Press release

Horse Insurance Market Growth Accelerates: Strategic Forecast Predicts $1.24 Billion by 2029

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Will the Horse Insurance Industry Market Size Be by 2025?

The equine insurance industry has seen swift expansion in the previous few years. The market, which was valued at $0.75 billion in 2024, is projected to increase to $0.83 billion in 2025, with a compound annual growth rate (CAGR) of 11.0%. The historical growth of this market can be credited to a surge in veterinary costs for equines, increased incidents of horse injuries, more government support for equine health, a rise in international horse trade, and an expansion in commercial horse-riding services.

What's the Long-Term Growth Forecast for the Horse Insurance Market Size Through 2029?

The anticipated horse insurance market growth is projected to accelerate rapidly in the upcoming years, reaching $1.24 billion in 2029 with a compound annual growth rate (CAGR) of 10.6%. The surge during the forecast period is due to factors such as the increasing acceptance of digital insurance platforms, an uptick in the disposable income of horse owners, prevalent horse possession, amplified worth of superior breed horses, and a growing count of leisure horse riders. The forecast period is likely to witness major trends such as technological advancements, digital platform innovations, progress in medical treatments and surgeries, advancements in diagnostic methods, and an increasingly tech-savvy equestrian community.

View the full report here:

https://www.thebusinessresearchcompany.com/report/horse-insurance-global-market-report

What Are the Key Growth Drivers Fueling the Horse Insurance Market Expansion?

The expansion of horse racing events is projected to stimulate the development of the horse insurance market. Horse racing, usually involving jockeys guiding horses along a set track to determine the winner, is seeing an upsurge because of the advent of platforms. These platforms, offering mobile apps, live streaming, and real-time data features, have broadened its appeal and made it more accessible and engaging. As the frequency of horse racing events increases, horse insurance is becoming more advantageous in safeguarding owners against financial losses due to injuries, diseases, or even death of their prized racehorses during training or events. For example, the British Horseracing Authority, a UK regulator, reported in February 2025 that 2,052 individual Flat horses achieved a BHA performance rate of 85 or more in 2024, a 3.5% rise compared to 1,983 in 2023. Consequently, the escalating number of horse racing events is fuelling the horse insurance market's growth.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=26869&type=smp

What Are the Key Trends Driving Horse Insurance Market Growth?

Key players within the horse insurance market are emphasizing the development of innovative solutions like commercial equine liability insurance. These solutions expand the risk coverage for equine businesses and guarantee financial safety against third-party claims associated with property damage or physical injury as a result of horses. The commercial equine liability insurance provides a safety net for horse-related businesses against any legal claims due to injuries or property damages instigated by their horses or business activities. For instance, Hub International Limited, a US-based insurance brokerage firm, unveiled Private Client Equine Risk Advisory Services in February 2025. This service included coverage for equine death and major medical needs. Additionally, it offered protection for operations related to training, boarding, and instruction. The service also encompassed liability coverage for events and shows, handled care, custody, and control risks, and provided both personal and commercial equine liability protection. This personalized, consultative approach assists clients in mitigating the exclusive risks linked with valuable horses and equestrian activities.

How Is the Horse Insurance Market Segmented?

The horse insurance market covered in this report is segmented -

1) By Type: Mortality Insurance, Major Medical Insurance, Surgical Insurance, Loss Of Use Insurance, Personal Liability Insurance

2) By Type Of Horse: Sport Horses, Racehorses, Draft Horses, Leisure Horses, Ponies

3) By Distribution Channel: Agents And Brokers, Direct Response, Online, Other Distribution Channels

4) By Ownership Type: Individual Owners, Stable Or Boarding Facilities, Riding Schools And Clubs, Equine Therapy Centers, Professional Trainers

5) By Application: Recreational, Commercial

Subsegments:

1) By Mortality Insurance: Full Mortality Coverage, Limited Mortality Coverage, Named Perils Mortality

2) By Major Medical Insurance: Accident Coverage, Illness Coverage, Diagnostic Testing, Rehabilitation Services

3) By Surgical Insurance: Emergency Surgery Coverage, Elective Surgery Coverage, Post-Operative Care, Anesthesia Costs

4) By Loss Of Use Insurance: Full Loss of Use, Limited Loss of Use, External Injury Only, Internal Condition Coverage

5) By Personal Liability Insurance: On-Premises Liability, Off-Premises Liability, Third-Party Injury, Property Damage

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=26869&type=smp

Which Companies Are Leading the Charge in Horse Insurance Market Innovation?

