Press release

Global Commercial Insurance Market to Hit USD 1.89 Billion by 2030, Driven by Globalization and Digital Transformation: MarkNtel Advisors

The Global Commercial Insurance Market is poised for rapid expansion, with its value expected to grow from USD 1.2 billion in 2023 to USD 1.89 billion by 2030, at a compound annual growth rate (CAGR) of 7.9%, according to the latest market insights by MarkNtel Advisors. This growth is fueled by rising risk awareness, regulatory shifts, and the widespread adoption of advanced technologies that are reshaping the way businesses safeguard their assets.Access in-depth statistics and forecasts: View the Full Research Report - https://www.marknteladvisors.com/research-library/commercial-insurance-market.html

Risk Awareness Driving Demand:

Businesses worldwide are increasingly aware of the threats to their operations, from cyberattacks and natural disasters to global supply chain disruptions. This heightened risk perception is prompting organizations - both large enterprises and small-to-medium-sized businesses - to seek commercial insurance as a safeguard for continuity and resilience.

With cities expanding, infrastructure projects accelerating, and global trade becoming more complex, demand for customized insurance solutions has surged. Insurers are responding by tailoring coverage to fit the unique risk profiles of different industries, from healthcare and construction to transportation and technology.

Top Commercial Insurance Companies Driving Growth:

The market features a mix of global giants and innovative players. Key companies profiled in the report include:

◾ Allianz SE

◾ American International Group Inc.

◾ Aon plc

◾ Aviva plc

◾ Axa S.A.

◾ Chubb Limited

◾ Direct Line Insurance Group plc

◾ Marsh & McLennan Companies Inc.

◾ Willis Towers Watson Public Limited Company

◾ Zurich Insurance Group Ltd.

◾ Others

These firms are investing in partnerships, acquisitions, and digital transformation to strengthen their market positions. For example, AIG partnered with Stone Point Capital to launch Private Client Select Insurance Services, while AON expanded its trucking insurance offerings through Cover Whale.

Get a first look at data tables, company profiles, and regional insights: Download Free Sample PDF Brochure - https://www.marknteladvisors.com/query/request-sample/commercial-insurance-market.html

Market Growth Drivers: Globalization & Regulations:

The globalization of business operations remains a primary driver of market growth. As companies expand across borders, they face a host of risks including political instability, currency fluctuations, and changing regulatory frameworks. Commercial insurance has become an essential financial tool for navigating these uncertainties.

Meanwhile, government regulations are shaping insurance strategies worldwide. For example, in 2024, the European Union's insurance regulator introduced new climate risk measures, encouraging businesses to adopt comprehensive insurance portfolios. Similar regulatory shifts across North America, Asia-Pacific, and the Middle East are reinforcing the importance of risk management and fueling demand for liability and property insurance.

Technology Reshaping the Insurance Landscape:

The integration of insurtech solutions is transforming the commercial insurance industry. Advanced tools such as artificial intelligence (AI), Internet of Things (IoT), telematics, and big data analytics are making it possible to detect risks with greater accuracy, streamline claims processing, and deliver more personalized coverage.

The rise of digital-first insurance startups and partnerships between insurtech firms and established players is fostering innovation in underwriting, pricing, and customer service. For businesses, this means more efficient claims handling, flexible policies, and enhanced user experiences.

Market Segmentation Insights:

◾ By Enterprise Size:

Large enterprises dominate the market due to their heightened focus on risk management and global expansion. Their adoption of telematics and advanced analytics is creating demand for more sophisticated, customizable coverage.

◾ By Insurance Type:

Liability insurance leads the pack, driven by regulatory mandates and rising risks in sectors such as healthcare, food, chemicals, and construction. The increasing threat of cyber liability is also accelerating demand for specialized liability solutions.

For detailed pricing insights, Visit Website - https://www.marknteladvisors.com/pricing/commercial-insurance-market.html

Region Insights: North America Capture the Largest Market Share:

Geographically, the Global Commercial Insurance Market expands across:

◾ North America

◾ South America

◾ Europe

◾ The Middle East-Africa

◾ Asia-Pacific

North America is set to dominate the commercial insurance sector, driven by increased risk awareness and the rise of cyber threats. Regulatory requirements and advancements in technology, like AI and data analytics, enhance coverage efficiency and customer service. These factors solidify North America's leading position and create significant growth opportunities for market players.

