Press release

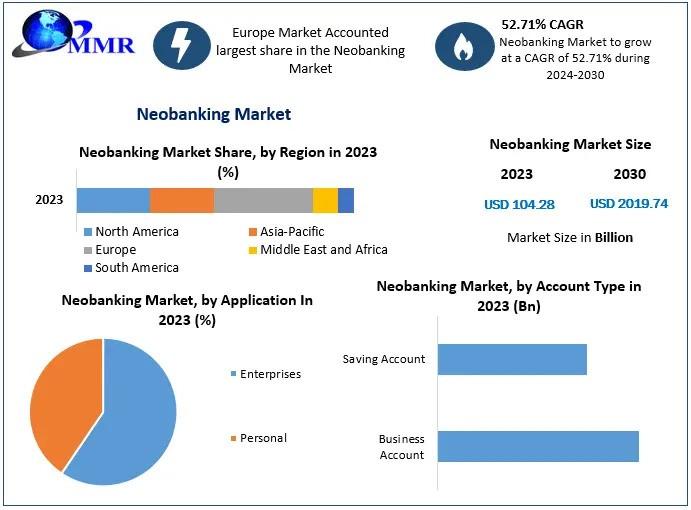

Neobanking Market Set for Unprecedented Expansion with 52.71% CAGR Through 2030

Neobanking Market size was valued at USD 104.28 Bn. in 2023 and the total Neobanking revenue is expected to grow by 52.71 % from 2024 to 2030, reaching nearly USD 2019.74 Bn.Neobanking Market Overview:

The neobanking market is redefining the financial services landscape by offering digital-first, customer-centric banking solutions. Unlike traditional banks, neobanks operate without physical branches, leveraging mobile applications and web platforms to deliver services such as savings accounts, payments, lending, and financial planning. Their simplified account setup, lower fees, and intuitive user experience have made them particularly popular among millennials, small businesses, and tech-savvy consumers. The rise of digital transactions and the growing acceptance of online banking services continue to fuel the rapid expansion of the neobanking sector.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/222171/

Neobanking Market Outlook and Future Trends:

The future of the neobanking market appears highly promising, with accelerated adoption expected as digital transformation reshapes financial ecosystems worldwide. Neobanks are likely to expand their offerings beyond core banking to include wealth management, insurance, and cryptocurrency-related services. Personalized financial products powered by artificial intelligence and data analytics will play a crucial role in enhancing customer engagement. Furthermore, strategic collaborations with fintech companies and regulatory support for digital financial inclusion are expected to drive sustained growth, making neobanks a central pillar of the next-generation banking system.

Neobanking Market Dynamics:

The growth of the neobanking market is driven by multiple factors, including rising smartphone penetration, increasing demand for seamless digital transactions, and a shift toward cashless economies. Lower operational costs compared to traditional banks allow neobanks to provide competitive pricing and innovative financial products. However, the sector also faces challenges such as regulatory compliance, cybersecurity risks, and limited customer trust in fully digital financial institutions. Despite these hurdles, the advantages of convenience, cost efficiency, and financial inclusion continue to create significant opportunities for neobanks worldwide.

Neobanking Market Key Recent Developments:

Recent developments in the neobanking industry highlight both innovation and expansion. Several neobanks have raised substantial funding rounds to accelerate their global reach and diversify product portfolios. New services, including AI-driven personal finance management tools and cross-border payment solutions, are being introduced to cater to evolving customer needs. Additionally, regulatory authorities in various regions are updating frameworks to encourage innovation while ensuring security and compliance. Strategic partnerships between neobanks, fintech firms, and technology providers are also shaping the competitive landscape, paving the way for broader adoption of digital banking solutions.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/222171/

Neobanking Market Segmentation:

by Account Type

Business Account

Saving Account

by Service Type

Loans

Mobile Banking

Checking Saving Account

Payments and Money Transfer

Others

by Application

Enterprises

Personal

Some of the current players in the Neobanking Market are:

1. Cash App [United States]

2. Chime [United States]

3. Atom Bank PLC [United Kingdom]

4. KakaoBank [South Korea]

5. Monzo [United Kingdom]

6. Nubank [Brazil]

7. Revolut [United Kingdom]

8. Starling Bank [United Kingdom]

9. Stocard [Germany]

10. Tinkoff [Russia]

11. Venmo [United States]

12. Fidor Bank Ag [Germany]

13. Monzo Bank Limited [United Kingdom]

14. Movencorp Inc. [United States]

15. Mybank [China]

16. N26 [Germany]

17. Simple Finance Technology Corporation [United States]

18. Ubank Limited [Australia]

19. Webank, Inc. [China]

20. Pockit Ltd [United Kingdom]

21. PRETA S.A.S. [France]

For additional reports on related topics, visit our website:

