Press release

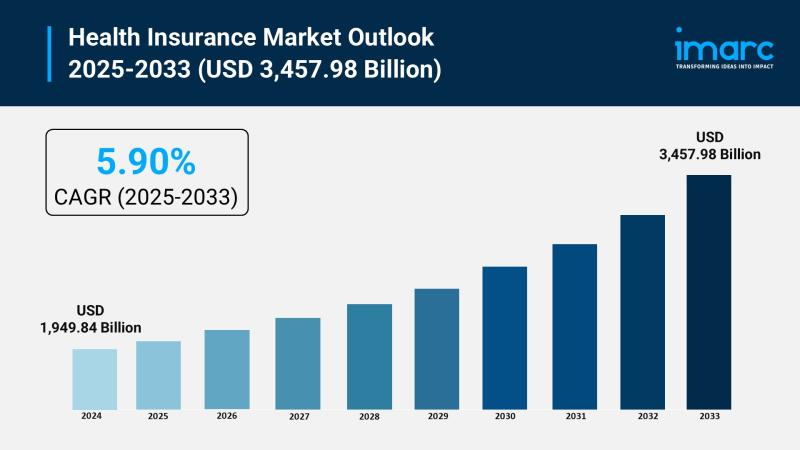

Health Insurance Market Size to Hit USD 3,457.98 Billion by 2033 | With a 5.90% CAGR

Market Overview:The health insurance market is experiencing rapid growth, driven by rising healthcare costs and awareness, government subsidies and supportive policies, and technological advancements and product innovation. According to IMARC Group's latest research publication, "Health Insurance Market Size, Share, Trends and Forecast by Provider, Type, Plan Type, Demographics, Provider Type, and Region, 2025-2033, the global health insurance market size was valued at USD 1,949.84 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,457.98 Billion by 2033, exhibiting a CAGR of 5.90% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/health-insurance-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Health Insurance Market

● Rising Healthcare Costs and Awareness

Healthcare expenses are steadily increasing worldwide, making health insurance essential for managing out-of-pocket costs. Rising awareness about health risks and insurance benefits encourages more individuals to invest in coverage. For example, many markets report an increase in lifetime coverage plans capturing over 55% of market share due to tax advantages and extended protection. Consumers are also attracted to term health insurances for their affordability, expanding insurance penetration across demographics.

● Government Subsidies and Supportive Policies

Government initiatives such as enhanced health insurance subsidies under the Inflation Reduction Act have expanded coverage affordability for middle-income families, providing average annual savings exceeding $4,200 for individuals buying insurance independently. These schemes boost enrollment significantly by lowering the financial burden. Additionally, regulations promoting universal healthcare access and incentivizing private insurance contribute to expanding insured populations, particularly in developed regions, aligning policy and market growth.

● Technological Advancements and Product Innovation

Health insurers are leveraging digital solutions like data analytics and telemedicine integration to improve efficiency, personalize plans, and streamline claims processing. Leading companies now offer tech-enhanced products that improve customer experience and operational transparency. For example, innovative offerings around mental health support and personalized critical illness benefits are gaining traction, while providers continually launch new plans to capture emerging health needs, boosting market dynamism and consumer engagement.

Key Trends in the Health Insurance Market

● Ecosystem Partnerships and Data Integration

Insurers are forming partnerships with tech firms and healthcare providers to integrate diverse data sources, enhancing underwriting accuracy and customer engagement. Examples include AI-driven facial analysis for stress and health metrics or unified health records improving claims management. These collaborations enable novel offerings and personalized wellness programs, which boost consumer satisfaction and strengthen insurer value propositions.

● Shift Toward Digital Payments and Customer Experience

The industry is embracing digital payment platforms, offering customers smoother, flexible, and transparent payment options globally. This transition attracts tech-savvy customers and simplifies policy administration. However, insurers must navigate complex international regulatory environments on data privacy and financial compliance to fully harness this opportunity without incurring risks or penalties.

● Expansion of Specialized Coverage Options

There is a growing focus on coverages addressing specific health challenges-such as mental health programs, dementia benefits, and precision medicine. These targeted products meet emerging consumer demand for tailored protection and reflect rising awareness of chronic illnesses and lifestyle diseases. Insurers investing in these niches can differentiate themselves, offering consumers enhanced value beyond traditional health insurance.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=3051&flag=E

Leading Companies Operating in the Global Health Insurance Industry:

● Aetna Inc

● AIA Group Limited

● Allianz Care

● Aviva India

● AXA Global Healthcare

● Centene Corporation

● Cigna Healthcare

● CVS Health

● International Medical Group, Inc.

● National Insurance Company Limited

● Ping An Insurance (Group) Company of China, Ltd

● United HealthCare Services, Inc.

● Zurich Kotak General Insurance

Health Insurance Market Report Segmentation:

By Provider:

● Private Providers

● Public Providers

Private providers dominate the market in 2024 with 51.7% share, offering diverse and customizable insurance products along with extensive healthcare networks.

By Type:

● Life-Time Coverage

● Term Insurance

Lifetime coverage leads with a 53.5% market share in 2024, providing long-term security and comprehensive benefits at stable premium rates.

By Plan Type:

● Medical Insurance

● Critical Illness Insurance

● Family Floater Health Insurance

● Others

Medical insurance holds a 51.8% market share in 2024, covering essential healthcare services and promoting preventive care to reduce financial burdens.

