Press release

North America Bancassurance Market Size & Forecast: Driving Innovation in Financial Services

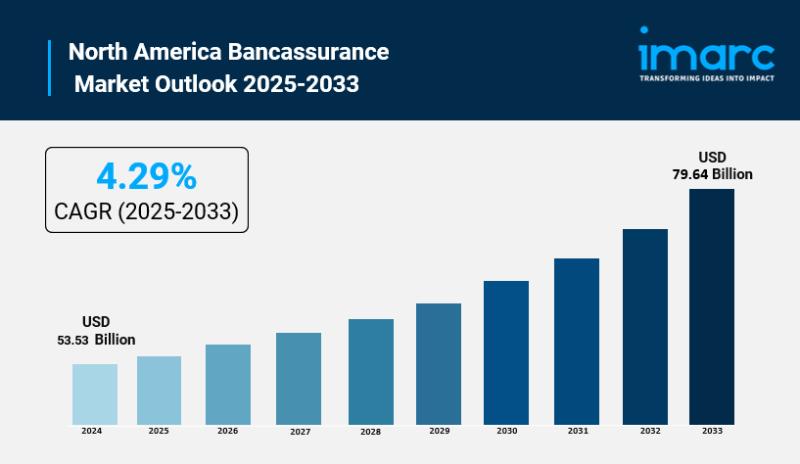

The North America bancassurance market size was valued at USD 53.53 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 79.64 Billion by 2033, exhibiting a CAGR of 4.29% from 2025-2033.The North America bancassurance market is expanding as banks and insurers deepen collaboration to sell insurance products via banks' channels. Bancassurance-banks selling life, health, property, and investment-linked insurance-remains gaining popularity as it leverages banks' big customer bases and established relationships with insurers' product knowledge. The channel enables insurers to reach customers more effectively while enabling banks to diversify revenues and enhance customer loyalty.

One of the major trends in 2025 is digital distribution. Banks and insurance companies are making bets on connected digital platforms that allow customers to compare, purchase, and manage policies online or mobile. Onboarding seamlessly, e-signatures, and API-based product integration reduce sales cycles and costs. Digital tools also make it possible to personalize offers based on customer banking data, which enhances relevance and conversion while maintaining compliance with data protection regulations.

Get your Sample of North America Bancassurance Market Insights for Free: https://www.imarcgroup.com/north-america-bancassurance-market/requestsample

Personalization and customer experience are influencing product design. Bancassurance teams apply analytics to suggest the appropriate combination of term life, annuities, critical illness, and protection products according to life stage, savings habits, and risk tolerance. Branch visit cross-sell programs, in-app alerts, and wealth-advice conversations assist in integrating insurance into overall financial planning as opposed to using it as an isolated sale.

Clarity of regulation and partnerships define market expansion. In 2025, regulators prioritize consumer protection, clear pricing, and suitability checking, which lead banks and insurers to spend on compliance, education, and audit trails. Where rules are clear, partnerships expand more rapidly. Strategic partnerships, white-labeling agreements, and co-branded initiatives enable both parties to exchange distribution, marketing, and service capabilities with the handling of capital and operational risks.

Wealthy and aging demographics in North America are significant drivers of demand. Increasing desire for retirement security, guaranteed income solutions, and long-term care coverage drives sales of annuities and protection policies. Meanwhile, younger consumers drive simplicity, low-cost micro-insurance and digital-first experiences that fit mobile lifestyles. Product innovation that strikes a balance between simplicity and substantive coverage is filling these demographic gaps.

Cost efficiency and channel optimization are still at the heart. Bancassurance lowers the cost of acquiring customers compared to direct sales or agent networks, particularly when digital tools help automate underwriting and claims. Insurers gain from rich data insights from banking partners to underwrite more accurately and combat fraud.

In all, the North America bancassurance market of 2025 is a marriage of digital technology, design-driven customer focus, and compliant partnerships. When strategy and technology are aligned by banks and insurers, bancassurance is increasingly an efficient, scalable channel that addresses changing protection and retirement needs throughout the region.

Ask Our Expert & Browse Full Report with TOC & List of Figure: & List of Figure: https://www.imarcgroup.com/request?type=report&id=1658&flag=E

Market Segmentation:

This report provides an analysis of the key trends in each segment of the market.

