Press release

Artificial Intelligence in BFSI Market to Reach $193.5 Billion by 2035 | Meticulous Research

Meticulous Research®-a leading global market research company, published a research report titled, "Artificial Intelligence (AI) in BFSI Market by Application (Banking, Financial Services, Insurance), Deployment Mode (Cloud, On-premises, Hybrid), Technology (Machine Learning, Deep Learning, NLP, Computer Vision), Organization Size, and Geography-Global Forecast to 2035."Download Sample Report Here : https://www.meticulousresearch.com/download-sample-report/cp_id=6258

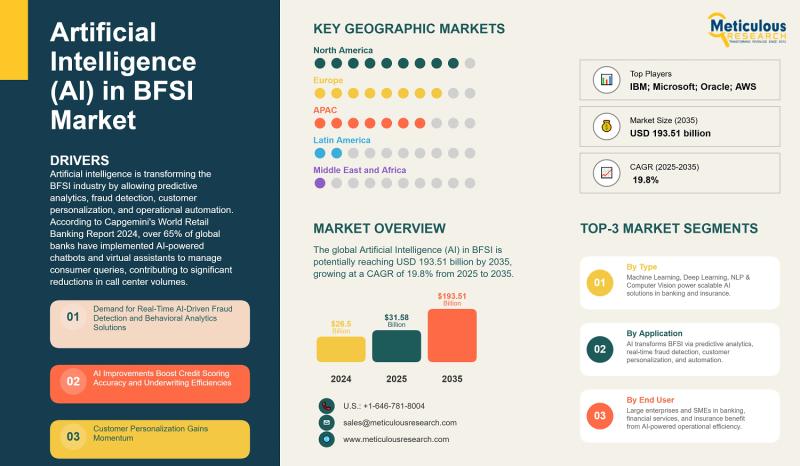

According to this latest publication from Meticulous Research®, the global AI in BFSI market is set for rapid expansion. Valued at USD 26.5 billion in 2024, the market is projected to grow to USD 31.58 billion in 2025 and is expected to reach USD 193.51 billion by 2035, at a CAGR of 19.8% from 2025-2035.

The growing use of AI in financial services is reshaping banking, insurance, and investment operations. AI is increasingly being adopted for predictive analytics, fraud detection, customer personalization, compliance automation, and credit scoring. As per Capgemini's World Retail Banking Report 2024, over 65% of global banks now deploy AI chatbots and virtual assistants, leading to significant reductions in call center workloads. Insurers have also reported 25% faster claims processing with AI-powered underwriting solutions.

The market is benefiting from innovations in generative AI, machine learning, and intelligent document processing, which enable real-time risk assessment and more efficient operations. While challenges such as data privacy, regulatory compliance, and legacy infrastructure remain, the rapid shift toward digital transformation ensures a positive outlook for AI in BFSI.

Browse in Depth : https://www.meticulousresearch.com/product/artificial-intelligence-in-bfsi-market-6258

Key Players

The key players operating in the AI in BFSI market (L'intelligence artificielle (IA) sur le marché des BFSI) include:

IBM Corporation (U.S.), Microsoft Corporation (U.S.), Oracle Corporation (U.S.), Google Cloud (U.S.), Amazon Web Services (AWS) (U.S.), SAS Institute Inc. (U.S.), Infosys Limited (India), Temenos AG (Switzerland), FICO (U.S.), UiPath (U.S.), DataRobot (U.S.), H2O.ai (U.S.), NICE Actimize (U.S.), and nCino (U.S.).

What's Driving Growth in the AI in BFSI Market (Künstliche Intelligenz (KI) im BFSI-Markt)?

1. Real-Time Fraud Detection and Security

With the rise of digital banking and mobile payments, AI-driven fraud detection has become a necessity. For instance, India's UPI platform processed over 1,400 crore transactions in May 2024, highlighting the scale of digital payments. Banks adopting AI-based fraud detection have reported a 20-22% reduction in fraud cases.

2. Smarter Credit Scoring and Underwriting

AI allows financial institutions to analyze alternative data sources such as rental history and utility payments, helping lenders reach underserved customers. Companies like Zest AI report that machine learning models have boosted loan approvals by up to 25%, while cutting default risks by around 12%.

3. Personalized Customer Experiences

Banks are using AI-driven assistants to provide hyper-personalized financial services, offering tailored recommendations and improving customer engagement.

4. RegTech Automation

AI-powered compliance solutions are automating reporting, monitoring transactions, and reducing manual workloads. This is expected to accelerate with stricter regulatory requirements worldwide.

