Press release

Silicon Irradiance Sensors Market to Reach CAGR 6,6% by 2031 Top 15 Company Globally

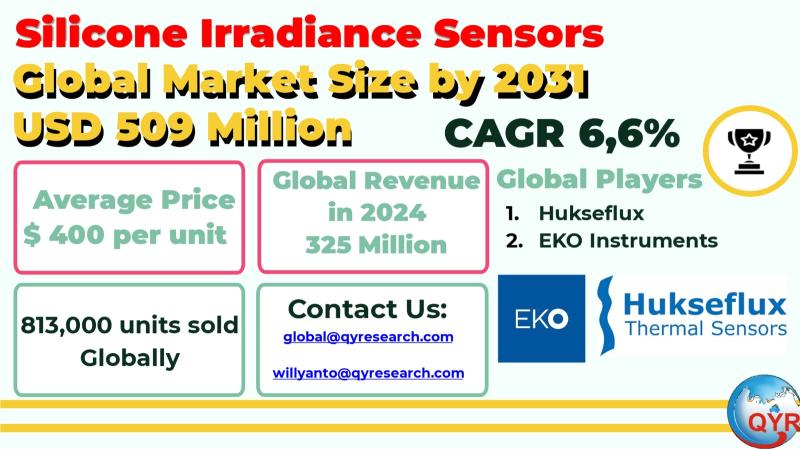

Silicon irradiance sensors often called silicon pyranometers or reference-cell irradiance sensors convert incident solar radiation into electrical signals to monitor PV performance, validate energy yields, drive tracker controls, and underpin compliance with PV monitoring standards. Compared with thermopile pyranometers, silicon devices offer faster response, lower cost, and easier integration, making them common on utility-scale PV plants, rooftop systems, and testbeds where high temporal resolution is prioritized and where site classes allow Class C/second class instruments under IEC 61724-1. The industry spans specialized sensor makers, PV monitoring OEMs, and calibration labs, tied together by evolving international standards such as IEC 61724-1:2021 for PV monitoring and ISO 9847:2023 for pyranometer calibration.The silicon-based irradiance sensors global market size around USD 325 million in 2024. CAGR of about 6,6%, implying a market reaching approximately USD 509 million by 2031. Average selling price for these sensors range around USD 400 per unit and around 813,000 units sold globally. These figures align with parallel estimates for pyranometers and silicon pyranometers that indicate mid-single- to high-single-digit growth as PV capacity expands and monitoring standards tighten.

.

Latest Trends and Technological Developments

The pace of product innovation remains strong, shaped by durability, reduced maintenance, and integration with IEC-compliant monitoring. On August 2025, EKO Instruments announced a two-year technical sponsorship with UC Berkeleys CalSol solar-car team to supply irradiance, heat-flux, and temperature sensors, highlighting the push toward real-time, embedded measurement in mobile PV applications. In June 2025 communications and event listings, Hukseflux previewed new solar-radiation sensors for Intersolar Europe 2025, signaling continued emphasis on ruggedized, networkable instruments; the company also points to the industrys shift to improved diffuse measurement (SRD100 diffusometer) that complements plane-of-array sensors. Earlier, Kipp & Zonen (OTT HydroMet) introduced the SMP12 spectrally flat Class A pyranometer with solid-state dome heating and enhanced surge protection, improving uptime in icing and soiling conditions and reinforcing the standards-driven migration to higher accuracy tiers even when silicon reference sensors are used elsewhere on site. Standards continue to steer designs: IEC 61724-1:2021 codifies sensor accuracy classes for PV monitoring, and ISO 9847:2023 updated pyranometer calibration procedures with greater focus on indoor methods all of which raise the compliance bar for vendors and EPCs. In August 2024, the IEA PVPS bifacial tracking best-practices report reinforced albedo/irradiance sensor siting guidance for bifacial arrays, underscoring the demand for multi-point silicon-based measurements in utility PV.