Challenges to Watch:

Despite its growth trajectory, the commercial insurance industry faces hurdles. Underpriced insurance products - initially attractive to buyers - often lead to insufficient claim coverage, forcing insurers to raise premiums or limit offerings. This instability could pose risks to market credibility. Additionally, lack of awareness among small businesses remains a challenge, as many remain uninsured despite being highly vulnerable to operational risks.

Browse More Dedicated Insurance Market Research Reports:

◾ UAE Health Insurance Market - https://www.marknteladvisors.com/research-library/uae-health-insurance-market.html

◾ Future of US Catering Market - https://futureofreportsmarkntel.blogspot.com/2025/08/future-of-us-catering-market.html

Contact:

MarkNtel Advisors

Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

Contact No: +91 8719999009

Email: sales@marknteladvisors.com

About US:

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Commercial Insurance Market to Hit USD 1.89 Billion by 2030, Driven by Globalization and Digital Transformation: MarkNtel Advisors here

News-ID: 4160265 • Views: …

More Releases from MarkNtel Advisors LLP

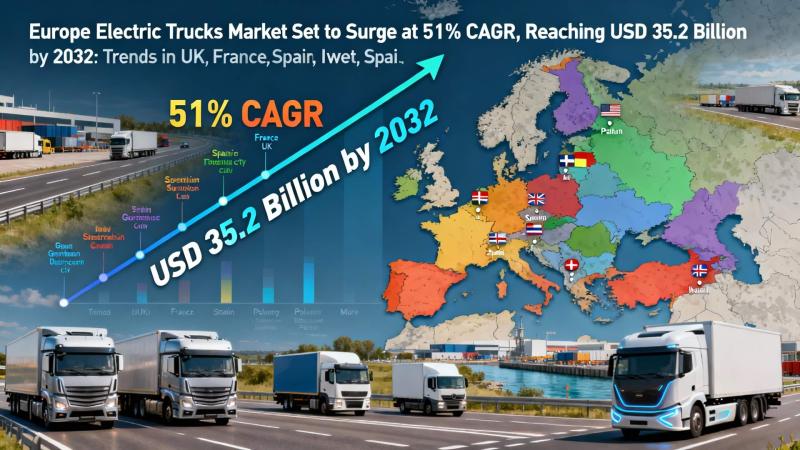

Europe Electric Trucks Market Set to Surge at 51% CAGR, Reaching USD 35.2 Billio …

Latest Research Report of European Electric Trucks Market Size and CAGR

According to MarkNtel Advisors latest market research report data, the Europe Electric Trucks Market is projected to grow from USD 1.96 billion in 2025 to USD 35.2 billion by 2032, registering a remarkable CAGR of 51.07%. Growth is primarily driven by stringent EU emission standards, expansion of high-capacity charging networks, and fleet electrification by major OEMs like Volvo Trucks and…

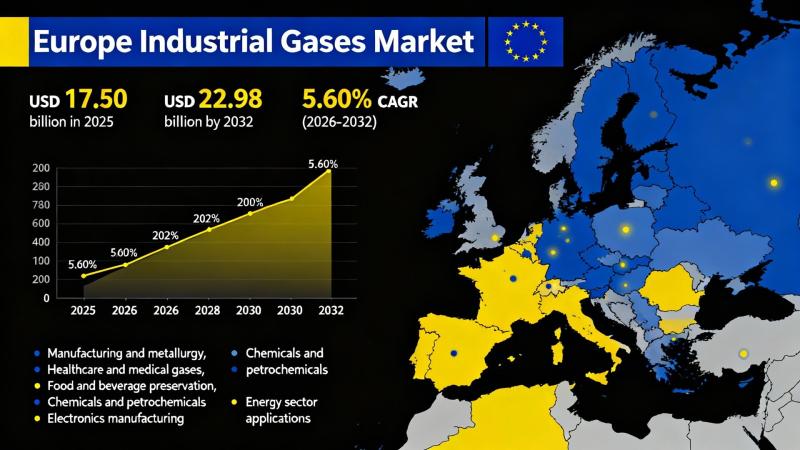

Europe Industrial Gases Market Expected to Reach Nearly $22.98 Billion by 2032: …

