Press release

Invoice Factoring Market Size Expected to Double, Hitting USD 5.51 Billion by 2032

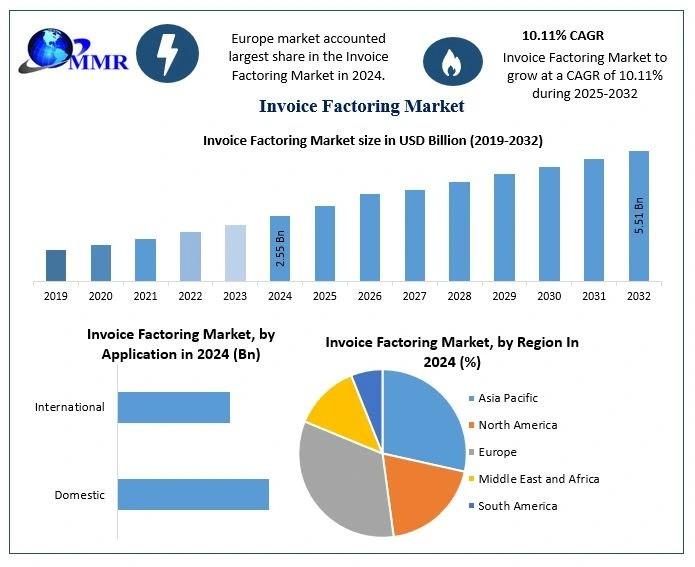

Invoice Factoring Market size was valued at USD 2.55 Billion in 2024 and the total Invoice Factoring revenue is expected to grow at a CAGR of 10.11% from 2025 to 2032, reaching nearly USD 5.51 Billion.Invoice Factoring Market Overview:

The Invoice Factoring Market has gained significant momentum as businesses across industries seek efficient ways to manage working capital and cash flow challenges. Factoring enables companies to sell their outstanding invoices to a third party at a discount, receiving immediate liquidity instead of waiting for customer payments. This financial solution is particularly attractive for small and medium-sized enterprises (SMEs) that often struggle with extended payment cycles and limited access to traditional financing. Increasing globalization, trade activities, and the growing adoption of alternative financing methods have further strengthened the market's growth. With digital platforms making factoring more accessible, the market is expected to witness consistent demand from businesses seeking flexible financing without taking on additional debt.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/168342/

Invoice Factoring Market Outlook and Future Trends:

The future outlook for the Invoice Factoring Market remains highly promising, driven by the increasing adoption of digital technologies and automation in financial services. Online factoring platforms and fintech solutions are expected to revolutionize the industry by offering faster approvals, transparent processes, and improved risk management. As businesses increasingly look for alternatives to traditional bank loans, invoice factoring is likely to emerge as a mainstream financing option. Moreover, the rise of cross-border trade is expected to create new opportunities, as factoring solutions help companies manage international transactions with ease. The integration of blockchain and AI in financial operations is also anticipated to enhance security and efficiency, thereby shaping the long-term trajectory of the market.

Invoice Factoring Market Dynamics:

The growth of the Invoice Factoring Market is being influenced by several dynamic factors. On the demand side, the rising number of SMEs and startups across emerging economies has significantly increased the need for immediate cash flow solutions. Extended payment terms in B2B transactions often create liquidity gaps, driving companies to seek factoring services. On the supply side, financial institutions, banks, and fintech companies are expanding their factoring services, making them more accessible. However, challenges such as high fees, regulatory concerns, and risks associated with non-payment by customers can hinder adoption in certain regions. Despite these hurdles, the growing emphasis on business sustainability, access to flexible financing, and enhanced financial tools is supporting market expansion.

