Press release

Global Embedded Banking Services Market to Hit US$ 57.6 Bn by 2032 at 14% CAGR

The global embedded banking services market is experiencing rapid growth as financial services become seamlessly integrated into non-financial platforms through API-driven solutions. This trend enables businesses to provide banking services like payments, lending, and account management directly within their applications, enhancing customer experience and operational efficiency. In 2025, the market is estimated at US$23.01 billion, with projections to reach US$57.6 billion by 2032, exhibiting a strong CAGR of 14.0%. Cloud-based deployments dominate the market due to their scalability and flexibility, while on-premises solutions continue to appeal to businesses seeking greater security and control.The growth is largely fueled by digital transformation initiatives, fintech innovation, and rising demand for seamless financial experiences. Among services, payment processing leads the market with a 40% share in 2025, supported by the rising adoption of digital payment platforms. Financial institutions dominate the enterprise segment, accounting for 35% of the market, leveraging banking-as-a-service (BaaS) to expand their digital footprint. Geographically, North America remains the leading market due to advanced fintech adoption, robust API infrastructure, and the high rate of digital transformation in banking. Meanwhile, Asia Pacific is the fastest-growing region, driven by embedded banking solutions in e-commerce and digital commerce platforms.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/32989

Key Highlights from the Report

• Payment processing dominates with a 40% market share in 2025.

• Lending services are growing rapidly due to embedded banking solutions for businesses.

• Financial institutions hold 35% market share, driven by BaaS adoption.

• Technology companies are leveraging API-driven banking for enhanced services.

• North America leads globally with 38% market share, spearheaded by the U.S.

• Asia Pacific is the fastest-growing region at 20%, fueled by embedded banking in e-commerce.

Market Segmentation

The embedded banking services market can be segmented by service type, deployment model, and end-user industry. By service type, payment processing and lending services are the leading segments, reflecting the growing demand for seamless transactions and business financing. Other services such as insurance and account management are gradually gaining traction, especially among SMEs and tech-driven enterprises.

By deployment model, cloud-based embedded banking solutions dominate due to scalability, flexibility, and lower infrastructure costs. On-premises solutions remain relevant for organizations requiring higher security and regulatory compliance. Industry-wise, financial institutions, technology companies, and e-commerce platforms represent the primary adopters, leveraging embedded banking to streamline operations and enhance customer engagement.

Read More: https://www.persistencemarketresearch.com/market-research/embedded-banking-services-market.asp

Regional Insights

North America, led by the United States, dominates the embedded banking services market, driven by strong fintech adoption, digital payment infrastructure, and API-enabled services. The region benefits from early integration of BaaS models and advanced regulatory frameworks supporting digital banking innovation.

In Asia Pacific, countries like China, India, and Southeast Asian markets are emerging as high-growth regions. Rapid e-commerce expansion, increasing smartphone penetration, and growing fintech adoption are key drivers for embedded banking solutions in this region, positioning Asia Pacific for sustained growth through 2032.

Market Drivers

The market is primarily driven by digital transformation initiatives, increasing fintech adoption, and demand for seamless financial experiences. Businesses and financial institutions are integrating banking services directly into non-financial platforms to enhance customer convenience and operational efficiency.

Market Restraints

Key challenges include regulatory compliance complexities, data security concerns, and integration challenges for legacy systems. Organizations may face operational hurdles when embedding banking solutions, particularly in regions with fragmented financial regulations.

Market Opportunities

Opportunities exist in API-driven banking, cloud-based embedded solutions, and expansion into e-commerce and fintech ecosystems. Businesses can capitalize on the growing demand for instant payment processing, lending, and account management solutions, especially among SMEs and digital-first enterprises.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/32989

Reasons to Buy the Report

✔ Comprehensive analysis of embedded banking services market size and forecast (2025-2032)

✔ In-depth insights into market segmentation by service type, deployment, and industry

✔ Regional analysis highlighting growth trends in North America and Asia Pacific

✔ Identification of market drivers, restraints, and emerging opportunities

✔ Profiles of leading players with recent developments and competitive strategies

Frequently Asked Questions (FAQs)

How Big is the Embedded Banking Services Market?

Who are the Key Players in the Global Market for Embedded Banking Services?

What is the Projected Growth Rate of the Market?

What is the Market Forecast for 2032?

Which Region is Estimated to Dominate the Industry through the Forecast Period?

Company Insights

Key players operating in the embedded banking services market include:

• Stripe, Inc.

• Marqeta, Inc.

