Press release

The Growing E-Commerce Is Driving The Growth Of The Market Due To Increasing Online Shopping And Global Payment Needs: The Driving Engine Behind Digital Cross Border Payments Market Evolution in 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Digital Cross Border Payments Market Size Growth Forecast: What to Expect by 2025?

The market for digital cross-border payments has experienced rapid expansion in past years. It is expected to surge from a market size of $36.81 billion in 2024 to $42.77 billion in 2025, with a compound annual growth rate (CAGR) of 16.7%. Factors contributing to this historical growth include an escalation in international trade activities, an increase in mobile phone usage, a burgeoning demand for money transfer services, growing internet access in developing countries, and the rise in global business operations.

How Will the Digital Cross Border Payments Market Size Evolve and Grow by 2029?

In the forthcoming years, the digital cross border payments market is anticipated to witness swift expansion, registering a Compound Annual Growth Rate (CAGR) of 15.8% and reaching the value of $77.01 billion by 2029. This progression in the predicted timeframe is due to the escalating demand for immediate fund transfers, the boost in cross-border e-commerce business deals, surging efforts towards financial inclusion, increasing population of worldwide freelancers and gig workers, and the escalating necessity for real-time foreign exchange solutions. The forecast period signals major trends such as artificial intelligence incorporation for fraud detection and conformity, application of artificial intelligence in payment verification, advances in compliance automation tools, adoption of instantaneous payment systems and the employment of biometric authentication in digital payments.

View the full report here:

https://www.thebusinessresearchcompany.com/report/digital-cross-border-payments-global-market-report

What Drivers Are Propelling the Growth of Digital Cross Border Payments Market Forward?

The expansion of the e-commerce sector is anticipated to fuel the digital cross border payments market's growth in the future. Essentially, e-commerce involves the online purchase and sale of goods or services through digital outlets utilizing electronic payment systems. Thanks to increased internet and smartphone usage, more customers can easily use online platforms for their shopping needs from anywhere. This convenience gets even better with digital cross-border payments, which facilitates swift, secure, and smooth international transactions, thus enabling businesses to comfortably cater to their worldwide customers. To exemplify, in February 2025, the United States Census Bureau, a US government agency, stated that in 2024, aggregate e-commerce sales attained approximately $1,192.6 billion, denoting an expansion of 8.1% (±1.1) compared to 2023. Therefore, the e-commerce sector's robust growth is stirring up the progress of the digital cross border payments market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=27001&type=smp

Which Emerging Trends Are Transforming the Digital Cross Border Payments Market in 2025?

Key players in the digital cross border payments market, such as major corporations, are increasingly focusing on the creation of innovative solutions like digital wallet-integrated payment platforms. These platforms are designed to simplify international transactions and increase user convenience by incorporating digital wallets with the capability to handle cross-border payments. This combination enables users to manage, send and receive international transactions all in one application. For example, Mastercard Inc., a leading US credit card company, introduced Mastercard Pay Local in November 2024. This new development in cross-border payments integrates Mastercard credit and debit cards with local digital wallets to enhance customer payments experience. The service also allows users to directly link their cards to local wallets, enabling instantaneous purchases at over 35 million merchants, thereby removing the need for setting up or topping up prepaid accounts. The service provides a secure and efficient payment option for wallet operators, travelers, residents, and card issuers. Initially launched in the Asia Pacific, Mastercard aims to extend this service to other global markets.

What Are the Key Segments in the Digital Cross Border Payments Market?

The digital cross border payments market covered in this report is segmented -

1) By Service Type: Payment Processing, Currency Conversion, Fraud Detection And Prevention, Compliance And Risk Management, Reporting And Analytics

2) By Payment Method: Bank Transfers, Credit Or Debit Cards, E-Wallets, Cryptocurrencies, Prepaid Cards

3) By Transaction Type: Business To Business Transactions, Business To Consumer Transactions, Consumer To Business Transactions, Consumer To Consumer Transactions, Merchant Payments

4) By Technology Adoption: Traditional Banking Schemes, Blockchain-Based Solutions, Mobile Payment Applications, Payment Gateways, Application Programming Interface For Cross-Border Transactions

5) By End-User: Banking, Financial Services And Insurance (BFSI), Retail And E-Commerce, Travel And Transportation, Healthcare, Other End-User

Subsegments:

1) By Payment Processing: Real-Time Payment Processing, Batch Payment Processing, Peer-To-Peer Payment Processing, Merchant Payment Processing, Mobile Payment Processing

2) By Currency Conversion: Automated Currency Conversion, Real-Time Exchange Rate Conversion, Multi-Currency Wallet Conversion, Card-Based Currency Conversion, Blockchain-Based Currency Conversion

3) By Fraud Detection And Prevention: Transaction Monitoring, Identity Verification, Behavioral Analytics, Biometric Authentication, Artificial Intelligence-Based Risk Scoring

4) By Compliance And Risk Management: Know Your Customer Verification, Anti-Money Laundering Monitoring, Regulatory Reporting, Sanctions Screening, Risk Assessment Tool

5) By Reporting And Analytics: Transaction Reporting, Performance Analytics, Customer Behavior Analysis, Real-Time Dashboard Reporting, Predictive Analytics

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=27001&type=smp

Who Are the Key Players Shaping the Digital Cross Border Payments Market's Competitive Landscape?

