, innovative environmental, social, and governance (ESG) performance measurements, incorporation of real-time analytics platforms, improvements in automated compliance systems, and the integration of cloud-based portfolio management solutions.

View the full report here:

https://www.thebusinessresearchcompany.com/report/post-investment-management-global-market-report

What Drivers Are Propelling the Growth of Post Investment Management Market Forward?

The escalation of digital transformation is predicted to spur the expansion of the post-investment management market in the future. This transformation denotes the amalgamation of digital technologies into all aspects of an enterprise, fundamentally altering its operation and value proposition to customers. This surge in digital transformation stems from the increasing demand for operational productivity, as corporations progressively employ technology to simplify procedures, minimize manual labor, and boost productivity. By utilizing data-oriented tools and technologies, post-investment management bolsters digital transformation, facilitating a more efficient monitoring of investments. It fosters enlightened strategic decision-making, optimizes operational effectiveness, and ensures portfolios adapt to progressive digital trends, promoting sustained value growth. For example, in May 2023, 69% of European firms had adopted sophisticated digital technologies in 2022, as reported by the European Investment Bank, a Luxembourg-based bank, marking an increase from the previous 61%. Hence, the continued surge in digital transformation is fueling the expansion of the post-investment management market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=27044&type=smp

Which Emerging Trends Are Transforming the Post Investment Management Market in 2025?

Key players in the post-investment management market are putting their efforts towards the creation of highly technological solutions, such as those driven by artificial intelligence (AI) data analytics. The primary aims here are to better monitor portfolios, manage risk effectively, and elevate the decision-making efficiency in the post-investment realm. AI data analytics incorporating AI technologies involve using strategies such as machine learning and natural language processing to analyze large, intricate data sets, identify patterns, forecast outcomes, and foster informed decision-making in investment management. To elaborate, in June 2025, Jio Blackrock Asset Management Private Limited from India launched Aladdin, an advanced platform for risk and portfolio management. The platform gives AI-led real-time risk analytics, complete portfolio management functionalities, and improved transparency. Aladdin's goal is to provide Indian fund managers and investors with high-caliber tools, driving intelligent and data-driven choices in mutual fund investments.

What Are the Key Segments in the Post Investment Management Market?

The post investment management market covered in this report is segmented -

1) By Service Type: Portfolio Management, Asset Management, Risk Management, Compliance And Reporting, Other Service Types

2) By Deployment Mode: On-Premises, Cloud

3) By End User: Institutional Investors, High Net Worth Individuals, Family Offices, Others End-Users

Subsegments:

1) By Portfolio Management: Performance Monitoring, Strategy Realignment, Exit Planning, Stakeholder Reporting

2) By Asset Management: Asset Valuation, Capital Expenditure Planning, Operational Improvement, Asset Lifecycle Tracking

3) By Risk Management: Financial Risk Assessment, Operational Risk Monitoring, Regulatory Risk Analysis, Scenario Planning

4) By Compliance And Reporting: Environmental, Social, And Governance Compliance Tracking, Regulatory Filings, Investor Reporting, Audit Support

5) By Other Service Types: Value Creation Advisory, Governance Support, Post-Merger Integration, Technology Integration

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=27044&type=smp

Who Are the Key Players Shaping the Post Investment Management Market's Competitive Landscape?

Major companies operating in the post investment management market are JPMorgan Chase & Co., Bank of America Corporation, China Post Group Corporation Limited, Citigroup Inc., Wells Fargo & Company, HSBC Holdings plc, Morgan Stanley & Co. LLC, BNP Paribas S.A., The Goldman Sachs Group Inc., UBS Group AG, Deutsche Bank AG, Barclays PLC, Fidelity Investments Inc., The Vanguard Group Inc., Invesco Ltd., FTI Consulting Inc., Everbright Securities Company Limited, eFront S.A., Allvue Systems Holdings Inc., Post Advisory Group LLC, Altvia Solutions LLC

What Geographic Markets Are Powering Growth in the Post Investment Management Market?

North America was the largest region in the post investment management market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the post investment management market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=27044

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay

Europe - +44 7882 955267,

Asia: +91 88972 63534,

Americas - +1 310-496-7795 or

Email:saumyas@tbrc.info

Follow Us On:

• LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Emerging Post Investment Management Market Trends: Real-Time Insights Boost Efficiency In Investment Processes Shaping the Future of the Industry here