• Solarisbank AG

• Railsbank

• Bankable

Recent Developments:

• Stripe launched new API-driven embedded banking solutions in 2024 to enhance fintech integration for e-commerce platforms.

• Marqeta expanded its embedded banking offerings in 2025, targeting SMEs and digital platforms in North America and Europe.

Related Reports:

Smart Parcel Locker Market https://www.persistencemarketresearch.com/market-research/smart-parcel-locker-market.asp

Applicant Tracking System Market https://www.persistencemarketresearch.com/market-research/applicant-tracking-system-market.asp

Podcasting Market https://www.persistencemarketresearch.com/market-research/podcasting-market.asp

Rugged Thermal Cameras Market https://www.persistencemarketresearch.com/market-research/rugged-thermal-cameras-market.asp

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Embedded Banking Services Market to Hit US$ 57.6 Bn by 2032 at 14% CAGR here

News-ID: 4166791 • Views: …

More Releases from Persistence Market Research

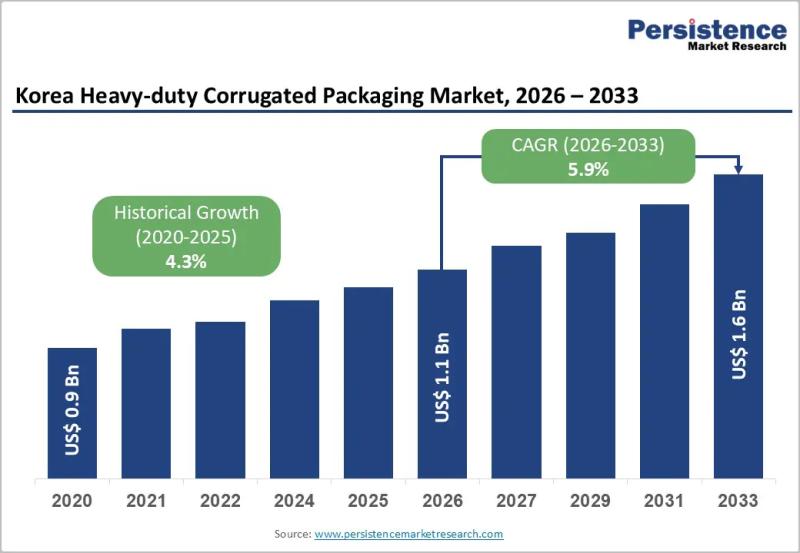

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Services

Managed Services by Ensure Services

Ensure Services is a leading managed services provider offering comprehensive IT support and solutions designed to streamline operations, improve efficiency, and reduce operational costs for businesses of all sizes. Our managed services are tailored to meet the unique needs of your organization, ensuring you can focus on your core business while we handle your IT infrastructure.

With years of experience and a team of certified professionals, we deliver proactive monitoring, ongoing…

Electrical Services Market Next Big Thing | Major Giants SSI Electrical Services …

A new business intelligence report released by AMA with title "Electrical Services Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Electrical Services Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and…

North & South America Commercial Services Market 2022 (Employment Services, Offi …

The Business Research Company’s Commercial Services Global Market Report 2019 covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography. Ratios of market size and growth to related markets, GDP proportions, and expenditure per capita for the market is detailed in the report. Data and analysis throughout the…

AC Services & Repair, Refrigerator Services & Repair, Washing Machine Services & …

Kunal Repair & Services is growing on-demand home services platform in India and we are currently operating in Gurgaon. We offer an array of services which include AC Services & Repair, Refrigerator Services & Repair, Washing Machine Services & Repair, R.O Services & Repair, Microwave Services & Repair, Geyser Services & Repair. Our operating philosophy for solving this massive problem is - Right price.

To know why we do what we…

Electrical Services Market Technology and Outlook 2023 Top Companies are Allianc …

A report added to the rich database of Qurate Business Intelligence, titled “Global Electrical Services Market Size, Status and Forecast 2023”, provides a 360-degree overview of the worldwide market. Approximations associated with the market values over the forecast period are based on empirical research and data collected through both primary and secondary sources. The authentic processes followed to exhibit various aspects of the market makes the data reliable in context…

Electrical Services Market Size 2018: Alliance Electrical Services, Housejoy, Te …

In 2017, the global Electrical Services market size was million US$ and it is expected to reach million US$ by the end of 2025, with a CAGR of during 2018-2025.

This report focuses on the global Electrical Services status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Electrical Services development in United States, Europe and China.

Get Sample Copy of this report @ http://www.orbisresearch.com/contacts/request-sample/2311492…