Press release

Mobile Check Scanning System Market Insights 2025-2034: Growth Forecast and Strategic Priorities

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Mobile Check Scanning System Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

In recent years, the market size of the mobile check scanning system has experienced significant expansion. This development expects to proceed from a total worth of $2.71 billion in 2024, to achieve an estimated $3.07 billion in 2025, showing a compound annual growth rate (CAGR) of 13.5%. The surge in the historic period can be credited to factors such as the amplifying requirement for branchless financial operations, escalating acceptance of remote deposit captures, increasing smartphone penetration, broadening popularity of mobile banking apps, and a growing emphasis on enhancing consumer convenience.

Mobile Check Scanning System Market Size Forecast: What's the Projected Valuation by 2029?

The market for mobile check scanning systems is anticipated to experience a swift surge in size in the forthcoming years, increasing to $5.04 billion in 2029 with a CAGR of 13.2%. This expansion during the projected period is due to factors such as the growing transition to digital payment platforms, the rise in the use of AI-based banking systems, a greater emphasis on transactional procedures without paper, growth in the fintech universe, and an increasing demand for immediate check processing. Some imperative trends foreseeable during this period encompass advancements in image recognition technology, innovations in fraud detection powered by artificial intelligence, increasing investments in mobile-dominant financial services, the evolution of cloud-based scanning frameworks, and progressive integration capabilities for mobile devices.

View the full report here:

https://www.thebusinessresearchcompany.com/report/mobile-check-scanning-system-global-market-report

What Are the Drivers Transforming the Mobile Check Scanning System Market?

An increase in demand for touch-free payment solutions is projected to stimulate the expansion of the mobile check scanning system market in future. These contactless payment methods, which can be processed by merely tapping a card or mobile gadget near a payment terminal, remove the need for direct contact. Consumer preference for speedy transactions that cut down on checkout time and boost convenience fuels the need for such payment systems. Mobile check scanning systems enable consumers to deposit checks remotely, reducing the need for in-person bank visits and fostering safer transactions. They deliver a smooth, contact-free experience through mobile devices. For example, the European Central Bank, a central bank in Germany serving European Union countries, recorded a 24.3% increase in contactless card payments in the first half of 2023 compared to 20.9 billion in the first half of 2022. The corresponding value swelled by 25.9% to $545.27 billion in January 2024. As such, the escalating demand for touch-free payment solutions is fuelling the growth of the mobile check scanning system market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=26836&type=smp

What Long-Term Trends Will Define the Future of the Mobile Check Scanning System Market?

Leading firms in the mobile check scanning system market are focusing their efforts on introducing advanced technology such as image-based deposit solutions. This technology aims to reduce processing time and ensure secure, instantaneous check clearance through mobile appliances. This solution allows users to deposit checks remotely by taking and sending digital images of the check via a mobile gadget. This simplifies the deposit process and eradicates the need for manual check handling or branch trips. For example, in March 2022, Hang Seng Bank, a Hong Kong-based provider of all-inclusive online banking services, introduced its Mobile Cheque Deposit service. The services permit both individual and corporate clients to deposit Hong Kong dollar checks at any place or time through the Hang Seng personal or business mobile application, eliminating the need for branch visits. Clients merely have to take photos of the check's front and back and verify the details for the deposit to commence regular clearing. Checks deposited before 5:30 p.m. on a settlement day are accounted for on the subsequent settlement day. The service handles checks issued by Hang Seng and HSBC and enforces transaction limits, making check deposits quicker and more user-friendly, particularly during the ongoing pandemic.

Which Segments in the Mobile Check Scanning System Market Offer the Most Profit Potential?

The mobile check scanning system market covered in this report is segmented -

1) By Component: Hardware, Software, Services

2) By Deployment Type: On-Premises, Cloud-Based

3) By Enterprise Size: Small And Medium Enterprises, Large Enterprises

4) By Technology: Optical Character Recognition (OCR), Image Processing, Machine Learning

5) By End-User: Banking, Insurance, Retail, Government, Other End-Users

Subsegments:

1) By Hardware: Check Scanners, Cash Recyclers, Coin Recyclers, Imaging Devices, Biometric Readers, Signature Pads, Receipt Printers

2) By Software: Image Recognition Software, Fraud Detection Modules, Check Processing Software, Optical Character Recognition (OCR) Engines, Integration Middleware, Analytics And Reporting Tools, Cloud-Based Management Software

3) Services: Installation And Deployment Services, Maintenance And Support Services, Consulting Services, Training And Education Services, System Integration Services, Managed Services, Upgrade And Customization Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=26836&type=smp

Which Firms Dominate the Mobile Check Scanning System Market by Market Share and Revenue in 2025?

