Press release

Lenders Mortgage Insurance Market on Track for Strong Growth, Estimated to Grow at 6.3% CAGR Through 2029

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Is the Expected CAGR for the Lenders Mortgage Insurance Market Through 2025?

In recent years, the market size for lenders mortgage insurance has seen significant growth. It is anticipated to expand from $9.23 billion in 2024 to $9.85 billion in 2025, marking a compound annual growth rate (CAGR) of 6.7%. Factors contributing to this upward trend in the historic period include the increase in housing prices, urbanization rates that are on the rise, a growing number of first-time homebuyers, escalating volumes of home loans, and higher levels of household debt.

What's the Projected Size of the Global Lenders Mortgage Insurance Market by 2029?

Anticipated robust expansion in the size of the lenders mortgage insurance market is discernable in the forthcoming years. The market is predicted to burgeon to a worth of $12.57 billion by 2029, featuring a compound annual growth rate (CAGR) of 6.3%. Many factors contribute to this prospective growth within the forecast period including a heightened interest in accessible housing, the escalating demand for mortgage securitization, a surge in mortgage market penetration within emergent economies, increasing regulatory focus on loan-to-value ratios, and a growing necessity for credit protection due to economic instability. Significant inclinations predicted for the forecast period encompass improvements in risk-aligned pricing frameworks, the consolidation of digital mortgage platforms, the invention of tailored lender's mortgage insurance products, and the assimilation of blockchain technology for claims administration.

View the full report here:

https://www.thebusinessresearchcompany.com/report/lenders-mortgage-insurance-global-market-report

Top Growth Drivers in the Lenders Mortgage Insurance Industry: What's Accelerating the Market?

Boosting housing values are anticipated to accelerate the growth of the lenders mortgage insurance market. Housing prices denote the sum of money needed to buy residential properties in a particular area during a specified time. Low interest rates leading to cheaper borrowing costs and heightened home demand are contributing factors to these surging housing prices. The role of lender's mortgage insurance is to support these housing prices by facilitating higher loan-to-value lending and enabling more prospective homebuyers to join the market even with lesser amount of deposits. This, in turn, enhances housing affordability, upholds demand, and contributes towards the total stability of the housing market. For example, data from the United States Census Bureau, a government agency based in the US, revealed in July 2025 that the typical sales price of freshly sold homes in June 2025 stood at $501.0 million, a rise from June 2024 when it was $487.2 million. Consequently, the surge in housing prices is steering the expansion of the lenders mortgage insurance market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=27067&type=smp

What Trends Will Shape the Lenders Mortgage Insurance Market Through 2029 and Beyond?

Leading corporations in the lenders mortgage insurance (LMI) market are concentrating on creating sophisticated digital solutions, such as platforms based on distributed ledger technology (DLT) to improve transparency, simplify operations, and mitigate operational hazards. DLT platforms are digital systems that document, distribute, and synchronize transactions or data across numerous nodes in a decentralized network, eliminating the need for a central authority. For example, in March 2025, Magyar Nemzeti Bank (MNB), a central bank based in Hungary, introduced a digital register based on blockchain (DLT), a database for mortgages and home insurance that utilizes distributed ledger technology. This platform facilitates a secure, paper-free, and GDPR-compliant exchange of insurance data between lenders and insurers, eradicating the necessity of manual document submissions by homeowners. This system guarantees real-time updates, lowers the chances of fraud, and improves compliance by offering a tamper-resistant record of lenders mortgage insurance policies.

What Are the Main Segments in the Lenders Mortgage Insurance Market?

The lenders mortgage insurance market covered in this report is segmented -

1) By Type: Borrower-Paid, Lender-Paid, Single Premium, Split Premium

2) By Insurance Type: Standard Lenders Mortgage Insurance, Low-Doc Lenders Mortgage Insurance, Non-Standard Lenders Mortgage Insurance

3) By Borrower Type: First-Time Homebuyers, Repeat Buyers

4) By Application: Agency, Digital And Direct Channels, Brokers, Bancassurance

Subsegments:

1) By Borrower-Paid: Monthly Premium Borrower-Paid, Annual Premium Borrower-Paid, Automatic Termination Borrower-Paid, Borrower-Paid With Refund Option

2) By Lender-Paid: Financed Lender-Paid, Single Premium Lender-Paid, Built-In Rate Lender-Paid

3) By Single Premium: Upfront Lump Sum Payment, Refundable Single Premium, Non-Refundable Single Premium

4) By Split Premium: Upfront + Monthly Split Premium, Upfront + Annual Split Premium, Custom Ratio Split Premium

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=27067&type=smp

Which Top Companies are Driving Growth in the Lenders Mortgage Insurance Market?