♦ Global Industrial metrology Market https://www.maximizemarketresearch.com/market-report/global-industrial-metrology-market/7005/

♦ Global Portable Gaming Console Market https://www.maximizemarketresearch.com/market-report/global-portable-gaming-console-market/62637/

♦ Global Digital Marketing Courses Market https://www.maximizemarketresearch.com/market-report/digital-marketing-courses-market/2452/

♦ Coffee Machine Market https://www.maximizemarketresearch.com/market-report/coffee-machine-market/216041/

♦ Global Shot Blasting Machine Market https://www.maximizemarketresearch.com/market-report/global-shot-blasting-machine-market/115544/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a leading market research and consulting company, recognized for delivering reliable insights and strategies across diverse industries such as healthcare, pharmaceuticals, technology, automotive, and many more. Our expertise lies in providing in-depth market analysis, trend forecasting, competitive benchmarking, and strategic consulting tailored to client needs. We are committed to empowering organizations with actionable intelligence that enhances decision-making, strengthens market positioning, and fuels sustainable business growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neobanking Market Set for Unprecedented Expansion with 52.71% CAGR Through 2030 here

News-ID: 4166687 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Procurement Software Market Forecast: Automation, Analytics and Cloud Adoption

Procurement Software Market size was valued at USD 8.18 billion in 2024, and the total revenue is expected to grow at CAGR of 10.8 % from 2025 to 2032, reaching nearly USD 18.58 billion.

Procurement Software Market Overview:

The procurement software market is a core component of enterprise digital transformation, enabling organizations to automate, standardize, and optimize purchasing activities across goods and services. Procurement software solutions support functions such as supplier discovery,…

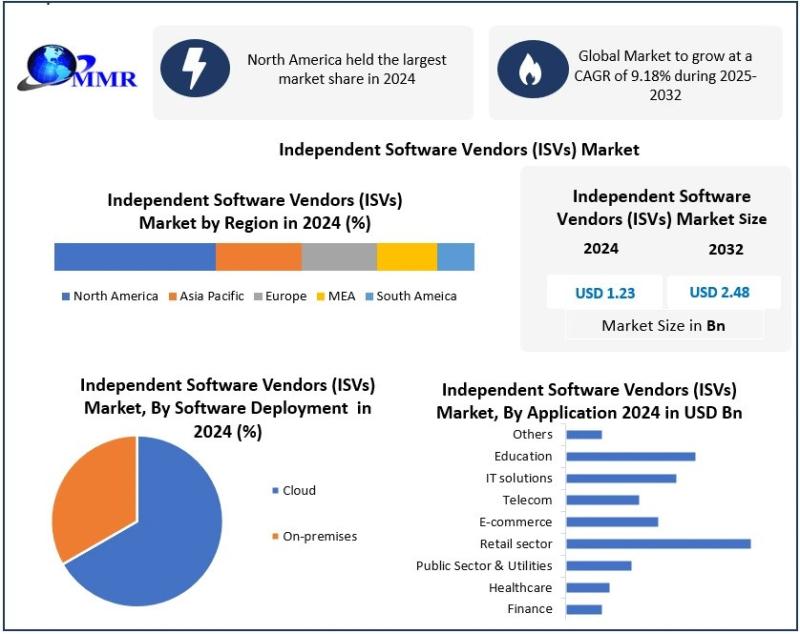

What Is Driving Growth in the Independent Software Vendors (ISVs) Market?

Independent Software Vendors (ISVs) Market was valued at USD 1.23 Bn in 2024, and total global Independent Software Vendors (ISVs) Market revenue is expected to grow at a CAGR of 9.18% and reach nearly USD 2.48 Bn from 2025 to 2032. Driven by Rising Demand for Multi-cloud & Hybrid Cloud.

