Press release

High Salt Tolerant Universal Nuclease Market to Reach CAGR 22% by 2031 Top 10 Company Globally

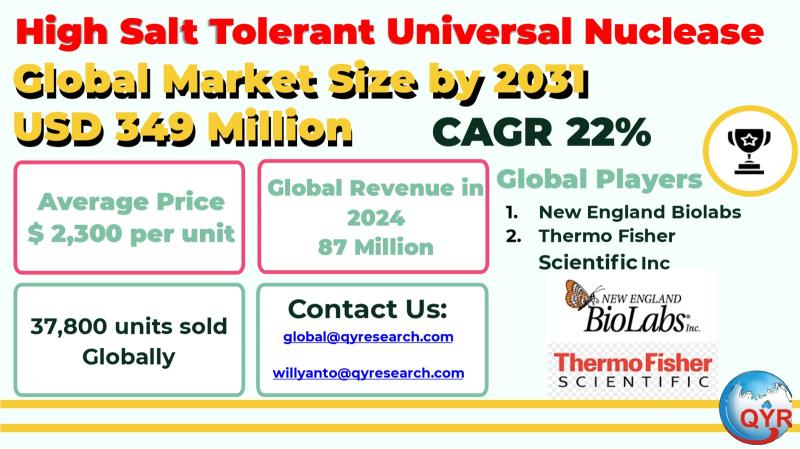

High salt tolerant universal nucleases are engineered endonucleases designed to efficiently degrade residual DNA and RNA across elevated ionic strengths and challenging buffer conditions. They underpin critical bioprocess steps such as viscosity reduction of lysates, impurity clearance in viral vector and vaccine manufacturing, plasmid DNA processing, and sample preparation workflows where downstream chromatography and ultrafiltration require salt compatibility. As cell and gene therapy pipelines scale and as biologics manufacturers pursue process intensification with tighter impurity specifications, demand has shifted from traditional Benzonase-class enzymes toward salt-tolerant variants that maintain activity in ≥0.5-1.0 M salt and complex excipients, reduce unit operations, and ease validation with GMP documentation.The global market for high salt tolerant universal nucleases is small but rapidly expanding. Recent industry trackers estimate the market was valued at about USD 87 million in 2024 and is projected to reach roughly USD 349 million by 2031, implying a 2024 to 2031 CAGR of 22% Average selling prices (ASP) at the USD 2,300 per unit. Applying that range to the 2024 market value implies global unit volumes on the order of 37,800 units.

Latest Trends and Technological Developments

Recent news flow underscores both technology maturation and commercial traction. On August 2025, ArcticZymes reported strong biomanufacturing momentum with Q2 2025 biomanufacturing sales up about 50 percent year over year, citing increased adoption of M-SAN HQ and SAN HQ neo GMP for vector manufacturing; this is a direct proxy for rising salt-tolerant nuclease utilization in GMP processes. On March 2025, c-LEcta (Sartorius group) launched the GMP-grade version of DENARASE High Salt after releasing the R&D grade in 2024, explicitly targeting high-salt viral vector processes; independent comparative work presented through Cell & Gene Therapy Insights further profiled performance characteristics of salt-tolerant endonucleases. In late 2024, QIAGEN announced new sample preparation automation initiatives and continuing platform investments supporting workflow integration around nuclease-dependent steps, signaling sustained enabling-tool innovation in the category. Together these developments highlight rapid GMP adoption, growing high-salt SKUs, and more robust analytics and ELISA kits for residual nuclease monitoring in quality control.

Asia is emerging as the fastest-growing demand center given its build-out of viral vector, plasmid DNA and vaccine manufacturing. Multiple 2025 conference agendas in Asia revolve around vector manufacturing bottlenecks, while market outlooks point to double-digit growth in vector manufacturing across key Asian countries. South Koreas viral vector and plasmid DNA manufacturing market, for example, is forecast to grow at over 20 percent CAGR through 2030, reflecting broader APAC capacity scaling that lifts the adoption of salt-tolerant nucleases for high-ionic-strength steps and intensified chromatography. Regional investments from large biopharma and CDMOs, plus regulatory roadmaps tailored for CGT across APAC, further de-risk technology transfer and process validation involving high-salt nuclease steps.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/4804194

High Salt Tolerant Universal Nuclease by Type:

GMP

Scientific Research

High Salt Tolerant Universal Nuclease by Application:

Medical Biology

Laboratory

Others

Global Top 10 Key Companies in the High Salt Tolerant Universal Nuclease Market

Thermo Fisher Scientific Inc

New England Biolabs

Bio-Techne Corporation

Genscript Biotech Corporation

AMSBIO

Acrobiosystems Co., Ltd.

Sino Biological,Inc

ProteoGenix

Novoprotein Scientific Inc

TransGen Biotech Co.,Ltd.