News-ID: 4167442 • Views: …

More Releases from The Business Research Company

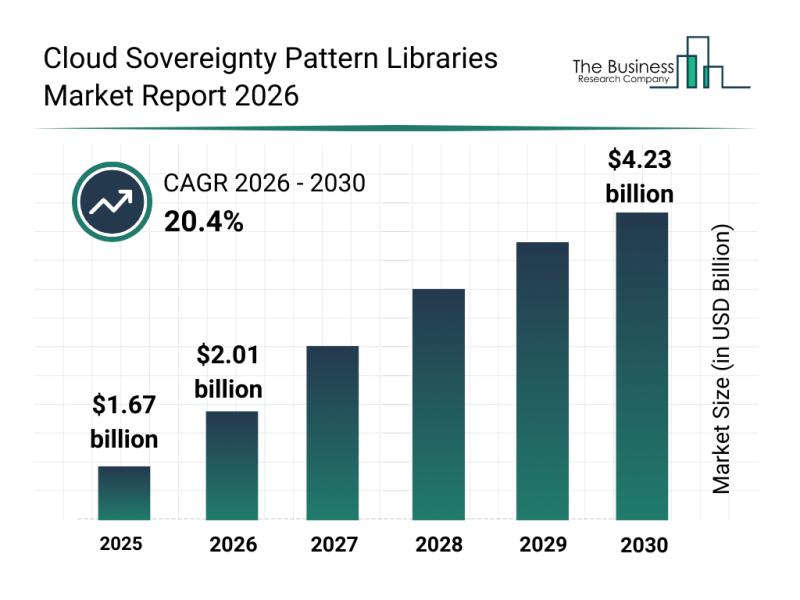

In-Depth Study of Segments, Industry Trends, and Key Players in the Cloud Sovere …

The cloud sovereignty pattern libraries market is poised for remarkable expansion as organizations increasingly prioritize data governance and regulatory compliance across diverse regions. With growing emphasis on sovereignty standards and secure cloud environments, this sector is set to experience dynamic growth and innovation through 2030.

Projected Market Size and Growth Trajectory of the Cloud Sovereignty Pattern Libraries Market

The market for cloud sovereignty pattern libraries is anticipated to grow significantly,…

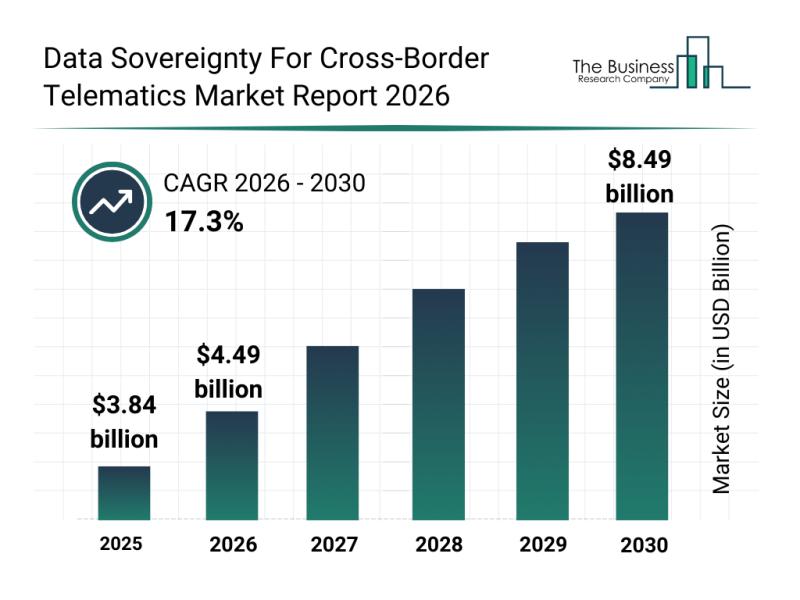

Leading Industry Participants Reinforcing Their Roles in the Data Sovereignty fo …

The landscape of cross-border telematics is rapidly evolving as data sovereignty becomes a critical concern for businesses and governments alike. With the increasing use of smart mobility solutions and stringent regulations surrounding data transfer across borders, the market for data sovereignty in cross-border telematics is set for significant expansion. Let's explore the current market size, the leading players, key trends, and segmentation driving this dynamic sector.

Market Size and Growth Outlook…

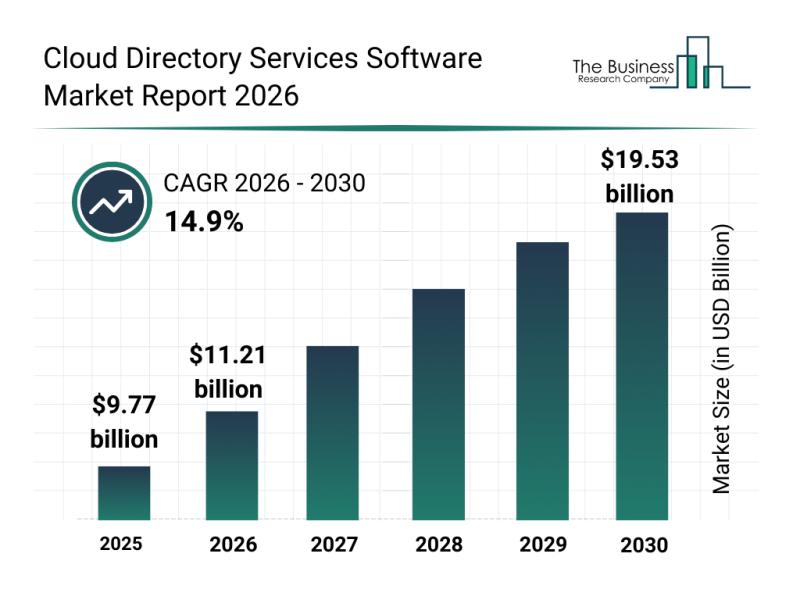

Top Companies and Competitive Dynamics in the Cloud Directory Services Software …

The cloud directory services software market is on track for substantial expansion over the coming years, driven by evolving security needs and technological advancements. This sector is becoming increasingly vital as organizations prioritize identity management and secure access in complex cloud environments. Let's explore the market's expected growth, key players, emerging trends, and segmentation to understand its future trajectory.

