Press release

2025 Payables Supply Chain Finance Industry Trends Report: Long-Term Outlook Through 2034

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.How Large Will the Payables Supply Chain Finance Market Size By 2025?

In recent years, the receivables supply chain finance market has seen a substantial surge. Its size is projected to increase from $528.55 billion in 2024 to $582.26 billion in 2025, showcasing a compound annual growth rate (CAGR) of 10.2%. The previous growth period's expansion can be credited to the accelerated utilization of cloud-based solutions, the active involvement of fintech firms and alternative lenders, greater emphasis on managing supplier relations, increasing digital transitions within procurement and finance departments, and an amplified reliance on supplier networks.

How Big Is the Payables Supply Chain Finance Market Size Expected to Grow by 2029?

The market size for payables supply chain finance is forecasted to experience substantial expansion in the following years, ballooning to $846.09 billion in 2029 with a compound annual growth rate (CAGR) of 9.8%. The predicted growth during the forecast period can be linked to factors such as the increasing use of digital financial platforms, the escalating demand for the optimization of working capital, the rising requirement for liquidity support amongst suppliers, an intensified focus on financial supply chain resilience, and a broader acceptance of dynamic discounting models. Key trends projected during the forecast period encompass the progression in blockchain technology, enhancements in cloud computing, the automation of purchase-to-pay cycles driven by technology, advancements in data analysis, and improvements in e-invoicing system technology.

View the full report here:

https://www.thebusinessresearchcompany.com/report/payables-supply-chain-finance-global-market-report

Which Key Market Drivers Powering Payables Supply Chain Finance Market Expansion and Growth?

The growth of the payables supply chain finance market is forecasted to be driven by the rise in digital solutions for financial transactions. Such digital solutions refer to tech-powered platforms and tools that ensure safe, efficient, and seamless monetary transactions digitally. The upscaling of these solutions is due to the growing consumer preference for instant, user-friendly, and readily available financial services over internet platforms. Payables supply chain finance facilitates digital solutions for financial transactions by making receipt processing streamlined and enabling automatic early payments, thereby improving cash flow efficiency for buyers and suppliers. It encourages financial transparency and agility across the supply chain. For instance, the Consumer Financial Protection Bureau, a US government agency, reported in September 2023 that consumer expenditure through Google Pay had a dramatic increase from $24.8 billion in 2021 to $65.2 billion in 2022. Consequently, the growth of the payables supply chain finance market is being propelled by the rising digital solutions for financial transactions.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=27160&type=smp

Which Fast-Growing Trends Are Poised to Disrupt the Payables Supply Chain Finance Market?

In the payables supply chain finance market, prominent companies are prioritising the creation of groundbreaking solutions like Environmental, Social, and Governance (ESG)-connected working capital finance. The goal is to foster sustainable supply chains and answer the increasing need for responsible corporate actions. ESG-linked working capital finance involves a financing strategy that relates a company's access to or cost of working capital to the achievement of specific ESG objectives, thus promoting sustainable and responsible supply chain operations. To illustrate, in July 2024, Deutsche Bank AG, an investment banking firm based in Germany, introduced BASF's first-ever sustainability-linked payables finance scheme in Asia. The program aims to aid BASF's suppliers by providing them with better financing rates if they fulfil certain sustainability performance goals. This initiative aligns with BASF's wider ESG objectives, urging suppliers to embrace eco-friendly practices and optimise working capital across the supply chain. With the integration of sustainability incentives into payables financing, Deutsche Bank strives to create a positive environmental impact while boosting long-term business efficiency.

What Are the Emerging Segments in the Payables Supply Chain Finance Market?

The payables supply chain finance market covered in this report is segmented -

1) By Type Of Financing: Dynamic Discounting, Reverse Factoring, Invoice Financing, Purchase Order Financing, Supply Chain Financing Platforms

2) By Financing Source: Banks, Non-Bank Financial Institutions, Fintech Companies, Investment Funds, Peer-To-Peer Lending Platforms

3) By Enterprise Size: Small Enterprises (1-50 employees), Medium Enterprises (51-200 employees), Large Enterprises (201+ employees)

4) By Technology Deployment: Cloud-Based Solutions, On-Premises Solutions, Hybrid Solutions

5) By Industry Vertical: Manufacturing, Retail, Healthcare, Information Technology, Construction, Food And Beverage, Telecommunications

Subsegments:

1) By Dynamic Discounting: Buyer-Funded Dynamic Discounting, Third-Party-Funded Dynamic Discounting, Early Payment Programs

2) By Reverse Factoring: Bank-Led Reverse Factoring, Multi-Bank Reverse Factoring, Fintech-Enabled Reverse Factoring

3) By Invoice Financing: Invoice Discounting, Factoring, Selective Invoice Financing

4) By Purchase Order Financing: Pre-Shipment Financing, Post-Shipment Financing, Transaction-Based Financing

5) By Supply Chain Financing Platforms: Cloud-Based Platforms, Application Programming Interface-Integrated Platforms, Blockchain-Enabled Platforms

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=27160&type=smp

Who Are the Global Leaders in the Payables Supply Chain Finance Market?

