Press release

U.S. Individual Health Insurance Market Size, Share & Trends Report | Persistence Market Research

The U.S. individual health insurance market plays a pivotal role in the country's healthcare system, offering consumers an array of options for coverage outside of employer-sponsored plans. As the demand for flexible, affordable, and personalized health insurance continues to grow, insurers are adapting to meet the needs of a diverse population. According to a recent study by Persistence Market Research, the market is expected to increase from US$1.8 billion in 2024 to US$2.7 billion by 2031, reflecting a compound annual growth rate (CAGR) of 5.9% over the forecast period.Get a Sample Copy of Research Report (Use Corporate Mail id for Quick Response): https://www.persistencemarketresearch.com/samples/34794

Overview of the U.S. Individual Health Insurance Market

The U.S. individual health insurance market is currently undergoing significant transformation. With the shift in employment patterns, where individuals increasingly turn to freelance, gig, or self-employment, the demand for individual health insurance policies outside of traditional employer-sponsored plans is on the rise. In addition, the aging population and the rising prevalence of chronic conditions such as diabetes, cancer, and cardiovascular diseases have fueled the need for tailored health insurance coverage.

Key factors driving this market include rising healthcare costs, the expansion of public health insurance programs like Medicare and Medicaid, and the growing trend of personalized healthcare plans. Furthermore, the growing acceptance of telehealth services and the introduction of innovative product options by insurers are also contributing to the expansion of the market. Persistence Market Research reports that seniors aged 65 and above continue to form the dominant demographic in the individual health insurance sector, accounting for more than 88% of the market share in 2022.

The U.S. individual health insurance market is segmented based on product type, end-user demographics, and geography. The public segment, driven largely by government-sponsored programs such as Medicare, is expected to see substantial growth. Meanwhile, the private insurance market also remains significant, with an increasing number of individuals opting for private policies due to their flexibility and personalized features.

Key Growth Drivers Behind Market Growth

Several factors contribute to the continued growth of the U.S. individual health insurance market:

Rising Healthcare Costs: With increasing medical expenses, many individuals are looking for health insurance plans that provide a safety net against high treatment costs.

Aging Population: The senior demographic, which typically requires more extensive healthcare coverage, continues to drive demand for health insurance products, particularly Medicare Advantage and Medigap plans.

Shifts in Employment Patterns: As more individuals move away from traditional full-time employment to freelance, gig, or contract work, the need for personal health insurance has increased significantly.

Government Regulations and Subsidies: Policies such as the Affordable Care Act (ACA), which provides subsidies for individuals purchasing insurance on the marketplace, have made health insurance more accessible for a broader segment of the population.

Leading Segment and Geographical Region

The senior segment remains the dominant force in the U.S. individual health insurance market, accounting for over 88% of market share in 2022. As the Baby Boomer generation ages, the demand for specialized products like Medicare Advantage and Medigap policies continues to rise. These plans are designed to address the unique healthcare needs of the elderly population, including long-term care and chronic condition management.

Geographically, the South region leads the U.S. individual health insurance market. Florida and Texas are the key players in this region, with Florida securing the largest share, approximately 20.1%, and Texas at 21.0%. This dominance can be attributed to the significant number of seniors residing in these states, coupled with high adoption rates of individual health insurance plans. The West region, with states like California, Arizona, and Washington, follows closely behind, driven by a rising demand for individual health insurance and a projected CAGR of 9.9% during the forecast period.

Key Highlights from the Report

• The U.S. individual health insurance market is expected to grow from US$1.8 Bn in 2024 to US$2.7 Bn by 2031.

• The market is anticipated to expand at a CAGR of 5.9% between 2024 and 2031.

• Seniors aged 65 and older constitute over 88% of the market share.

• The public segment, including government-sponsored programs like Medicare, is poised for significant growth.

• The South region is the largest market, with Florida and Texas as major contributors.

• The market faces increasing pressure due to rising healthcare costs and the need for more affordable plans.