Asia remains the gravitational center of PV additions and, by extension, irradiance sensor demand. Chinas continuing utility-scale buildout and Japans high-spec monitoring culture sustain both reference-cell and thermopile deployments, while Indias grid-scale tenders and rooftop expansion broaden the installed base. Regional stakeholders increasingly align to IEC 61724-1 monitoring frameworks and tighter calibration practices as lenders and insurers scrutinize performance risk, with standards adoption serving as a catalyst for higher sensor penetration per megawatt. Broader IEA forecasts anticipate solar PV dominating renewable additions through 2030, reinforcing multi-year demand for irradiance measurement equipment across Asian supply chains and PV plants.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/4924252

Silicon Irradiance Sensors by Type:

Reference Cell Based Sensors

Photodiode Based Sensors

Integrated Pyranometer Style Silicon Sensors

Others

Silicon Irradiance Sensors by Application:

Building and Construction

Agriculture and Horticulture

Industrial and Manufacturing

Others

Global Top 15 Key Companies in the Silicon Irradiance Sensors Market

Kipp & Zonen

Apogee instruments

Hukseflux Thermal Sensors

EKO Instruments

Campbell Scientific

Delta-T Devices

LI-COR Biosciences

OTT HydroMet

Skye Instruments

GHI Sensors

Sendrop

Spectrafy

Solmetric

Rika Sensors

Apresys instruments

Regional Insights

Southeast Asias push to scale PV is creating a step-change in monitoring intensity. Vietnam is pivoting back toward large-scale solar in 2025 after grid constraints slowed projects, a shift that will require robust plant-level DAQ and sensor suites; however, ongoing feed-in-tariff disputes and payment uncertainty pose near-term investment risk and may delay sensor procurement for some assets until PPA clarity improves. Malaysias LSS5 program targets additional capacity by 2026, fostering demand for IEC-compliant site monitoring and bankable O&M data. Regionally, ASEAN bodies encourage harmonization of PV and BESS safety standards, which typically flow down to tighter monitoring specifications on irradiance, temperature, soiling, and wind supporting a thicker sensor stack even on smaller plants. In Indonesia, the 2024 rooftop solar regulation (MEMR 2/2024) introduces capacity quotas and new procedures; as the market professionalizes under these rules, developers and PLN-interconnected sites are expected to standardize on plane-of-array irradiance sensors and calibrated references to reduce billing disputes and meet interconnection requirements over time.

Despite resilient demand, three constraints weigh on the market. First, policy uncertainty in key ASEAN markets such as Vietnam can slow procurement cycles and elongate receivables for monitoring packages that include irradiance sensors. Second, standard-driven accuracy requirements push owners toward thermopile Class A devices for primary irradiance while silicon sensors occupy POA or redundancy roles, compressing margins in commoditized silicon segments unless vendors differentiate on diagnostics, heating, or surge protection. Third, supply-chain frictions and calibration capacity bottlenecks persist in peak seasons as owners align with ISO 9847:2023 recalibration intervals and lender technical adviser requirements.

Vendors and investors should prioritize solutions that pair silicon irradiance sensors with complementary diffuse/albedo sensing and on-board diagnostics, thus addressing IEC class requirements at the system level while preserving cost advantages in POA measurement. Expanding regional calibration and service hubs in ASEAN shortens turnaround time and strengthens bankability narratives for local projects. Partnerships with data-platform providers and tracker OEMs can translate faster silicon response into improved control algorithms, reducing clipping and wake losses in variable conditions especially in tropical ASEAN climates characterized by fast-moving cloud fields. Aligning product roadmaps to updated standards and to bifacial best practices will position suppliers to win EPC specifications and O&M retrofits.

Product Models

Silicon irradiance sensors leverage semiconductor technology to measure solar radiation with precision and affordability.

Reference cell-based sensors use silicon solar cells calibrated to mimic photovoltaic (PV) module behavior, providing accurate irradiance data for solar performance monitoring. Notable products include:

TRISense IR-MOD-T-Ta - Trinity (TRISENSE): Monocrystalline silicon cell with temperature compensation and MODBUS output; calibrated to PTB standards.

IMT Si-V-1.5TC-batt - IMT Solar: Battery-powered reference cell with active temperature compensation and ultra-low power draw (~15 μA).

i-EM Distributed Si Sensor - i-EM (Ingenieurbüro Mencke & Tegtmeyer): Reference cell matching PV module spectral response, with analog or MODBUS options and temperature compensation.