Invoice Factoring Market Key Recent Developments:

The Invoice Factoring Market has witnessed notable developments in recent years, with fintech innovations taking the lead. Several financial service providers have launched digital factoring platforms that enable businesses to upload invoices and receive funds within hours. Strategic partnerships between banks and fintech companies are becoming increasingly common, aimed at expanding factoring services to underserved SMEs. Additionally, regulatory reforms in regions like Europe and North America are promoting the growth of transparent and standardized factoring practices. The market has also seen increased investment in AI-driven credit assessment tools, which help reduce risks for factoring companies. These advancements highlight a clear shift toward digital transformation and efficiency, positioning invoice factoring as a vital financial service for global businesses.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/168342/

Invoice Factoring Market Segmentation:

by Type

Recourse Factoring

Non-recourse Factoring

by Application

Domestic

International

by Enterprise Size

Large Enterprises

Small and Medium-sized Enterprises

by Provider

Banks

NBFCs

by Industry

Vertical Construction

Manufacturing

Healthcare

Transportation and Logistics

Energy and Utilities

IT and Telecom

Staffing

Others

Some of the current players in the Invoice Factoring Market are:

1.Porter Capital

2. Adobe

3. Barclays Bank UK PLC

4. ICBC

5. Intuit Inc.

6. American Express Company

7. Lloyds Bank

8. Sonovate

9. Waddle

10. Velotrade

11. eCapital

12. Triumph Business Capital

13. Breakout Capital

14. Nav

15.altLINE

16. Riviera Finance

17. RTS Financial

18. Fundbox

19.Paragon Financial Group

For additional reports on related topics, visit our website:

♦Global Structured Cabling Market https://www.maximizemarketresearch.com/market-report/global-structured-cabling-market/23526/

♦Global Probe Card Market https://www.maximizemarketresearch.com/market-report/global-probe-card-market/32586/

♦Global Virtual Desktop Market https://www.maximizemarketresearch.com/market-report/global-virtual-desktop-market/55301/

♦Rapid Prototyping Market https://www.maximizemarketresearch.com/market-report/global-rapid-prototyping-market/35142/

♦Global Virtual Desktop Market https://www.maximizemarketresearch.com/market-report/global-virtual-desktop-market/55301/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a leading market research and consulting company, recognized for delivering reliable insights and strategies across diverse industries such as healthcare, pharmaceuticals, technology, automotive, and many more. Our expertise lies in providing in-depth market analysis, trend forecasting, competitive benchmarking, and strategic consulting tailored to client needs. We are committed to empowering organizations with actionable intelligence that enhances decision-making, strengthens market positioning, and fuels sustainable business growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Invoice Factoring Market Size Expected to Double, Hitting USD 5.51 Billion by 2032 here

News-ID: 4160005 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Factoring

Growing Reverse Factoring Adoption Boosts Market Growth: Critical Driver Shaping …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Reverse Factoring Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

Over the past few years, the reverse factoring market has seen significant growth. It is expected to increase from $539.41 billion in 2024 up to $592.1 billion in 2025, representing a compound annual growth rate…

Factoring Market Next Big Thing | Major Giants BNP Paribas, HSBC, Deutsche Facto …

HTF MI just released the Global Factoring Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Giants in Factoring Market are:

BNP Paribas, HSBC, Deutsche Factoring Bank, Eurobank,…

What's Driving the Reverse Factoring Market 2025-2034: Growing Reverse Factoring …

What Are the Projections for the Size and Growth Rate of the Reverse Factoring Market?

The market size of reverse factoring has seen significant growth over the last few years. It is projected to expand from $539.41 billion in 2024 to $592.1 billion in 2025, displaying a compound annual growth rate (CAGR) of 9.8%. The growth trajectory in the past can be linked to the increased awareness of supply chain finance…

Reverse Factoring Market

The reverse factoring market has been experiencing significant growth, with its market size accounted for USD 530.8 billion in 2022. It is projected to achieve a remarkable market size of USD 1,452.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2032. This substantial growth is driven by various market trends, emerging opportunities, and a competitive landscape that is continuously evolving.

Download Free Reverse…

Factoring Market Outlook 2024-2030: Trends and Opportunities|BNP Paribas, Deutsc …

Infinity Business Insights is providing qualitative and informative knowledge by adding the title factoring Market to recognize, describe and forecast the global market. The report provides systematic consideration analysis along with forecasts for market players. The report aims to facilitate understanding of the global factoring market forecast through statistical and numerical data in the form of tables, graphs, and charts. The study provides a calculated assessment of new recent developments,…

Factoring Services Market is Booming Worldwide | Deutsche Factoring Bank, Euroba …

The Latest Released Factoring Services market study has evaluated the future growth potential of Global Factoring Services market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers,…