Press release

Growth In Institutional And Retail Investments Fueling The Market Due To Rising Digital Accessibility And Portfolio Oversight Needs: Powering Innovation and Expansion in the Investment Monitoring Service Market by 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Is the Expected CAGR for the Investment Monitoring Service Market Through 2025?

The market size for investment monitoring services has experienced a rapid expansion in recent years. The industry is projected to rise from $1.52 billion in 2024 to $1.68 billion in 2025, with a compound annual growth rate (CAGR) of 10.4%. The significant growth during the historical period can be linked to a heightened need for portfolio transparency, increased regulatory and compliance demands, growing intricacy of investment products, a surge in demand for risk management solutions, and an upward trend in the utilization of digital and automated tools.

What's the Projected Size of the Global Investment Monitoring Service Market by 2029?

The market size of the investment monitoring service industry is anticipated to experience substantial expansion in the imminent years. It is projected to reach a value of $2.46 billion by 2029, achieving a compound annual growth rate (CAGR) of 10.0%. This advancement during the projection period can be imputed to factors such as an expanding institutional investor base, the prevalence of outsourcing in investment operations, the increasing integration of ESG and sustainability measures, a mounting need for open and clear fees and performance, and a rising propensity towards adopting cloud-based monitoring systems. Major market trends projected for this period consist of enhancements in artificial intelligence and machine learning, the incorporation of real-time data analytics, the use of technology in automated compliance monitoring, progress in cloud-based monitoring platforms, and improvements in API and system compatibility.

View the full report here:

https://www.thebusinessresearchcompany.com/report/investment-monitoring-service-global-market-report

Top Growth Drivers in the Investment Monitoring Service Industry: What's Accelerating the Market?

The expansion of the investment monitoring service market is anticipated to be fueled by the rise in institutional and retail investments. These terms refer to funds injected into financial markets by large bodies like pension and mutual funds (institutional), and by private investors in pursuit of personal financial objectives (retail). The growth in institutional and retail investments is attributed to the widening access to digital investment platforms that ease market entry and portfolio regulation. These investment monitoring services are beneficial for both institutional and retail investors, allowing the tracking of portfolio performance, risk management, and real-time regulatory compliance. For example, in the first quarter of 2025, the UK's Office for National Statistics reported a 3.9% increase in business investment, marking a 6.1% leap from the equivalent quarter of the preceding year. Hence, the surge of institutional and retail investments significantly contributes to the upward trend of the investment monitoring service market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=27026&type=smp

What Trends Will Shape the Investment Monitoring Service Market Through 2029 and Beyond?

Leading firms in the investment monitoring service market are now focusing their energies on creating cutting-edge solutions such as proptech solutions. These innovative solutions enhance real-time tracking of assets, risk evaluation, portfolio performance analysis, and data-supported decision-making for developers, investors, and financial institutions. PropTech refers to technological innovations designed to streamline and revolutionize processes within the real estate industry, including property management, investment monitoring, transaction management, and risk evaluation. For example, CBRE South Asia Pvt. Ltd., a commercial real estate service and investment company based in India, launched the groundbreaking Investment IQ platform in April 2025. This platform is a first of its kind digital monitoring tool for the real estate sector in India, aimed at empowering stakeholders like real estate developers, investors, and lenders within the banking, financial services, and insurance (BFSI) segment. The critical need for streamlined, data-driven decision-making in the dynamic Indian real estate market is addressed by Investment IQ. It offers a comprehensive, all-encompassing solution for portfolio analysis in real-time, giving unprecedented transparency and control.

What Are the Main Segments in the Investment Monitoring Service Market?

The investment monitoring service market covered in this report is segmented -

1) By Component: Software, Services

2) By Type: Personal Investment Monitoring, Enterprise Investment Monitoring

3) By Deployment Mode: On-Premises, Cloud

4) By Enterprise Size: Small And Medium Enterprises, Large Enterprises

5) By End-User: Banking, Financial Services, And Insurance (BFSI), Healthcare, Retail, Manufacturing, Information Technology (IT) And Telecommunications, Other End-Users

Subsegments:

1) By Software: Portfolio Management Software, Risk Analytics Tools, Performance Tracking Platforms, Asset Allocation Software, Compliance Monitoring Tools

2) By Services: Managed Services, Consulting Services, Integration And Deployment Services, Support And Maintenance Services, Data Management Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=27026&type=smp

Which Top Companies are Driving Growth in the Investment Monitoring Service Market?

