Press release

Micro Medical Drone Market to Reach CAGR 25% by 2031 Top 10 Company Globally

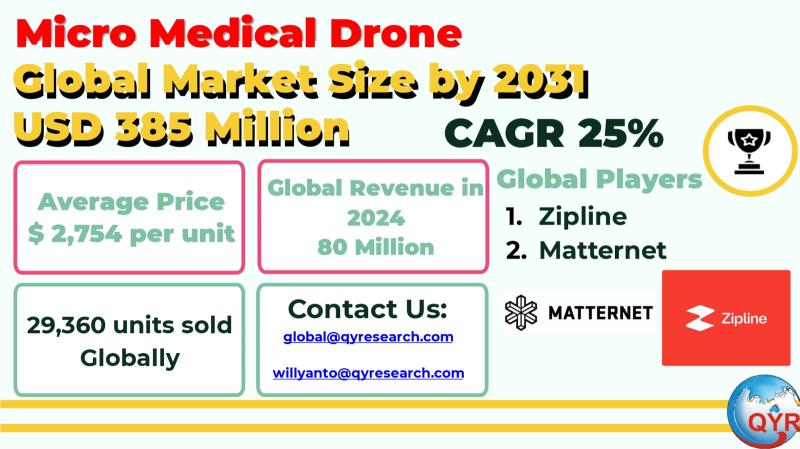

The micro medical drone industry refers to small, lightweight, primarily electric unmanned aircraft systems designed to transport time-critical, low-payload medical goods such as blood components, vaccines, lab samples, essential medicines and small medical devices. These systems generally emphasize high reliability, autonomous navigation, cold-chain compatibility for small parcels, and the regulatory approvals required to fly extended distances over people and beyond visual line of sight. They are increasingly integrated with hospital logistics and public-health supply chains, where end-to-end delivery time, mission success under adverse weather, and validated safety cases are central. Micro medical drones differ from larger cargo UAVs by prioritizing sub-5 kg payloads, rapid turnaround, and dense route networks that connect clinics, district hospitals and community pharmacies.Globally, the market size in 2024 is approximately USD 80 million, with a modeled path to USD 385 million by 2031, implying a CAGR of 25% over 2024 to 2031. Which helps explain why growth vectors appear steep at the micro end as healthcare systems shift from trials to standardized service contracts. In 2024, around 29,360 unit sold globally at average selling price around USD 2,754 per unit.

Latest Trends and Technological Developments

The latest trends and technological developments are defined by regulatory breakthroughs, hospital-network integrations, and autonomy advancements that lower unit costs. On July 2024, Zipline received the FAAs first approval of an airspace traffic-management system for drone delivery, a precursor to more routine operations at scale in the U.S. healthcare market. On August 2025, the FAA proposed its BVLOS rule, outlining a risk-based framework expected to expand routine operations and thereby increase the addressable market for medical missions. On June 2024, Matternet announced it had become the first company to self-authorize SAIL III operations via a Swiss Light UAS Operator Certificate, enabling BVLOS flights over populated areas and accelerating hospital logistics networks in Europe. On June 2025, Skye Air Mobility and Arrive AI announced a partnership to scale secure delivery infrastructure in India, signaling commercialization beyond pilots for medical and pharmacy use cases. Ziplines continuing milestones, including over a million commercial deliveries and active healthcare logistics workstreams, reinforce the shift from demonstrations to dependable services for hospitals and ministries of health. Dates: July 2024 (Zipline airspace management approval); August 2025 (FAA BVLOS proposed rule); June 2024 (Matternet LUC/SAIL III); June 2025 (Skye AirArrive AI partnership).

Rapid movement from pilots to structured corridors. India remains the bellwether with Medicine from the Sky and state-level corridors that are evolving from exemptions toward repeatable service models; industry groups and operators report longer-range BVLOS medical flights and expanding hospital partnerships, although full routine BVLOS remains constrained and largely conducted under trials or waivers. Japan and South Korea continue to mature UTM/UTMS and advanced operations frameworks, while hospital and pharmacy delivery pilots spread in urban hubs. In parallel, Africa-to-Asia technology transfer is visible as Asian providers and regulators study results from Rwanda and Ghana, where drone delivery has reduced blood delivery times and wastage, providing rigorous evidence for cost-effectiveness and patient outcomes that Asian health ministries can reference.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/4745842

Micro Medical Drone by Type:

Fixed Wing Drone

Rotor Wing Drone

Hybrid Wing Drone

Micro Medical Drone by Application:

Drug Transmission

Blood Transmission

Sample Transmission

Others

Global Top 10 Key Companies in the Micro Medical Drone Market

Zipline

Sf Technology Co., Ltd.

Matternet

SZ DJI Technology Co., Ltd.

