Press release

Critical Illness Insurance Market Landscape 2025: Forecast Data and Growth Strategy Insights

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Is the Expected CAGR for the Critical Illness Insurance Market Through 2025?

The market size of critical illness insurance has experienced swift expansion in the past few years. The market size, which sits at $286.98 billion in 2024, is predicted to increase to $330.36 billion in 2025, reflecting a compound annual growth rate (CAGR) of 15.1%. The historic period's growth can be linked to aspects such as healthcare expenditures, advancements in medicine, public consciousness, and education, lifestyle-related factors, and employer-provided benefits.

What's the Projected Size of the Global Critical Illness Insurance Market by 2029?

Expectations are high for substantial expansion in the critical illness insurance market size over the coming years. By 2029, it is projected to reach a sizable $529.26 billion, with a compound annual growth rate (CAGR) of 12.5%. This anticipated growth in the forthcoming period is reflective of multiple factors including an aging demographic, rising disease incidents, soaring healthcare expenditures, personal finance strategies, and advancements in technology. Key development trends to watch out for during this forecast period consist of digital modernization, tailored insurance deliverables, policies covering heart ailments, and multi-illness coverage plans.

View the full report here:

https://www.thebusinessresearchcompany.com/report/critical-illness-insurance-global-market-report

Top Growth Drivers in the Critical Illness Insurance Industry: What's Accelerating the Market?

The global critical illness insurance market is being propelled by the rising occurrence of critical illnesses. Significant medical expenses arise from treating critical diseases such as cancer, hence the value of obtaining a critical illness insurance policy that mitigates the financial impact of these costs. Insurance companies offer a single, large sum to the insured person upon diagnosis of a critical disease. Common examples of these severe illnesses are heart attacks, strokes, and coronary artery bypasses. The American Cancer Society, a professional company based in the United States, speculated in September 2024 that global cancer incidences in men are set to shoot up by 84%, escalating from 10.3 million cases in 2022 to 19 million by 2050, whereas cancer fatalities are forecasted to grow by 93%, from 5.4 million in 2022 to 10.5 million. Consequently, the escalating rate of critical illnesses is anticipated to stimulate the growth of the global critical illness insurance market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=4004&type=smp

What Trends Will Shape the Critical Illness Insurance Market Through 2029 and Beyond?

The critical insurance market is being significantly influenced by the trend of expanding the spectrum of critical illnesses covered in insurance policies. Principal insurance firms are broadening their coverage to include a variety of new diseases alongside cancer, stroke, coronary artery bypass, and heart attack, such as Alzheimer's ailment, multiple sclerosis, Parkinson's disease, and motor neuron disorders. For example, data from the Parkinson's Foundation highlights that 1 million individuals are living with the disease in the US, a figure projected to rise to 1.2 million by 2030. This widened coverage of critical illnesses is driving the surge in insurance policy trends.

What Are the Main Segments in the Critical Illness Insurance Market?

The critical illness insurance market covered in this report is segmented -

1) By Type: Individual Insurance, Family Insurance

2) By Premium Mode: Monthly, Quarterly, Half Yearly, Yearly

3) By Application: Cancer, Heart Attack, Stroke, Other Applications

Subsegments:

1) By Individual Insurance: Heart Attack Insurance, Stroke Insurance, Cancer Insurance, Organ Transplant Insurance, Kidney Failure Insurance

2) By Family Insurance: Family Floater Plans, Dependent Coverage, Child Coverage Plans

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=4004&type=smp

Which Top Companies are Driving Growth in the Critical Illness Insurance Market?

Major companies operating in the critical illness insurance market include China Life Insurance Company Limited, Allianz SE, Ping An Insurance Company of China Ltd., Aviva plc, Legal and General Group plc, China Pacific Insurance Co. Ltd., Prudential plc, New China Life Insurance Co. Ltd., Aegon NV, AXA SA, American International Group Inc., Sun Life Financial Inc., Aflac Inc., Huaxia Life Insurance Co., Ltd., MetLife Inc., Zurich Insurance Group Ltd., Hospitals Contribution Fund of Australia Limited, Dai-ichi Life Insurance Company Limited, UnitedHealthcare Inc., Liberty Mutual Group, Bajaj Allianz General Insurance Company Limited, Cigna Group, Future Generali India Insurance Company Limited, Royal London Mutual Insurance Society Limited, Plum Benefits Private Limited, Tata AIG General Insurance Company Limited, AmMetLife Insurance Berhad, Manulife Financial Corporation, Great-West Lifeco Inc., Canada Life Assurance Company, Chubb Limited, Assurity Life Insurance Company, Colonial Life and Accident Insurance Company, Mutual of Omaha, New York Life Insurance Company

Which Regions Will Dominate the Critical Illness Insurance Market Through 2029?

The countries covered in the critical illness insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=4004

"This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work."

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Critical Illness Insurance Market Landscape 2025: Forecast Data and Growth Strategy Insights here