Major companies operating in the digital cross border payments market are Fidelity National Information Services Inc., Adyen N.V., Wise Payments Limited., TransferMate Payments Services Ltd., Payoneer Inc., Airwallex, Banking Circle Holdings Ltd., NIUM Pte Ltd., PingPong Payments Ltd., Verto Limited., Currencycloud Limited., Alviere GmbH, Tazapay Pte Ltd., InstaReM Pte Ltd., Brightwell Payments Ltd., Fable Fintech Pvt Ltd., Payall Payment Systems Pvt. Ltd., Cymonz Limited., Corpay Inc., Volt Bank Limited.

What Geographic Markets Are Powering Growth in the Digital Cross Border Payments Market?

North America was the largest region in the digital cross border payments market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the digital cross border payments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=27001

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Growing E-Commerce Is Driving The Growth Of The Market Due To Increasing Online Shopping And Global Payment Needs: The Driving Engine Behind Digital Cross Border Payments Market Evolution in 2025 here

News-ID: 4163169 • Views: …

More Releases from The Business Research Company

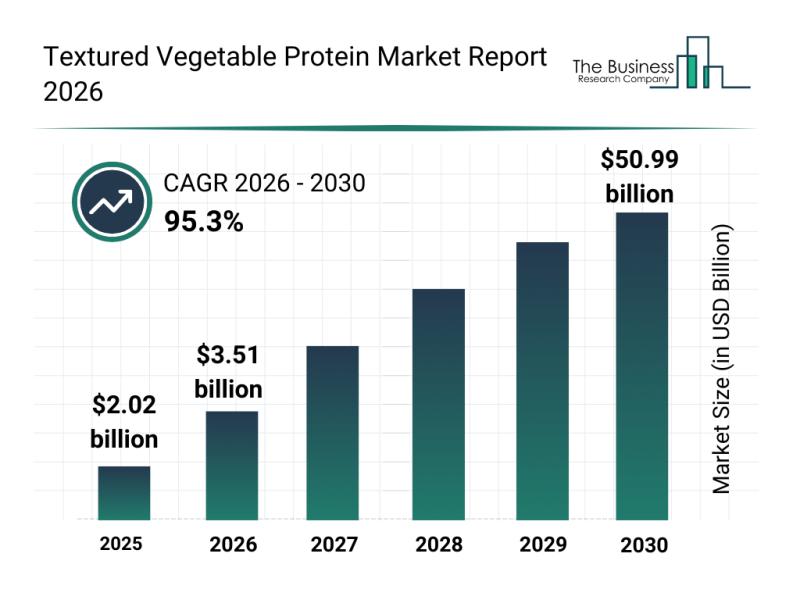

Key Factors and Emerging Trends Shaping the Textured Vegetable Protein Market La …

The textured vegetable protein sector is poised for remarkable growth as the global market shifts increasingly toward plant-based nutrition. With rising consumer demand for sustainable and clean-label protein options, innovations and expanding applications are driving this market forward. Let's explore the current market size, key players, emerging trends, and leading segments shaping the future of textured vegetable protein.

Projected Expansion of the Textured Vegetable Protein Market Size by 2030

The…

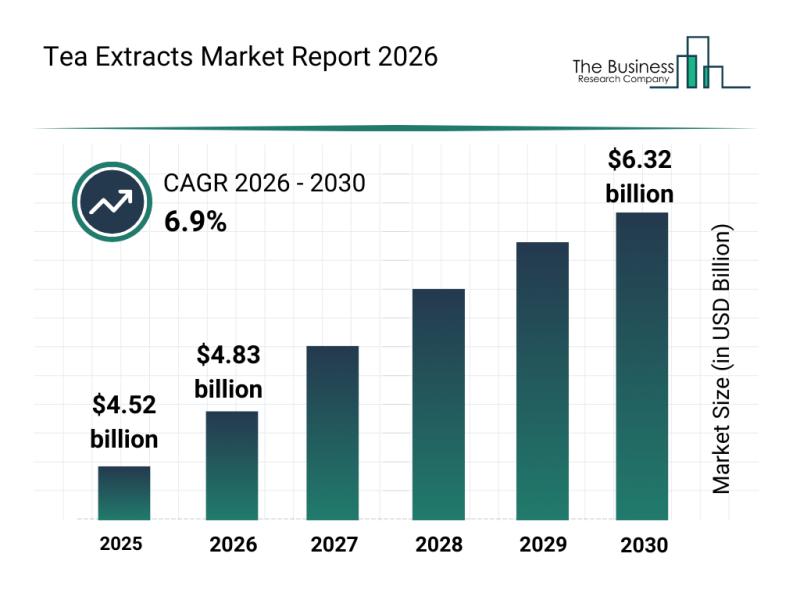

Analysis of Segments and Major Growth Areas in the Tea Extracts Market

The tea extracts market is gaining considerable traction as consumers increasingly seek natural health products and wellness solutions. With innovations in extraction methods and growing interest across multiple industries, this sector is set for notable expansion in the coming years. Let's explore the current market size, leading companies, emerging trends, and detailed segmentation that define the tea extracts landscape.

