Press release

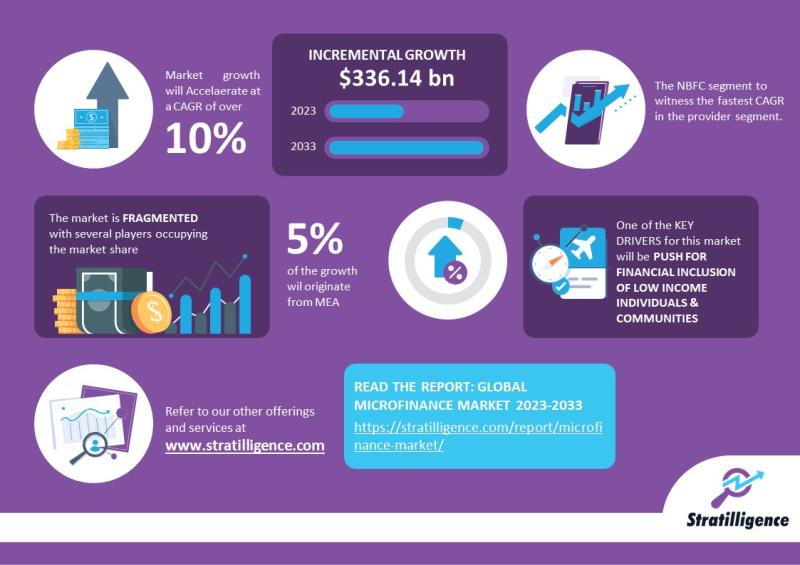

Stratilligence to Release Report on Global Microfinance Market, which is projected to surpass $500 billion by 2033

Microfinance Market: Driven by financial inclusion, strong MEA growth, and a fragmented landscape-explore full insights.

Key Highlights of the Report

The microfinance market is projected to experience substantial growth, driven by several key factors such as financial inclusion initiatives, digital transformation, and support for small and medium enterprises (SMEs).

The report is set to provide critical insights into the Microfinance industry, with a focus on key segments based on provider and end user. Some preliminary insights include:

• Regulatory frameworks are evolving to create a more conducive environment for microfinance operations. This includes better protections for borrowers and incentives for lenders, which helps to bolster confidence in the sector.

• The integration of fintech solutions in microfinance is transforming how institutions operate. Mobile banking and digital platforms are enabling MFIs to offer services more efficiently, reduce costs, and reach remote areas that traditional banking has struggled to serve.

• As microfinance institutions strive to empower low-income populations, there is a growing emphasis on providing financial literacy programs. These initiatives help clients make informed decisions, manage their finances better, and ultimately enhance the impact of microfinance

According to Stratilligence, "This report will offer vital insights into the evolving landscape of Microfinance, highlighting key growth opportunities and market dynamics."

For more information, please visit https://stratilligence.com/report/microfinance-market/

Comprehensive Market Analysis

The Microfinance market will offer a detailed market analysis using both qualitative and quantitative methods, including:

• Market forecasts and trends analysis for 2023 to 2033

• Detailed coverage of market segments, including by By Provider (Banks, Micro Finance Institute (MFI), Non-Banking Financial Institutions (NBFC), and Others) and End User (Small Enterprises, Micro Enterprises, and Solo Entrepreneurs or Self-Employed).

• An examination of the competitive landscape, highlighting major market players such as Annapurna Finance (P) Ltd, Bank Rakyat Indonesia (BRI), Bandhan Bank, CDC Small Business Finance, Cashpor Micro Credit, Grameen America, Grameen Bank, Kiva, Madura Microfinance Ltd., and Pacific Community Ventures Inc.

Regional and Segment-Specific Insights

The report will also provide an in-depth analysis of regional markets, covering North America, Europe, Asia-Pacific, Latin America, Middle East & Africa. The Microfinance market is segmented based on provider and end user. Provider covered in the study include banks, Micro Finance Institute (MFI), Non-Banking Financial Institutions (NBFC), and others. By end user, the market is segregated into small enterprises, micro enterprises, and solo entrepreneurs or self-employed.

• The microfinance market in North America is relatively smaller compared to regions like Asia-Pacific or Africa, but it is growing steadily, driven by a rising interest in financial inclusion and social impact investing. In the United States, microfinance institutions primarily focus on supporting small businesses, particularly in underserved communities. Organizations such as Grameen America are expanding their reach by providing microloans and financial education to low-income entrepreneurs.