Analysis by Product:

Life Bancassurance

Non-Life Bancassurance

Analysis by Bancassurance Models:

Pure Distributor

Exclusive Partnership

Financial Holding

Joint Venture

Country Analysis:

United States

Canada

Mexico

Competitive Landscape:

The market in North America is highly competitive, driven by diverse insurance providers and continual technological innovations. The key market players often use digital platforms to enhance service delivery, improve customer experience, and expand market reach. Also, strategic partnerships and collaborations between banks and insurers are popular, as they enable the creation of tailored, comprehensive financial products that appeal to a broader customer base.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release North America Bancassurance Market Size & Forecast: Driving Innovation in Financial Services here

News-ID: 4157542 • Views: …

More Releases from IMARC Group

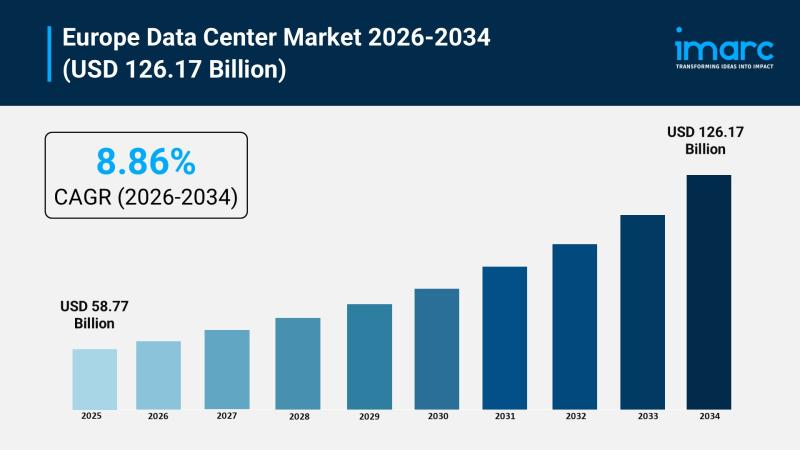

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

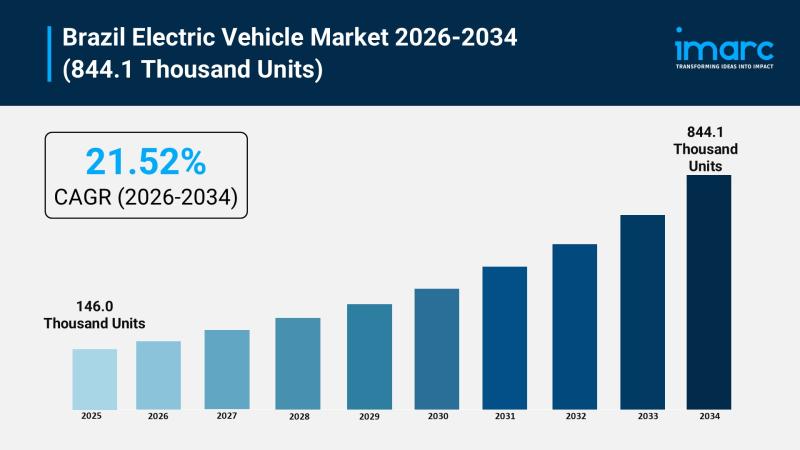

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Bancassurance

Bancassurance Market Dynamics: Innovation and Automation Driving 5.52% CAGR

The Bancassurance market was valued at USD 1.6 trillion in 2024 and is projected to reach USD 2.2 trillion by 2030, growing at a steady CAGR of 4.6% during the forecast period from 2024 to 2030.

Driven by the seamless integration of financial services, the bancassurance model-where insurance products are sold through banking channels-is redefining the customer experience. By leveraging existing bank-customer trust and massive distribution networks, financial institutions are successfully…

Investment Outlook: Analyzing Europe Bancassurance Market Trajectory by 2033

Market Overview

The Europe bancassurance market was valued at USD 646.79 Billion in 2024 and is forecast to reach USD 971.75 Billion by 2033, growing at a CAGR of 4.40% during 2025-2033. Digital transformation and enhanced financial literacy are primary growth drivers. Partnerships between banks and insurers create integrated service offerings, expanding customer access to insurance.

Download a sample copy of the report: https://www.imarcgroup.com/europe-bancassurance-market/requestsample

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Period: 2025-2033

Europe…

Bancassurance Market: An Extensive Analysis Predicts Significant Future Growth

According to USD Analytics the Global Bancassurance Market is projected to register a high CAGR from 2025 to 2034.

The latest study released on the Global Bancassurance Market by USD Analytics Market evaluates market size, trend, and forecast to 2034. The Bancassurance market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study…

GCC Bancassurance Market 2024: Trends, Growth Drivers, and Opportunities

The Business Research Company recently released a comprehensive report on the Global Food Inclusions Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The food inclusions market size…

Bancassurance Market Growth, Size, Trends,Share Analysis 2024-2033

"The Business Research Company recently released a comprehensive report on the Global Bancassurance Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Global Bancassurance Market Professional 2027-

Global Bancassurance Market Size Is Projected To Reach US$ 2291.7 Million By 2027, From US$ 2008.8 Million In 2020, At A CAGR Of 1.9% During 2021-2027

QY Research recently published a research report titled, "Global Bancassurance Market Report, History and Forecast , Breakdown Data by Manufacturers, Key Regions, Types and Application". The research report attempts to give a holistic overview of the Bancassurance market by keeping the information simple, relevant, accurate,…