By Demographics:

● Minor

● Adults

● Senior Citizen

Adults represent 57.5% of the market in 2024, largely due to employer-sponsored plans and policies that cover entire families.

By Provider Type:

● Preferred Provider Organizations (PPOs)

● Point of Service (POS)

● Health Maintenance Organizations (HMOs)

● Exclusive Provider Organizations (EPOs)

Preferred Provider Organizations (PPOs) lead the market with 60.9% share in 2024, offering flexibility in provider choice and coverage for both in-network and out-of-network services.

Region Insights:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America captures over 65.4% of the healthcare insurance market in 2024, driven by its affluent population and complex healthcare systems that necessitate private insurance.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Health Insurance Market Size to Hit USD 3,457.98 Billion by 2033 | With a 5.90% CAGR here

News-ID: 4155740 • Views: …

More Releases from IMARC Group

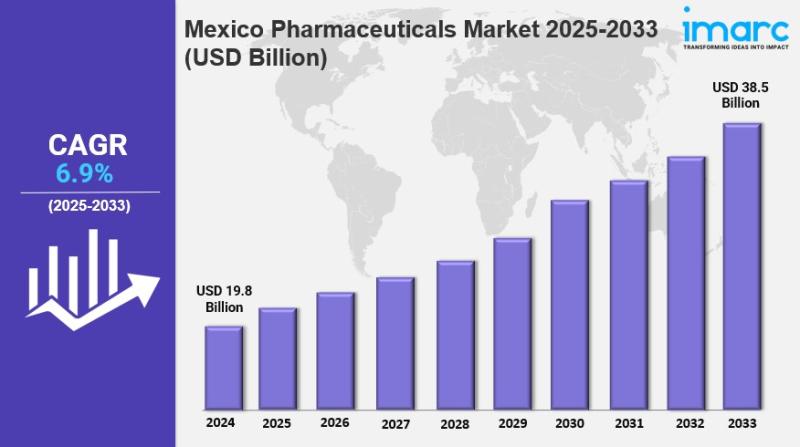

Mexico Pharmaceuticals Market Size to Hit USD 38.5 Billion by 2033: Trends & For …

IMARC Group has recently released a new research study titled "Mexico Pharmaceuticals Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Pharmaceuticals Market Overview

The Mexico pharmaceuticals market size reached USD 19.8 Billion in 2024 and is expected to reach USD 38.5…

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

More Releases for Health

Health Coach Market Positioned for Accelerated Growth with Iora Health, Virta He …

Global health coach market is estimated to be valued at USD 18.83 Bn in 2025 and is expected to reach USD 30.65 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 7.2% from 2025 to 2032.

Latest Report on the Health Coach Market 2025-2032, focuses on a comprehensive analysis of the current and future prospects of the Health Coach Market industry. An in-depth analysis of historical trends, future trends,…

Digital Therapeutics Market Research 2025 Leading Key Players - Proteus Digital …

An exclusive Digital Therapeutics Market research report created through broad primary research (inputs from industry experts, companies, and stakeholders) and secondary research, the report aims to present the analysis of Global Digital Therapeutics Market by Type, By Application, By Region - North America, Europe, South America, Asia-Pacific, Middle East and Africa. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment evaluation. Besides, the report…

Digital Therapeutics Market Outlook 2025 : Proteus Digital Health, Omada Health, …

ReportsWeb.com has announced the addition of the “Global Digital Therapeutics Market Size, Status and Forecast 2025” The report focuses on major leading players with information such as company profiles, product picture and specification.

This report studies the global Digital Therapeutics market, analyzes and researches the Digital Therapeutics development status and forecast in United States, EU, Japan, China, India and Southeast Asia.

This report focuses on the top players in global market,…

Digital Therapeutics Market Outlook to 2025 - Propeller Health, CANARY HEALTH, N …

The global digital therapeutics market is segmented on the basis of application, distribution channel, and geography. The application segment includes, respiratory diseases, central nervous system disease, smoking cessation, medication adherence, cardiovascular diseases, musculoskeletal diseases, and other applications. Based on distribution channel, the digital therapeutics market is segmented as, B2B and B2C.

Digital therapeutics, a subset of digital health, is a health discipline and treatment option that utilizes a digital and…

Digital Therapeutics Market Analysis 2018 | Growth by Top Companies: Proteus Dig …

Global Digital Therapeutics Market to 2025

This report "Digital Therapeutics Market Analysis to 2025" provides an in-depth insight of medical device industry covering all important parameters including development trends, challenges, opportunities, key manufacturers and competitive analysis.

Digital therapeutics, a subset of digital health, is a health discipline and treatment option that utilizes a digital and often online health technologies to treat a medical or psychological condition. The treatment relies on behavioral and…

Digital Therapeutics Market Global Outlook to 2025 - Proteus Digital Health, Wel …

“Digital Therapeutics Market" covers a detailed research on the industry with financial analysis of the major players. The report provides key information and detailed study relating to the industry along with the Economic Impact and Regulatory and Market Support. The report examines the industry synopsis, strategic investments, Industry Surveys, Economic Impact, etc.

The market of digital therapeutics market is anticipated to grow with a significant rate in the coming years, owing…