Volansi Inc.

Guangzhou EHang Intelligent Technology Co., Ltd.

Flirtey

Vayu

Swoop Aero Pty. Ltd.

AeroMobil

Regional Insights

Suggest a step-change as governments frame low-altitude policies and public-health agencies test last-mile drone logistics. Indonesias overarching rules fall under CASR Part 107, with BVLOS generally requiring specific waivers; operational experience during COVID-19 in cities such as Makassar demonstrated the practical value of aerial delivery for medicines and isolation-support logistics. Current commercial guidance indicates that BVLOS remains permission-based, but industry momentum and emergency-use precedents are catalyzing broader adoption. Elsewhere in ASEAN, Thailand and Vietnam have hosted increasingly sophisticated demonstrations and early hospital-network use cases; APAC-wide analyses place medical drone services on a double-digit growth path as pharmacy and lab logistics digitize. These developments, together with growing e-pharmacy penetration and challenging archipelagic geographies in Indonesia and the Philippines, point to a robust multi-year runway for micro medical drones focused on sub-5 kg cold-chain parcels and pathology samples.

While the proposed U.S. BVLOS rule marks a watershed, many Asian and ASEAN jurisdictions still require mission-specific approvals, limiting route density and aircraft utilization. Total cost of ownership remains sensitive to battery cycles, maintenance, and fleet management software; achieving clinic-level unit economics depends on high route density, reliable weather tolerance and automated ground handling. Healthcare integration brings additional hurdles such as chain-of-custody documentation, pathology sample integrity, and cold-chain validation at handoff points. Finally, public acceptance and local-authority permissions, especially in dense urban areas, must be actively managed through quiet aircraft designs, privacy-by-design sensor suites and transparent safety cases.

For operators and investors emphasize targeting must-fly use cases where time savings are clinically consequential and economically priced, such as blood, antivenom, lab samples and critical medicines. Partnerships with hospital groups, diagnostics networks and health ministries can anchor predictable volumes, while modular droneports, standardized payload pods and integrated UTM connectivity reduce marginal costs per mission. In Asia and ASEAN, success depends on regulatory engagement for corridor pre-approval, local assembly or servicing to meet offset requirements, and analytics that prove avoided stock-outs, shorter turn-around time and improved patient outcomes. Cross-pollination from proven networks in Rwanda and Ghana provides credible evidence to accelerate approvals in Indonesia, Vietnam and India, where policy is trending toward structured BVLOS and urban air mobility roadmaps.

Product Models

Micro medical drones are revolutionizing healthcare by enabling rapid delivery of critical supplies like blood, vaccines, and lab samples even in remote or urban areas.

Fixed-wing drones excel at long-range, high-speed deliveries. Notable products include:

Albatross UAV Applied Aeronautics: Designed for long-range BVLOS operations, offering cost-efficient and reliable delivery.

Windracers Cargo UAV Windracers: Self-flying fixed-wing aircraft that successfully deliver medical supplies across significant distances.

Gadfin Spirit-X Gadfin: with extended 500 km range and high payload capacity (up to 150 kg), tailored for medical delivery.

Zipline Sparrow Zipline: A fixed-wing drone delivering blood and medical supplies in Rwanda, Ghana, and other remote regions using parachute drops.

Rotor-wing drones offer vertical takeoff and precise, on-demand urban logistics. Examples include:

Matternet M2 Matternet: Quad-rotor drone with FAA type certification, designed for urban medical deliveries (up to 2 kg over 20 km), with automated battery/payload swaps.

Aerospace SORA-V Aerospace: Multi-rotor UAV optimized for transporting organs, blood, and emergency supplies over short-to-medium distances with enhanced sensor safety

OEM Multi-Rotor HXMX616 OEM/ODM: 6-rotor drone with a 16 L medicine box foldable and durable design for agricultural and potential medical delivery.

Phoenix ACE XL Threod Systems: Heavy-lift multirotor (38 lb payload) suitable for delivering medical packages or supplies.

Hybrid-wing drones combine the endurance of fixed-wing models with the flexibility of vertical lift. Notable products include:

Wingcopter 178 Wingcopter GmbH: used for BVLOS delivery of medical samples, supported NHS and COVID-19 responses.

Swoop Kookaburra Swoop Aero: optimized for medical supplies to rugged and remote areas used across Africa and Pacific regions.

Gadfin Spirit-One Gadfin: Hybrid eVTOL with long-range, cold-chain capable medical delivery features.