Regional Insights

Within Southeast Asia, Singapore anchors advanced bioprocessing and cell-and-gene therapy manufacturing, with new high-complexity biologics plants and strong public-sector support likely to increase demand for nuclease-centric impurity removal at GMP scale. Regional vaccine alliances and technology transfers are expanding ASEANs capabilities, and Indonesia, via Bio Farma, stands out for both capacity expansion and strategic collaborations with CEPI and industry partners to add rapid-response vaccine and vector capabilities. As ASEAN sites move from clinical to commercial batches and as process platforms adopt elevated ionic strengths for stability and yield, high salt tolerant nucleases become must-have raw materials to reduce viscosity, accelerate clarification and achieve residual-DNA specs at scale.

Despite growth, the category faces several hurdles. First, regulatory expectations for raw-material traceability and adventitious agent control are tightening, elevating the need for GMP documentation, validated ELISAs for residual nuclease, and secure multi-geography supply. Second, price compression could emerge as volumes rise and more entrants offer high-salt variants; however, enzyme activity per kU, impurity profiles, and downstream clearance characteristics remain key differentiators. Third, process heterogeneity across AAV, LV, and plasmid workflows means that fit-for-purpose optimization is still required to balance salt levels, nuclease dosage, and residence times. Capacity concentration in a few suppliers also creates supply-chain risk during surges in CGT demand.

Suppliers should prioritize multi-grade portfolios (R&D to GMP) with harmonized analytical kits for residuals, plus application notes for high-salt compatibility across vector types and chromatography matrices. For biomanufacturers in Asia and ASEAN, dual-sourcing from at least two high-salt nuclease brands, forward contracting of MU-scale lots, and on-site bridging studies that model ionic-strength excursions will reduce tech transfer risk. Investments in automation and integrated sample prep, aligned with vendors assay ecosystems, can compress development timelines while easing regulatory submissions.

Product Models

High salt tolerant universal nucleases are versatile enzymes engineered to retain robust activity even under high salt conditions. They non-specifically degrade all forms of DNA and RNA, making them invaluable for processes like protein purification, vaccine production, and viral vector manufacturing.

GMP-grade suited for stringent biomanufacturing and clinical applications. Notable products include:

Ultra Nuclease GMP-grade (HYC120) Hyasen Biotech: A recombinant Serratia-derived enzyme that degrades DNA/RNA to reduce viscosity and remove host nucleic acidsformulated for GMP environments and used in vaccine and biologics manufacturing.

Universal Nuclease (GMP Grade) TransGen Biotech: A non-specific endonuclease that efficiently digests DNA and RNA in multiple molecular forms, widely used in vaccine production and protein purification workflows.

GMP Salt Active GENIUSTM Nuclease - ACROBiosystems: Engineered to maintain activity in salt concentrations up to 500 mM NaCl-ideal for nucleic acid removal in high-salt biologic production processes.

Salt Active UltraNuclease GMP-grade - Yeasen Biotech: High-purity enzyme (≥98%) active in high-salt conditions, designed to improve downstream purification efficiency by reducing viscosity and nucleic acid contamination.

Salt-Active Nuclease High Quality (SAN HQ), GMP Grade - Amerigo Scientific / ArcticZymes: A GMP-compliant, high-salt active nuclease with accompanying ELISA kit for downstream process validation in biologics manufacturing.

Scientific Research-grade optimized for laboratory workflows and discovery settings. Examples include:

Salt Tolerant Nuclease (research use) LGC Biosearch Technologies: A recombinant nuclease from a psychrophilic marine bacterium, effective at degrading nucleic acids in high-salt environmentsfor viral vector and recombinant protein prep.

BenzoNuclease® Nuclease Amerigo Scientific: Research-grade Serratia-derived endonuclease used to digest all forms of nucleic acids in molecular biology labs.

SAN HQ (Research Grade) Amerigo Scientific: A research-grade salt-active nuclease, optimized for high-salt workflows common in protein and viral particle purification.

Benzonase® Alternative: Basemuncher Westburg Life Sciences: A close functional alternative to Benzonase for DNA/RNA degradation in standard lab protocols.

Benzo Nuclease Tinzyme: Another Benzonase-like enzyme, widely used in molecular biology for reducing nucleic acid contamination.

High salt tolerant universal nucleases have evolved from niche research reagents into critical raw materials for modern biologics and CGT manufacturing. The combination of robust activity at elevated ionic strength, simplified downstream clearance and GMP-grade documentation has catalyzed adoption as batches scale and regulatory limits tighten. With 2024 market value near USD 87 million and a projected 22% CAGR through 2031, the categorys growth is tightly coupled to APAC capacity expansion, ASEAN vaccine and vector initiatives, and a steady flow of enabling-tool innovations.

