Press release

Neo and Challenger Bank Market to Hit $875.6 Billion by 2035, Growing at 23.5% CAGR

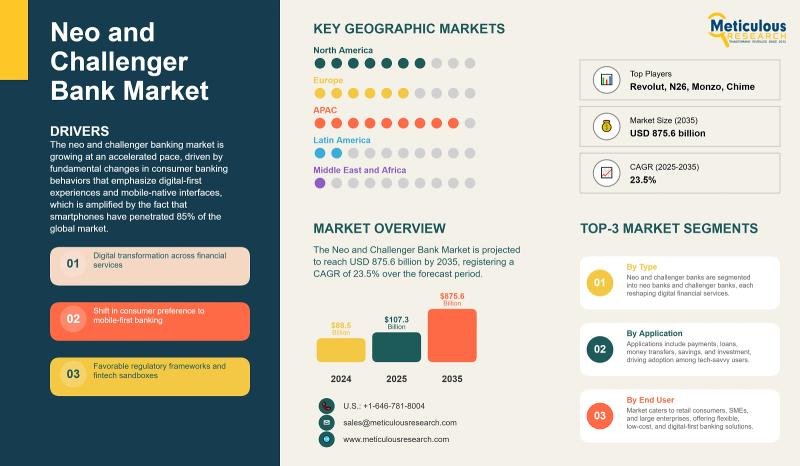

Neo and Challenger Bank Market OverviewThe global neo and challenger bank market (Neo- und Challenger-Bankenmarkt) has been expanding at an extraordinary pace. Valued at USD 88.5 billion in 2024, the market is expected to rise to USD 107.3 billion in 2025. By 2035, it could reach a staggering USD 875.6 billion, growing at a robust CAGR of 23.5%. This remarkable trajectory highlights how digital-first banking is reshaping the global financial services landscape.

These banks-whether fully digital-only players or hybrid models-are winning over millions of customers by offering fast, mobile-native, and low-cost alternatives to traditional banking. With smartphones now in the hands of 85% of the world's population, banking has shifted firmly into the digital era.

Download Sample Report Here : https://www.meticulousresearch.com/download-sample-report/cp_id=6248

Why Neo and Challenger Banks Are Growing

The shift toward digital banking is fueled by consumer behavior. Around 78% of millennials and 67% of Gen Z say they prefer banking on their phones instead of visiting a physical branch. This creates a massive, multi-trillion-dollar opportunity for neo banks that operate entirely online.

Regulatory changes are also playing a key role. Frameworks such as Europe's PSD2 directive and similar initiatives in Asia-Pacific have pushed open banking, enabling banks and fintechs to build connected, API-driven ecosystems. Since 2021, fintech-bank partnerships have tripled, giving rise to seamless and competitive services.

Cost efficiency is another driver. Neo banks operate at 60-70% lower costs than traditional banks. With no branches and modern tech stacks, they can offer fee-free accounts, higher savings rates, and instant account opening-features that are highly attractive to younger and price-sensitive consumers.

The COVID-19 pandemic further accelerated this shift. Between 2020 and 2024, digital account openings surged 200%, while 40% of physical branches closed worldwide. Customers have now grown accustomed to opening accounts in minutes, making real-time transfers, and accessing 24/7 support-something traditional banks still struggle to match.

Browse in Depth : https://www.meticulousresearch.com/product/neo-and-challenger-bank-market-6248

Market Segmentation

The market is typically segmented by business model, licensing model, services, end-users, and region:

Business model: Digital-only banks dominate with 65-70% market share, leveraging their low costs and better customer experience.

Services: Payments and money transfers remain the leading category, representing 35-40% of revenue.

End-users: Retail customers are the largest segment, accounting for 70-75% of the market.

Fastest-growing service: Embedded finance and Banking-as-a-Service (BaaS), with an impressive 25.3% CAGR.

Geography: Asia-Pacific is the fastest-growing region, with a forecast 26.4% CAGR through 2035.

Digital-only Banks Lead the Way

Digital-only banks are setting the standard. By cutting costs and delivering streamlined mobile and web experiences, they have transformed what customers expect from banking. Account setup takes less than five minutes, cards (virtual and physical) are issued instantly, and AI-powered tools provide personalized financial insights that used to require human advisors.

Leaders like Revolut already serve more than 60 million customers globally, while U.S.-based Chime has reached 12 million users by offering features such as early paycheck access and no-fee overdrafts. As regulations mature and trust in digital-only banking grows, this segment is expected to remain dominant.

Payments and Transfers Dominate Services

Payments and money transfers account for 35-40% of revenues, making them the most widely used neo bank services. Customers rely on these platforms for everyday transactions, whether it's paying bills, sending money to friends, or managing international transfers. Neo banks now process more than 10 billion transactions annually, with transaction volumes growing at 45% year over year.

Buy the Complete Report with an Impressive Discount: https://www.meticulousresearch.com/view-pricing/1565

Key Drivers and Challenges

Drivers:

Digital-first demand from millennials and Gen Z.

Lower operating costs enabling fee-free services.

Supportive regulatory environments promoting open banking.

Technology innovations such as AI-driven personalization and instant payments.

Challenges:

Profitability remains a concern for many neo banks.

Security and trust issues persist, especially around data handling.