Major companies operating in the mobile check scanning system market are Wells Fargo, U.S. Bank, Fiserv Inc., Fidelity National Information Services Inc., Deluxe Corporation, Jack Henry & Associates Inc., Flatworld Solutions Inc., HighRadius, Mitek Systems Inc., SmartBank, VSoft Corporation, Digital Check Corp., Alogent Corporation, CrossCheck Inc., Panini S.p.A., Scanbot SDK GmbH, Financial Transmission Network Inc., Check21.com LLC, All My Papers Inc., EasCorp.

Which Regions Offer the Highest Growth Potential in the Mobile Check Scanning System Market?

North America was the largest region in the mobile check scanning system market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the mobile check scanning system market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=26836

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay

Americas +1 310-496-7795,

Asia +44 7882 955267 & +91 8897263534,

Europe +44 7882 955267

Email:saumyas@tbrc.info

The Business Research Company -www.thebusinessresearchcompany.com

Follow Us On:

LinkedIn:https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Check Scanning System Market Insights 2025-2034: Growth Forecast and Strategic Priorities here

News-ID: 4164883 • Views: …

More Releases from The Business Research Company

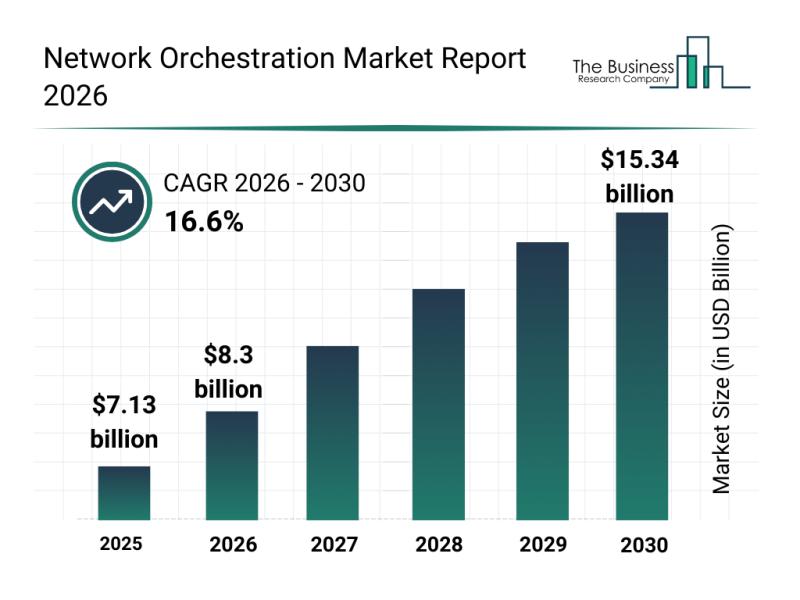

Network Orchestration Market Overview: Major Segments, Strategic Developments, a …

The network orchestration market is on track for substantial growth over the coming years, driven by technological advancements and increasing demand for efficient network management. As businesses and service providers seek more streamlined and automated networking solutions, this market is expected to experience significant expansion. Let's explore the current market size, key players, emerging trends, and detailed segment analysis shaping the future of network orchestration.