Investor Analysis

For investors, this segment offers exposure to a high-growth picks-and-shovels theme within CGT and advanced vaccines. What matters is the convergence of three durable drivers: rising vector and plasmid volumes, process intensification favoring high-ionic-strength steps, and global GMP harmonization. How value accrues is through portfolio breadth (R&D to GMP), validated analytics for residuals, and Asia-centric commercial execution where capacity is being built fastest. Why it benefits investors is the attractive mix of high gross margins typical of specialty enzymes, increasing switching costs once validated into GMP processes, and recurring revenue as customers lock in multi-MU contracts and dual-source across two or three brands to secure supply.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/4804194

5 Reasons to Buy This Report

It quantifies the 2024 market size and provides a defensible 20242031 growth trajectory, triangulated against multiple adjacent market trackers and openly published price benchmarks.

It integrates current, dated news on product launches and supplier momentum that directly influence demand in GMP environments.

It converts public price sheets into unit-volume estimates, giving a pragmatic view of demand elasticity and procurement planning.

It drills into Asia and ASEAN, with specific Indonesia context, linking capacity build-outs and alliances to nuclease consumption growth.

It delivers actionable sourcing and validation guidance that can shorten tech transfer timelines and de-risk regulatory submissions.

5 Key Questions Answered

What is the global market size for high salt tolerant universal nucleases in 2024 and the implied CAGR through 2031, and how does this compare with adjacent nuclease estimates?

How are Asia and ASEAN capacity expansions, particularly in Singapore and Indonesia, translating into near-term demand for salt-tolerant nucleases?

Which suppliers are shaping product roadmaps and GMP documentation, and what do their latest dated updates reveal about adoption curves?

What are realistic ASPs at the kU and MU scales, and how do these map to total units sold globally under conservative and aggressive scenarios?

What strategies should buyers and investors pursue to mitigate supply risk, manage cost per batch, and validate residuals under high-salt conditions?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release High Salt Tolerant Universal Nuclease Market to Reach CAGR 22% by 2031 Top 10 Company Globally here

News-ID: 4155051 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for GMP

Creative Peptides Released GMP Synthesis Service

Located in Shirley, New York, the world’s leading peptide supplier Creative Peptides announced the launch of its GMP synthesis (https://www.creative-peptides.com/services/custom-gmp-peptide-synthesis-services.html ) business on August 29, 2018. Now this company is focused on the development and GMP manufacturing of pharmaceutical grade peptides.

As the demand of pharmaceutical market continues to grow, more and more pharmas and research institutions choose the CMO and CRO models to expand their businesses, which is more…

Diapharm implements European GMP guidelines in China

Münster (DE), London (UK), Ningbo (CN), 20 December 2013 – Pharmaceutical service provider Diapharm (diapharm.com) is increasing its business activities in China: Diapharm has now implemented a “European” quality management system for Neptune Pharma Ltd (www.neptunepharma.com) in their Joint Venture Partner’s factory in Ningbo, Zhejiang Province. And it has done so successfully: The veterinary medicinal product Trident 500mg/g Powder for Suspension for Fish Treatment (www.trident-50.com), is manufactured onsite under EU…

ECA Foundation releases free GMP WebApp

The ECA Foundation has been providing advanced training and information services in the pharmaceutical industry and especially with regard to pharmaceutical Quality Assurance and GMP compliance for more than 10 years. Now the organisation took advantage of its extensive experience to develop a further free of charge service – the new GMP WebApp.

This new GMP WebApp runs on all smartphones and tablet PCs (Apple and Android platforms) and allows users…

GMP Friction Products Awarded ISO 9001:2008

Internationally Recognized Certification Measures Consistency in Process, Procedure and Quality Performance in Manufacture of Friction Materials

AKRON, OH (March 23, 2011) -- GMP Friction Products, a world leader manufacturing powdered metal friction products for clutch plates and brake pads, recently received certification for ISO 9001:2008.

“ISO 9001:2008 signifies we have taken the extra measure of documenting the policies and standards to ensure consistent compliance with our manufacturing processes,” said Jerry Lynch,…

GMP MANUAL Volume 2 - Validation Procedures by Maas & Peither AG – GMP Publish …

GMP Publishing is launching its new GMP MANUAL Volume 2 – Validation Procedures.

The compendium on validation procedures was written by Dr. Doris Borchert, Dr. Peter Bosshard, Dr. Ralph Gomez, Dr. Michael Hiob, Dr. Christine Oechslein, Max Lazar, Ulrike Reuter, Michael Schulte, Uwe Schwarzat – all international experts and key opinion leaders. They share their detailed understanding of the various aspects of the validation process in clear and comprehensive style…

blue inspection body celebrates 50 GMP audits

Münster (Germany), 20 November 2009. Two years after founding the company and just 18 months after gaining the accreditation blue inspection body GmbH announced today the successful execution of its 50th GMP audit. Further audit trips to China, India, Israel and various European countries have been scheduled already, meaning that in the first quarter 2010 the 75th audit is targeted to be completed. Blue, as a privately organised inspection body,…