Press release

Private Equity Market Overview, Size, Share, Growth And Trends Report 2025-2033

Overview of the Private Equity Market:The private equity market involves investment firms that pool capital from various investors to acquire and manage privately held companies or take public companies private. This market plays a crucial role in the global economy by providing capital for growth, restructuring, and operational improvements. Private equity firms typically invest in companies with the potential for significant value creation, often focusing on sectors such as technology, healthcare, consumer goods, and industrials. The investment horizon for private equity is generally medium to long-term, with firms aiming to exit their investments through various strategies, including public offerings, sales to other companies, or secondary buyouts. The market has seen substantial growth over the years, driven by favorable economic conditions, increased liquidity, and a growing appetite for alternative investments among institutional and high-net-worth investors.

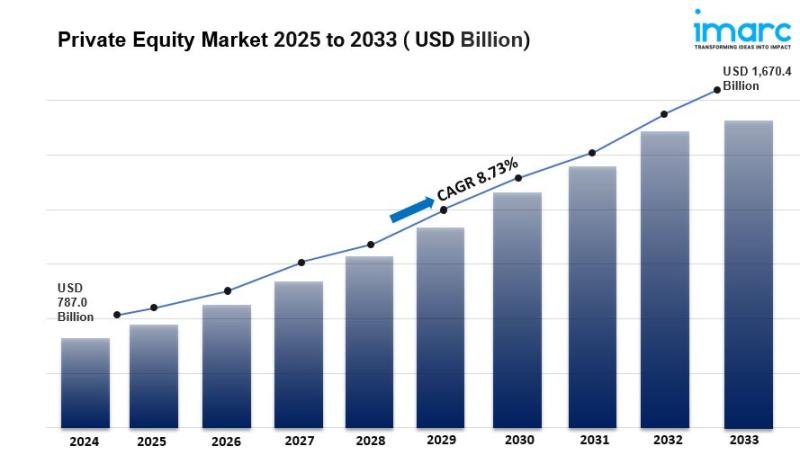

The global private equity market size reached USD 787.0 Billion in 2024 and is expected to reach USD 1,670.4 Billion by 2033, exhibiting a growth rate (CAGR) of 8.73% during 2025-2033. The increased investor appetite for alternative investments, low-interest rates encouraging leverage, the pursuit of higher returns amidst market volatility, and a favorable regulatory environment fostering investment opportunities are some of the key factors explained in the market research.

Request to Get the Sample Report: https://www.imarcgroup.com/private-equity-market/requestsample

Key Highlights:

Market Growth:

• The private equity market has experienced significant growth, with assets under management (AUM) reaching trillions of dollars globally.

• Factors contributing to this growth include low interest rates, a favorable fundraising environment, and an increasing number of investment opportunities across various sectors.

Diverse Investment Strategies:

• Private equity firms employ various investment strategies, including buyouts, venture capital, growth equity, and distressed asset investments.

• Each strategy targets different stages of a company's lifecycle, from early-stage startups to mature businesses in need of restructuring.

Focus on ESG and Impact Investing:

• There is a growing emphasis on Environmental, Social, and Governance (ESG) factors within the private equity sector.

• Investors are increasingly seeking to align their capital with sustainable practices, leading firms to integrate ESG considerations into their investment processes and portfolio management.

Technological Integration:

• The integration of technology and data analytics is transforming how private equity firms conduct due diligence and manage portfolio companies.

• Advanced tools and platforms enable firms to analyze market trends, optimize operations, and enhance decision-making processes.

Emerging Markets Opportunities:

• Private equity firms are increasingly looking to emerging markets for growth opportunities, driven by rising consumer demand and economic development.

• These markets offer potential for higher returns, although they also present unique challenges related to regulatory environments and market dynamics.

Increased Competition:

• The private equity landscape is becoming more competitive, with an influx of new entrants and increased capital availability.

• This competition is driving firms to differentiate themselves through innovative investment strategies and value creation approaches.

Factors Affecting the Growth of the Private Equity Industry:

Increased Focus on ESG Investments: The private equity market is experiencing a notable shift towards Environmental, Social, and Governance (ESG) investments, driven by rising awareness and demand for sustainable and responsible investing. As institutional investors, including pension funds and endowments, increasingly prioritize ESG criteria in their investment decisions, private equity firms are adapting their strategies to align with these values. The integration of ESG factors into the investment process not only enhances risk management but also creates opportunities for value creation in portfolio companies. Firms are focusing on acquiring businesses that demonstrate strong ESG practices, as these companies are often better positioned for long-term success and resilience. Additionally, the emphasis on social responsibility and ethical governance is attracting a new generation of investors who are keen to make a positive impact through their capital. As we approach 2025, the trend towards ESG investing is expected to intensify, influencing deal sourcing, due diligence, and exit strategies within the private equity landscape. Firms that effectively incorporate ESG considerations into their investment theses will likely gain a competitive edge, attracting capital from socially conscious investors and enhancing their reputations in the market.

