Press release

Wearable Payment Devices Market Size Report (2024-2034): Market Outlook, Segmentation, Regional Insights & Key Players

Executive SummaryThe global wearable payment devices market was valued at USD 57.99 billion in 2024 and is forecast to reach approximately USD 205.02 billion by 2034, expanding at a CAGR of 17.10% between 2025 and 2034. This remarkable growth is driven by rising adoption of contactless payments, rapid expansion of wearable technology, consumer demand for convenience, and strong integration of IoT and fintech ecosystems.

Access key findings and insights from our Report in this sample - https://www.zionmarketresearch.com/sample/wearable-payment-devices-market

Wearable payment devices-including smartwatches, fitness trackers, rings, and wristbands-are becoming mainstream, replacing physical cards and cash in many markets. The increasing acceptance of NFC-enabled payments, digital wallets, and embedded biometric authentication is accelerating global adoption.

Market Drivers

Shift toward contactless payments - Post-pandemic consumer behavior has accelerated demand for secure, fast, and touch-free transactions.

Wearable technology adoption - Rising penetration of smartwatches and fitness trackers with integrated payment features.

Integration with banking & fintech apps - Partnerships between banks, fintechs, and wearable device manufacturers boost market adoption.

Enhanced security - Biometric authentication (fingerprint, heart-rate patterns) improves consumer confidence in wearable payments.

Millennial and Gen Z adoption - Younger consumers increasingly prefer digital-first, mobile, and wearable-based payments.

Market Restraints

High device cost - Smartwatches and advanced wearables remain expensive in price-sensitive markets.

Interoperability issues - Limited compatibility across payment networks and regions.

Data privacy & cybersecurity concerns - Potential vulnerabilities in wearable devices can restrain adoption.

Battery life & performance limitations - Continuous payment and tracking functions strain device efficiency.

Do You Have Any Query Or Specific Requirement? Request Free Brochure: https://www.zionmarketresearch.com/requestbrochure/wearable-payment-devices-market

Market Segmentation

By Device Type

Smartwatches - Leading category due to high adoption and multifunctionality.

Fitness Trackers - Growing segment as fitness and health tracking converge with payments.

Smart Rings - Emerging niche gaining popularity for its discreet and stylish form factor.

Wristbands & Others - Used for events, transit, and contactless access control.

By Technology

Near Field Communication (NFC) - Dominant technology enabling tap-to-pay functions.

Radio Frequency Identification (RFID) - Widely used in access cards and transit systems.

QR Code & Barcode - Growing adoption in emerging markets with lower device penetration.

Others (Bluetooth, biometric-enabled devices)

By Application

Retail & Shopping

Transportation & Transit Systems

Entertainment & Events

Hospitality & Leisure

Healthcare Payments

By Distribution Channel

Online Stores / E-commerce

Offline Stores (Electronics, Brand Stores, Telecom Providers)

Regional Outlook

North America

North America dominates the market, supported by high smartwatch adoption, strong digital payment infrastructure, and tech giants like Apple, Google, and Fitbit driving innovation. The U.S. leads in consumer penetration of contactless payments.

Europe

Europe has widespread contactless payment adoption and regulatory support for digital transactions. The U.K., Germany, and France are key markets, with wearables gaining momentum in retail, transport, and healthcare payments.

Asia-Pacific (APAC)

APAC is expected to witness the fastest growth during 2025-2034. Rapid digitalization, strong e-wallet penetration (Alipay, WeChat Pay, Paytm), and rising disposable incomes in China, India, and Southeast Asia fuel expansion. Japan and South Korea lead in wearable tech integration.

Latin America

Brazil and Mexico are emerging as strong markets due to growing fintech ecosystems and government-led digital payment initiatives.

Middle East & Africa (MEA)

MEA markets are growing steadily with increased fintech adoption and smart city initiatives. The UAE, Saudi Arabia, and South Africa are early adopters of wearable payments.

Access our report for a comprehensive look at key insights -https://www.zionmarketresearch.com/report/wearable-payment-devices-market

Competitive Landscape & Key Players

The market is highly competitive, with technology leaders, fintech companies, and wearable brands expanding rapidly.

