Press release

Emerging Trends to Drive New Energy Vehicle (NEV) Insurance Market Growth at 29.7% CAGR Through 2029

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.New Energy Vehicle (NEV) Insurance Market Size Growth Forecast: What to Expect by 2025?

In recent times, the size of the new energy vehicle (NEV) insurance market has seen significant growth. This market, from a projected size of $14.09 billion in 2024, is expected to expand to $18.32 billion in 2025, marking a compound annual growth rate (CAGR) of 30.0%. This historic period's growth can be traced back to factors such as the increasing access to data from connected vehicles, surging incorporation of telematics-based insurance, a rise in consumer necessity for comprehensive digital claims processing, urbanization combined with smart city initiatives, and growing worries about climate variations.

How Will the New Energy Vehicle (NEV) Insurance Market Size Evolve and Grow by 2029?

Expectations are high for the new energy vehicle (NEV) insurance market as it is predicted to witness remarkable growth over the next few years, reaching $51.80 billion in 2029 with a compound annual growth rate (CAGR) of 29.7%. Factors contributing to this growth during the forecast period include the escalating popularity of electric vehicles, heightened awareness among consumers about environmental sustainability, significant investments in EV charging facilities, an increasing demand for tailored insurance coverages, and the move towards digitization in the insurance sector. Key trends anticipated during the forecast period are improvements in battery technology, the inclusion of telematics systems, advancements in autonomous driving technology, the adoption of analytics powered by technology, and progress in vehicle connectivity.

View the full report here:

https://www.thebusinessresearchcompany.com/report/new-energy-vehicle-nev-insurance-global-market-report

What Drivers Are Propelling the Growth of New Energy Vehicle (NEV) Insurance Market Forward?

The advancement of the new energy vehicle (NEV) insurance market is poised to be driven by the growing acceptance of electric vehicles (EVs). These EVs are cars that use electric motors powered by chargeable batteries or fuel cells as opposed to internal combustion engines. They have the added advantage of reduced emissions, greater energy efficiency, and less use of fossil fuels. The rise in EV adoption is primarily due to mounting environmental worries since these vehicles emit less and help fight air pollution and climate change. NEV insurance caters to EVs specifically by offering bespoke covers designed for EV's unique components like batteries and charging systems. It elevates the ownership experience, providing coverage against EV-specific hazards, simplifying claims and refining all-around vehicle management. For example, the International Energy Agency, a France-based global organization, recorded that electric car sales in 2024 hit 3.5 million in 2023, an annual growth of 35% from 2022. Thus, the rise in the acquisition of electric vehicles (EVs) propels the progress of the new energy vehicle (NEV) insurance market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=26728&type=smp

Which Emerging Trends Are Transforming the New Energy Vehicle (NEV) Insurance Market in 2025?

Prominent firms in the new energy vehicle (NEV) insurance market are concentrating on the creation of innovative offerings, such as online car insurance platforms, with the intention of elevating the customer experience, simplifying claims procedures, and delivering personalized insurance plans in line with electric vehicle usage tendencies. Online car insurance platforms are digital solutions that permit users to buy, oversee, and submit insurance claims purely digitally, typically through websites or mobile applications. The goal of these platforms is to streamline insurance operations, frequently providing quicker quotes, adaptable plans, and AI-powered customer service. To illustrate, SunCar Technology Group Inc., a technology enterprise based in China, unveiled a web-based insurance tool specifically for Li Auto Inc. customers in October 2023. This tool allows owners to promptly compare and buy insurance via the Li Auto application, resulting in effortless convenience and speedy transaction processing. This amalgamation is conceptualized to present insurance as the most convenient default option for Li owners, thus improving client satisfaction and stimulating repeat business for SunCar.

What Are the Key Segments in the New Energy Vehicle (NEV) Insurance Market?

