Press release

Australian Automotive Financing Market 2025 | Worth USD 10,344.1 Million by 2033

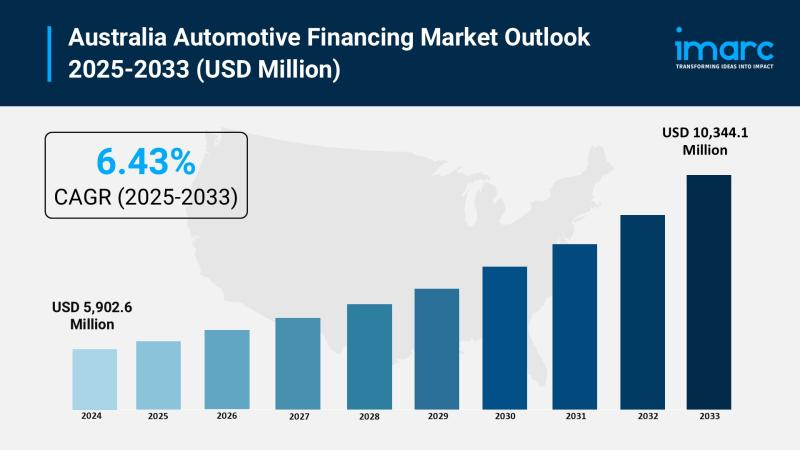

The latest report by IMARC Group, "Australian Automotive Financing Market Report by Type (New Vehicle, Used Vehicle), Source Type (OEM, Banks, Credit Unions, Financial Institution), Vehicle Type (Passenger Cars, Commercial Vehicles), and Region 2025-2033," provides an in-depth analysis of the Australian automotive financing market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australian automotive financing market size reached USD 5,902.6 Million in 2024 and is projected to grow to USD 10,344.1 Million by 2033, exhibiting a growth rate of 6.43% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 5,902.6 Million

Market Forecast in 2033: USD 10,344.1 Million

Market Growth Rate 2025-2033: 6.43%

Australian Automotive Financing Market Overview:

Australia's automotive financing sector is experiencing robust transformation as the nation embraces sustainable transportation and digital-first lending solutions. The market is benefiting from a growing national fleet of 20.1 million registered motor vehicles, with significant growth in electric vehicle adoption supported by government incentives. Financial institutions are implementing flexible loan structures including balloon payments, variable interest rates, and extended terms to accommodate diverse consumer preferences. The sector is witnessing enhanced digitalization through online platforms that streamline loan applications and provide immediate credit approvals. Major policy shifts, including Bank Australia's decision to cease fossil fuel vehicle financing from 2025, reflect the industry's commitment to supporting Australia's transition toward a low-carbon transportation system while maintaining competitive financing options for environmentally conscious consumers.

Request For Sample Report: https://www.imarcgroup.com/australian-automotive-financing-market/requestsample

Australian Automotive Financing Market Trends:

• Digital Platform Integration: The market is embracing online loan applications, immediate credit approvals, and automated documentation processes that streamline the borrowing journey for tech-savvy consumers.

• Green Vehicle Financing Shift: Banks are implementing specialized financing programs for electric and hybrid vehicles, with some institutions like Bank Australia ceasing fossil fuel vehicle loans from 2025 to support decarbonization goals.

• Flexible Financing Structures: Traditional rigid loan terms are being replaced by customizable options including balloon payments, variable rates, and extended terms that provide lower monthly payments and improved budget management.

• Used Vehicle Market Growth: Rising interest in pre-owned vehicles is driving specialized financing solutions with shorter loan terms and flexible repayment options, supported by integrated digital marketplace tools.

• Subscription-Style Access Models: The industry is exploring innovative financing approaches including bundled maintenance and insurance packages alongside subscription-based vehicle access programs.

Australian Automotive Financing Market Drivers:

• Growing Vehicle Ownership Demand: Australia's national fleet increased by 1.7% from 2020 to 2021, reaching 20.1 million registered vehicles, with Toyota leading passenger vehicle registrations for 16 consecutive years.

• Government Policy Support: The Australian Renewable Energy Agency allocated $4.76 million for electric vehicle infrastructure development, supporting the deployment of 3,100 rental EVs and 256 charging stations across 41 sites.

• Economic Stability Benefits: Stable economic conditions and consumer confidence are supporting automotive purchases, with attractive interest rates and government initiatives contributing to robust market growth.

• Digital Transformation Adoption: Online financing platforms with pre-approval calculators and comparison tools are enhancing customer engagement and expediting decision-making across urban and regional areas.

• Electrification Incentive Programs: Government rebates, lower registration fees, and tax benefits for electric vehicles are creating favorable financing conditions with reduced interest rates for eco-friendly vehicle purchases.

