Press release

Rising Prevalence Of Chronic Diseases Fueling The Growth Of The Market Due To Increasing Demand For Continuous And Cross-Border Care: A Key Catalyst Accelerating International Health Insurance Market Growth in 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.International Health Insurance Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The global health insurance marketplace has seen significant growth in the past few years, with its value set to rise from $29.04 billion in 2024 to $31.68 billion in 2025, marking an annual compound growth rate of 9.1%. Factors contributing to this substantial growth in the past include an increase in overseas medical travel, growing demand for elective procedures in foreign countries, broader access to inexpensive healthcare destinations, the growth of international hospital networks, and more extensive collaborations between insurance companies and overseas hospitals.

International Health Insurance Market Size Forecast: What's the Projected Valuation by 2029?

Expectations for the international health insurance market foresee a significant expansion in the coming years, with projections indicating a rise to $44.29 billion by 2029, equating to a compound annual growth rate (CAGR) of 8.7%. The projected growth during this period is influenced by a growing need for bespoke international healthcare, an upward trend in the aging population seeking care abroad, a rising favorability towards global consultations facilitated by telehealth, an enlarged scope of international insurance coverage, and an escalating emphasis on a value-based approach to healthcare delivery. Significant trends to watch during this forecast period encompass technological progression in sharing patient data across borders, novel adaptations in international telemedicine platforms, boosting investment in the worldwide healthcare infrastructure, and research advancement in creating safe travel treatment guidelines and digital medical concierge services innovation.

View the full report here:

https://www.thebusinessresearchcompany.com/report/international-health-insurance-global-market-report

What Are the Drivers Transforming the International Health Insurance Market?

The global health insurance market's growth is forecasted to be fueled by the increasing incidence of chronic diseases. Chronic diseases are long-lasting medical conditions that develop gradually and demand ongoing healthcare. Sedentary lifestyles, marked by extensive sitting and insufficient physical exercise, contribute to the escalating prevalence of chronic diseases such as heart conditions and diabetes. International health insurance aids in managing chronic diseases by ensuring continuous medical care across borders. It allows easy access to specialists and long-term medication, improving patient results by covering routine checkups, diagnostic tests, and subsequent treatments. This makes healthcare more attainable and consistent for people who regularly travel internationally. For example, the National Health Service, a government department based in the UK, reported that in June 2024, 3,615,330 individuals registered with a general practitioner were diagnosed with non-diabetic hyperglycemia or pre-diabetes in 2023. This marked an 18% rise from the 3,065,825 cases reported in 2022. Consequently, the surge in chronic diseases is fueling the expansion of the international health insurance market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=26885&type=smp

What Long-Term Trends Will Define the Future of the International Health Insurance Market?

Key players within the global health insurance sector are concentrating on introducing innovative offerings like digital-first travel-medical insurance to increase customer comfort, improve claims processing efficiency, and offer on-the-spot assistance to travelers around the globe. Digital-first travel medical insurance involves comprehensive platforms that render telehealth services in real-time, automated claims, and policy management through mobile to enhance the user experience and operational productivity. For example, Niva Bupa Health Insurance Company Limited, a health insurance firm from India, rolled out TravelAssure, an international health scheme in July 2022. This program gives wide-ranging coverage to globetrotters, encompassing emergency inpatient and outpatient medical services, doctor consultations, diagnostic tests, COVID-specific hospitalization, emergency medical evacuation, dental services, personal accident insurance, and daily hospital cash for miscellaneous expenses. It also safeguards against travel disruptions such as travel delays, trip cancellations, missed flight connections, loss of passport, delayed or misplaced luggage, loss of international driving licenses, loss of electronic devices, and non-compliance with hotel or flight reservations. For overseas students, the scheme encompasses emergency inpatient services for pre-existing health conditions and an array of maternity-related benefits, including childbirth, termination of pregnancy, newborn hospital expenses, and vaccination charges.

Which Segments in the International Health Insurance Market Offer the Most Profit Potential?

The international health insurance market covered in this report is segmented -

1) By Plan Type: Individual Plans, Family Plans, Group Plans, Senior Citizen Plans, Other Plan Types

2) By Coverage Type: Preferred Provider Organization, Exclusive Provider Organization, Health Maintenance Organization, Points Of Service

3) By Payment Method: Annual Premiums, Monthly Premiums, One-time Lump Sum Payment, Flexible Payment Plans, Premium Financing Options

4) By Distribution Channel: Direct Sales, Insurance Brokers, Online Platforms, Financial Services Institutions, Corporate Partnerships

5) By End-User: Individuals, Corporates, Students, Other End Users

Subsegments:

1) By Individual Plans: Short-Term Individual Coverage, Long-Term Individual Coverage, Student Travel Insurance, Digital Nomad Health Plans

2) By Family Plans: Joint Family Coverage, Maternity And Childcare Coverage, Emergency Evacuation Plans, Multi-Country Family Protection

3) By Group Plans: Corporate Group Health Insurance, Non-Governmental Organization And Missionary Group Plans, International Employee Assistance Programs, Group Travel Medical Insurance

4) By Senior Citizen Plans: Pre-Existing Condition Coverage, Geriatric Care Management Plans, Age-Specific Critical Illness Coverage, Annual Renewable Senior Policies

5) By Other Plan Types: Adventure Traveler Health Plans, Medical Tourism-Specific Policies, Remote Worker Health Coverage, Exchange Visitor Insurance Plans

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=26885&type=smp

Which Firms Dominate the International Health Insurance Market by Market Share and Revenue in 2025?

