Press release

Top Health Insurance Companies in India 2025: Leading Key Players

Market Dynamics of Health Insurance Companies in India 2025:Industry Expansion:

India's health insurance market has been undergoing rapid growth in recent years due to rising healthcare costs, increasing lifestyle-related illnesses and interventions, and heightened public awareness of financial protection. Leading the way in this growth are 13 of the major health insurance companies in India, who provide different policies for individuals, families and organizations. This growth is further facilitated as health insurance penetration and access is aided by government further schemes, and other reforms aimed at improving affordability. Moreover, the industry has been influenced by technology, including digital claim processes, teleconsultations, and cashless hospitalization networks that improve customer experience.

Plus, the rise in health insurance policies which are wellness-focused and include components relating to coverage for preventive healthcare, diagnostics, and wellness checks, is widening the breadth of coverage levels in health insurance policies. Increasingly urbanized populations with rising disposable incomes is observing a greater adoption of health insurance policies among the middle-class population. The private insurers' involvement in health insurance sector, through partnerships with hospitals and diagnostic centers to strengthen the healthcare ecosystem. As awareness of the significance of health insurance coverage broadens among consumers, we expect to be part of sustained growth in this sector, with the top players being contributors to improving healthcare access and financial protection for millions of families in India, in aggregate, financial protection for consumers.

Strategic Approaches:

The leading health insurance providers have implemented forward-thinking approaches to fashioning the competitive advantage of health insurance firms in India to meet the innovative demands of customers. These health insurance providers have modified their product portfolios to include valuable products such as policies on critical illness, maternity-care, mental health, and modalities for holistic health approaches. Additionally, health insurance providers are improving their underwriting processes through the use of technology that will hasten the speed and transparency of policy issue. Furthermore, leading health insurance companies are providing enhanced customer engagement with mobile applications, AI-based chatbots, and support for policyholders, 24/7.

Additionally, through collaborating with hospitals, fitness applications, and telehealth service providers, companies will deliver integrated healthcare solutions for consumers.

Many health insurers are also helping prevent health deterioration by improving lifestyles through premium discounts, reward points, and wellness incentives based on consumers engaging in regular activity, and are prevented from mitigating their response to processing and caring for their needs.

They are also expanding their distribution networks for both consumer access and distribution capabilities through digital commerce, bancassurance collaborations, and agency training, which is required to provide consumers with access to products and services. By innovating, regulatory steering, and improving customer trust, these companies are building rapid brand equity and predictable allegiance beyond competition. This multi-offensive strategy will achieve market leader status, and create longstanding reputation as an emerging healthcare partner in regards to brand equity development prospects yielded in a highly competitive market.

How Big is the India Electric vehicle Market:

• Market Size Value in 2024: USD 145.0 billion

• Industry Revenue Forecast in 2033: USD 308.0 billion

• Growth Rate: CAGR of 8.70%

• Base Year of Estimation: 2024

• Historical Data: 2019-2024

• Future Forecast Period: 2025-2023

Request Free Sample Report: https://www.imarcgroup.com/india-health-insurance-market/requestsample

Emerging Trends:

Few insurance sectors are undergoing as many changes and innovation as the Indian health insurance industry, with some notable industry trends including how insurers conduct operations and how individuals represent themselves in insurance policies. Insurers are honing processes aided by paperless onboarding, immediate approval and settlement of claims through prepaid cashless cards, and AI driven risk assessment. Insurers are not just building outpatient policies separate from the hospitalization policies, and to include consultations, home based healthcare, and preventative care programs. Insurers are also developing plans that include customization, such as flexible premium structures, and specific guaranteed benefits based on an individual's health profile/needs. There is also growing integration into lifestyle habits of the consumers through wearable devices and healthcare applications, including real-time health and lifestyle monitoring and dynamic discount premiums.

The rate of growth of mental health coverage is also indicative of changing attitudes, supports by the growing emphasis on mental health by unions and continuing pressure from regulators. Global best practice integrated telehealth and virtual healthcare methods will continue to evolve as a means to increase accessibility in areas not comfortable with modern healthcare, or low accessibility (i.e. rural and semi-urban areas). Family floater plan as well as specific senior citizen health insurance policies continue to provide expanding lives into paying premiums. These emerging trends are a reflection of how the top 13 health insurance companies in India are aligning themselves with technology and consumer demands in meeting the economy's growth in sustainable accessibility into health care.

By IMARC Group, the top 13 Health Insurance Companies in India in 2025:

• Aditya Birla Health Insurance Co. Ltd

• Bajaj Allianz General Insurance Company Limited

• Care Health Insurance Company Limited

• Cholamandalam MS General Insurance Company Limited

• HDFC ERGO General Insurance Company Limited

• ICICI Lombard General Insurance Company Limited

• Magma HDI General Insurance Company

• National Insurance Company Limited

• NIVA BUPA HEALTH INSURANCE COMPANY LIMITED

• Reliance General Insurance Company Limited

• SBI General Insurance Company Limited

• Star Health & Allied Insurance Co. Pvt. Ltd.

