Press release

Burial Insurance Market Set for Steady 5.4% CAGR Growth from 2025-2032, Reveals Persistence Market Research

The global burial insurance market is poised for steady growth, rising from a valuation of US$ 312 million in 2025 to an estimated US$ 449.4 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.4% during the forecast period. Burial insurance-also known as final expense insurance-has gained significant traction as families increasingly prioritize financial security for end-of-life expenses. It is designed to ease the financial burden of funeral and burial costs, which continue to climb globally.Key growth drivers include the aging global population, escalating funeral expenses, and growing public awareness around pre-need planning. According to Persistence Market Research, North America will remain the dominant region in the market, projected to hold 37.4% market share in 2025, thanks to a mature insurance infrastructure, high funeral costs, and a growing elderly demographic. Among policy types, modified death benefit plans lead the market, expected to contribute 44.7% to the global revenue due to their flexibility in premium adjustments.

Get a Sample Copy of Research Report (Use Corporate Mail id for Quick Response): https://www.persistencemarketresearch.com/samples/35169

Key Highlights from the Report

• Modified death benefit plans will dominate the market with a 44.7% share in 2025 due to flexible premium features.

• North America is expected to lead globally with a 37.4% market share by 2025.

• The over 70 age group is projected to hold 34.6% market share, driven by rising chronic conditions.

• Insurance brokers will manage 48.7% of market distribution in 2025.

• The market will grow at a 5.4% CAGR between 2025 and 2032.

• The digital transformation of insurance platforms will play a pivotal role in increasing market accessibility.

Market Segmentation

By Insurance Coverage

The burial insurance market is segmented by insurance coverage into level death benefit, guaranteed acceptance, and modified or graded death benefits. Among these, modified or graded plans are expected to lead with 44.7% market share in 2025. Their appeal lies in flexible premium structures and phased payout options, which attract customers unable to afford high initial premiums.

Level death benefit plans, however, are gaining traction for their full immediate coverage and lower rates over time. Meanwhile, guaranteed acceptance policies continue to attract seniors and individuals with pre-existing conditions, offering simplified issue policies without medical examinations, albeit with waiting periods and limited initial benefits.

By End User Age Group

The over 70 age group dominates the market with a 34.6% share, attributed to higher instances of cardiovascular disease, cancer, and age-related illnesses. These individuals typically seek robust policies to ensure their families face no financial burden upon death. The over 50 to 60 group is also a key segment, increasingly engaging in pre-need planning to lock in affordable rates while still in relatively good health.

Seniors over 80 face higher premiums and limited plan options but still drive demand for modified benefit plans. As awareness of funeral costs grows, burial insurance is becoming an essential part of retirement planning for people of all age groups over 50.

Read Detailed Analysis: https://www.persistencemarketresearch.com/market-research/burial-insurance-market.asp

Regional Insights

North America

North America is set to remain the largest market for burial insurance, driven by rising healthcare costs and an aging population. The region, particularly the U.S., is witnessing a surge in bundled plans combining health, life, and funeral insurance. With funeral costs averaging US$ 7,000 to US$ 12,000, pre-need insurance is becoming a standard financial planning tool for American families.

Europe

Europe is witnessing the rise of group funeral insurance, especially in countries like the Netherlands, Germany, and the U.K., where coverage costs are integrated into workplace and union benefits. With funeral costs ranging from €3,500 to €6,500, this approach significantly alleviates the financial burden. The adoption of digital platforms and prepaid funeral services is enhancing accessibility, especially in Western Europe.

Asia Pacific

The Asia Pacific region is experiencing strong growth in burial insurance due to its diverse cultural funeral practices. In Japan, policies tailored for cremation dominate, while in India and China, insurers offer specialized products for traditional and religious ceremonies. Rising life expectancy and increased financial literacy are key drivers of market growth in this region.

Market Drivers

1. Increasing Funeral Costs and Aging Population

The most significant driver for burial insurance is the rising cost of funerals, now averaging over US$ 7,848 in the U.S., with burial services exceeding US$ 9,000. As global life expectancy rises, more individuals are proactively seeking burial insurance to relieve their families of future financial stress. This trend is especially prominent in aging societies such as Japan, Canada, and Western Europe.

2. Insurer Innovation and Marketing Strategies

Insurers are actively marketing burial insurance plans as accessible, flexible financial tools. Companies like Mutual of Omaha, Colonial Penn, and Globe Life have introduced online platforms, simplified underwriting processes, and waived premiums for initial months, encouraging more consumers to adopt burial insurance. Additionally, funeral service providers such as Dignity Memorial offer bundled funeral arrangements with insurance options.

3. Integration with Palliative and Hospice Care

Burial insurance is increasingly seen as a complement to palliative and hospice care, easing end-of-life planning for families and reducing the burden on healthcare systems. This is especially evident in healthcare-focused nations like Japan, where over 28% of the population is over 65, and burial insurance has increased by 20% since 2020.

Market Restraints

1. Fraud and Misleading Marketing Tactics

The burial insurance sector faces significant challenges from deceptive advertising practices, particularly targeting the elderly. Ads promising "coverage for pennies a day" often result in underinsured policies, leading to consumer dissatisfaction and distrust. Fraudulent operators, like Executives Financial Group, have seniors by offering false "government-backed" burial plans, resulting in millions in financial losses.