Major companies operating in the international health insurance market are UnitedHealth Group Incorporated, Ping An Insurance (Group) Company of China Ltd., Cigna Corporation, Allianz SE, AXA S.A., Munich Reinsurance Company, Prudential plc, Zurich Insurance Group Ltd, Chubb Limited, The Manufacturers Life Insurance Company (Manulife), ALC Health Limited, Now Health International Limited, International Medical Group Inc., Bupa Global Limited , VIP Universal Medical Insurance Group Ltd., GeoBlue LLC , APRIL International Care, MSH International , Best Doctors Insurance Limited , PassportCard Group

Which Regions Offer the Highest Growth Potential in the International Health Insurance Market?

North America was the largest region in the international health insurance in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the international health insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=26885

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay

Americas +1 310-496-7795,

Asia +44 7882 955267 & +91 8897263534,

Europe +44 7882 955267

Email:saumyas@tbrc.info

The Business Research Company -www.thebusinessresearchcompany.com

Follow Us On:

LinkedIn:https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Prevalence Of Chronic Diseases Fueling The Growth Of The Market Due To Increasing Demand For Continuous And Cross-Border Care: A Key Catalyst Accelerating International Health Insurance Market Growth in 2025 here

News-ID: 4164853 • Views: …

More Releases from The Business Research Company

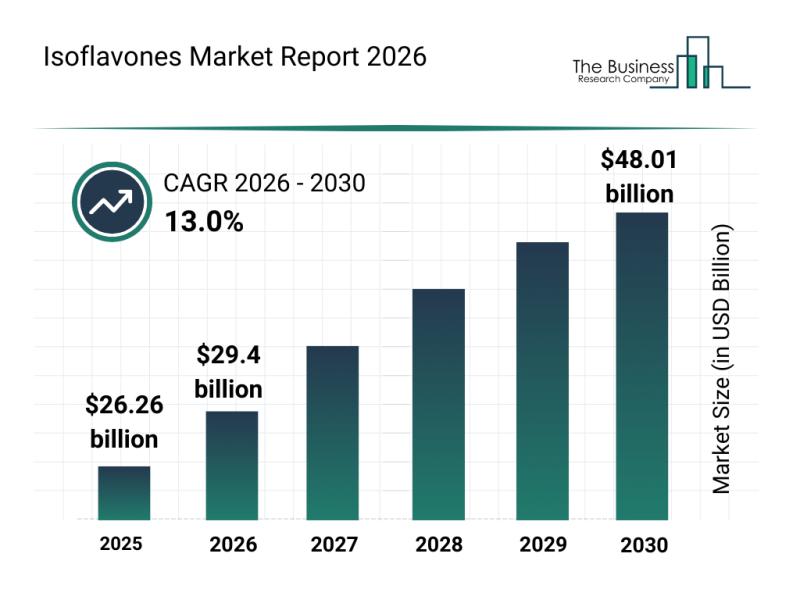

Segment Analysis and Major Growth Areas in the Isoflavones Market

The isoflavones market is poised for remarkable growth over the coming years, driven by increasing consumer awareness and expanding applications across various industries. With rising interest in health supplements and natural ingredients, this market is attracting significant attention from manufacturers and investors alike. Let's delve into the market's size, key players, emerging trends, and segment breakdowns shaping its trajectory.

Projected Market Size and Growth Outlook for Isoflavones

The isoflavones market…

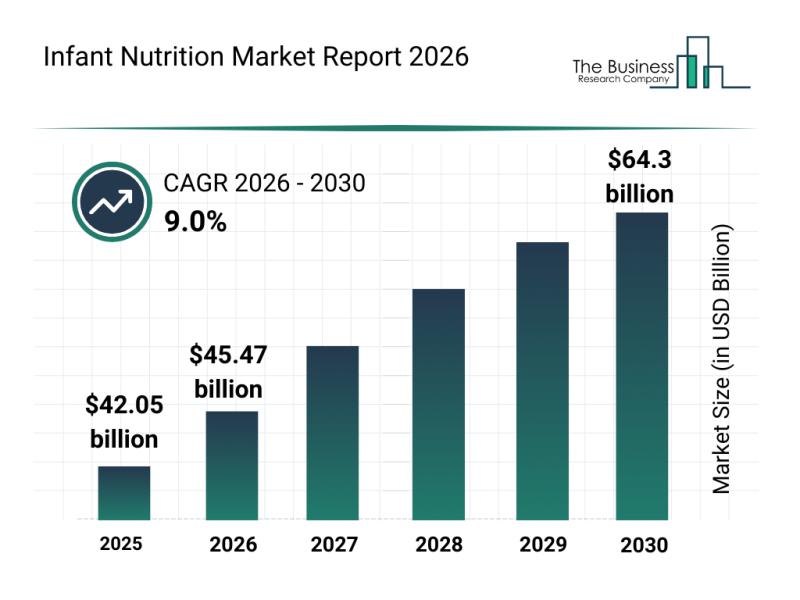

Key Strategic Developments and Emerging Changes Shaping the Infant Nutrition Mar …