Forecasted Market Size and Growth of the Cloud Directory Services Software Market…

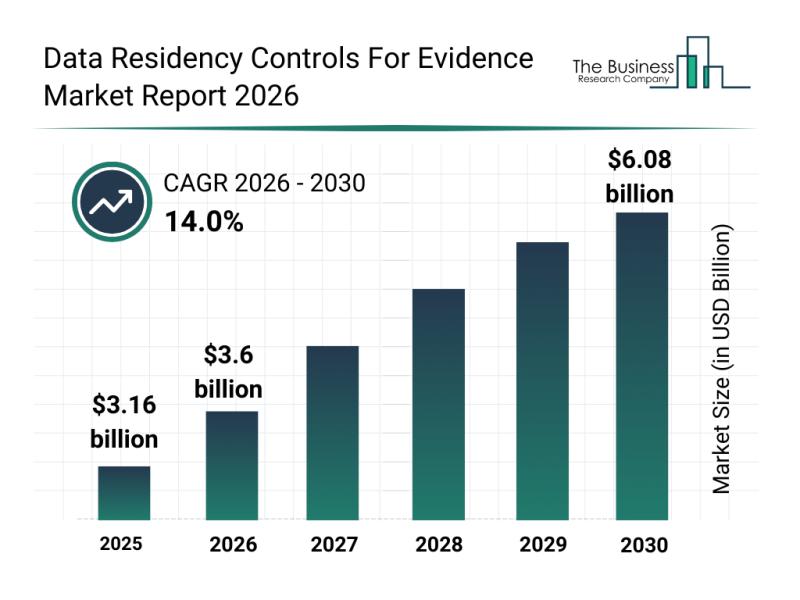

Future Perspectives: Key Trends Shaping the Data Residency Controls for Evidence …

The data residency controls for evidence market is gaining significant attention as organizations increasingly prioritize secure and compliant handling of digital data. This sector is on track to experience substantial expansion over the coming years, driven by evolving legal and technological demands. Let's explore the market's growth projections, leading companies, emerging trends, and how the market is segmented to understand the current landscape and future outlook.

Strong Growth Predictions for the…

More Releases for Management

Gym Management Software Market By Functions - Scheduling Appointments, Waitlist …

MarketResearchReports.Biz announces addition of new report "Gym Management Software Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2017 - 2025" to its database.

Gym management software is a software solution which allows the users to manage the different processes associated with running a gym in an efficient and effective manner. These software solutions are generally multifunctional and can manage all the diverse processes associated with managing a gym…

Water Network Management, Water Network Management trends, Water Network Managem …

MarketStudyReport.com adds a new 2018-2023 Global Water Network Management Market Report focuses on the major drivers and restraints for the global key players providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

This report presents a comprehensive overview, market shares, and growth opportunities of by Water Network Management product type, application, key manufacturers and key regions. Over the next five years, Water Network Management will…

Cloud Project Portfolio Management Market Report 2018: Segmentation by Applicati …

Global Cloud Project Portfolio Management market research report provides company profile for CA Technologies (New York, U.S.), HPE (California, U.S.), Changepoint Corporation (Richmond Hill, Ontario), Clarizen, Inc. (California, U.S.), Microsoft Corporation (Washington, U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…

Prescriptive analytics Market Outlook 2025 focus On: Risk Management, Operation …

A detailed market study on "Global Prescriptive analytics Market" examines the performance of the Prescriptive analytics Market. It encloses an in-depth Research of the Prescriptive analytics Market state and the competitive landscape globally. This report analyzes the potential of Prescriptive analytics Market in the present and the future prospects from various prospective in detail.

Get Free Sample Report@ https://databridgemarketresearch.com/request-a-sample/?dbmr=global-prescriptive-analytics-market

Prescriptive analytics market accounted for USD 1.20 billion growing at a CAGR of…

Facility Management Market Solutions & Services (Real Estate & Lease Management, …

ReportsWeb.com added “Global Facility Management Market to 2025” to its vast collection of research Database. The report classifies the global Facility Management Market in a precise manner to offer detailed insights into the aspects responsible for augmenting as well as restraining market growth.

Facility Management is an essential part which handles all functions related to enterprise and helps in streaming all the operations with reducing cost. Managing life cycle management of…

Telecom Expense Management Market Analysis For Financial Management, Order Manag …

The telecom expense management (TEM) market report provides analysis for the period 2014–2024, wherein the period from 2016 to 2024 is the forecast period and 2015 is the base year. The report covers all the major trends and technologies playing a key role in telecom expense management market growth over the forecast period. It also highlights the drivers, restraints, and opportunities expected to influence the market’s growth during the said…