Projected Market Size and Growth of the Tea Extracts Market

The…

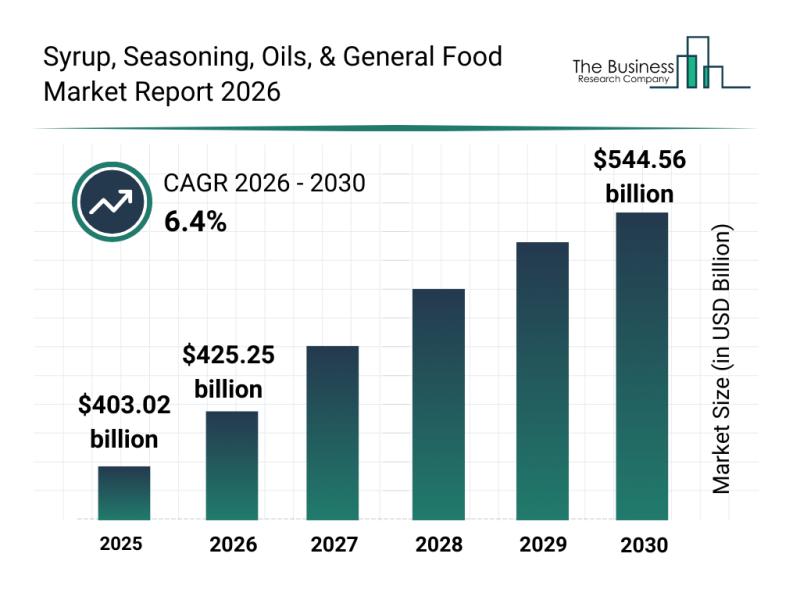

Emerging Growth Patterns Driving Expansion in the Syrup, Seasoning, Oils, and Ge …

The syrup, seasoning, oils, and general food market is poised for impressive expansion in the coming years, driven by evolving consumer preferences and innovative product developments. This sector is seeing a surge in demand fueled by healthy and sustainable trends, alongside rapid growth in digital shopping platforms. Below, we delve into the market's expected size, key players, current trends, and important segments shaping its future.

Projected Market Size and Growth Trajectory…

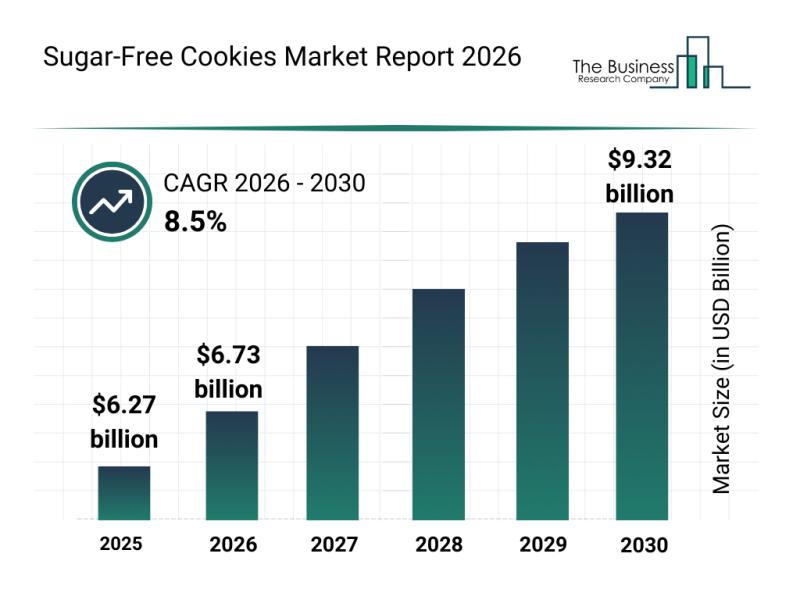

Overview of Segmentation, Market Dynamics, and Competitive Landscape in the Suga …

The market for sugar-free cookies is gaining momentum as consumers become more health-conscious and seek alternatives to traditional baked goods. With growing interest in functional snacks and innovative sugar substitutes, this sector is poised for substantial expansion in the years ahead. Below, we explore the market size, key players, trends, and segmentation that define the sugar-free cookies industry.

Projected Market Size and Growth Trajectory in the Sugar-Free Cookies Market

The…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…