Major companies operating in the payables supply chain finance market are JPMorgan Chase & Co., Citibank N.A., Bank of America Corporation, Banco Santander S.A., HSBC Holdings plc., Wells Fargo & Company, Oracle Corporation, Deutsche Bank AG., Standard Chartered plc., FIS Global, Finastra, Infor Nexus, OpenText Business Network, ACI Worldwide Inc., Basware Corporation, Kyriba Corp., Tradeshift Holdings Inc., C2FO, SAP Taulia Inc., PrimeRevenue Inc., Orbian Management Limited, Credlix Technologies Private Limited

Which are the Top Profitable Regional Markets for the Payables Supply Chain Finance Industry?

North America was the largest region in the payables supply chain finance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the payables supply chain finance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=27160

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2025 Payables Supply Chain Finance Industry Trends Report: Long-Term Outlook Through 2034 here

News-ID: 4164651 • Views: …

More Releases from The Business Research Company

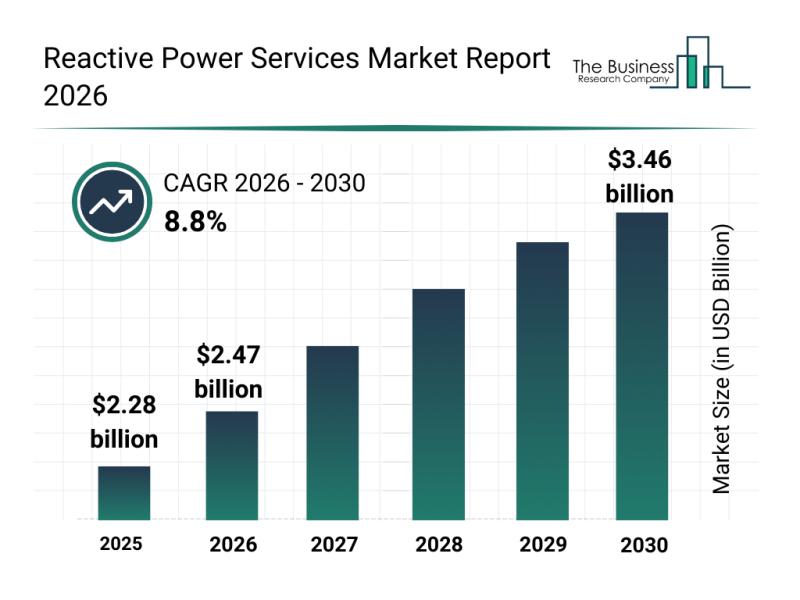

Future Perspective: Key Trends Shaping the Reactive Power Services Market up to …

The reactive power services market is set for significant expansion in the coming years as the energy sector evolves to meet modern demands. With increasing renewable energy adoption and advancements in grid technologies, this market is becoming a critical component in ensuring power system reliability and efficiency. Let's explore the market size forecast, key companies involved, influential trends, and the various segments shaping this industry.

Projected Growth and Market Size of…

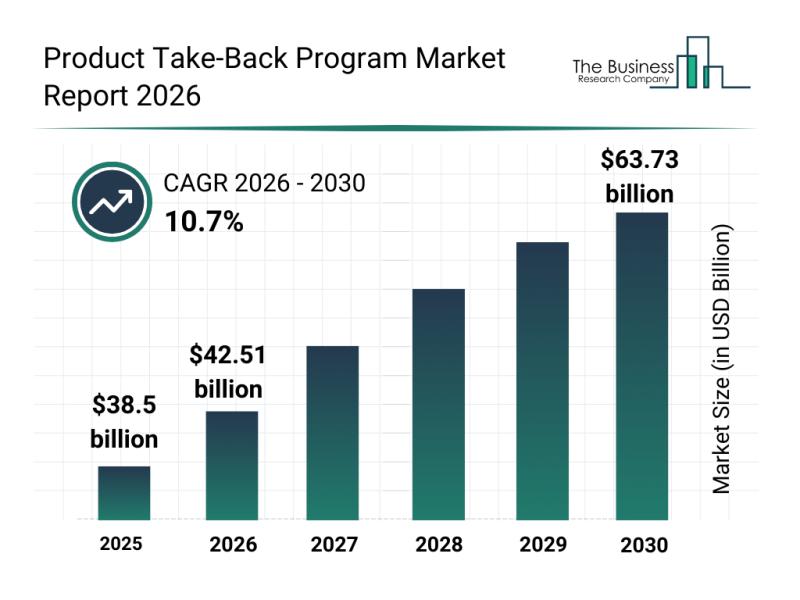

Analysis of Key Market Segments Driving the Product Take-Back Program Market

The product take-back program market is gaining significant attention as sustainability becomes a higher priority for businesses and consumers alike. With increasing efforts to promote circular economy models, this sector is set for impressive growth and innovation over the coming years. Let's explore the market's size projections, major players, key drivers, notable trends, and segmentation details to better understand its evolving landscape.