News-ID: 4154369 • Views: …

More Releases from The Business Research Company

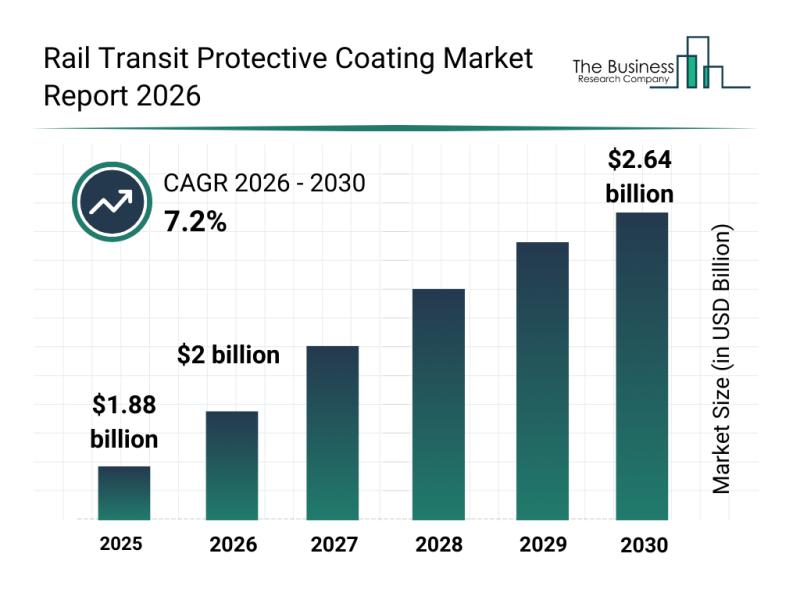

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

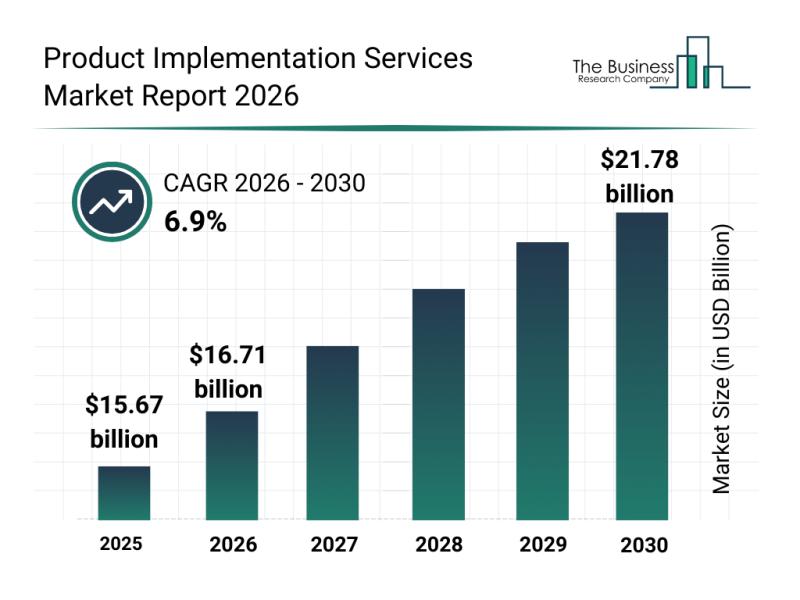

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

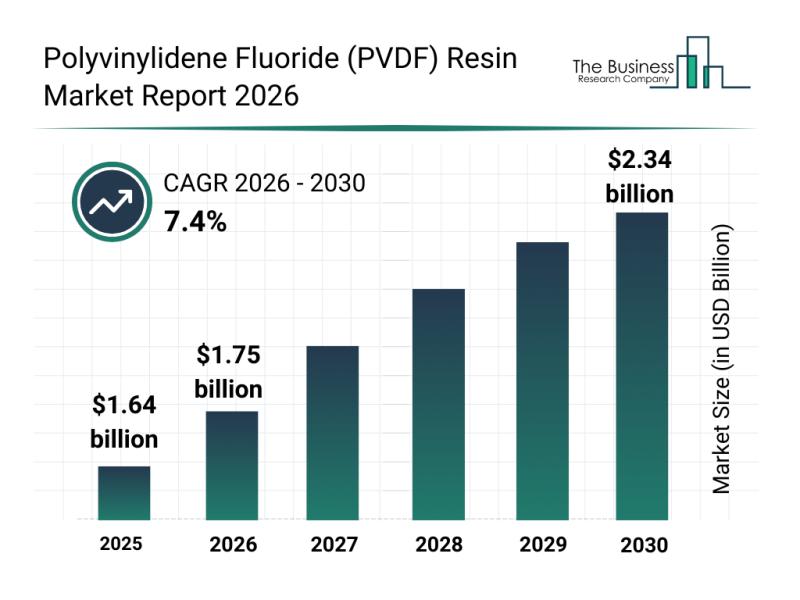

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

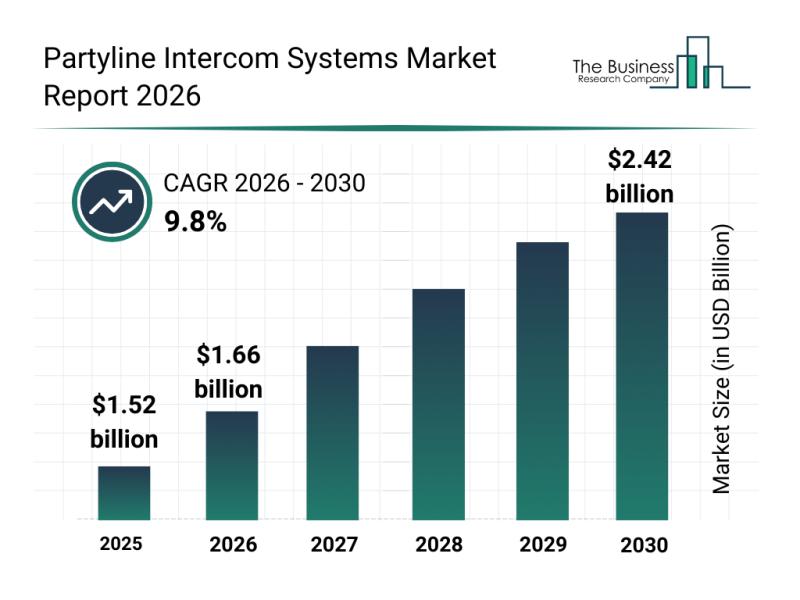

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…