The new energy vehicle (nev) insurance market covered in this report is segmented -

1) By Type: Compulsory Insurance, Optional Insurance

2) By Coverage Type: Liability Coverage, Comprehensive Coverage, Collision Coverage, Uninsured Or Underinsured Motorist Coverage, Gap Insurance

3) By Distribution Channel: Insurance Brokers, Direct Insurance Providers, Online Aggregators, Agent Intermediaries, Automobile Dealerships

4) By Application: Hybrid Electric Vehicles (HEV), Pure Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Other Applications

5) By End-User: Individual, Commercial

Subsegments:

1) By Compulsory Insurance: Mandatory Liability Insurance, Property Damage Liability, Third-Party Bodily Injury Coverage

2) By Optional Insurance: Comprehensive Coverage, Theft Protection, Collision Coverage

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=26728&type=smp

Who Are the Key Players Shaping the New Energy Vehicle (NEV) Insurance Market's Competitive Landscape?

Major companies operating in the new energy vehicle (nev) insurance market are Ping An Group, Allianz SE, State Farm Mutual Automobile Insurance Company, AXA SA, BYD Property & Casualty Insurance Co. Ltd., China Pacific Insurance Group, The Allstate Corporation, Liberty Mutual Group, Tokio Marine Holdings Inc., Zurich Insurance Group, Chubb Limited, Travelers, MAPFRE S.A., ZhongAn Online Property and Casualty Insurance Co. Ltd., Direct Line Group, ACKO General Insurance Limited, Bajaj Allianz General Insurance Company Limited, Admiral Group plc., HDFC ERGO General Insurance Company Limited, Nationwide Mutual Insurence Company, United Services Automobile Association(USAA), Tesla Insurance Services Inc.

What Geographic Markets Are Powering Growth in the New Energy Vehicle (NEV) Insurance Market?

Asia-Pacific was the largest region in the new energy vehicle (NEV) insurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the new energy vehicle (nev) insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=26728

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Reach Out to Us

Speak With Our Expert:Saumya Sahay,

Americas +1 310-496-7795,

Asia +44 7882 955267 & +91 8897263534,

Europe +44 7882 955267,

Email: saumyas@tbrc.info

The Business Research Company - www.thebusinessresearchcompany.com

Follow Us On:LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Emerging Trends to Drive New Energy Vehicle (NEV) Insurance Market Growth at 29.7% CAGR Through 2029 here