Avy Aera Avy B.V.: fixed-wing drone with cooled cargo module (28 °C) for medical transport, operating BVLOS under EU certification

micro medical drones are transitioning from proof-of-concept to critical infrastructure for time-sensitive healthcare logistics. With a 2024 market of about USD 80 million and an expected 25% CAGR to 2031, growth will be driven by BVLOS normalization, hospital-network standardization and evidence of clinical and economic value. Asia and ASEAN particularly India, Indonesia, Thailand and Vietnam are poised to contribute disproportionate growth as regulators and providers codify corridors, invest in droneports and digitize lab and pharmacy logistics.

Investor Analysis

what matters is exposure to certified BVLOS operations and defensible hospital integrations; how returns accrue is through network density, repeat medical use cases, and software-driven fleet utilization that compresses cost per mission; why now is compelling is the alignment of regulation (FAA BVLOS proposal and European SAIL frameworks), hospital demand for faster, greener logistics, and operator track records that de-risk execution. Investors should prioritize platforms with proven reliability, cold-chain validation, and clear regulatory pathways in Asia and ASEAN, where unlocking BVLOS at scale can rapidly expand addressable volumes and operating margins.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/4795542

5 Reasons to Buy This Report

it gives a reconciled, source-based estimate of the 2024 global micro medical drone market and a transparent CAGR outlook to 2031.

it translates dated regulatory and operator milestones into concrete adoption catalysts that affect revenue timing.

it provides Asia and ASEAN insights, including Indonesias regulatory posture and operational precedents, to inform market-entry sequencing.

it benchmarks leading operators by regulatory depth, hospital integration and network scale to aid partnership or investment screening.

it maps execution risks BVLOS permissions, economics and healthcare integration into pragmatic mitigation levers that preserve margins.

5 Key Questions Answered

what is the best-supported 2024 market size for micro medical drones and the implied CAGR through 2031?

which dated regulatory events and operator deals in 20242025 most accelerate scaling?

how do Asia and ASEAN dynamics including Indonesias permissions and public-health use cases shape near-term growth?

which companies are best positioned to win hospital and ministry contracts based on certifications and network evidence?

what operational metrics route density, utilization, cold-chain compliance most strongly correlate with sustainable unit economics and investable scale?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Micro Medical Drone Market to Reach CAGR 25% by 2031 Top 10 Company Globally here

News-ID: 4152951 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for BVLOS

Latest Research on Application in the BVLOS UAV (Drone) Market by MarketsandMark …

The Beyond Visual Line Of Sight (BVLOS) Unmanned Aerial Vehicle (UAV) Market is expected to grow from USD 15.36 billion in 2025 to USD 25.32 billion by 2030, at a compound annual growth rate (CAGR) of 10.5% during the forecast period.

The report "BVLOS UAV (Drone) Market [https://www.marketsandmarkets.com/Market-Reports/bvlos-uav-drone-market-152414713.html?utm_source=abnewswire.com&utm_medium=PaidPR&utm_campaign=BVLOSUAVdronemarket] by Application (Military, Commercial, Government & Law Enforcement), By MTOW (600 KG), By MTOW, By Wing Type, and Region - Global Forecast to…

Transformative Trends Impacting the Autonomous Beyond Visual Line Of Sight (BVLO …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Autonomous Beyond Visual Line Of Sight (BVLOS) Drones Market Size By 2025?

The market size for drones that can operate beyond visual line of sight (BVLOS) autonomously has seen a significant increase in recent years. The market is estimated to soar from $1.33 billion…

Transformative Trends Impacting the Autonomous Beyond Visual Line Of Sight (BVLO …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Autonomous Beyond Visual Line Of Sight (BVLOS) Drones Market Size By 2025?

The market size for drones that can operate beyond visual line of sight (BVLOS) autonomously has seen a significant increase in recent years. The market is estimated to soar from $1.33 billion…

Utility Drones Market Soars with AI, Automation & BVLOS: Trends, Opportunities & …

Utility Drones Market is valued at a significant CAGR during the forecast period (2024-2031). As per DataM Intelligence Database.

The utility drones market refers to the sector that involves the use of unmanned aerial vehicles (UAVs), or drones, in utility applications such as power line inspections, wind turbine monitoring, solar panel assessment, pipeline surveillance, and infrastructure maintenance. These drones help utility companies enhance operational efficiency, reduce inspection costs, improve worker safety,…

Emerging Trends Influencing The Growth Of The Autonomous Beyond Visual Line Of S …

The Autonomous Beyond Visual Line Of Sight (BVLOS) Drones Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Autonomous Beyond Visual Line Of Sight (BVLOS) Drones Market Size Expected to Be by 2034?

The autonomous beyond visual line of sight (BVLOS) drones market…

Autonomous BVLOS Drones Market Analysis: Size, Share, and Emerging Industry Tren …

The Business Research Company recently released a comprehensive report on the Global Autonomous Beyond Visual Line Of Sight (BVLOS) Drones Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something…