SunCel 3.0 Photovoltaic Reference Cell - TTA, Inc.: Laboratory-calibrated silicon PV cell with Pt100 temperature probes, wind speed input, and multiple analog/protocol outputs.

CS325DM-L Atonometrics: : Rugged, PV-module-style irradiance sensor with analog/digital outputs and built-in temperature compensation; now retired

Photodiode-based sensors rely on the current response of silicon photodiodes to optical radiation ideal for compact, fast-response measurements. Examples include:

PD300-3W Silicon Photodiode Sensor Ophir Photonics: Measures optical power up to 3 W with 10×10 mm aperture; covers 3501100 nm spectrum.

LPUVA03 Series Senseca: Radiometric probe for UVA irradiance using a photodiode, blind to visible and IR light.

ML-01 Si-Pyranometer EKO Instruments: An industrial-grade silicon pyranometer with fast response, UV-resistant diffuser, and excellent cosine response even at low solar angles.

SP-215-SS Amplified Pyranometer (05 V Output) Apogee Instruments: Its designed for harsh environments with a self-cleaning housing and is commonly used in agricultural, ecological, and PV monitoring settings.

LP471BLUE Probe Senseca: Measures irradiance specifically in the blue-light spectrum with a photodiode element

Integrated pyranometer-style silicon sensors combine photodiodes with diffusers to approximate a true pyranometers cosine response, offering a lightweight and cost-effective solution for solar irradiance measurement. Notable products include:

LPSILICON-PYRA04 Senseca (Delta OHM): A high-precision silicon photodiode-based pyranometer with cosine-corrected diffuser, ISO 9060 Class C, sensing global solar irradiance in the 4001100 nm range. Ideal for meteorology and solar energy monitoring.

ML-01 Si-Pyranometer EKO Instruments: A compact, industrial-grade silicon pyranometer (ISO 9060 Class C) with fast response and UV-resistant diffuser, delivering excellent cosine behavior and broad applicability from solar to agricultural use.

SP Lite2 Silicon Pyranometer Omni Instruments / EcoTech Umwelt-Meßsysteme GmbH: A cost-effective, durable silicon-cell pyranometer with conical diffuser (4001100 nm) rated ISO 9060 Class C, designed for routine solar irradiance measurement in all-weather conditions.

240-SP Silicon-Cell Pyranometers NovaLynx Corporation: A rugged series featuring multiple output options (0400 mV, 05 V, 420 mA, USB data logger), self-cleaning head, rapid response, and cost-effective alternatives to thermopile pyranometers, for applications in agriculture, meteorology, and PV system monitoring.

Novalynx Silicon Pyranometer Aeroqual / NovaLynx: A small, robust silicon pyranometer with a photovoltaic detector and cosine-corrected head, offering ±5% accuracy a compact, economical choice for integrated weather or air quality stations

Silicon irradiance sensors will continue to scale in lockstep with PV additions worldwide and especially across Asia and ASEAN, where a blend of new utility plants, rooftop mandates, and lender scrutiny is pushing owners toward denser, smarter monitoring. With a 2024 market baseline near USD 325 million and a modeled 6,6% CAGR to 2031, this niche will reward firms that align with IEC/ISO requirements, deliver maintenance-light designs with built-in diagnostics, and provide credible calibration and data services close to growing markets. Recent product advances and standards updates point to a market where performance risk is increasingly priced and where accurate, reliable irradiance sensing materially affects revenue certainty.