Market Challenges:

• Competitive Interest Rate Environment: Traditional automotive financing faces pressure from low-cost alternatives and competitive banking products, requiring differentiation through service quality and specialized offerings.

• Regulatory Compliance Complexity: Evolving financial services regulations and responsible lending obligations create operational challenges for lenders managing risk assessment and documentation requirements.

• Electric Vehicle Infrastructure Limitations: Limited charging infrastructure in regional areas may restrict electric vehicle adoption despite favorable financing terms, affecting market expansion potential.

• Economic Sensitivity: Automotive financing demand remains vulnerable to economic downturns, employment fluctuations, and interest rate changes that affect consumer purchasing power and confidence.

• Credit Risk Management: Rising operational costs and changing consumer debt profiles require enhanced credit scoring and risk assessment capabilities to maintain portfolio quality and profitability.

Market Opportunities:

• Electric Vehicle Market Expansion: The transition to electric vehicles creates opportunities for specialized financing products with favorable terms, government incentive integration, and infrastructure partnerships.

• Subscription and Mobility Services: Growing demand for flexible vehicle access models presents opportunities for innovative financing structures beyond traditional ownership-based loans.

• Commercial Vehicle Financing: Light commercial vehicle registrations increased by 3.3%, creating expansion opportunities in business financing for fleet operations and commercial transportation needs.

• Regional Market Development: Geographic expansion into underserved regional markets can leverage improved digital platforms and local dealer partnerships to capture new customer segments.

• Fintech Partnership Integration: Collaboration with financial technology companies can enhance digital capabilities, improve customer experiences, and create competitive advantages in automated lending processes.

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/australian-automotive-financing-market

Australian Automotive Financing Market Segmentation:

By Type:

• New Vehicle

• Used Vehicle

By Source Type:

• OEM

• Banks

• Credit Unions

• Financial Institution

By Vehicle Type:

• Passenger Cars

• Commercial Vehicles

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Major Market Competiters List:

• Toyota Finance Australia Limited

• Commonwealth Bank of Australia

• National Australia Bank

• ANZ Banking Group

• Westpac Banking Corporation

• Macquarie Group Limited

• Pepper Money Limited

• Liberty Financial

• BMW Financial Services

• Mercedes-Benz Financial Services Australia

Australian Automotive Financing Market News:

• August 2025: New vehicle registrations reached 103,097 units in July 2025, representing a 3.6% increase over the previous July according to the Federal Chamber of Automotive Industries, demonstrating sustained market demand that supports continued growth in automotive financing across passenger and commercial vehicle segments.

• March 2025: Bank Australia's policy to cease financing new fossil fuel vehicles from 2025 has been implemented as part of the institution's commitment to achieve net zero carbon emissions by 2035, with the bank now exclusively offering financing for electric vehicles and hybrid models to support Australia's decarbonization goals.

Key Highlights of the Report:

• Australia's registered vehicle fleet reached 20.1 million units with consistent 1.7% annual growth

• New vehicle registrations increased 3.6% in July 2025 demonstrating sustained market demand

• Light commercial vehicles showing strongest growth at 3.3% reaching 17.5% of national fleet

• Government supporting electric vehicle transition through $110.6 million infrastructure investment

• Bank Australia implementing fossil fuel vehicle financing phase-out from 2025

• Digital financing platforms enhancing customer engagement and decision-making processes

• Queensland, South Australia, and ACT leading regional growth with 2.3% increases

Frequently Asked Questions (FAQs):

Q1: What are the main factors driving growth in Australia's automotive financing market?

The market is driven by Australia's growing national fleet of 20.1 million registered vehicles, government support for electric vehicle adoption through $110.6 million infrastructure investment, and flexible financing options including balloon payments and extended terms. Digital platforms and economic stability with attractive interest rates are also supporting sustained growth.

Q2: How is the shift toward electric vehicles impacting automotive financing in Australia?

Banks like Bank Australia are ceasing fossil fuel vehicle financing from 2025, while offering specialized EV financing with reduced interest rates. Government incentives including rebates and tax benefits, combined with infrastructure development supporting 3,100 rental EVs, are creating favorable conditions for electric vehicle financing growth.

Q3: What role are digital platforms playing in transforming automotive financing?

Digital platforms are revolutionizing financing through online loan applications, immediate credit approvals, and automated processes. These tools offer pre-approval calculators and comparison features that enable consumers to assess financing options independently, improving customer engagement across urban and regional markets.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24090&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australian Automotive Financing Market 2025 | Worth USD 10,344.1 Million by 2033 here

News-ID: 4167426 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…