Expected Market Value and Growth Trajectory…

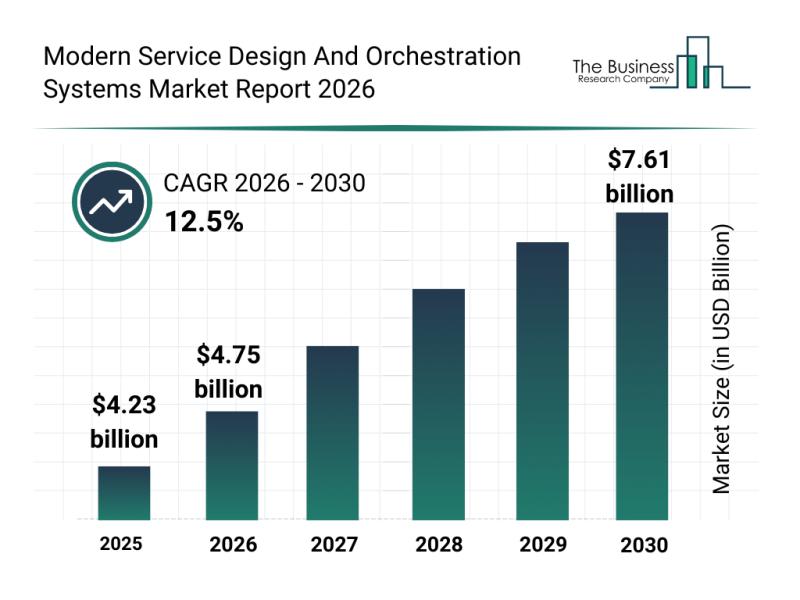

Segment Analysis and Major Growth Areas in the Contemporary Service Design and O …

The modern service design and orchestration systems market is positioned for remarkable expansion in the coming years. Driven by evolving digital demands and increasing complexity across industries, this sector is set to play a pivotal role in streamlining service delivery and enhancing operational efficiency. Let's explore the market's growth projections, leading players, key trends, and segment breakdowns shaping its future.

Projected Market Value and Growth Drivers in the Modern Service Design…

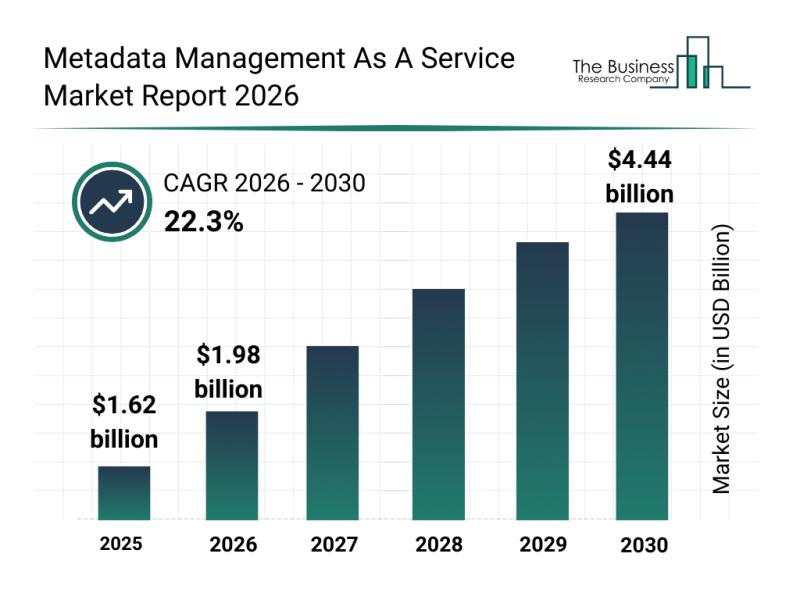

Key Strategic Developments and Emerging Changes Shaping the Metadata Management …

The landscape of metadata management is rapidly evolving with the increasing adoption of cloud technologies and artificial intelligence. As organizations seek efficient ways to govern and utilize their data, the Metadata Management as a Service market is positioned for substantial growth. This overview explores the market's size projections, driving factors, key players, significant trends, and segmentation to provide a clear picture of its future trajectory.