Complex regulations vary by country, slowing expansion.

To overcome these, many players are diversifying revenue streams through lending, wealth management, and premium subscription services. Enhanced security features, including biometric authentication, are also improving consumer trust.

Regional Outlook

The fastest growth is expected in Asia-Pacific, where a mobile-first population and large unbanked communities create fertile ground. China leads with a forecast CAGR of 28.3%, driven by super-app ecosystems like WeChat Pay and Alipay, which integrate banking into daily digital life. India follows closely at 27.8% CAGR, powered by government-led initiatives such as UPI and Aadhaar-linked banking.

In the United States, the market is set to grow at 19.2% CAGR, boosted by strong venture funding and consumer dissatisfaction with traditional banks. Players like Chime and Varo Bank are carving out large customer bases by focusing on financial inclusion and innovative services.

Competitive Landscape

The market is competitive, with both global giants and regional leaders scaling rapidly. Notable players include Revolut, Nubank, Chime, N26, Monzo, Starling Bank, WeBank, KakaoBank, Paytm Payments Bank, and Varo Bank.

Revolut: Over 60 million customers, $4B annual revenue in 2024, targeting profitability by 2025.

Nubank: Latin America's leader with more than 114 million customers.

Chime: A top U.S. player preparing for a multi-billion-dollar IPO.

WeBank and KakaoBank: Leveraging super-app ecosystems in Asia to serve hundreds of millions.

Growth strategies include expanding internationally, embedding financial services into ecosystems, and using M&A to accelerate capabilities.

Related Reports

Asia-Pacific E-commerce Market : https://www.meticulousresearch.com/product/asia-pacific-e-commerce-market-5596

E-commerce Market: https://www.meticulousresearch.com/product/e-commerce-market-4644

AI in E-commerce Market: https://www.meticulousresearch.com/product/ai-in-e-commerce-market-5767

South East Asia E-commerce Market: https://www.meticulousresearch.com/product/south-east-asia-e-commerce-market-5599

About Us:

We are a trusted research partner for leading businesses worldwide, empowering Fortune 500 organizations and emerging enterprises with actionable market intelligence tailored to drive revenue transformation and strategic growth. Our insights reveal forward-looking revenue opportunities, providing our clients with a competitive edge through a diverse suite of research solutions-syndicated reports, custom research, and direct analyst engagement.

Each year, we conduct over 300 syndicated studies and manage 60+ consulting engagements across eight key industry sectors and 20+ geographic markets. With a focus on solving the complex challenges facing global business leaders, our research enables informed decision-making that propels sustainable growth and operational excellence. We are dedicated to delivering high-impact solutions that transform business performance and fuel innovation in the competitive global marketplace.

Contact Us:

Meticulous Market Research Pvt. Ltd.

1267 Willis St, Ste 200 Redding,

California, 96001, U.S.

Email- sales@meticulousresearch.com

USA: +1-646-781-8004

Europe: +44-203-868-8738

APAC: +91 744-7780008

Visit Our Website: https://www.meticulousresearch.com/

For Latest Update Follow Us:

LinkedIn- https://www.linkedin.com/company/meticulous-research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo and Challenger Bank Market to Hit $875.6 Billion by 2035, Growing at 23.5% CAGR here

News-ID: 4166337 • Views: …

More Releases from Meticulous Research®

Global HVAC Air Filters Market Projected to Reach USD 14 Billion by 2035

Global HVAC Air Filters Market Projected to Reach USD 14 Billion by 2035, Driven by Indoor Air Quality Regulations and Post-Pandemic Health Awareness

Meticulous Research, a leading global market research company, has published a new research report titled "HVAC Air Filters Market Size, Share, Trends, Growth Opportunities & Forecast by Filter Type, MERV Rating, End-Use Industry, and Region - Global Outlook 2025 to 2035."

According to the report, the global HVAC air…

PFAS-Free Food Packaging Coating Market to Reach $707.7 Million by 2035

The global PFAS-free food packaging coating market is experiencing significant growth as regulators tighten restrictions on 'forever chemicals' and major brands commit to sustainable packaging solutions Valued at USD 365.6 million in 2024, the market is estimated to reach USD 389.0 million in 2025 and projected to grow at a compound annual growth rate of 6.1% from 2025 to 2035, reaching USD 707.7 million by 2035.

Market expansion is driven by…

Active Speaker Market to Reach $29.1 Billion by 2035

The global active speaker market is experiencing robust growth as consumers embrace wireless, smart, and high-quality audio solutions. Valued at USD 12.8 billion in 2024, the market is estimated to reach USD 13.8 billion in 2025 and projected to grow at a compound annual growth rate of 7.6% between 2025 and 2035, reaching USD 29.1 billion by 2035.

Market expansion is driven by rising demand for wireless, Bluetooth-enabled, and smart active…

How In-Cab Displays Are Quietly Reshaping Modern Agriculture

Over the next decade, agricultural in-cab displays are expected to play a much larger role in how farming operations are run. The market, valued at USD 1.34 billion in 2026, is forecast to reach USD 2.98 billion by 2036, growing at a compound annual rate of 8.3%. While those numbers reflect steady financial expansion, they also point to something broader: the way farming work is planned, executed, and measured is…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…