Major Key Players include:

Apple Inc. (Apple Pay with Apple Watch)

Samsung Electronics (Samsung Pay, Galaxy Watch)

Garmin Ltd. (Garmin Pay)

Fitbit (Google-owned, Fitbit Pay)

Xiaomi Corporation (Mi Smart Bands with NFC)

Huawei Technologies Co. Ltd.

Sony Corporation (Wena Wrist)

PayPal Holdings, Inc.

Visa Inc. & Mastercard Incorporated (partnerships with wearable OEMs)

Barclaycard & Gemalto (Thales Group) - pioneers in contactless wearable solutions.

Future Trends

Integration of AI & biometrics - Wearables will feature heart-rate and fingerprint authentication for payments.

Expansion of smart rings & niche devices - Growing as a fashionable alternative to bulky smartwatches.

Crypto & blockchain-enabled wearables - Future devices may support cryptocurrency transactions.

Embedded IoT ecosystems - Seamless integration of wearables with smart homes, connected cars, and healthcare services.

Sustainability & eco-friendly wearables - Rising demand for energy-efficient, recyclable, and green devices.

Conclusion

The wearable payment devices market is set for explosive growth, reaching USD 205.02 billion by 2034. With strong adoption in APAC and North America, coupled with fintech partnerships and consumer preference for digital-first lifestyles, the sector will become a cornerstone of the global payments landscape. Companies that emphasize security, interoperability, affordability, and stylish design will capture the largest share of this rapidly expanding market.

Browse Other Related Research Reports from Zion Market Research-

Power Plant Control System Market-https://www.zionmarketresearch.com/report/power-plant-control-system-market

Progressing Cavity Pump Market-https://www.zionmarketresearch.com/report/progressing-cavity-pump-market

Twin Screw Extruders Market-https://www.zionmarketresearch.com/report/twin-screw-extruders-market

Ceramic Tube Market-https://www.zionmarketresearch.com/report/ceramic-tube-market

Waste Heat Boiler Market-https://www.zionmarketresearch.com/report/waste-heat-boiler-market

Asia Pacific Office

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1-855-465-4651

Email: sales@zionmarketresearch.com

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client's needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us-after all-if you do well, a little of the light shines on us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wearable Payment Devices Market Size Report (2024-2034): Market Outlook, Segmentation, Regional Insights & Key Players here

News-ID: 4162955 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

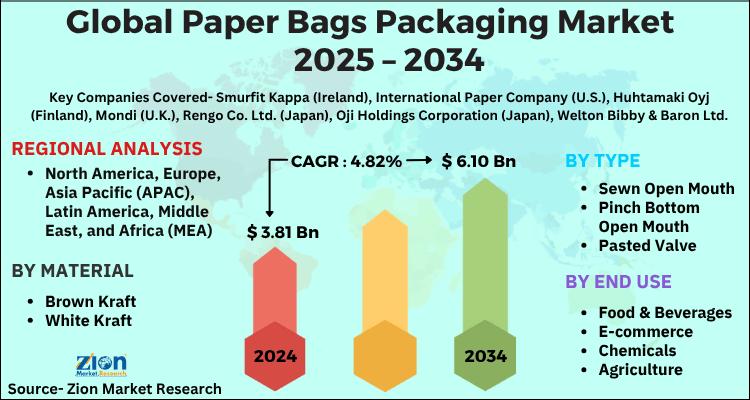

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

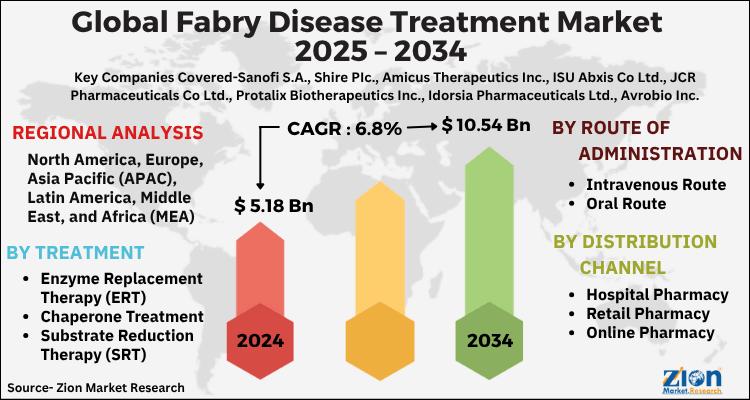

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…