Major companies operating in the lenders mortgage insurance market are Commonwealth Bank Lenders Mortgage Insurance Limited, QBE Insurance Group (QBE LMI), Westpac LMI., Suncorp Lenders Mortgage Insurance Limited., National Australia Bank Limited., Arch Capital Group Ltd., Old Republic International Corporation, Genworth Financial Inc., Radian Guaranty Inc., Mortgage Guaranty Insurance Corporation, CUNA Mutual Holding Company, Essent Group Ltd., Sagen MI Canada Inc., Helia Group Limited, Triad Guaranty Insurance Corporation, United Guaranty Corporation, National Mortgage Insurance Corporation, Canada Guaranty Mortgage Insurance Company, AmTrust Europe Limited, CMG Mortgage Insurance Company

Which Regions Will Dominate the Lenders Mortgage Insurance Market Through 2029?

North America was the largest region in the lenders mortgage insurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the lenders mortgage insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=27067

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lenders Mortgage Insurance Market on Track for Strong Growth, Estimated to Grow at 6.3% CAGR Through 2029 here

News-ID: 4165364 • Views: …

More Releases from The Business Research Company

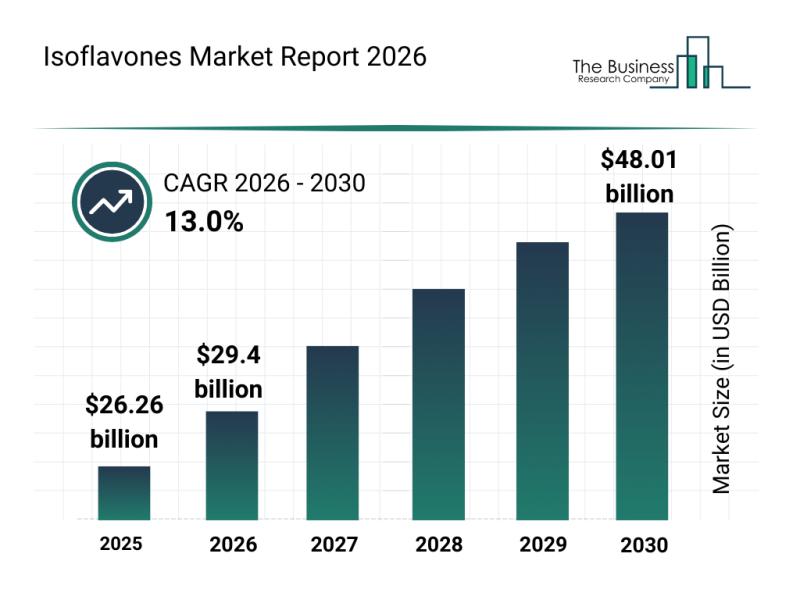

Segment Analysis and Major Growth Areas in the Isoflavones Market

The isoflavones market is poised for remarkable growth over the coming years, driven by increasing consumer awareness and expanding applications across various industries. With rising interest in health supplements and natural ingredients, this market is attracting significant attention from manufacturers and investors alike. Let's delve into the market's size, key players, emerging trends, and segment breakdowns shaping its trajectory.

Projected Market Size and Growth Outlook for Isoflavones

The isoflavones market…

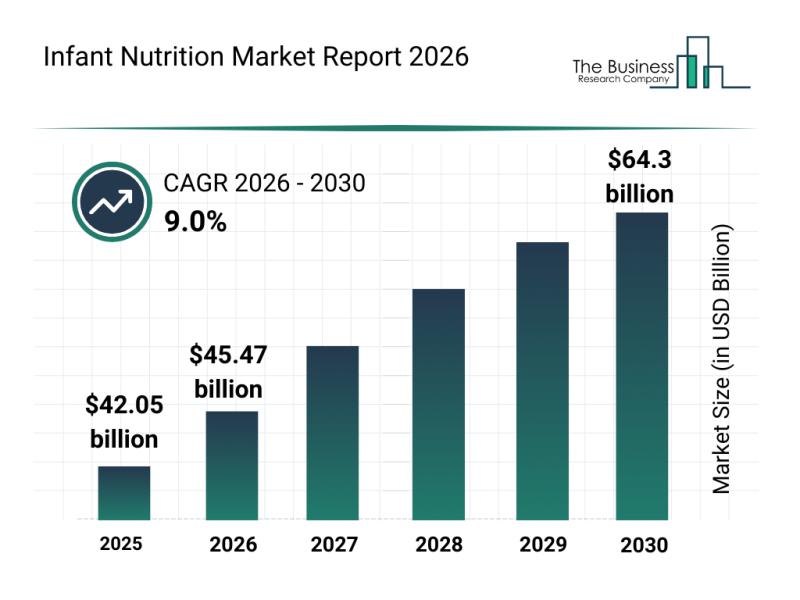

Key Strategic Developments and Emerging Changes Shaping the Infant Nutrition Mar …

The infant nutrition market is on track for substantial expansion in the coming years, driven by evolving consumer preferences and advancements in product offerings. As parents increasingly seek high-quality nutrition solutions tailored to their babies' needs, the sector is poised for remarkable growth through innovative products and diverse distribution channels. Let's explore the market's size projections, key players, emerging trends, and segment breakdowns shaping this dynamic industry.