Major companies operating in the investment monitoring service market are JPMorgan Chase & Co., Deloitte Touche Tohmatsu Limited, Morgan Stanley, The Goldman Sachs Group Inc., UBS Group AG, Fidelity Investments Inc., BlackRock Inc., The Bank of New York Mellon Corporation, Franklin Resources Inc., Northern Trust Corporation, T. Rowe Price Group Inc., Invesco Ltd., Capital Group Companies Inc., Schroders plc, Morningstar Inc., The Vanguard Group Inc., Pacific Investment Management Company LLC, Acuity Knowledge Partners, State Street Global Advisors, Andrade Financial Services Inc.

Which Regions Will Dominate the Investment Monitoring Service Market Through 2029?

North America was the largest region in the investment monitoring service market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the investment monitoring service market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=27026

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Growth In Institutional And Retail Investments Fueling The Market Due To Rising Digital Accessibility And Portfolio Oversight Needs: Powering Innovation and Expansion in the Investment Monitoring Service Market by 2025 here

News-ID: 4165358 • Views: …

More Releases from The Business Research Company

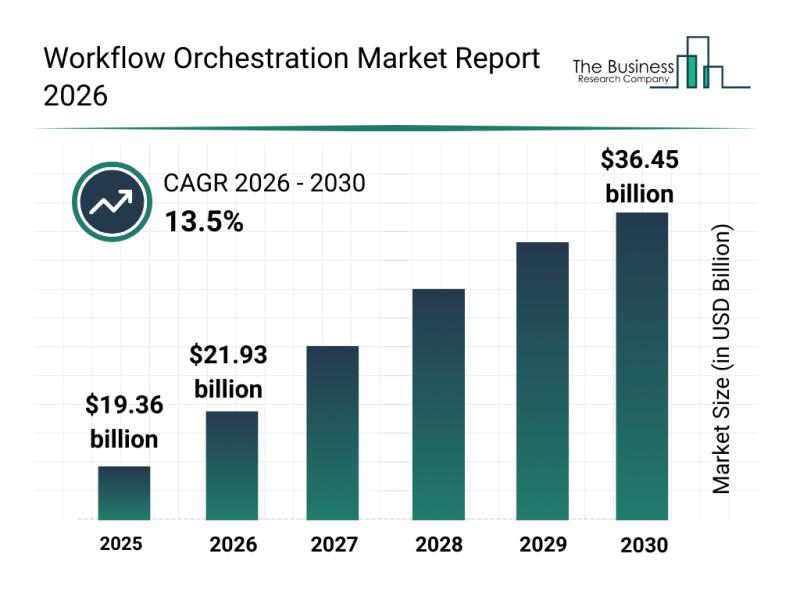

Analysis of Key Market Segments Driving the Workflow Orchestration Market

The workflow orchestration market is positioned for significant expansion over the coming years, driven by technological advancements and evolving business needs. As organizations increasingly seek to automate and streamline processes, this sector is attracting substantial investment and innovation. Let's explore the market's expected growth, key players, emerging trends, and main segments shaping its future.