Projected Growth and Market Size for…

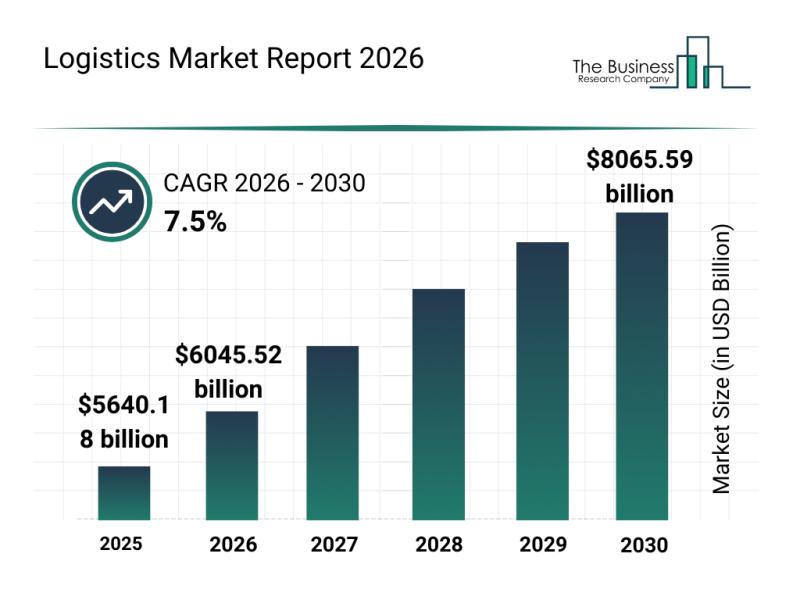

Leading Companies Fueling Innovation and Growth in the Logistics Market

The logistics industry is set to experience substantial growth in the coming years, driven by technological advancements and evolving supply chain demands. As businesses increasingly adopt innovative solutions to enhance efficiency and sustainability, the market dynamics are shifting to accommodate these changes. Here's an in-depth exploration of the logistics market's size, key players, emerging trends, and segmentations shaping its future trajectory.

Projected Expansion of the Logistics Market by 2030

The…

More Releases for Mobile

Global Mobile Wallet Market, Global Mobile Wallet Industry, Market Revenue, Mark …

The digital wallet is the engine of mobile commerce and also agreements an evolutionary path to decrease the friction in the transaction and optimize consumer satisfaction. The users are interested towards gorgeous cash backs and loyalty coupons suggested by dissimilar mobile wallet corporates. The mobile wallet market in the report denotes to payment services functioned under financial regulation and functioned through a mobile device instead of paying with cheques, cash, or credit cards.…

Asia - Mobile Infrastructure and Mobile Broadband

Bharat Book Bureau Provides the Trending Market Research Report on "Asia - Mobile Infrastructure and Mobile Broadband" under Telecom category. The report offers a collection of superior market research, market analysis, competitive intelligence and industry reports.

Executive Summary

Leading Asian nations prepare for 5G rollouts

Asia’s mobile subscriber market is now witnessing moderate growth in a fast maturing market. Whilst there are still developing markets continuing to grow their mobile subscriber base at…

Mobile Virtual Network Operator (MVNO) Market Analysis by Top Key Players Tracfo …

The mobile virtual network operator (MVNO) is also referred to as the mobile other licensed operator (MOLO), or the virtual network operator (VNO), is the remote service of communication which does not claim the remote network infrastructure on which it gives the customer the services.

Get Sample Copy of this Report @ https://www.bigmarketresearch.com/request-sample/2835705?utm_source=RK&utm_medium=OPR

The MVNO goes into the business agreement with the mobile network operator for acquiring more access to…

Mobile Virtual Network Operator (MVNO) Market Comprehensive Study 2018: Boost Mo …

Global Mobile Virtual Network Operator (MVNO) market report provides a thorough synopsis on the study for market and how it is changing the industry. The data and the information regarding the industry are taken from reliable sources such as websites, annual reports of the companies, journals, and others and were checked and validated by the market experts. Mobile Virtual Network Operator (MVNO) Market report includes historic data, present market trends,…

Asia - Mobile Infrastructure And Mobile Broadband

Asian mobile broadband market continues to grow strongly

With 3.9 billion mobile subscribers and over 50% of the mobile subscribers in the world, spread across a diverse range of markets, the region is already rapidly advancing in the adoption of mobile broadband services. Mobile broadband as a proportion of the total Asian mobile broadband subscriber base, has increased from 2% in 2008 to 18% in 2013, 27% in 2014, 33% in…

Mobile Money Market Trends, Public Demand and Worldwide Strategy - Mobile Commer …

The mobile money market report provides an analysis of the global mobile money market for the period 2014 – 2024, wherein 2015 is the base year and the period from 2016 to 2024 is the forecast period. Data for 2014 has been included as historical information. The report covers all the prevalent trends playing a major role in the growth of the mobile money market over the forecast period. It…