Press release

Future of the Debt Based Peer-To-Peer (P2P) Crowdfunding Market: Trends, Innovations, and Key Forecasts Through 2034

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Debt Based Peer-To-Peer (P2P) Crowdfunding Market Size Growth Forecast: What to Expect by 2025?

The expansion of the debt-based peer-to-peer (P2P) crowdfunding marketplace has been swift and marked in recent times. Its projected growth is from $4.63 billion in 2024 to a robust $5.43 billion in 2025, demonstrating a compound annual growth rate (CAGR) of 17.3%. The surge in this historic period can be credited to factors such as enhanced adoption of fintech, an increased requirement for alternative funding, growing investor inclination for better returns, widespread internet access and a noticeable increase in displeasure with conventional banking services.

How Will the Debt Based Peer-To-Peer (P2P) Crowdfunding Market Size Evolve and Grow by 2029?

There is an anticipation of rapid escalation in the debt-based peer-to-peer (P2P) crowdfunding market, with a projected growth reaching $10.14 billion in 2029 at a compound annual growth rate (CAGR) of 16.9%. The upswing during the forecasted period can be linked to the increasing utilization of open banking APIs, a spike in demand for financing solutions for small to medium-sized enterprises (SMEs), the expansion of mobile-led lending platforms, and the growth of environmental, social, and governance (ESG)-oriented lending products. An increased participation from institutional investors in P2P markets also contributes to this growth. Key trends to watch out for during this projected period include advancements in AI-driven risk analysis, growth of blockchain influenced loan administration, innovations in alternative credit scoring systems, increased embrace of blockchain technology, and the integration of regulatory technology.

View the full report here:

https://www.thebusinessresearchcompany.com/report/debt-based-peer-to-peer-p2p-crowdfunding-global-market-report

What Drivers Are Propelling the Growth of Debt Based Peer-To-Peer (P2P) Crowdfunding Market Forward?

The surge in fintech activities is predicted to stimulate the expansion of the debt-based peer-to-peer (P2P) crowdfunding market. The term fintech is used to describe services that merge finance and technology, like digital payments, online lending, and crowdfunding, all of which are intended to enhance efficiency and accessibility in finance. The rise in fintech activities is influenced by the escalating demand for quicker, more accessible financial services as traditional banking methods are being replaced by consumers and businesses. Debt-based P2P crowdfunding platforms amplify fintech activities by facilitating direct digital lending and bypassing conventional banks. For instance, it was reported by the International Trade Administration (ITA), a U.S. government agency, in November 2023, that the Fintech sector in the UK, comprising more than 1,600 firms, is anticipated to double by 2030. Hence, growth in fintech activities is powering the expansion of the debt-based peer-to-peer (P2P) crowdfunding market. The rapid proliferation of start-ups is fuelling the growth of the debt-based peer-to-peer (P2P) crowdfunding market on account of the growing need for flexible and easily available initial stage funding. Start-ups denote fledgling businesses that aim to bring innovative products or services to market. The surge in start-ups is aided by increased access to digital technology, allowing entrepreneurs to initiate and grow businesses cost-effectively through affordable internet, cloud services, and online platforms without the need for expensive infrastructure. Debt-based peer-to-peer (P2P) crowdfunding aids start-ups by offering accessible funding without the need for traditional banking. For instance, the NatWest Group, a UK-based insurance company, reported in February 2025 that the UK hit 5.63 million active companies registered with Companies House in 2024, marking a 3% growth from 2023. Hence, the swift proliferation of start-ups is influencing the growth of the debt-based peer-to-peer (P2P) crowdfunding market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=26698&type=smp

Which Emerging Trends Are Transforming the Debt Based Peer-To-Peer (P2P) Crowdfunding Market in 2025?