Major companies operating in the horse insurance market are Markel Insurance Company, Great American Insurance Group, Petplan Equine Insurance, ASPCA Pet Health Insurance, Agria Pet Insurance Ltd., Allen Financial Insurance Group Inc., Horse Insurance Specialists LLC, Blue Bridle Equine Insurance Agency Inc., Broadstone Equine Insurance Agency LLC, Kay Cassell Equine Insurance Agency LLC, Hallmark Equine Insurance Agency Inc., Franklin Equine Services LLC, Equine Insurance Center LLC, Equine Insurance Solutions LLC, Fry's Equine Insurance Agency Inc., American Equine Insurance Group Inc., Equine Protect Ltd., Jorene Mize Insurance Agency Inc., Equine Insurance Brokers Ltd., Equine Insurance Professionals LLC.

Which Regions Are Leading the Global Horse Insurance Market in Revenue?

North America was the largest region in the horse insurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the horse insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=26869

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay

Europe - +44 7882 955267,

Asia: +91 88972 63534,

Americas - +1 310-496-7795 or

Email:saumyas@tbrc.info

Follow Us On:

• LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Horse Insurance Market Growth Accelerates: Strategic Forecast Predicts $1.24 Billion by 2029 here

News-ID: 4167405 • Views: …

More Releases from The Business Research Company

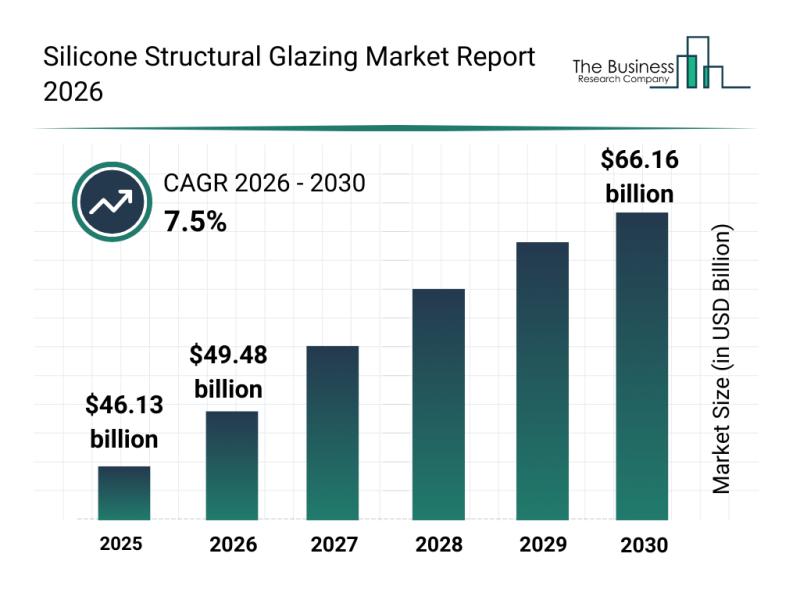

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

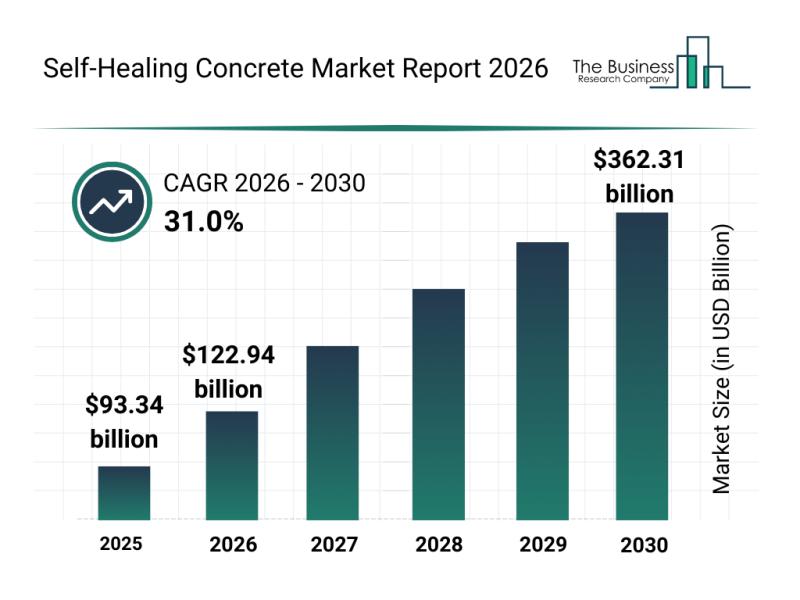

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

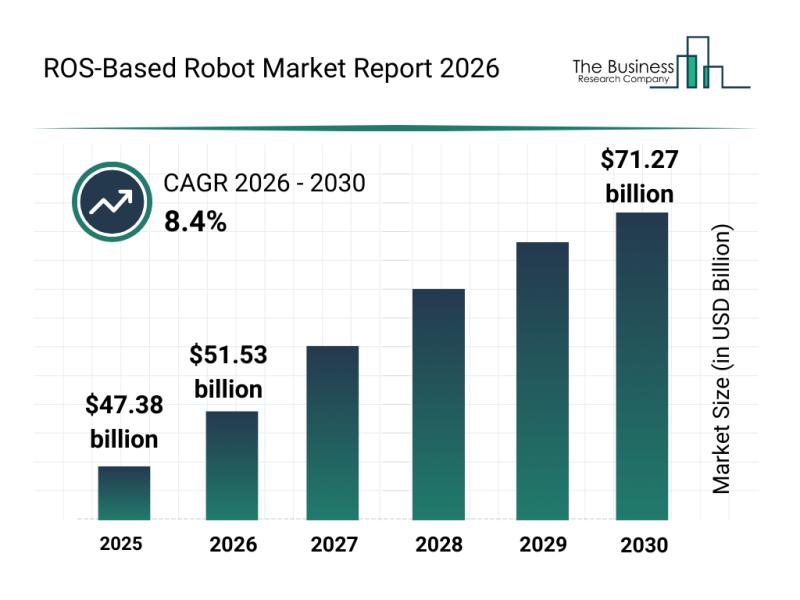

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

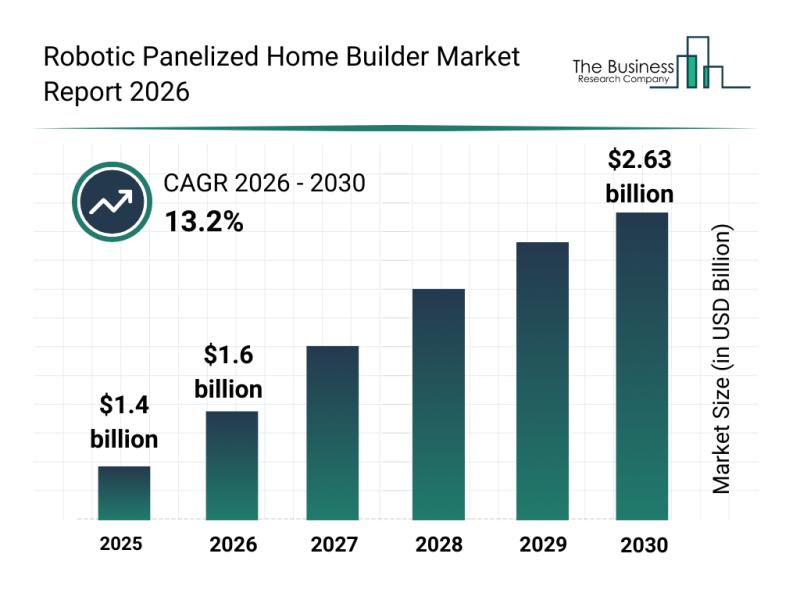

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…