Technological Transformation and Digitalization: The private equity market is undergoing a significant transformation driven by technological advancements and digitalization. As firms seek to enhance operational efficiency and improve decision-making processes, there is a growing reliance on data analytics, artificial intelligence (AI), and machine learning. These technologies enable private equity firms to conduct more thorough due diligence, assess market trends, and identify potential investment opportunities with greater accuracy. Furthermore, portfolio companies are increasingly leveraging technology to optimize their operations, enhance customer experiences, and drive growth. This trend is particularly pronounced in sectors such as healthcare, fintech, and e-commerce, where digital capabilities are essential for competitive advantage. As we approach 2025, the integration of technology within the private equity landscape will continue to accelerate, reshaping how firms evaluate investments and manage portfolios. Firms that embrace digital transformation and invest in innovative technologies will not only improve their operational efficiency but also better position themselves to capitalize on emerging market trends and drive value creation in their investments.

Growing Interest in Emerging Markets: As traditional markets become increasingly saturated, private equity firms are turning their attention to emerging markets as a source of growth and opportunity. Regions such as Southeast Asia, Africa, and Latin America are witnessing rapid economic development, rising consumer demand, and an expanding middle class, making them attractive destinations for private equity investment. These markets offer unique opportunities for firms to invest in high-growth sectors such as technology, renewable energy, and infrastructure. Additionally, the potential for higher returns in emerging markets is appealing to investors seeking to diversify their portfolios and enhance overall returns. However, investing in these regions also presents challenges, including regulatory complexities, political instability, and varying market dynamics. As we move towards 2025, private equity firms are likely to adapt their strategies to navigate these challenges, leveraging local partnerships and expertise to mitigate risks and capitalize on growth opportunities. Firms that successfully identify and invest in promising emerging markets will be well-positioned to achieve substantial returns and drive portfolio value in the evolving global landscape.

Buy Now: https://www.imarcgroup.com/checkout?id=8078&method=1670

Private Equity Market Report Segmentation:

By Fund Type:

• Buyout

• Venture Capital (VCs)

• Real Estate

• Infrastructure

• Others

Buyout holds the majority of the market share because buyout funds focus on acquiring and restructuring underperforming companies, providing opportunities for significant value creation and high returns.

Regional Insights:

• North America

• Asia-Pacific

• Europe

• Latin America

• Middle East and Africa

North America's dominance in the market is attributed to its mature financial ecosystem, robust economic growth, and a high concentration of institutional investors and private equity firms.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=8078&flag=C

Key Companies:

• AHAM Asset Management Berhad

• Allens

• Apollo Global Management, Inc.

• Bain and Co. Inc.

• Bank of America Corp.

• BDO Australia

• Blackstone Inc.

• CVC Capital Partners

• Ernst and Young Global Ltd.

• HSBC Holdings Plc

• Morgan Stanley

• The Carlyle Group

• Warburg Pincus LLC

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) (+1-201971-6302)

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Private Equity Market Overview, Size, Share, Growth And Trends Report 2025-2033 here

News-ID: 4160917 • Views: …

More Releases from IMARC Group

Helium Production Plant DPR & Unit Setup Cost- 2026: Machinery Requirements, Cap …

Setting up a Helium Production Plant positions investors in one of the most stable and essential segments of the industrial gas and strategic materials value chain, backed by sustained global growth driven by increasing demand from medical imaging, semiconductor manufacturing expansion, advanced scientific research applications, and the ultra-high purity, reliability, irreplaceable advantages of helium across critical technology sectors. As healthcare infrastructure accelerates, semiconductor fabrication intensifies, and space exploration initiatives expand…

Setting Up a Green Hydrogen Plant in India 2026- Complete Cost Model with CapEx, …

What Does It Cost to Set Up a Green Hydrogen Production Plant in India?

Setting up a 300-ton-per-year green hydrogen plant in India requires a carefully mapped investment across CapEx, OpEx, and long-term profitability. Raw material costs - primarily electricity - run between 60 to 70 percent of operating expenditure. Gross margins project between 25 and 30 percent. And capital investment spans electrolyzer procurement, renewable energy infrastructure, utilities, and compliance -…

Pharmaceutical Formulation Manufacturing Plant DPR & Unit Setup - 2026: Business …

Setting up a pharmaceutical formulation manufacturing plant positions investors in one of the most stable and essential segments of the global healthcare value chain, backed by sustained global growth driven by growing prevalence of chronic diseases, pharmaceutical industry expansion, rising demand for patient-centric dosage forms, and the safety, efficacy, stability advantages of finished medicinal products. As global healthcare spending accelerates, chronic and lifestyle diseases increase, and regulatory frameworks increasingly mandate…

Triple Superphosphate (TSP) Manufacturing Plant DPR & Unit Setup 2026: Demand An …

Setting up a triple superphosphate (TSP) manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This essential high-analysis phosphate fertilizer serves field crop agriculture, horticulture, fertilizer blending, and soil nutrient management programs. Success requires careful site selection, efficient phosphate rock processing, stringent safety protocols, reliable raw material sourcing, and compliance with environmental regulations to ensure profitable and sustainable operations.

Market Overview and Growth Potential:

The global…

More Releases for Private

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private asset management,private wealth management firms,middle market private e …

Private asset management is the management of assets on behalf of private individuals, families, or institutions. It involves the creation of a customized investment strategy to achieve specific financial goals, such as wealth preservation, growth, income generation, or a combination of these objectives. The assets managed can include cash and cash equivalents, stocks, bonds, real estate, private equity, and alternative investments.

https://tendawholesale.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private asset management is typically provided by…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…