• Tata AIG General Insurance Company Limited

Explore Complete Blog for Detailed Information About Companies, Shares, and Data:

https://www.imarcgroup.com/top-india-health-insurance-companies

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas: +1 631 791 1145 | Africa and Europe: +44-702-409-7331 | Asia: +91-120-433-0800

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top Health Insurance Companies in India 2025: Leading Key Players here

News-ID: 4167393 • Views: …

More Releases from IMARC Group

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

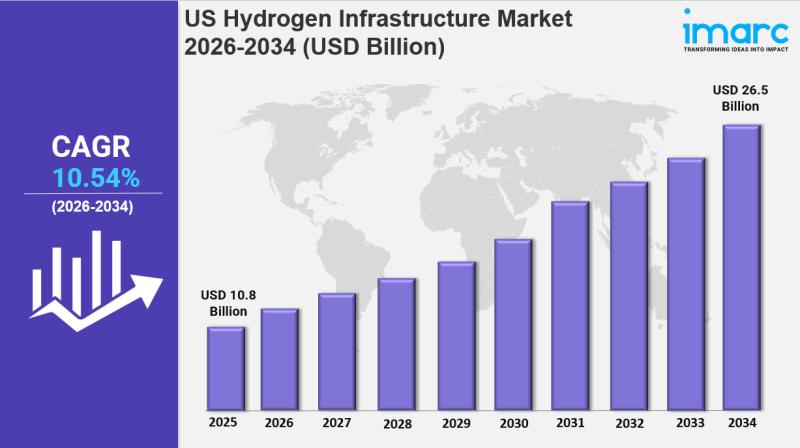

US Hydrogen Infrastructure Market Size, Growth, Latest Trends and Forecast 2026- …

IMARC Group has recently released a new research study titled "US Hydrogen Infrastructure Market Report by Production (Steam Methane Reforming, Coal Gasification, Electrolysis, and Others), Storage (Compression, Liquefaction, Material Based), Delivery (Transportation, Refinery, Power Generation, Hydrogen Refueling Stations), and Region 2026-2034" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The U.S. hydrogen infrastructure market…

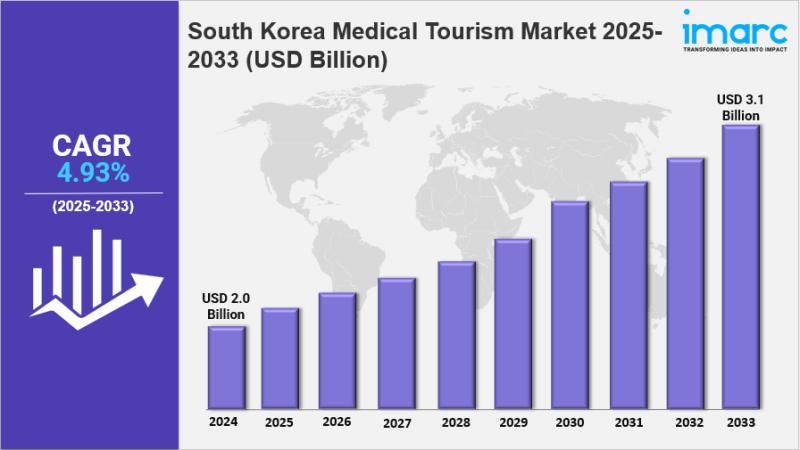

South Korea Medical Tourism Market Size, Share, Industry Overview, Trends and Fo …

IMARC Group has recently released a new research study titled "South Korea Medical Tourism Market Report by Type (Outbound, Inbound, Intrabound), Treatment Type (Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, and Others) 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Medical Tourism Market Overview

The South Korea…

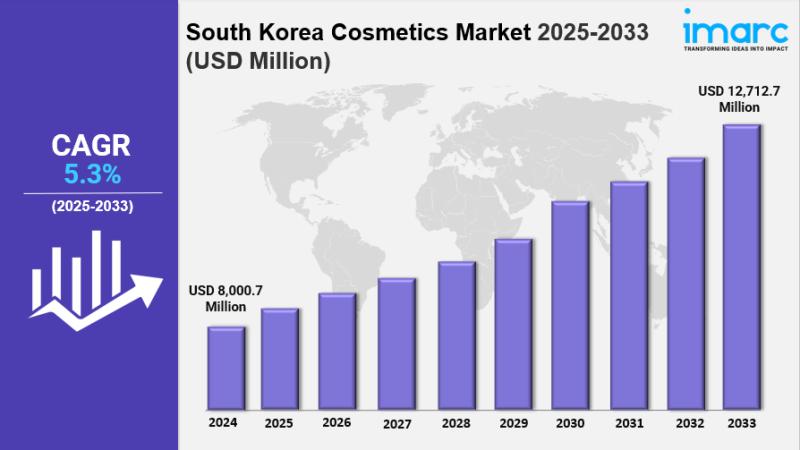

South Korea Cosmetics Market Size, Share, Industry Overview, Trends and Forecast …

IMARC Group has recently released a new research study titled "South Korea Cosmetics Market Report by Product Type (Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, and Others), Category (Conventional, Organic), Gender (Men, Women, Unisex), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, and Others), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…