Read Detailed Analysis: https://www.persistencemarketresearch.com/market-research/us-individual-health-insurance-market.asp

Market Segmentation

The U.S. individual health insurance market is segmented across several categories, including product type, end-user demographics, and regional variations.

By Product Type

Public Insurance: Public health insurance programs such as Medicare and Medicaid continue to play a crucial role in the market. These government-sponsored programs provide coverage for the elderly, low-income individuals, and those with certain disabilities. With a growing senior population and increased state-level Medicaid expansion, the public segment is expected to witness substantial growth.

Private Insurance: The private health insurance segment includes policies offered by major insurers for individuals who do not qualify for government assistance. The shift towards private insurance plans is evident, as they offer more flexibility, coverage options, and specialized services, such as telemedicine, wellness programs, and chronic condition management.

By End-User Demographics

Seniors: Seniors remain the most significant consumer base for individual health insurance, driven by the aging Baby Boomer generation and an increased need for long-term healthcare solutions. These individuals typically require comprehensive coverage options for chronic disease management, specialist care, and prescription drug plans.

Adults: While seniors dominate the market, adults aged 18-64 are increasingly seeking individual health insurance, especially those in non-traditional employment settings. Flexible and affordable plans are essential for this demographic, who often face challenges related to rising premiums and out-of-pocket costs.

Minors: Although less significant in terms of market share, minors still require health insurance. These plans are often offered through parents' insurance or standalone policies for children with specific health needs or conditions.

Regional Insights

Northeast and Midwest

The Northeast and Midwest regions of the U.S. are characterized by a diverse demographic, including a mix of young adults and aging populations. In these regions, health insurance adoption rates are strong, but the market growth is tempered by the high costs of healthcare and insurance premiums. States like New York and Illinois have seen steady adoption of individual health insurance, but the focus is on affordability and comprehensive care.

South and West Regions

The South continues to lead the market, largely due to the high proportion of retirees in states like Florida and Texas. These regions are expected to see consistent growth in individual health insurance adoption. The West, driven by California and other progressive states, is poised for significant growth, with a projected CAGR of 9.9%, primarily driven by an increase in demand for flexible health insurance products and acceptance of telehealth.

Market Drivers

Regulatory Changes: The ongoing adjustments to the Affordable Care Act (ACA), state-level Medicaid expansions, and the introduction of new government initiatives play a crucial role in increasing insurance availability and affordability.

Rising Chronic Health Issues: As the prevalence of chronic diseases like diabetes and heart conditions increases, more individuals are opting for individual health insurance policies that cover ongoing treatments and specialized care.

Telehealth Growth: The growing demand for telemedicine, accelerated by the COVID-19 pandemic, is making it easier for individuals to access healthcare remotely. This trend encourages more people to invest in individual health insurance that includes telehealth services.

Market Restraints

Affordability Challenges: While subsidies and policy adjustments help mitigate some costs, rising premiums and high deductibles remain a significant barrier for many individuals, particularly those in lower-income brackets.

Market Instability: Frequent changes in healthcare regulations and policies create uncertainty for both insurers and consumers, leading to fluctuating premium rates and reduced consumer confidence.

Adverse Selection: The imbalance in risk pools, where individuals with higher healthcare needs are more likely to enroll in comprehensive plans, could lead to rising premiums and market instability.

Market Opportunities

Personalized Plans: There is an increasing demand for personalized healthcare plans. Insurers can leverage technology and data analytics to offer tailored plans that address specific needs, such as chronic illness care or mental health coverage.

Telehealth Integration: Offering insurance plans that cover telehealth services can provide a competitive edge in the market, as remote healthcare becomes more integral to patient care.

Government Collaboration: Insurers can collaborate with the government to create more affordable and accessible plans, particularly for underserved populations.

Request for Customization of the Research Report: https://www.persistencemarketresearch.com/request-customization/34794

Reasons to Buy the Report

• Gain a comprehensive understanding of the U.S. individual health insurance market size, trends, and projections.

• Understand the drivers, restraints, and opportunities impacting market growth.