Europe Industrial Gases Market: Trends, Insights, and Future Outlook

The Europe Industrial Gases Market is seeing robust growth, driven by increasing demand across key sectors such as petrochemicals, healthcare, and steelmaking. Innovations in hydrogen production and carbon capture technologies are prominent factors influencing market dynamics. A shift towards renewable and low-carbon sources presents significant opportunities amid growing environmental regulations. Additionally, the rise in energy costs is reshaping the landscape for industrial…

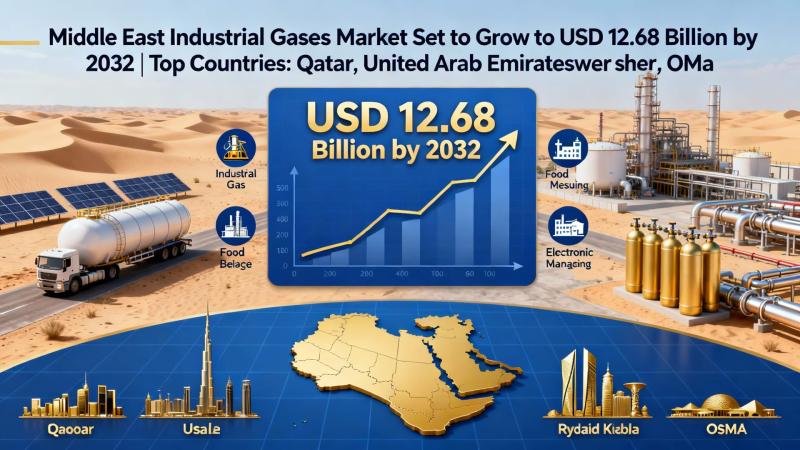

Middle East Industrial Gases Market Set to Grow to USD 12.68 Billion by 2032 | T …

The Middle East Industrial Gases Market is forecasted to expand from USD 10.06 billion in 2025 to USD 12.68 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.72% during the period of 2026 to 2032. The primary drivers fueling this growth are the increasing demand for hydrogen and the robust expansion of the petrochemical industry, which necessitates high-purity gases for various applications such as chemical synthesis and…

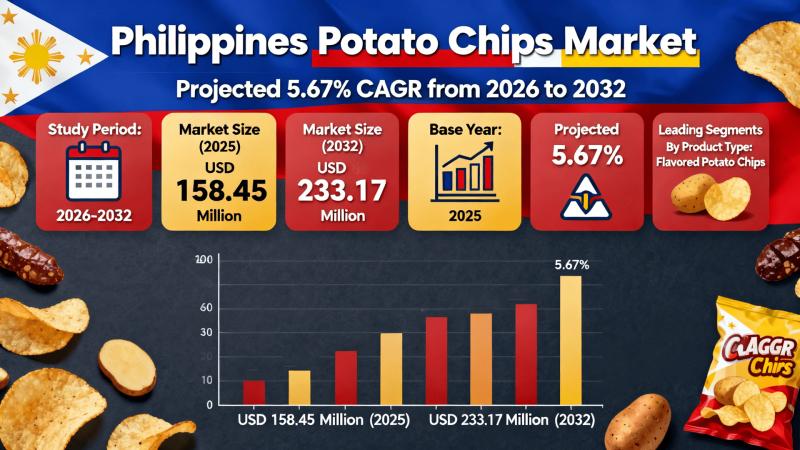

Potato Chips Market in Philippines Set to Grow to USD 233.17 Million by 2032 as …

The Philippines Potato Chips Market is entering a significant growth phase, projected to expand from USD 158.45 million in 2025 to USD 233.17 million by 2032, with a robust compound annual growth rate (CAGR) of 5.67%. Key growth drivers include government initiatives aimed at bolstering local potato production and the rising popularity of flavored varieties among consumers.

Philippines Potato Chips Market Growth Outlook:

As snack food preferences evolve, the Philippines Potato Chips…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…