Projected Growth Trajectory and…

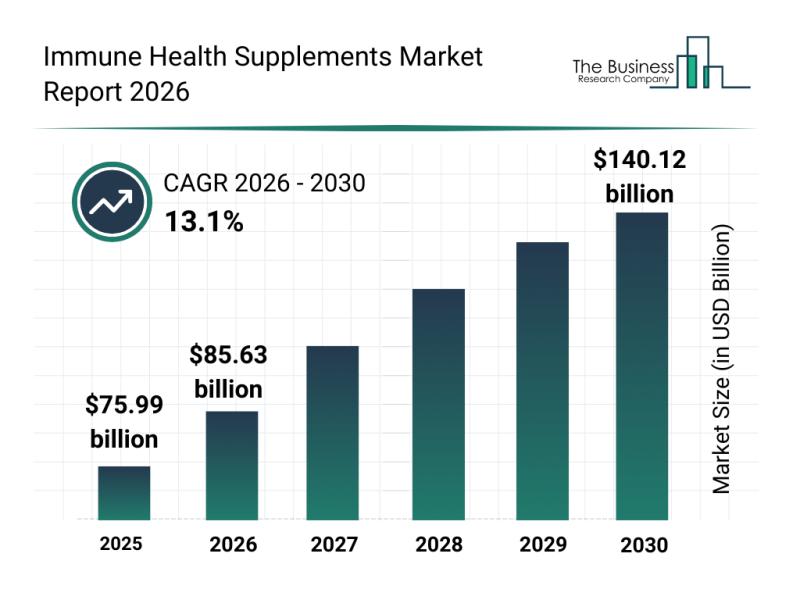

Leading Companies Advancing Innovation and Growth in the Immune Health Supplemen …

The immune health supplements sector is gaining significant traction as consumers increasingly prioritize wellness and preventive care. With a growing interest in personalized nutrition and plant-based options, this market is set to expand rapidly. Let's explore the expected market size, key players, emerging trends, and segmentation that define the future of immune health supplements.

Projected Expansion of the Immune Health Supplements Market by 2030

The immune health supplements market is…

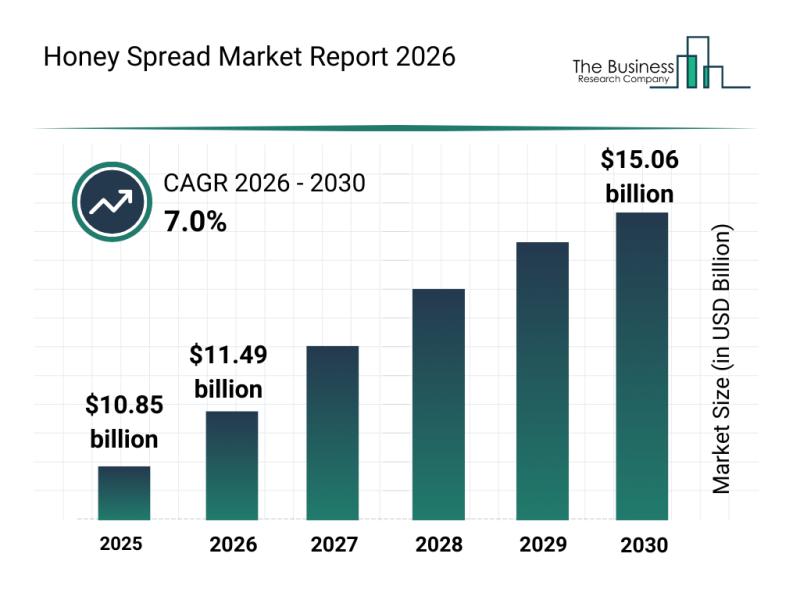

Honey Spread Market Overview: Major Segments, Strategic Developments, and Leadin …

The honey spread market is gaining significant momentum as consumers increasingly seek healthier and more flavorful alternatives to traditional spreads. Growing awareness around natural ingredients and sustainability, combined with e-commerce expansion and innovative product offerings, is set to shape the future of this sector. Below, we explore the market's size, key players, emerging trends, and segmentation to provide a comprehensive outlook through 2030.

Robust Expansion Expected in the Honey Spread Market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…