• Analyze the competitive landscape and strategic initiatives undertaken by key players.

• Get insights into regional dynamics and leading states in individual health insurance adoption.

• Benefit from detailed market segmentation analysis by product type, demographics, and region.

Frequently Asked Questions (FAQs)

• How Big is the U.S. Individual Health Insurance Market?

• Who are the Key Players in the U.S. Individual Health Insurance Market?

• What is the Projected Growth Rate of the U.S. Individual Health Insurance Market?

• What is the Market Forecast for the U.S. Individual Health Insurance Market in 2032?

• Which Region is Estimated to Dominate the U.S. Individual Health Insurance Market through the Forecast Period?

Company Insights

• Elevance Health (formerly Anthem, Inc.)

• Cigna

• Health Care Service Corporation

• Providence Health Plan

• Point32Health

• Highmark

• UnitedHealth Group Incorporated

• Kaiser Foundation Health Plan, Inc.

Recent Developments

In 2023, UnitedHealthcare and Aetna introduced more competitively priced silver-level plans to cater to a broader segment of the individual health insurance market.

The introduction of new telehealth services by insurers like Cigna aims to enhance the accessibility and flexibility of individual health insurance policies.

The U.S. individual health insurance market is undergoing significant transformation, driven by regulatory changes, increasing chronic health issues, and shifting employment patterns. As insurers continue to innovate and adapt to consumer needs, the market is expected to see consistent growth, with substantial opportunities for those who can meet the demand for affordable, flexible, and personalized coverage options.

Read More Related Reports:

Bone Void Fillers Market https://www.persistencemarketresearch.com/market-research/bone-void-fillers-market.asp

Ammonia Inhalants Market https://www.persistencemarketresearch.com/market-research/ammonia-inhalants-market.asp

Liniments Rubs Market https://www.persistencemarketresearch.com/market-research/liniments-rubs-market.asp

Meniscal Fixation Devices Market https://www.persistencemarketresearch.com/market-research/meniscal-fixation-devices-market.asp

Dental Lights Market https://www.persistencemarketresearch.com/market-research/dental-lights-market.asp

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Individual Health Insurance Market Size, Share & Trends Report | Persistence Market Research here