Investor Analysis

For investors, understanding irradiance sensor adoption is a practical leading indicator for PV asset quality, curtailment risk mitigation, and O&M sophistication. What matters is that lenders, insurers, and PPAs increasingly condition financing and availability metrics on IEC 61724-1 monitoring classes; portfolios that standardize on compliant silicon POA sensors plus higher-class references show fewer disputes over underperformance and more reliable yield attribution. How this translates into value is twofold: first, equipment and service vendors with strong Asia/ASEAN footprints and calibration capacity capture recurring revenue through recalibration, spares, and data subscriptions; second, PV asset owners that budget for robust monitoring typically reduce uncertainty premiums in financing costs and unlock higher leverage. Why now is compelling because ASEANs policy push and pipeline recovery mean monitoring choices are being baked into BOQs today, while recent news highlights both upside (new programs in Malaysia, regulatory maturation in Indonesia) and risk (policy reversals in Vietnam) that sophisticated monitoring can partially hedge by documenting performance unambiguously.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/4924252

5 Reasons to Buy This Report

It provides a reconciled 2024 market size baseline for silicon irradiance sensors using multiple third-party sources and explains the differences in scope, enabling more defensible financial models.

It quantifies a 20242031 CAGR and derives a transparent forecast to 2031, facilitating revenue sizing for product and service lines.

It translates standards changes (IEC 61724-1:2021 and ISO 9847:2023) into concrete procurement and calibration implications relevant to EPC bids and lender technical reviews.

It offers Asia and ASEAN-specific insights, including policy and program updates in Indonesia, Vietnam, and Malaysia that directly influence monitoring specifications and timelines.

It profiles leading vendors and highlights differentiators investors can use to evaluate moat strength in bids and M&A screens.

5 Key Questions Answered

What is the most credible 2024 market size for silicon irradiance sensors and how does it compare to broader irradiance-sensor and pyranometer markets across sources?

How fast will the market grow to 2031 and what are the drivers and risks that bound the 68% growth corridor?

Which standards and calibration updates most affect purchasing decisions and O&M budgets over the next planning cycle?

How will Asia and ASEAN policy and grid conditions shape sensor mix, density, and service demand, particularly under Indonesias MEMR 2024, Malaysias LSS5, and Vietnams evolving incentives?

Which vendors are best positioned to win in Asia/ASEAN on technology, service coverage, and bankability, and where are the white-space opportunities for partnerships or consolidation?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Silicon Irradiance Sensors Market to Reach CAGR 6,6% by 2031 Top 15 Company Globally here

News-ID: 4152954 • Views: …

More Releases from QY Research

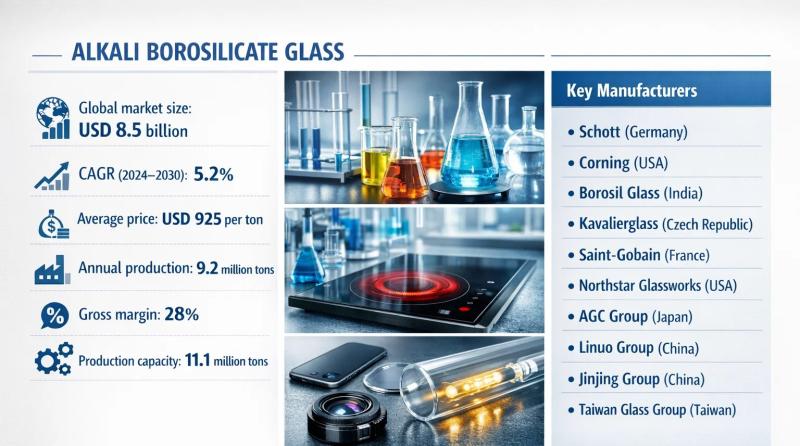

Market Overview - Alkali Borosilicate Glass

QY Research has recently published a comprehensive market study on Alkali Borosilicate Glass, a widely used technical glass material combining good thermal stability, chemical resistance, and cost efficiency. Positioned between soda-lime glass and high-boron borosilicate glass, alkali borosilicate glass is extensively applied in pharmaceutical packaging, laboratory ware, lighting, display components, and industrial glass assemblies.