The infant nutrition market is on track for substantial expansion in the coming years, driven by evolving consumer preferences and advancements in product offerings. As parents increasingly seek high-quality nutrition solutions tailored to their babies' needs, the sector is poised for remarkable growth through innovative products and diverse distribution channels. Let's explore the market's size projections, key players, emerging trends, and segment breakdowns shaping this dynamic industry.

Projected Growth Trajectory and…

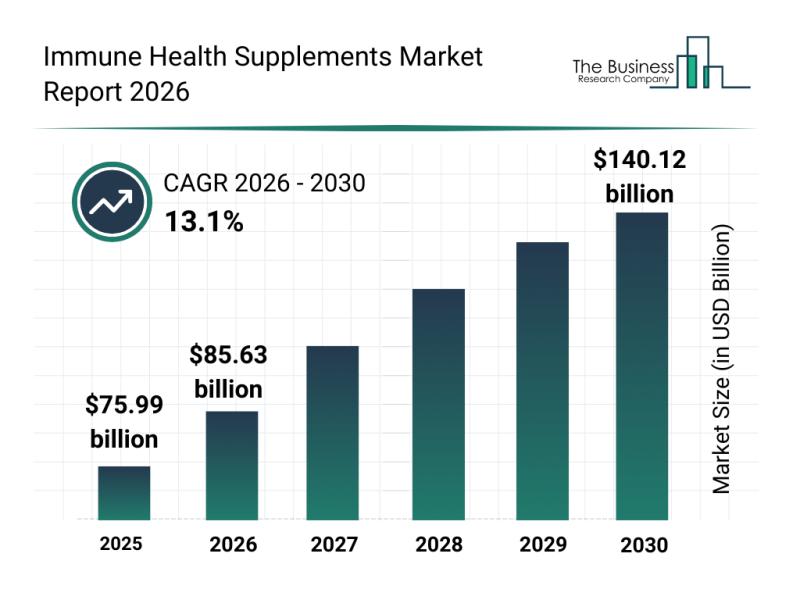

Leading Companies Advancing Innovation and Growth in the Immune Health Supplemen …

The immune health supplements sector is gaining significant traction as consumers increasingly prioritize wellness and preventive care. With a growing interest in personalized nutrition and plant-based options, this market is set to expand rapidly. Let's explore the expected market size, key players, emerging trends, and segmentation that define the future of immune health supplements.

Projected Expansion of the Immune Health Supplements Market by 2030

The immune health supplements market is…

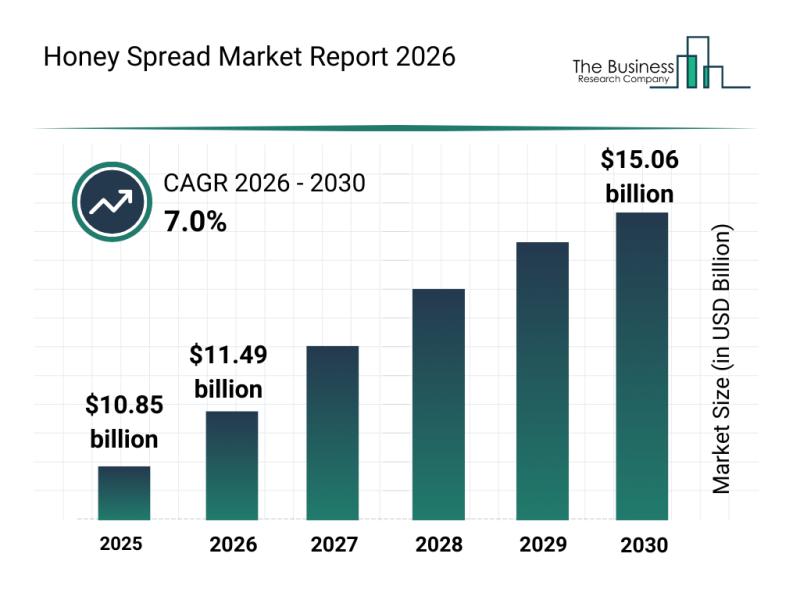

Honey Spread Market Overview: Major Segments, Strategic Developments, and Leadin …

The honey spread market is gaining significant momentum as consumers increasingly seek healthier and more flavorful alternatives to traditional spreads. Growing awareness around natural ingredients and sustainability, combined with e-commerce expansion and innovative product offerings, is set to shape the future of this sector. Below, we explore the market's size, key players, emerging trends, and segmentation to provide a comprehensive outlook through 2030.

Robust Expansion Expected in the Honey Spread Market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…