Independent Software Vendors (ISVs) Market Overview:

The Independent Software Vendors (ISVs) market represents a critical layer of the global software ecosystem, delivering…

India Lighting Market Analysis: Industry Dynamics and Growth Forecast

India Lighting Market size was valued at USD 4139.2 Million in 2024 and the total India Lighting Market size is expected to grow at a CAGR of 7.1% from 2025 to 2032, reaching nearly USD 7674 Million by 2032.

India Lighting Market Overview:

The India lighting market is a rapidly evolving sector driven by urbanization, infrastructure expansion, and the transition toward energy-efficient illumination solutions. Lighting demand spans residential, commercial, industrial, and outdoor…

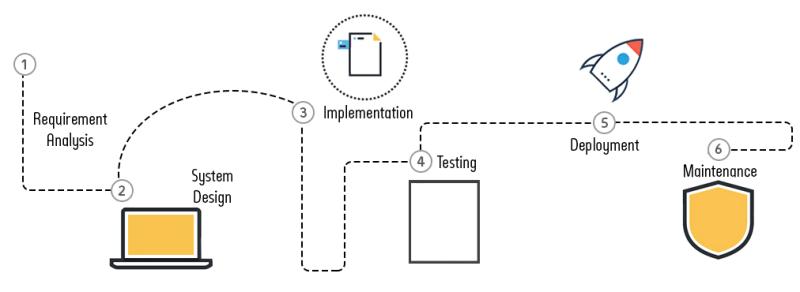

Custom Software Development Services Market Forecast: Cloud, AI and DevOps Trend …

Agricultural Waste Market size was valued at USD 20.20 Billion in 2025 and the total Agricultural Waste revenue is expected to grow at a CAGR of 7.20% from 2025 to 2032, reaching nearly USD 32.86 Billion by 2032.

Custom Software Development Services Market Overview:

The custom software development services market plays a pivotal role in enabling enterprises to align digital systems with specific operational, regulatory, and customer-experience requirements. Unlike off-the-shelf solutions, custom…

More Releases for Neobanking

Neobanking Market Trends That Will Shape the Next Decade: Insights from Neobanki …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Neobanking Market Size By 2025?

The scale of the neobanking market has seen remarkable expansion in the past few years. It is expected to surge from $176.05 billion in 2024 up to $261.4 billion in 2025, reflecting a compound annual growth rate (CAGR) of 48.5%.…

Primary Catalyst Driving Neobanking Market Evolution in 2025: Rapid Digitalizati …

How Are the key drivers contributing to the expansion of the neobanking market?

The burgeoning need for digital transformation in banking agencies worldwide is fuelling the neobanking market's expansion. Digital banking involves the complete digitization of banking operations, replacing the physical branches with a constant online presence, thereby eliminating the requirement for customers to visit a physical office. Traditional banking services are getting streamlined through digital means. With digital banking, bank…

Neobanking Market Size & Trends To 2030

The Neobanking Market 2024 Report makes available the current and forthcoming technical and financial details of the industry. It is one of the most comprehensive and important additions to the Prudent Markets archive of market research studies. It offers detailed research and analysis of key aspects of the global Neobanking market. This report explores all the key factors affecting the growth of the global Neobanking market, including demand-supply scenario, pricing…

Neobanking Market Potential and Growth Opportunities 2024-2031

The Neobanking Market is a rapidly evolving sector, driven by advancements in hardware, software, and digital infrastructure. It encompasses a wide range of services, including cloud computing, cybersecurity, data analytics, and artificial intelligence. The increasing demand for digital transformation across industries is fueling growth. Emerging technologies like 5G, blockchain, and IoT are further expanding its potential. With continuous innovation, the IT market is expected to see robust growth in the…

Neobanking Market Key Trends, Analysis, Forecast To 2033

"The Business Research Company has recently revised its global market reports, now incorporating the most current data for 2024 along with projections extending up to 2033.

Neobanking Global Market Report 2024 by The Business Research Company offers comprehensive market insights, empowering businesses with a competitive edge. It includes detailed estimates for numerous segments and sub-segments, providing valuable strategic guidance.

The Market Size Is Expected To Reach $836.11 billion In 2028 At A…

Neobanking Market Size, Share, Industry, Forecast to 2030

The Neobanking Market 2023 Report makes available the current and forthcoming technical and financial details of the industry. It is one of the most comprehensive and important additions to the Prudent Markets archive of market research studies. It offers detailed research and analysis of key aspects of the global Neobanking market. This report explores all the key factors affecting the growth of the global Neobanking market, including demand-supply scenario, pricing…