Leading organizations in the debt-based peer-to-peer (P2P) crowdfunding sector are concentrating on constructing innovative strategies such as term-based P2P plans. These strategies aim to augment the flexibility of investment, engage a more extensive investor demographic, and improve the payment formations for lenders. A term-based P2P plan is a loan framework where investors offer financial support to borrowers for a specific time period, with agreed upon interest rates and remuneration schedules. For example, in July 2022, an Indian P2P lending platform, LenDenClub, introduced the Fixed Maturity Peer-to-Peer Plan (FMPP), a term-based investment option. This plan provides investors with a selection of term lengths, ensuring foreseeable profits while decreasing risks through varied loan portfolios. The platform uses cutting-edge risk evaluation algorithms to pair lenders with trustworthy borrowers, maximizing returns while ensuring safety. The fixed-term structure provides clarity about the investment time-span and anticipated yields for investors, thereby becoming a preferred choice for individuals seeking steady, short-to-medium-term returns.

What Are the Key Segments in the Debt Based Peer-To-Peer (P2P) Crowdfunding Market?

The debt based peer-to-peer (p2p) crowdfunding market covered in this report is segmented -

1) By Type: Online, Offline

2) By Platform Type: Consumer Lending, Business Lending, Real Estate Lending

3) By Application: Individuals, Businesses, Other Applications

4) By End-User: Individuals, Small And Medium Enterprises, Large Enterprises

Subsegments:

1) By Online: Web-Based Platforms, Mobile Applications, Cloud-Hosted Solutions, Application Programming Interface (API)-Integrated Systems, Software As A Service (SaaS)-Based Custody Tools

2) By Offline: Hardware Devices, Paper Wallet Storage, Air-Gapped Systems, Universal Serial Bus (USB)-Encrypted Solutions, Cold Vault Infrastructure

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=26698&type=smp

Who Are the Key Players Shaping the Debt Based Peer-To-Peer (P2P) Crowdfunding Market's Competitive Landscape?

Major companies operating in the debt based peer-to-peer (p2p) crowdfunding market are LendingClub Corporation, Upstart Network Inc., Funding Circle Holdings plc, Zopa Bank Limited, Mintos Marketplace AS, LenDenClub, Peerform Inc., LendInvest Limited, Faircent Tech Private Limited, Assetz Capital Limited, Bondora Capital OÜ, Twino LLC, Rebuilding Society Limited, KILDE PTE. LTD., Viainvest SIA, Folk2Folk Limited, Prosper Marketplace Inc., i2iFunding, IndiaP2P, Crowd2Fund Limited.

What Geographic Markets Are Powering Growth in the Debt Based Peer-To-Peer (P2P) Crowdfunding Market?

North America was the largest region in the debt based peer-to-peer (P2P) crowdfunding market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the debt based peer-to-peer (p2p) crowdfunding market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=26698

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay

Europe - +44 7882 955267,

Asia: +91 88972 63534,

Americas - +1 310-496-7795 or

Email:saumyas@tbrc.info

Follow Us On:

• LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future of the Debt Based Peer-To-Peer (P2P) Crowdfunding Market: Trends, Innovations, and Key Forecasts Through 2034 here