The market is transitioning from commodity glass supply toward application-specific formulations optimized for thermal shock resistance, ion…

Global and U.S. Spot Meters Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Spot Meters, are handheld or portable light-measuring instruments designed to measure the intensity of light from a very small, specific area (or "spot") within a scene. Using a narrow measurement angle, they allow precise evaluation of luminance or illuminance from targeted points, making them especially useful in photography, cinematography, lighting design, display calibration, and industrial inspections where accurate exposure or…

Global and U.S. Intralogistics Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Intralogistics Robots, automated robotic systems designed to handle internal material movement, storage, picking, sorting, and palletizing within warehouses, distribution centers, and manufacturing facilities. Intralogistics robots form the physical execution layer of smart logistics, integrating closely with WMS, MES, and ERP platforms to enable high-throughput, flexible, and data-driven material flows. As labor shortages, SKU complexity, and fulfillment speed requirements intensify, this…

Top 30 Indonesian Personal Care Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Unilever Indonesia Tbk (UNVR) personal care leader

PT Victoria Care Indonesia Tbk (VICI) cosmetics & body care

PT Kino Indonesia Tbk (KINO) wide personal care portfolio

PT Mandom Indonesia Tbk (TCID) grooming & cosmetics

PT Mustika Ratu Tbk (MRAT) heritage cosmetics & herbal

PT Martina Berto Tbk (MBTO) cosmetics manufacturer

PT Akasha Wira International Tbk (ADES) …

More Releases for Silicon

Silicon Carbide Ceramics and Silicon Nitride Ceramics

Overview of Silicon Carbide Ceramics [https://www.rbsic-sisic.com/wear-resistant-silicon-carbide-ceramic-tiles-3.html]

Silicon carbide ceramics are a new type of ceramic material made mainly from silicon carbide powder through high-temperature sintering. Silicon carbide ceramics have high hardness, wear resistance, corrosion resistance, and excellent high temperature resistance, with excellent mechanical, thermal, and electrical properties. Silicon carbide ceramics can be divided into compacted sintered silicon carbide ceramics and reaction sintered silicon carbide ceramics due to different firing processes.

Overview of…

High Purity Silicon Metal Market Growth Forecast: Latest Research Unveils Opport …

Global High Purity Silicon Metal Market Overview:

Global High Purity Silicon Metal Market Report 2022 comes with the extensive industry analysis by Introspective Market Research with development components, patterns, flows and sizes. The report also calculates present and past market values to forecast potential market management through the forecast period between 2022-2028.

This research study of High Purity Silicon Metal involved the extensive usage of both primary and secondary data sources. This…

Future Prospects of Silicon Rings and Silicon Electrodes for Etching Market by …

The Silicon Rings and Silicon Electrodes for Etching Market research report provides all the information related to the industry. It gives the outlook of the market by giving authentic data to its client which helps to make essential decisions. It gives an overview of the market which includes its definition, applications and developments and manufacturing technology. This Silicon Rings and Silicon Electrodes for Etching market research report tracks all the…

Silicon Metal Market Global Outlook 2021-2026: Ferroglobe, Mississippi Silicon, …

The Global Silicon Metal Market Research Report 2021-2026 is a valuable source of insightful data for business strategists. It provides the industry overview with growth analysis and historical & futuristic cost, revenue, demand, and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Market study provides comprehensive data which enhances the understanding, scope, and application of this report.

The market…

Global Solar Grade Multi-Crystal Silicon Market Leading Major Players – GCL-Po …

Researchmoz added Most up-to-date research on "Global (United States, European Union and China) Solar Grade Multi-Crystal Silicon Market Research Report 2019-2025" to its huge collection of research reports.

The Solar Grade Multi-Crystal Silicon market report [6 Year Forecast 2019-2025] focuses on Major Leading Industry Players, providing info like company profiles, product type, application and regions, production capacity, ex-factory price, gross margin, revenue, market share and speak to info. Upstream raw materials…

Silicon Metal Market 2018: Top Key Players H.C. Starck, Elkem, Zhejiang Kaihua Y …

Silicon Metal Market Status and Forecast 2025

This Write up presents in detail analysis of Silicon Metal Market especially market drivers, challenges, vital trends, standardization, deployment models, opportunities, future roadmap, manufacturer’s case studies, value chain, organization profiles, Sales Price and Sales Revenue, Sales Market Comparison and strategies.

The Silicon Metal market Report provides a detailed analysis of the Silicon Metal industry. It provides an analysis of the past 5 years and a future forecast till the year…