Projected Market Value and Growth Drivers in the Workflow Orchestration Market

The workflow orchestration market is…

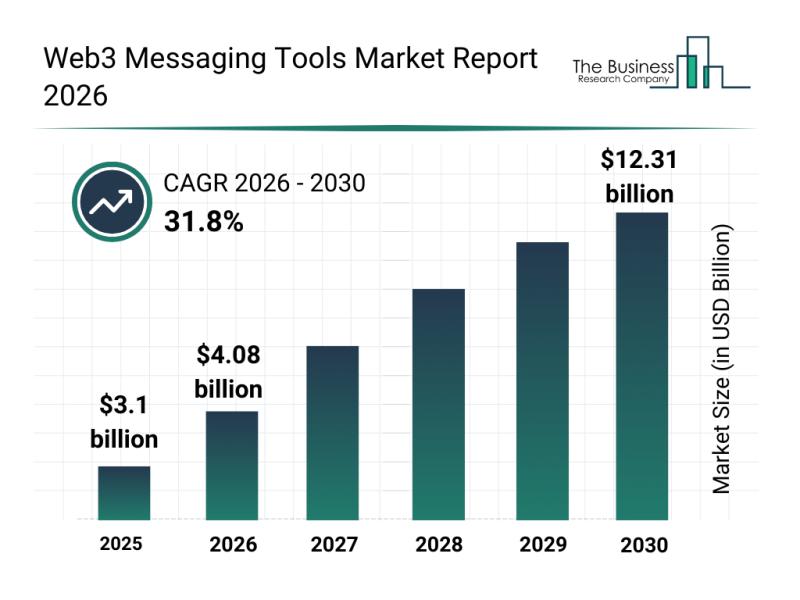

Market Trend Analysis: The Impact of Recent Advances on the Web3 Messaging Tools …

The Web3 messaging tools market is on the brink of remarkable growth, driven by the expanding use of decentralized communication technologies. As businesses and individual users increasingly seek secure, censorship-resistant messaging platforms, this sector is expected to undergo significant transformation. Let's explore the market size projections, leading companies, key trends, and the segmentation that define the future of Web3 messaging tools.

Projected Expansion of the Web3 Messaging Tools Market Size Through…

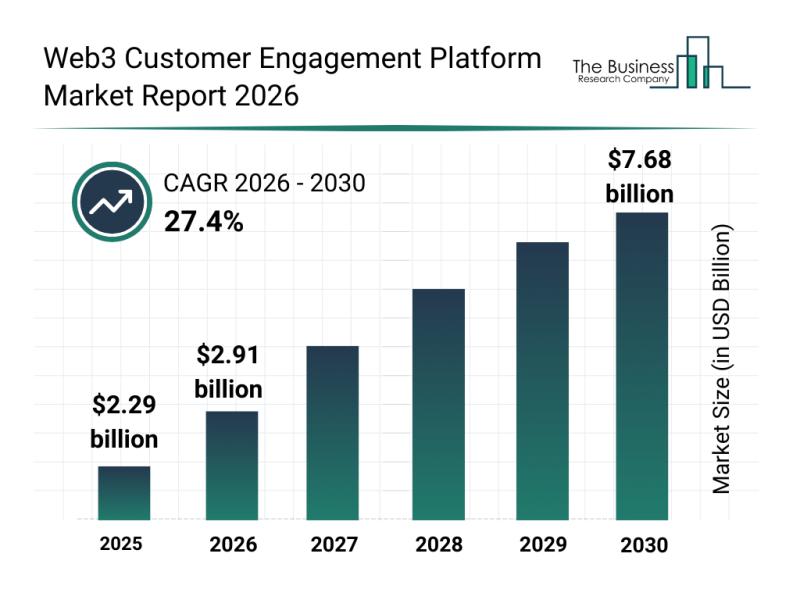

Emerging Growth Patterns, Segment Analysis, and Competitor Approaches Influencin …

The Web3 customer engagement platform sector is on the verge of remarkable growth, driven by increasing interest in decentralized technologies and blockchain applications. This emerging market is rapidly evolving as businesses seek innovative ways to engage customers through new digital experiences. Let's explore the market's projected value, key players, influential trends, and the segment breakdown shaping the future of Web3 engagement platforms.