News-ID: 4159150 • Views: …

More Releases from Persistence Market Research

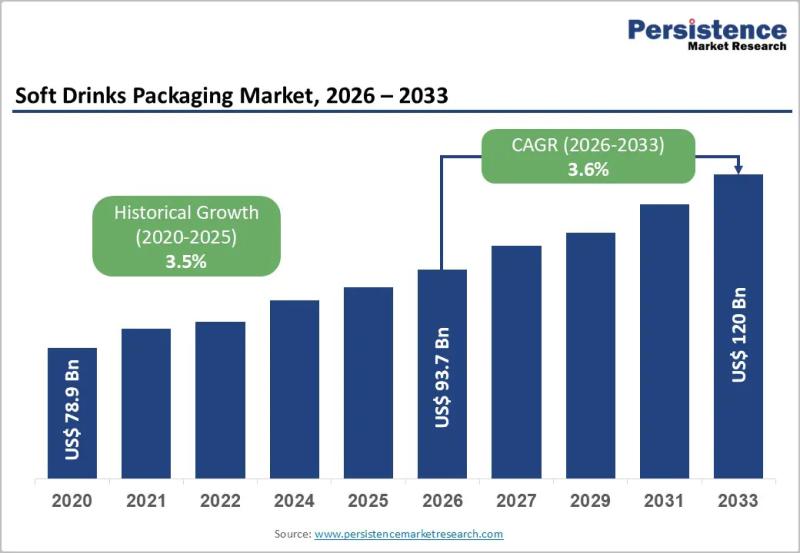

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

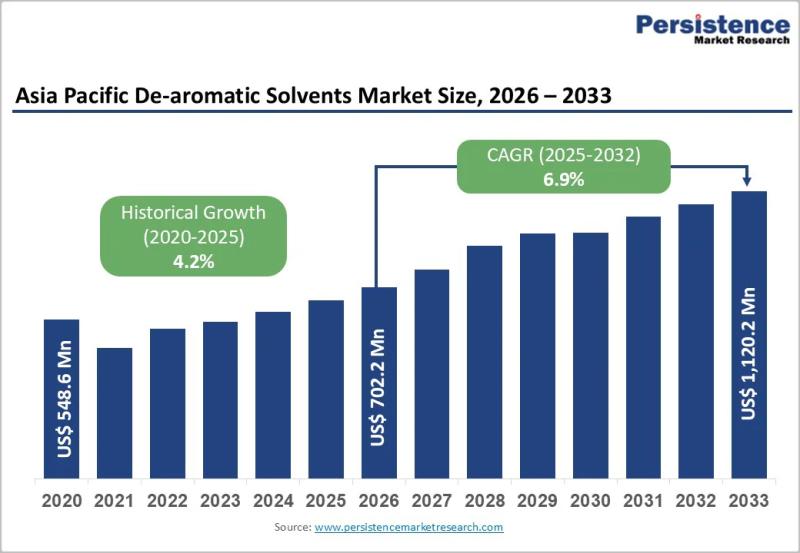

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Health

Health Coach Market Positioned for Accelerated Growth with Iora Health, Virta He …

Global health coach market is estimated to be valued at USD 18.83 Bn in 2025 and is expected to reach USD 30.65 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 7.2% from 2025 to 2032.

Latest Report on the Health Coach Market 2025-2032, focuses on a comprehensive analysis of the current and future prospects of the Health Coach Market industry. An in-depth analysis of historical trends, future trends,…

Digital Therapeutics Market Research 2025 Leading Key Players - Proteus Digital …

An exclusive Digital Therapeutics Market research report created through broad primary research (inputs from industry experts, companies, and stakeholders) and secondary research, the report aims to present the analysis of Global Digital Therapeutics Market by Type, By Application, By Region - North America, Europe, South America, Asia-Pacific, Middle East and Africa. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment evaluation. Besides, the report…

Digital Therapeutics Market Outlook 2025 : Proteus Digital Health, Omada Health, …

ReportsWeb.com has announced the addition of the “Global Digital Therapeutics Market Size, Status and Forecast 2025” The report focuses on major leading players with information such as company profiles, product picture and specification.

This report studies the global Digital Therapeutics market, analyzes and researches the Digital Therapeutics development status and forecast in United States, EU, Japan, China, India and Southeast Asia.

This report focuses on the top players in global market,…

Digital Therapeutics Market Outlook to 2025 - Propeller Health, CANARY HEALTH, N …

The global digital therapeutics market is segmented on the basis of application, distribution channel, and geography. The application segment includes, respiratory diseases, central nervous system disease, smoking cessation, medication adherence, cardiovascular diseases, musculoskeletal diseases, and other applications. Based on distribution channel, the digital therapeutics market is segmented as, B2B and B2C.

Digital therapeutics, a subset of digital health, is a health discipline and treatment option that utilizes a digital and…

Digital Therapeutics Market Analysis 2018 | Growth by Top Companies: Proteus Dig …

Global Digital Therapeutics Market to 2025

This report "Digital Therapeutics Market Analysis to 2025" provides an in-depth insight of medical device industry covering all important parameters including development trends, challenges, opportunities, key manufacturers and competitive analysis.

Digital therapeutics, a subset of digital health, is a health discipline and treatment option that utilizes a digital and often online health technologies to treat a medical or psychological condition. The treatment relies on behavioral and…

Digital Therapeutics Market Global Outlook to 2025 - Proteus Digital Health, Wel …

“Digital Therapeutics Market" covers a detailed research on the industry with financial analysis of the major players. The report provides key information and detailed study relating to the industry along with the Economic Impact and Regulatory and Market Support. The report examines the industry synopsis, strategic investments, Industry Surveys, Economic Impact, etc.

The market of digital therapeutics market is anticipated to grow with a significant rate in the coming years, owing…