Key Challenges

Data Privacy & Regulation: AI models rely on large volumes of personal and financial data, raising compliance challenges under regulations such as GDPR.

Legacy Infrastructure: A large share of global banks still operate on outdated IT systems, slowing AI integration and increasing costs.

Explainability & Governance: Regulators demand transparency in AI decision-making, pushing institutions to adopt explainable AI frameworks.

Recent Developments

Google Cloud Expands AI-Powered AML Solution

In May 2025, Google Cloud rolled out its AI-based Anti-Money Laundering technology to global banks, enabling advanced risk scoring and real-time monitoring of suspicious activities.

Mastercard Strengthens AI Fraud Detection

In 2024, Mastercard extended its AI-powered fraud detection system across its global transaction network, analyzing billions of daily transactions and reducing fraud losses significantly.

Buy the Complete Report with an Impressive Discount: https://www.meticulousresearch.com/view-pricing/1575

Regional Insights

North America

North America leads the global market, driven by a mature fintech ecosystem, advanced cloud infrastructure, and regulatory support. U.S. banks like JPMorgan Chase are heavily investing in AI for fraud detection, compliance, trading, and customer personalization. Regulators such as the SEC and OCC are actively developing AI governance frameworks to balance innovation and consumer protection.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by mobile-first banking, fintech adoption, and government-led AI initiatives. India's UPI and China's AI-driven credit systems highlight the region's innovation. Southeast Asia is also leveraging AI to expand financial inclusion, particularly in microfinance and insurance.

Europe

Europe is prioritizing ethical AI, transparency, and GDPR compliance. German banks like Deutsche Bank are adopting explainable AI frameworks to ensure trust, fairness, and accountability while using AI for fraud detection and credit risk analysis.

Segmental Insights

By Application: The banking sector dominates AI adoption, especially in fraud detection, AML compliance, and customer onboarding.

By Technology: Machine Learning accounts for the largest share, powering fraud detection, predictive modeling, and risk scoring.

By Deployment: Cloud-based AI solutions are gaining the most traction due to scalability, cost-effectiveness, and faster integration.

By Organization Size: Large enterprises currently lead adoption, but SMEs are rapidly investing in AI tools for credit scoring and customer services.

Future Outlook

The future of AI in BFSI will be defined by explainability, personalization, and automation. By 2035, AI will play a central role in real-time fraud prevention, robo-advisory services, automated underwriting, and fully integrated RegTech solutions. As generative AI and blockchain converge with financial technologies, institutions that invest early in AI governance, cloud-native platforms, and scalable analytics will gain a decisive edge in the global market.

Related Reports:

Artificial Intelligence (AI) in Accounting Market: https://www.meticulousresearch.com/product/artificial-intelligence-in-accounting-market-6229

Artificial Intelligence (AI) in Retail Market : https://www.meticulousresearch.com/product/artificial-intelligence-in-retail-market-4979

Artificial Intelligence in Marketing Market: https://www.meticulousresearch.com/product/artificial-intelligence-in-marketing-market-5771

Artificial Intelligence in Food & Beverage Market: https://www.meticulousresearch.com/product/artificial-intelligence-in-food-&-beverage-market-5987

About Us:

We are a trusted research partner for leading businesses worldwide, empowering Fortune 500 organizations and emerging enterprises with actionable market intelligence tailored to drive revenue transformation and strategic growth. Our insights reveal forward-looking revenue opportunities, providing our clients with a competitive edge through a diverse suite of research solutions-syndicated reports, custom research, and direct analyst engagement.

Each year, we conduct over 300 syndicated studies and manage 60+ consulting engagements across eight key industry sectors and 20+ geographic markets. With a focus on solving the complex challenges facing global business leaders, our research enables informed decision-making that propels sustainable growth and operational excellence. We are dedicated to delivering high-impact solutions that transform business performance and fuel innovation in the competitive global marketplace.

Contact Us:

Meticulous Market Research Pvt. Ltd.

1267 Willis St, Ste 200 Redding,

California, 96001, U.S.

Email- sales@meticulousresearch.com

USA: +1-646-781-8004

Europe: +44-203-868-8738

APAC: +91 744-7780008

Visit Our Website: https://www.meticulousresearch.com/

For Latest Update Follow Us:

LinkedIn- https://www.linkedin.com/company/meticulous-research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Artificial Intelligence in BFSI Market to Reach $193.5 Billion by 2035 | Meticulous Research here

News-ID: 4161606 • Views: …

More Releases from Meticulous Research®

Global Smart Logistics Market Size, Share, Growth Analysis, and Forecast (2026-2 …

The global smart logistics market has emerged as one of the fastest-growing segments within the broader logistics and supply chain ecosystem. In 2025, the market was valued at USD 38.56 billion, reflecting strong adoption of digital technologies across warehousing, transportation, and inventory management operations. The market is projected to expand significantly, reaching approximately USD 46.00 billion in 2026 and further accelerating to USD 313.71 billion by 2036. This impressive expansion…

Global Plant-Based Protein Supplements Market: Size, Trends, Growth Analysis, an …

The global plant-based protein supplements market is experiencing consistent and long-term growth, reflecting a significant shift in consumer dietary preferences and health awareness. In 2026, the market was valued at USD 8.93 billion and is projected to reach USD 17.95 billion by 2036, expanding at a compound annual growth rate of 7.2% during the forecast period. This steady growth underscores the increasing integration of plant-based protein products into mainstream nutrition.…

Global 3D Printing PLA Market Size, Growth Trends, and Forecast (2026-2036)

The global 3D printing PLA market has established itself as one of the most dynamic segments within the additive manufacturing materials industry. Valued at USD 681 million in 2026, the market is projected to reach USD 3.41 billion by 2036, registering a strong compound annual growth rate (CAGR) of 17.5% during the forecast period from 2026 to 2036. This rapid expansion reflects the increasing adoption of polylactic acid (PLA) across…

Global CubeSat Market Size, Growth Trends, and Forecast (2026-2036)

The global CubeSat market stood at USD 0.38 billion in 2025 and is projected to expand steadily over the next decade. In 2026, the market size is expected to reach USD 0.42 billion, and by 2036 it is forecast to approach USD 1.45 billion. This reflects a compound annual growth rate of 13.2% during the 2026-2036 period. Growth is largely tied to the broader shift in the space industry toward…

More Releases for BFSI

Evolving Market Trends In The Robotic Process Automation In BFSI Industry: Advan …

The Robotic Process Automation In BFSI Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Robotic Process Automation In BFSI Market Size During the Forecast Period?

In recent times, the market size for robotic process automation in bfsi has witnessed a significant surge.…

Evolving Market Trends In The Banking, Financial Services and Insurance (BFSI) S …

The Banking, Financial Services and Insurance (BFSI) Security Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Banking, Financial Services and Insurance (BFSI) Security Market Size During the Forecast Period?

The market size for security within the banking, financial services and insurance (BFSI)…

Key Trend Reshaping the AI in BFSI Market in 2025: Transforming The BFSI Sector …

What combination of drivers is leading to accelerated growth in the ai in bfsi market?

The anticipated surge in the AI in BFSI market may be traced back to the mounting use of AI in improving efficiency. Artificial intelligence (AI) comprises various technologies and algorithms that simulate human intelligence, including problem-solving, drawing insights from data, and making effective decisions. This growing usage of AI for enhancing efficiency could be attributed to…

Mumbai's BFSI Sector Gears Up for Transformation at the 24th Edition of BFSI IT …

Mumbai: The banking, financial services, and insurance (BFSI) sector in Mumbai is currently undergoing a profound transformation, fueled by rapid technological advancements and a significant increase in digital adoption. Emphasizing a strong commitment to digitalization, key stakeholders in Mumbai are championing initiatives akin to advancements in digital payments and the establishment of the Digital Banking Transformation Office. These efforts are propelling the BFSI landscape forward, fostering innovation and paving the…

Empowering BFSI Security: Safeguarding Futures Amid Evolving Threats, BFSI Secu …

Guarding the financial backbone against evolving cyber threats fuels the burgeoning, emergence of tailored solutions, biometrics, and IoT-based cybersecurity solutions significantly enhancing online banking Opportunities for the market.

The BFSI Security Market, valued at USD 61.6 billion in 2022, is poised to witness exponential growth, reaching USD 166.2 billion by 2030, reflecting a robust CAGR of 13.2%. This escalating trajectory is primarily attributed to the stringent regulatory environment governing the banking,…

IoT in BFSI Market : How the Business Will Grow in 2026?�Top Players in IoT in B …

The global internet of things (IoT) in banking, financial services, and insurance (BFSI) market is predicted to reach USD 116.27 billion by 2026, exhibiting a CAGR of 26.5% during the forecast period. The increasing investment of banks and financial institutions in IoT technologies will stimulate the growth of the market in the foreseeable future. According to the studies conducted by Tata consultancy services, financial institutions spend an average IoT budget…