News-ID: 4167320 • Views: …

More Releases from The Business Research Company

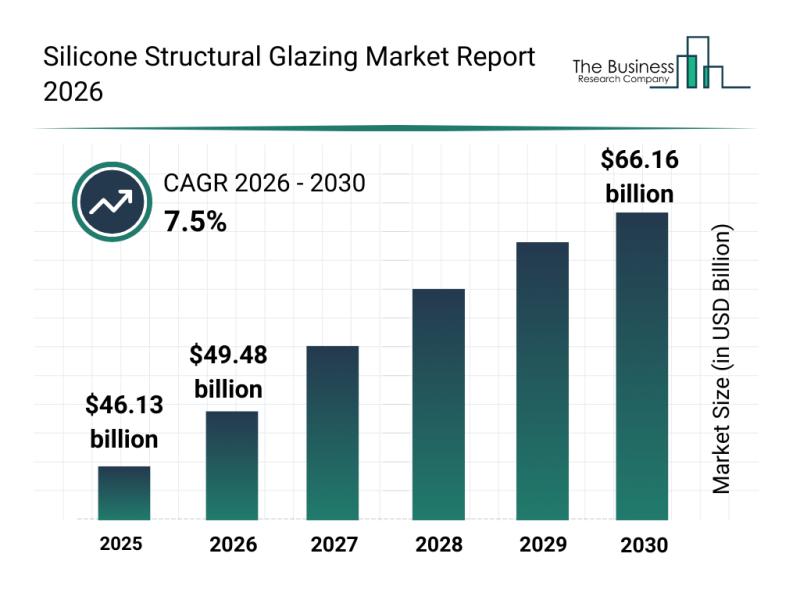

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

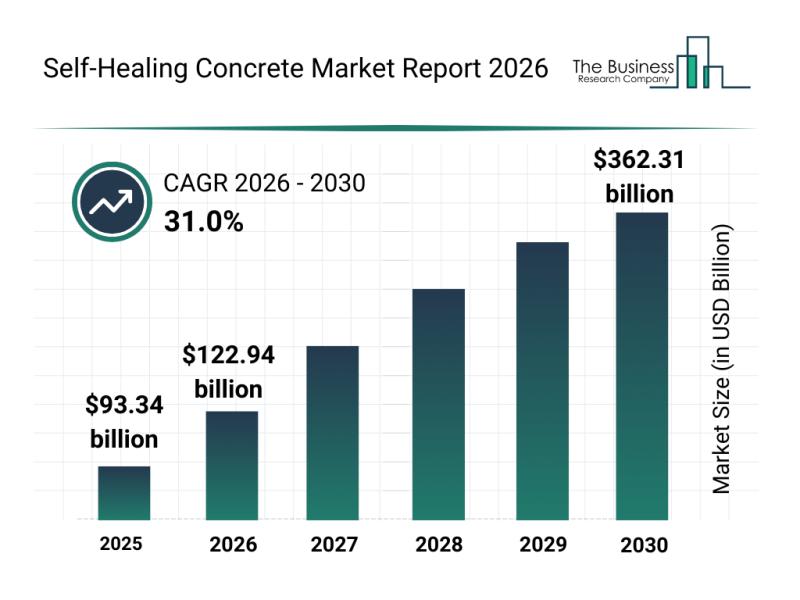

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

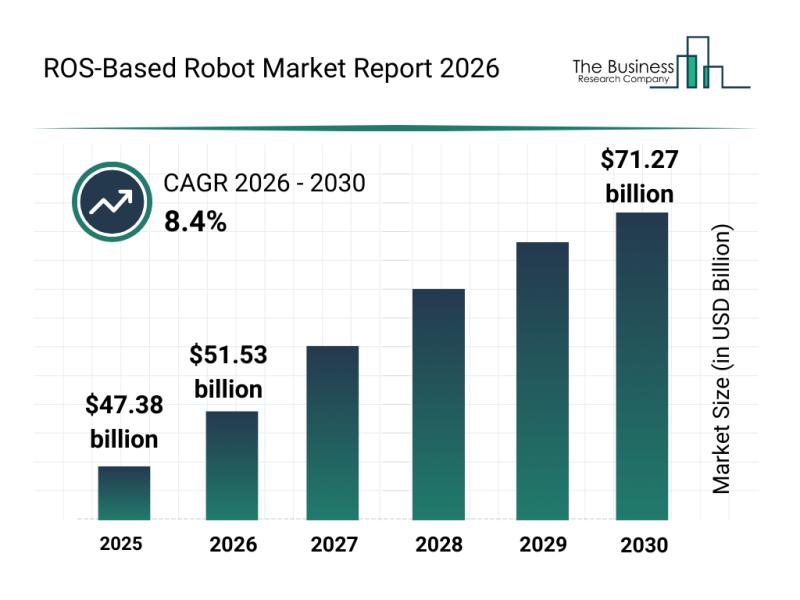

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

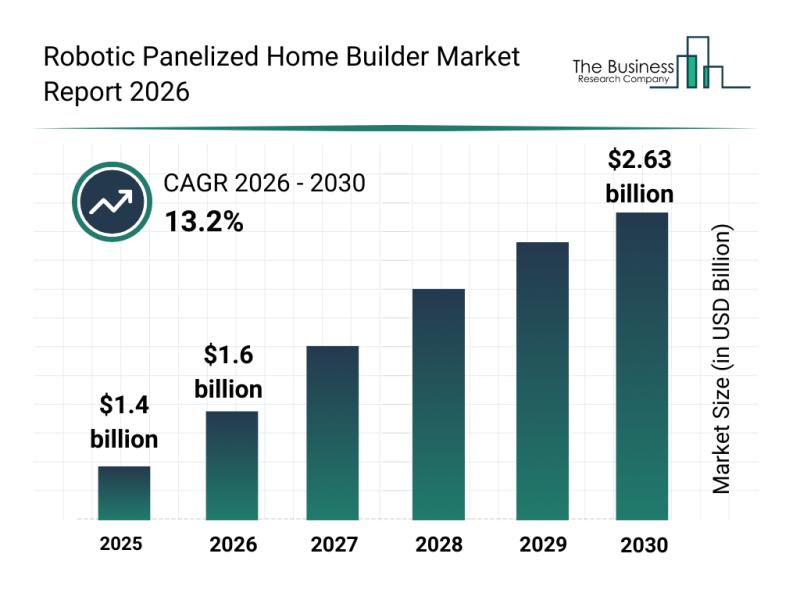

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for P2P

Millennials fuel P2P investment surge

According to the latest research, Robocash's core audience consists of millennial men with an average investment of up to €5,000. At the same time, the platform is becoming more appealing to a broader demographic, as well as geographically.

Robocash analysts studied how the profile of the platform's investors has changed over the past year.

Currently, the majority of investors on Robocash are aged 29-44. However, since 2024, the share…

P2P Content Delivery Network (P2P CDN) Market to Witness Growth by 2024-2031

The P2P Content Delivery Network (P2P CDN) market has emerged as a transformative force in the digital content distribution landscape. P2P CDNs leverage peer-to-peer technology to distribute content efficiently, reducing the strain on centralized servers and enhancing delivery speeds. This market has experienced substantial growth due to the increasing demand for high-quality video streaming, online gaming, and other content-rich applications. P2P CDNs enable more scalable and cost-effective content delivery, making…

P2P Content Delivery Network (P2P CDN) Market is Touching New Development Level …

