Press release

Future of the Instant Payments Market: Strategic Analysis and Forecast to 2034

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Instant Payments Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The market for instant payments has seen substantial expansion over the past few years. It is forecasted to swell from $67.74 billion in 2024 to a significant $84.31 billion in 2025, illustrating a compound annual growth rate (CAGR) of 24.5%. The impressive growth witnessed in the historical period is a result of several contributing factors including the surge in smartphone usage, heightened demand for swifter transactions, an increase in e-commerce ventures, growing acceptance of digital banking, and an escalating need for instantaneous fund transfers.

Instant Payments Market Size Forecast: What's the Projected Valuation by 2029?

There is a prediction of remarkable expansion in the instant payments industry over the coming years, with its valuation poised to hit $199.97 billion in 2029 with a CAGR of 24.1%. This surge during the anticipatory period is being ascribed to a growing fondness for a cashless society, increased incorporation of direct payments into e-commerce platforms, escalated governmental backing of digital payments, a rising usage of API-based payment methods, and an elevated need for instant cross-border transactions. Key projected trends over this period encompass enhancements in real-time payment infrastructure, improvements in fraud detection technologies, progress in instantaneous cross-border payment solutions, innovative developments in mobile payment applications, and advancements in API-led payment platforms.

View the full report here:

https://www.thebusinessresearchcompany.com/report/instant-payments-global-market-report

What Are the Drivers Transforming the Instant Payments Market?

Advancements in the instant payments market are predicted to be driven by the escalating acceptance of contactless payments. These payments operate via a swift and secure process, whereby users can simply tap a card or device near a compatible terminal using NFC or RFID technology. The increasing popularity of contactless payments is largely due to consumers wanting quick and hassle-free transactions devoid of physical contact or the need for PIN entry. Instant payments enhance this process by facilitating immediate fund transfers, thus quickening transaction completion times. They also offer a smoother, risk-free, and on-the-spot payment processing experience across digital platforms. For instance, UK Finance, a financial institution based in the UK, noted in July 2024 that in the previous year, the UK recorded 18.3 billion contactless transactions, an increase of 7% from 17.0 billion in 2022. Hence, the rising utilization of contactless payments is indeed fueling the expansion of the instant payments market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=26879&type=smp

What Long-Term Trends Will Define the Future of the Instant Payments Market?

Leading firms in the instant payments industry are concentrating their efforts on creating sophisticated technological solutions such as real-time payments to boost speed of transactions, heighten consumer convenience, and satisfy the increasing need for smooth digital financial solutions. Real-time payments are defined as instant money transfers that transpire within mere seconds, enabling seamless money movement between accounts 24/7 that comes with instantaneous confirmation and settlement. For example, ACI Worldwide, a software corporation based in the US, introduced ACI Instant Pay in January 2023. The solution allows for secure, real-time payments for merchants and billers. It doesn't require card fees, provides instant payment settlement, and decreases the risk of fraud by facilitating a straightforward application programming interface (API) integration. Besides improving cash flow for merchants, it also decreases operational expenses and improves the shopper's experience by offering a rapid, safe, and easy-to-use payment alternative.

Which Segments in the Instant Payments Market Offer the Most Profit Potential?

The instant payments market covered in this report is segmented -

1) By Payment Type: Person-To-Business(P2B), Business-To-Business(B2B), Person-To-Person(P2P), Other Payment Types

2) By Component: Solutions, Payment Gateway, Payment Processing, Security And Fraud Management, Services

3) By Technology: Mobile Payments, Online Transfers, Contactless Payments, Cryptocurrency Transactions

4) By Deployment: Cloud, On-premise

5) By End-Use Industry: Retail And E-commerce, Banking, Financial Services, And Insurance(BFSI), Information Technology And Telecom, Travel And Tourism, Government, Healthcare, Energy And Utilities, Other End-Use Industries

Subsegments:

1) By Person-To-Business (P2B): In-Store Payments, E-Commerce Payments, Utility And Bill Payments

2) By Business-To-Business (B2B): Supplier Vendor Payments, Invoice Payments, Payroll Disbursements

3) By Person-To-Person (P2P): Domestic Money Transfers, International Remittances, Wallet To Wallet Transfers

4) By Other Payment Types: Insurance Claim Settlements, Refunds And Reimbursements, Social Benefit Disbursements

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=26879&type=smp

Which Firms Dominate the Instant Payments Market by Market Share and Revenue in 2025?