News-ID: 4164678 • Views: …

More Releases from The Business Research Company

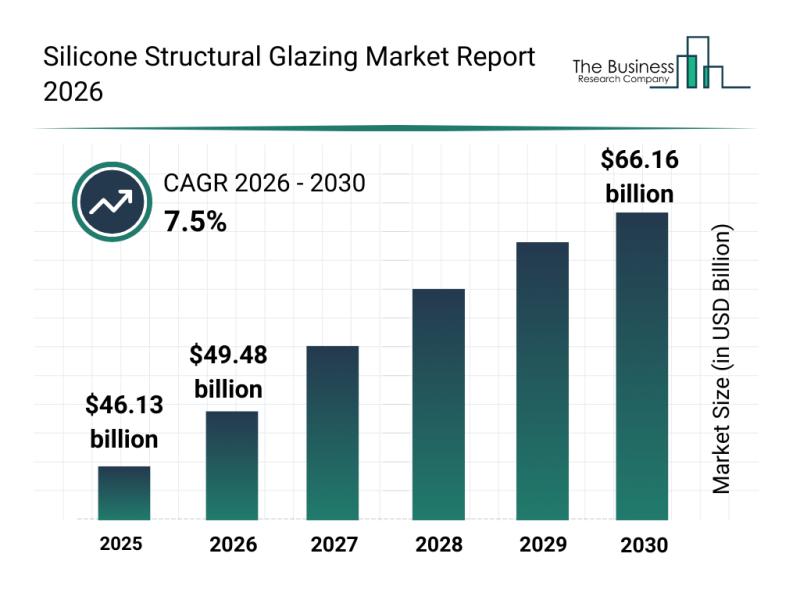

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

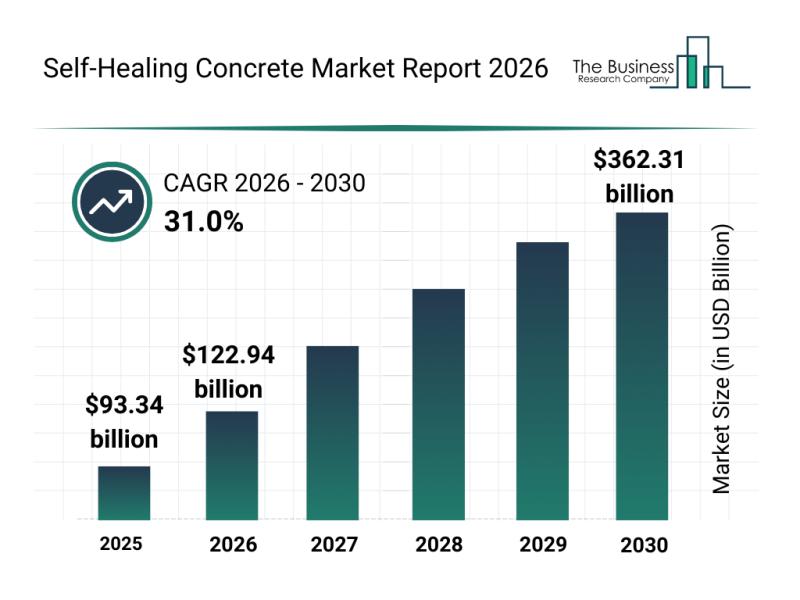

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

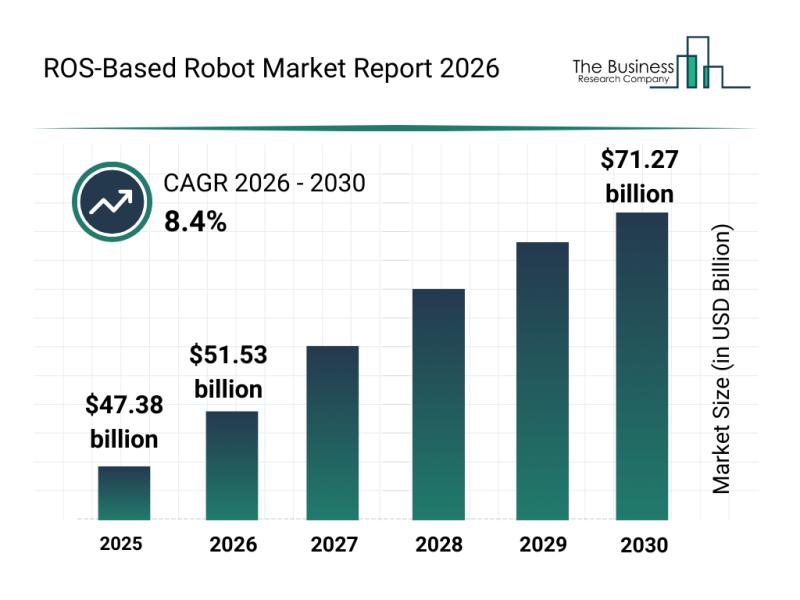

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

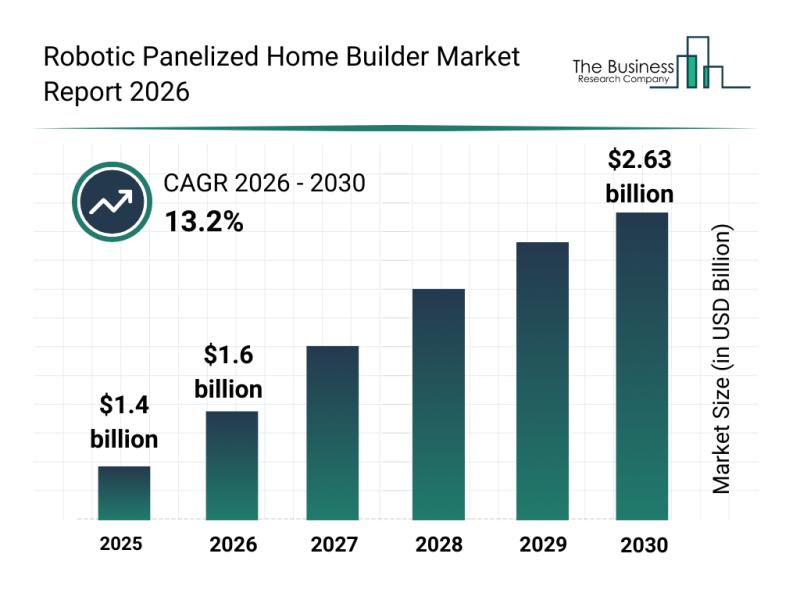

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…