The latest independent research document on P2P Content Delivery Network (P2P CDN) examines investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore their potential to become major business disrupters. The P2P Content Delivery Network (P2P CDN) study eludes very useful reviews & strategic assessments including the generic market trends, emerging technologies, industry drivers, challenges, and regulatory policies that propel the market growth,…

Revving Up Indonesia's P2P Lending Market: 3 Catalyst Driving the Indonesia's P2 …

Indonesia has witnessed a rapid increase in internet and smartphone usage, leading to greater accessibility and creating a conducive environment for P2P lending platforms to reach a large customer base.

Introduction

The peer-to-peer (P2P) lending market in Indonesia has experienced significant growth in recent years, driven by various factors. P2P lending platforms, also known as financial technology (FinTech) platforms, provide an alternative financing option for individuals and businesses, particularly those who are…

P2P Content Delivery Network (P2P CDN) Market to See Huge Demand by 2030: Alibab …

2022-2030 World P2P Content Delivery Network (P2P CDN) Market Report Professional Analysis 2022 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the P2P Content Delivery Network (P2P CDN) Market. Some of the key players profiled…

P2P Content Delivery Network (P2P CDN) Market to see Booming Worldwide | Major G …

A Qualitative Research Study accomplished by HTF MI Titled on Global P2P Content Delivery Network (P2P CDN) Industry Market Report-Development Trends, Threats, Opportunities and Competitive Landscape in 2020 with detailed information of Product Types [Video & Non-video], Applications [Media and Entertainment, Gaming, Retail and eCommerce, Education, Healthcare & Others] & Key Players Such as Streamroot, Alibaba Group, Viblast, Globecast, Edgemesh, Peer5, Akamai, Qumu Corporation & CDNvideo etc. The Study provides…