2. Limited Consumer Awareness in Emerging Markets

In developing countries, low insurance penetration and lack of financial literacy hamper market growth. Cultural taboos surrounding death and limited regulatory frameworks also slow the adoption of burial insurance in regions such as parts of Africa, Latin America, and Southeast Asia.

Market Opportunities

1. Expansion of Digital Distribution Channels

The rise of online platforms and insurtech solutions offers immense potential. With over 60% of consumers preferring online insurance research and purchase, companies are launching mobile apps, instant quote generators, and AI-powered chatbots to streamline the user experience. Partnerships between telecom firms and insurance providers are bringing low-cost burial insurance to underserved rural populations in Africa and Asia.

2. Growing Demand for Customization

Today's consumers seek personalized insurance plans. Burial insurance providers are innovating with custom benefit packages, flexible term options, and bundling with health and life policies. In countries like India, Japan, and Indonesia, insurers now offer burial insurance plans aligned with cultural and religious practices.

Request for Customization of the Research Report: https://www.persistencemarketresearch.com/request-customization/35169

Reasons to Buy the Report

• Comprehensive insights into emerging trends and future projections through 2032

• Strategic analysis of key market segments and insurance coverage types

• Detailed competitor profiling and recent industry developments

• Regional breakdown highlighting specific opportunities and threats

• Expert insights from Persistence Market Research for data-backed decision-making

Frequently Asked Questions (FAQs)

• How big is the burial insurance market in 2025 and what is its forecast through 2032?

• What is the projected growth rate of the burial insurance market globally?

• Who are the key players in the global burial insurance market?

• What are the leading segments and regions in the burial insurance industry?

• Which region is estimated to dominate the industry through the forecast period?

Company Insights

• The Baltimore Life Insurance Company

• United Home Life Insurance Company

• Allianz Life

• State Farm Mutual Automobile Insurance Company

• New York Life Insurance

• Gerber Life Insurance Company

• AAA Life Insurance Company

• Sagicor Life Insurance Company

• Globe Life and Accident Insurance Company

• Assurity Life Insurance Company

• Colonial Penn

• Fidelity Life Association

• Foresters Financial

• Sentinel Security Life Inc.

• Progressive Casualty Insurance Company

• Mutual of Omaha Insurance Company

• Choice Mutual

• AIG

• Transamerica

Recent Industry Developments

• In December 2024, National Guardian Life Insurance Company launched a funeral home support line, enhancing claims processing and customer service for funeral directors.

• In October 2024, Sanlam Life Insurance Uganda rolled out a new family-focused burial insurance plan with digital enhancements for easier policy management.

Conclusion

As the global population ages and funeral expenses continue to rise, burial insurance is evolving into a critical financial product, offering peace of mind and financial stability. While North America remains the market leader, opportunities are emerging across Europe, Asia Pacific, and Africa through digital platforms and culturally tailored insurance products.

Companies that innovate in policy customization, leverage digital distribution, and maintain transparency in their marketing will capture growing consumer demand. With a forecasted CAGR of 5.4% and increasing global adoption, the burial insurance market is positioned for sustainable growth through 2032 and beyond.

Read More Related Reports:

Perineal Care Market https://www.persistencemarketresearch.com/market-research/perineal-care-market.asp

Budesonide Market https://www.persistencemarketresearch.com/market-research/budesonide-market.asp

Stem Cell Assay Market https://www.persistencemarketresearch.com/market-research/stem-cell-assay-market.asp

Invisible Orthodontics Market https://www.persistencemarketresearch.com/market-research/invisible-orthodontics-market.asp

Orthopedic Implants Market https://www.persistencemarketresearch.com/market-research/orthopedic-implants-market.asp

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Burial Insurance Market Set for Steady 5.4% CAGR Growth from 2025-2032, Reveals Persistence Market Research here

News-ID: 4153059 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

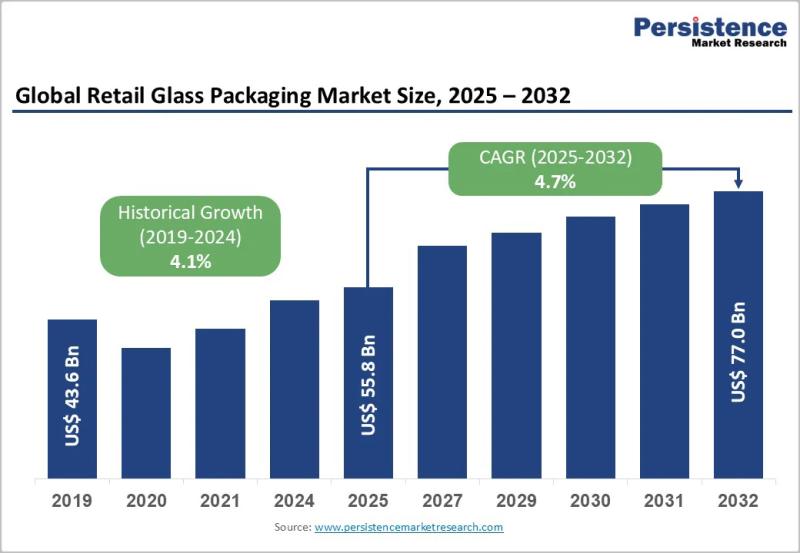

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…