Major companies operating in the instant payments market are Visa Inc., PayPal Holdings Inc., Mastercard Incorporated, Fiserv Inc., Fidelity National Information Services Inc., Adyen N.V., Nexi S.p.A., Worldline SA, Klarna Bank AB, Alipay, Revolut Ltd., Stripe Inc., ACI Worldwide Inc., Swift, Paytm, PhonePe Private Limited, Razorpay Software Private Limited, Volante Technologies Inc., National Payments Corporation of India, Amazon Pay, The Clearing House Payments Company L.L.C., NACHA, Zelle, Google Pay

Which Regions Offer the Highest Growth Potential in the Instant Payments Market?

Asia-Pacific was the largest region in the instant payments market in 2024. The regions covered in the instant payments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=26879

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay

Americas +1 310-496-7795,

Asia +44 7882 955267 & +91 8897263534,

Europe +44 7882 955267

Email:saumyas@tbrc.info

The Business Research Company -www.thebusinessresearchcompany.com

Follow Us On:

LinkedIn:https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future of the Instant Payments Market: Strategic Analysis and Forecast to 2034 here

News-ID: 4164838 • Views: …

More Releases from The Business Research Company

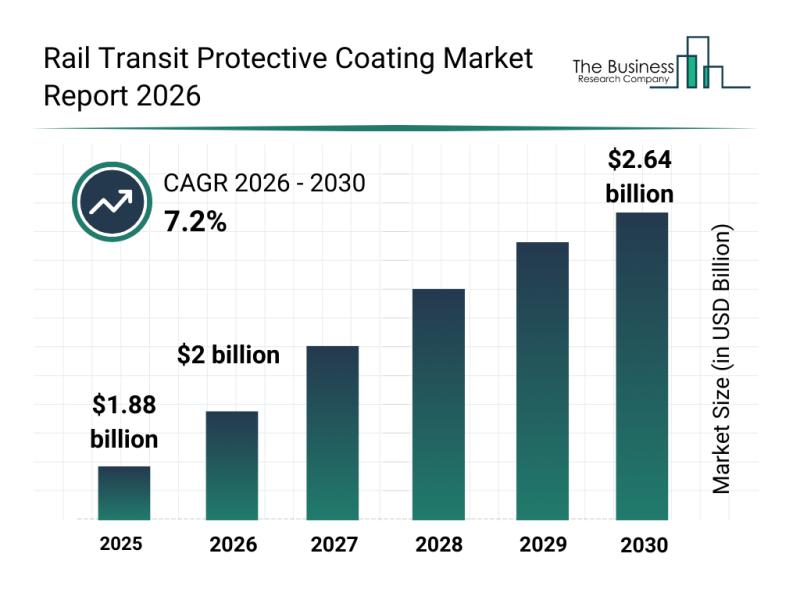

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

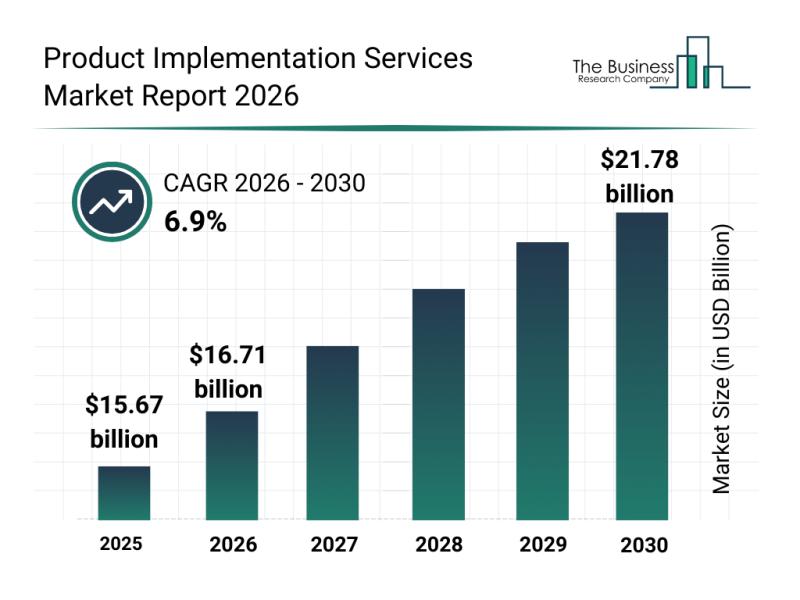

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

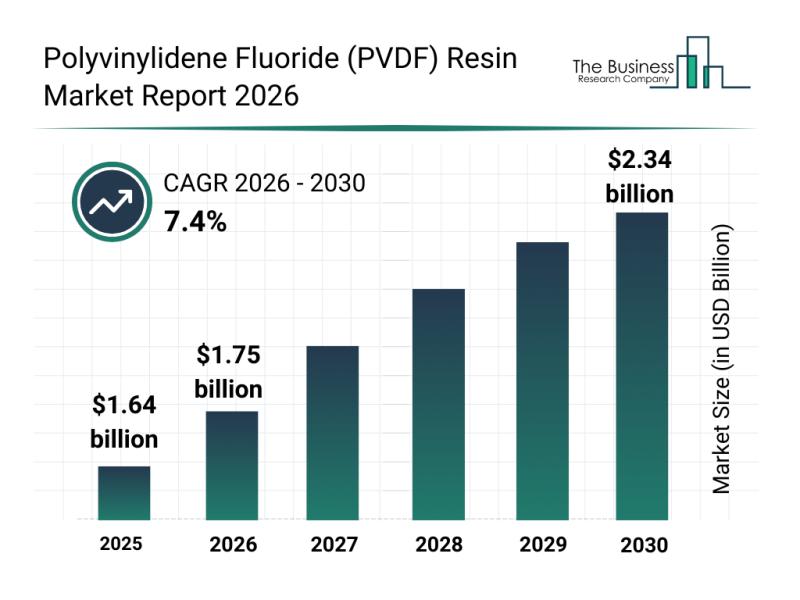

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

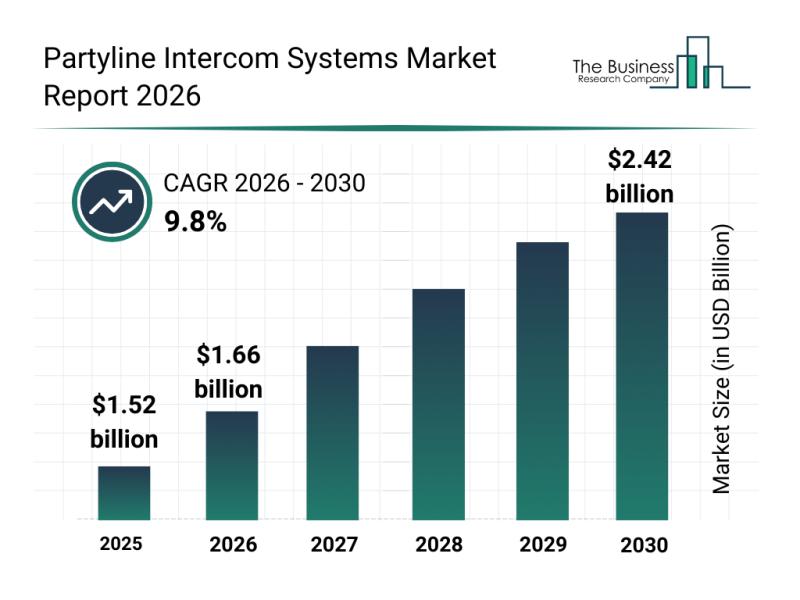

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…