Projected Market Value and Growth Potential of the Web3…

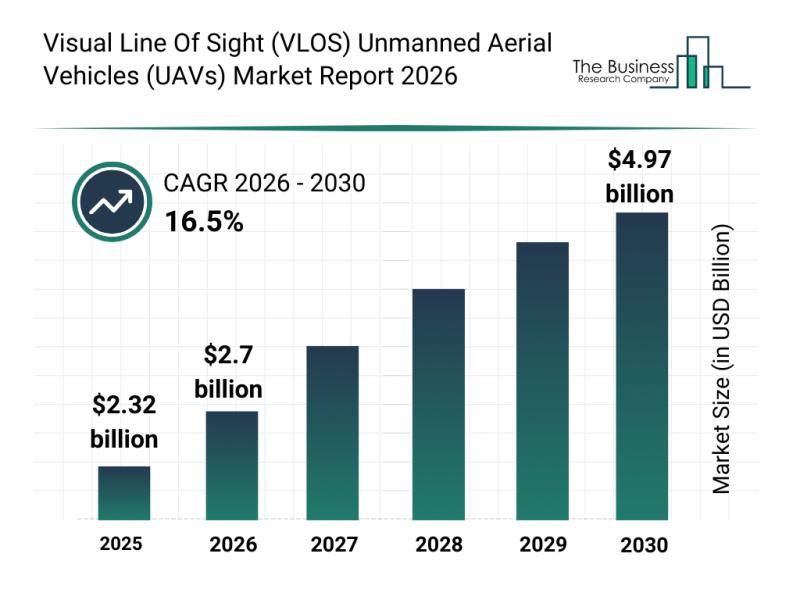

Analysis of Key Market Segments Influencing the Visual Line of Sight (VLOS) Unma …

The Visual Line of Sight (VLOS) Unmanned Aerial Vehicles (UAVs) sector is rapidly evolving, driven by technological advancements and expanding applications across various industries. Demand for these UAVs is intensifying as more sectors seek innovative aerial solutions for monitoring, inspection, and delivery. Let's explore the market's size, key players, impactful trends, and segmentation to understand its current trajectory and future outlook.

Projected Market Growth and Size of the Visual Line of…

More Releases for Investment

ST Investment Co., Ltd: Pioneering the Global Investment Trend

Since its establishment in 2017 in the United Kingdom, ST Investment Co., Ltd has rapidly emerged as a shining star in the global investment sector. Through its diversified business portfolio and exceptional financial services, the company provides a comprehensive wealth growth platform for clients worldwide. Its services span key sectors such as artificial intelligence-based smart contracts, private equity, gold investments, and wealth management, all aimed at delivering stable and diverse…

Lakshmishree Investment: Common Investment Mistakes When Markets Are High

One big mistake many investors make is taking too much risk because they fear missing out.

Stock markets around the world are on fire! From the bustling streets of Wall Street to the vibrant Bombay Stock Exchange (BSE), markets are scaling new highs, leaving many investors excited and bewildered. While this bull run is thrilling, it can also be confusing. Should you jump in and buy more? Hold on tight…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

China Investment Bank, China Investment Consultant, China Investment Corporation …

Pandacu is a company that specializes in cross-border investment in China. The company was founded in china and has since grown to become one of the leading cross-border investment firms in China. Pandacu offers a wide range of services to its clients, including investment advisory, market research, due diligence, and post-investment support.

http://pandacuads.com/

Investment banking consultant

Email:nolan@pandacuads.com

Cross-border investment in China can be a complex and challenging process, as the country has a unique…

Trident Steels - Investment Casting, Stainless Steel Investment Casting, Steel I …

With decades of experience in this industry, we have become the preferred partner for global companies who look for high-end metal casting manufacturing from India. Our investment casting company in India offers best-in-class quality products and services to our customers. We are a customer-centric company and invest in our people, processes, and technology to provide high-quality products every time. This has helped us to become the preferred partner for companies…

Investment Management Market Growth Improvement Highly Witness | NWQ Investment …

Investment management is designed to help investors or owners to recognize, manage, and communicate the performance and risks of assets and related investments. As an alternative to spending time pursuing data and manually creating reports, fund managers, owners, and operators can focus on maximizing performance.

Investment Management market size is expected to grow at a compound annual growth rate of xx% for the forecast period of 2021 to 2028.

Market IntelliX report…