Forecasted Growth and Market Size of the Product Take-Back…

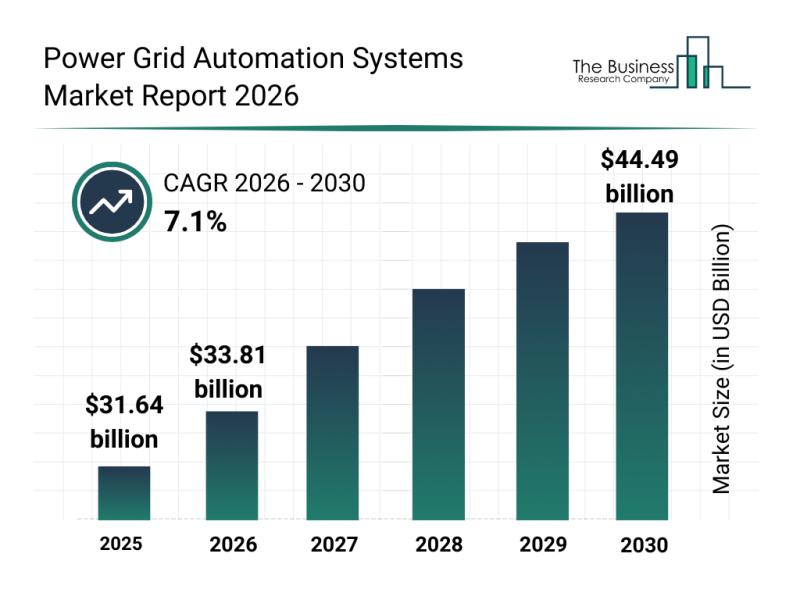

Global Drivers Analysis: The Rapid Evolution of the Power Grid Automation System …

The power grid automation systems market is on the verge of significant expansion, driven by technological advancements and increasing demands for smarter, more resilient energy networks. This sector is evolving rapidly as utilities and energy providers adopt innovative solutions to manage and optimize power grids more effectively. Below, we explore the market's projected value, key industry players, emerging trends, and the detailed segmentation shaping its future.

Projected Growth and Valuation of…

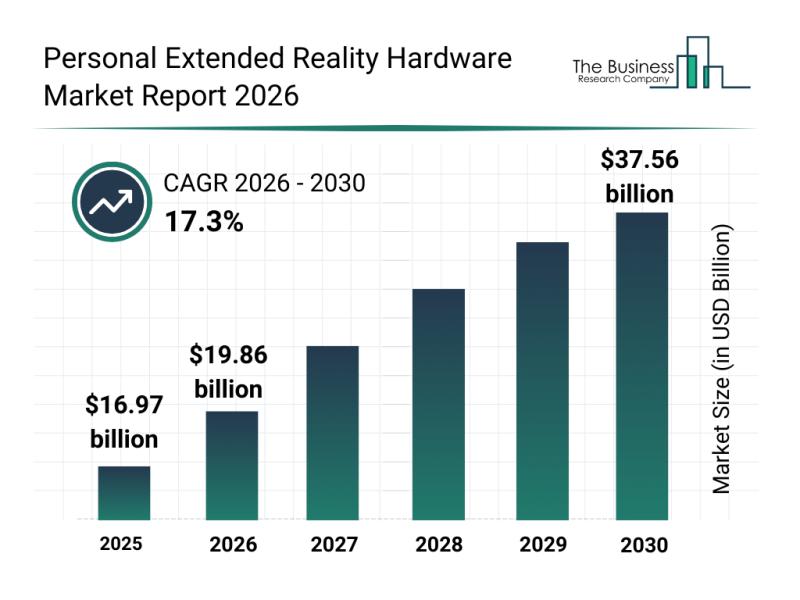

Leading Companies Consolidating Their Roles in the Personal Extended Reality Har …

The personal extended reality hardware market is on the cusp of remarkable expansion, driven by technological advancements and growing user demand. As industries and consumers increasingly embrace extended reality (XR) technologies, this market is expected to experience significant growth in the coming years. Let's delve into the anticipated market size, the key players shaping the landscape, current trends, and important segmentation within this evolving sector.

Projected Growth Trajectory of the Personal…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…