• In Europe, the microfinance sector has gained traction as a tool for economic development, particularly in response to the financial crises that have affected many countries. The European Investment Fund (EIF) and various governmental initiatives are supporting microfinance as a means to foster entrepreneurship and job creation, especially among youth and women.

• The Asia-Pacific region continues to lead the microfinance market due to its large population of underserved individuals. Countries like Bangladesh, India, and the Philippines have well-established microfinance sectors supported by both government initiatives and a network of microfinance institutions (MFIs). Digital microfinance is gaining traction, with mobile banking playing a crucial role in expanding access to financial services. For instance, the growth of platforms like bKash in Bangladesh highlights the potential for mobile-based solutions to reach rural populations. Similarly, Temenos serves over 330 non-bank financial institutions and has reported substantial growth from clients like Creditaccess Grameen in India, which has expanded its customer base to 4.6 million by leveraging Temenos' technology.

• In Latin America, microfinance has become integral to economic development, particularly in countries like Bolivia and Peru. Here, the focus has shifted towards enhancing financial literacy among clients, which is essential for the sustainable growth of microfinance. Institutions are increasingly using technology to offer tailored financial products that cater to local needs, ensuring better customer engagement and retention.

Have a custom request? Connect with us below:

https://stratilligence.com/contact-us/

Why This Report Will Be Essential

The Microfinance market will assist businesses, investors, and stakeholders in making informed decisions by offering insights into:

• Emerging market trends and growth prospects.

• A detailed overview of the competitive landscape, including market positioning of major players.

• Strategic recommendations for market entry, expansion, and investment.

Connect with us on our LinkedIn page:

https://www.linkedin.com/company/stratilligence/

Contact Information

Stratilligence Growth Consultant

10685-B Hazelhurst

Houston, Texas

US

Email: jessica.media@stratilligence.com

Phone: +1 (888) 800-0801

Fax: +1 (281) 754-4941

Website: https://www.stratilligence.com

About Stratilligence Growth Consultant

Stratilligence is a trusted market research and consulting firm specializing in all industry verticals across all major developing and developed economies. With a team of industry experts, the company provides high-quality research reports, custom consulting services, and actionable insights to help clients navigate market complexities and capitalize on growth opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Stratilligence to Release Report on Global Microfinance Market, which is projected to surpass $500 billion by 2033 here

News-ID: 4161936 • Views: …

More Releases for Micro

Micro and Ultra-Micro Balances Market Size Report 2025

"Global Micro and Ultra-Micro Balances Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Micro and Ultra-Micro Balances market, including Micro and Ultra-Micro Balances market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings,…

Micro Mobility Revolution: Exploring the Growing Micro Cars Market

The term micro car is used for small-sized and lightweight cars, with an engine small than 700 cc. Bubble cars, cycle cars and quadricycles are defined as micro cars. This is usually three-wheeled and four-wheeled vehicle, available for personal and commercial usage. It is often used as a second or commuter car due to its low cost and fuel efficiency. This car is suitable for urban and suburban environment, as…

Micro Injection Molded Plastic Market worth $1,692 million by 2026 | Key players …

According to recent market research the "Micro Injection Molded Plastic Market by Material Type (Liquid-Crystal Polymer (LCP), Polyether Ether (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM)), Application and Region - Global Forecast to 2026", published by MarketsandMarkets, the micro injection molded plastic market is projected to reach USD 1,692 million by 2026, at a CAGR of 11.2% from USD 995 million in 2021.

Micro injection molded plastics are made of micro…

Micro Combined Heat & Power (Micro CHP) Market 2022 | Detailed Report

The Micro Combined Heat & Power (Micro CHP) research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the Micro Combined Heat & Power (Micro CHP) research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope,…

Micro-Invasive Glaucoma Implants Micro-Invasive Glaucoma Implants

Global Micro-Invasive Glaucoma Implants Market Definition: Micro-invasive glaucoma implants is performed for the treatment of the open- angle glaucoma and is done through an ab- interno approach. It is very safe and provides faster recovery as compared to the traditional methods. They usually lower the intraocular by increasing the flow or reducing the production of the aqueous humor. Increasing cases of the glaucoma worldwide is the major factor fueling the…

Comprehensive Analysis On Micro Welding Equipment Market 2019 : Pro-Fusion, OR L …

Up Market Research added a new Micro Welding Equipment Market research report for the period of 2019 – 2026. Report focuses on the major drivers and restraints providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

Get Sample Copy Of This Report @

https://www.upmarketresearch.com/home/requested_sample/108038

The report contains 112 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing…