Press release

How International Investors Use U.S. LLCs to Access and Trade U.S. Markets

Image: https://lh7-rt.googleusercontent.com/docsz/AD_4nXfqqWdI3va7PcAguEdg3shSqAgR2LSuD6jJ-0uoH1Az7mPvuZjn5yFm9npystSinQ6MYdlfNkcaTGke3pBSgyzsrRqr0OQj7iACqyxUpuohBkaBf11q_QkeYQLzdp2ZE2qoTVJM?key=y5Vhso3xaMpNPJywVA1ldAThe U.S. financial markets remain the largest and most liquid in the world, attracting investors from every corner of the globe. From equities and ETFs to futures and options, the United States offers unparalleled access to capital markets. But for international investors, participating in these markets isn't always straightforward. Opening a U.S. brokerage account, navigating tax rules, and ensuring compliance can present real barriers.

One increasingly popular solution is forming a U.S. Limited Liability Company (LLC). An LLC provides foreign investors with a clear pathway to access U.S. markets, reduce tax friction, and establish a professional presence that opens doors with banks, brokers, and counterparties.

In this article, we'll break down how international investors use LLCs to access U.S. markets, what tax implications they need to consider, and why this structure can be a smart move for both short-term traders and long-term investors.

Why International Investors Look to the U.S.

The numbers speak for themselves:

* $53 trillion - The total market capitalization of U.S. stock exchanges as of 2024, representing 42% of global equity markets (World Bank).

* $25.4 trillion - The total holdings of U.S. assets by foreign investors, according to U.S. Treasury data.

* 30% - Share of global foreign exchange transactions tied to the U.S. dollar (Bank for International Settlements).

Whether it's liquidity, stability, or the breadth of investment opportunities, the U.S. remains the financial hub of the world. Yet, despite the appeal, many foreign investors hit barriers when trying to enter these markets directly.

The Barriers Non-U.S. Investors Face

International investors often face three key obstacles:

1. Brokerage Access

Most U.S. brokers require a U.S. entity or tax ID number (EIN) for account opening. Without these, non-U.S. residents may be limited to offshore brokers with higher fees and reduced access.

2. Tax Compliance

While many foreign investors avoid U.S. federal tax on capital gains if there is no effectively connected income (ECI) or U.S. nexus, confusion around tax rules discourages participation. Dividends, for example, are subject to 30% withholding tax, unless reduced by a tax treaty.

3. Operational Barriers

Without a U.S. address, bank account, or compliance structure, investors may struggle to manage funds efficiently. Even basic activities like opening an account with a U.S. exchange can be unnecessarily complex.

How LLCs Solve These Challenges

A U.S. LLC offers an elegant solution for international investors. Here's how:

1. Access to Brokerage and Banking

By registering an LLC, investors can obtain an Employer Identification Number (EIN) from the IRS. This number is essential for:

* Opening brokerage accounts

* Setting up U.S. bank accounts

* Establishing credibility with financial institutions

With an LLC and EIN in place, global investors can open accounts with many top U.S. brokers and banks.

BusinessAnywhere's EIN service [https://businessanywhere.io/ein-application-service/] helps investors secure their tax ID quickly, even without a U.S. Social Security Number.

2. Tax Efficiency

An LLC is treated as a "pass-through entity" by default, meaning profits are reported on the owner's personal tax return. For non-U.S. persons with no U.S. nexus (no employees, offices, or physical presence in the U.S.), trading income through an LLC is generally not considered taxable in the U.S.

However:

* U.S.-sourced dividends are still subject to withholding.

* Real estate investments have specific tax rules (FIRPTA).

* Each investor's home country tax laws must be considered.

This structure allows many non-U.S. investors to legally minimize U.S. tax exposure while trading or investing from abroad.

3. Privacy and Asset Protection

States like Wyoming, Delaware, and New Mexico allow LLCs with strong privacy protections. Ownership details often remain out of public records, adding a layer of confidentiality.

Additionally, LLCs shield personal assets from liabilities tied to trading activity, giving investors peace of mind when allocating large sums.

You can easily form a U.S. LLC online [https://businessanywhere.io/business-registration/] with BusinessAnywhere.io in just a few clicks.

4. Professional Presence

An LLC with a U.S. address projects legitimacy. With a virtual mailbox, international investors can:

* Receive legal and financial correspondence

* Use a U.S. business address with brokers and partners

* Forward mail internationally

This makes operations smoother and reduces delays when dealing with financial institutions.

Case Study: International Investor Using a Wyoming LLC

Consider Maria, a software entrepreneur based in Spain. She wants to diversify her portfolio by trading U.S. tech stocks and ETFs.

Her challenges:

* Spanish brokers charge high fees for U.S. trades.

* She can't open a direct U.S. brokerage account without a U.S. tax ID.

* She wants limited liability in case of disputes.

Her solution:

* Maria forms a Wyoming LLC with BusinessAnywhere.io.

* She obtains an EIN for her new entity.

* Using her LLC, she opens a U.S. brokerage account and a business bank account.

* She uses a virtual mailbox to manage her U.S. business correspondence.

Within weeks, Maria is trading U.S. markets directly, with lower fees and stronger legal protections.

State Choices: Wyoming, Delaware, or New Mexico?

Not all LLC jurisdictions are equal. Here's why international investors often choose these states:

* Wyoming: Known for low fees, strong privacy, and no state income tax.

* Delaware: Popular for legal flexibility and prestige, especially for large-scale investors.

* New Mexico: Offers affordable setup and anonymous ownership.

Choosing the right state depends on the investor's priorities - cost, privacy, or long-term prestige.

Compliance Considerations

While an LLC simplifies market access, investors should remain mindful of compliance:

* Annual Fees: Each state requires minimal annual filings, typically $50-$300.

* Registered Agent: Required by law in all states to receive legal and government notices.

BusinessAnywhere offers a reliable registered agent service [https://businessanywhere.io/registered-agent-service/] that ensures compliance across all 50 states.

The Bottom Line

The U.S. remains the world's premier financial market, but international investors often face barriers in accessing it directly. A U.S. LLC provides a practical solution - unlocking access to brokerages, simplifying tax compliance, protecting assets, and building credibility.

Whether you're an active trader in futures and options or a long-term investor in U.S. equities and real estate, forming a U.S. LLC can streamline your entry into American markets.

With services like BusinessAnywhere.io [https://businessanywhere.io/], setting up an LLC, obtaining an EIN, and maintaining compliance has never been easier - all 100% online, from anywhere in the world.

Media Contact

Company Name: BusinessAnywhere LLC

Contact Person: Media Relations

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=how-international-investors-use-us-llcs-to-access-and-trade-us-markets]

Country: United States

Website: https://businessanywhere.io/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How International Investors Use U.S. LLCs to Access and Trade U.S. Markets here

News-ID: 4161199 • Views: …

More Releases from ABNewswire

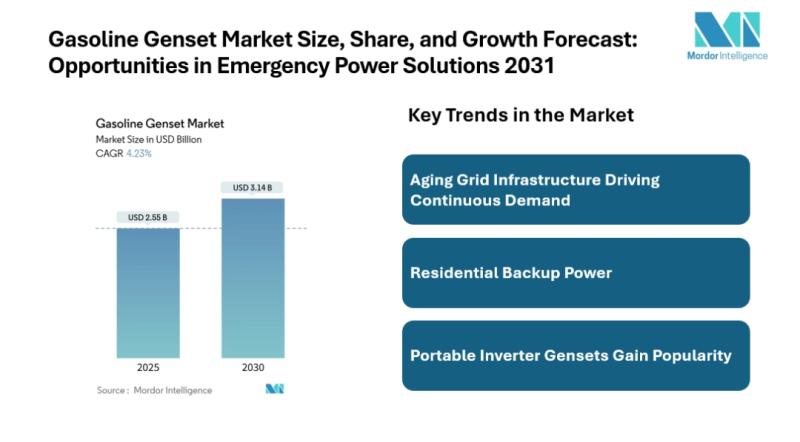

Gasoline Genset Market Size to rise to $ 3.14 Billion by 2030 | Standby and Port …

Mordor Intelligence has published a new report on the Gasoline Genset Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

The global gasoline genset market size estimated at USD 2.55 billion in 2025 and projected to reach USD 3.14 billion by 2030. This represents a CAGR of 4.23% 2025-2030.

The demand is anchored by ongoing vulnerabilities in power grids, increasing urban construction activity in emerging economies, and a growing…

Tofu Market Size to Reach USD 3.77 Billion by 2031 as Flexitarian Diets and Prod …

Mordor Intelligence has published a comprehensive analysis of the tofu market, highlighting long-term growth drivers, evolving consumer trends, and competitive positioning through 2031.

Tofu Market Forecast, Size, and Growth Outlook

According to a research report by Mordor Intelligence, the global tofu market size [https://www.mordorintelligence.com/industry-reports/tofu-market?utm_source=abnewswire] is projected to grow from USD 2.08 billion in 2026 to USD 3.77 billion by 2031, reflecting strong tofu market growth during the forecast period. This expansion is…

Silicone Gel Market Growth at 5% CAGR Across Key End-Use Industries 2025 to 2030 …

Mordor Intelligence has published a new report on the Silicone Gel Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

The Silicone Gel Market is projected to grow steadily over the forecast period, with a CAGR of 5% from 2025 to 2030, reflecting increasing demand across key end-use industries. The market has shown consistent expansion since 2019, driven by applications in electrical and electronics, healthcare, and cosmetics. Silicone…

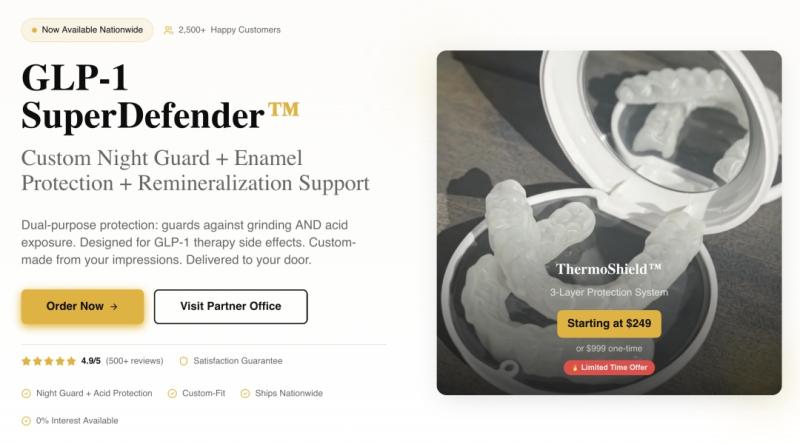

GLP-1 SuperDefender: The Revolutionary Oral Protection Appliance Against "Ozempi …

Los Angeles, California - Feb 18, 2026 - As medications like Ozempic Registered , Wegovy Registered , and Mounjaro Registered continue to reshape the future of weight management and diabetes treatment, millions of patients are unknowingly facing a growing dental crisis. Reports of acid reflux, dry mouth, and teeth grinding are rising among GLP-1 medication users, leading to irreversible enamel erosion and tooth loss; Collectively known as "Ozempic Teeth".

In response…

More Releases for LLCs

Kathryn Frese Releases New Book Coffee, Code, and LLCs: A Practical Playbook for …

Coffee, Code, and LLCs: A Practical Playbook for Modern Solo Founders by Kathryn Frese delivers a grounded, real-world guide for entrepreneurs building and running businesses without teams, excessive resources, or impossible schedules. This technical project management title provides a clear, actionable framework for founders who are balancing multiple responsibilities while striving to grow sustainable companies.

Designed for solo founders juggling client work, compliance, marketing, product development, and daily operations, Coffee, Code,…

NYLTA.com Opens Pre-Registration Portal for New York LLCs Ahead of 2026 Transpar …

NEW YORK, NY - November 6, 2025 - NYLTA.com today announced the launch of a statewide pre-registration initiative to assist limited liability companies (LLCs) in preparing for the New York LLC Transparency Act (NYLTA), which takes effect on January 1, 2026. The new law will require all LLCs formed or operating in New York to disclose their beneficial ownership information to state authorities.

Image: https://www.globalnewslines.com/uploads/2025/11/3aa127b6dc08027e2984a4055e370949.jpg

The initiative helps tens of thousands of…

Houston Estate Planning Attorney Whitney L. Thompson Highlights the Role of Fami …

As estate planning grows increasingly complex in the face of changing tax laws and rising asset values, Houston estate planning attorney Whitney L. Thompson (https://www.wthompsonlaw.com/considerations-for-including-a-family-llc-in-an-estate-plan/) is encouraging families to consider the advantages of incorporating a Family Limited Liability Company (LLC) into their estate plans. Through her practice at The Law Office of Whitney L. Thompson, PLLC, Thompson aims to provide straightforward legal tools that help clients protect their assets and…

My Refund Man, the Arlington, Texas, Business Offering Streamlined Virtual Tax C …

LLCs are required to file Beneficial Ownership Information Reports (BOIRs), and My Refund Man makes this daunting task easier than ever for clients who own Texas corporations and LLCs

Image: https://www.getnews.info/uploads/78e9d2fba49366d8485d2fe3f594c3c9.png

My Refund Man [https://myrefundman.com/], the Arlington, Texas, based company providing in-person and virtual tax consultation, prep, filing, and more, has now announced the launch of a new service that is already providing benefits to owners of Texas corporations and LLCs.

Image: https://www.getnews.info/uploads/72d6b742237cc376d32f8583500ce6fb.png

My…

Digital Scent Technology Market Size Report Predicts Healthy Growth with Demand …

The recently released research report, titled Digital Scent Technology Market Size, Share, Pricing, Trends, Growth, Opportunities, and Forecast 2024-2030. The study includes crucial data about the target market, such as forecasts of potential revenue, consumer demand, regional analysis, and the primary factors that will shape the market in the future. It provides information on leading industry players, supply chain trends, financials, significant events, and technological advancements, as well as upcoming…

Houston Estate Planning Attorney Whitney L. Thompson Releases Insightful Article …

Houston estate planning attorney Whitney L. Thompson (https://www.wthompsonlaw.com/considerations-for-including-a-family-llc-in-an-estate-plan/), of The Law Office of Whitney L. Thompson, PLLC, has recently published an insightful article detailing the considerations for including a Family Limited Liability Company (LLC) in estate planning. The article sheds light on the strategic advantages of utilizing an LLC as an instrument for estate management and tax minimization.

The Houston estate planning attorney explains the structural benefits of an LLC, which…