Press release

REALMO Highlights the Role of Aggregator Tools in Avoiding Costly Self-Storage Investment Errors

How I Almost Lost $2.3 Million by Trusting Pretty Spreadsheets (And the Data Tools That Saved My Self-Storage Career)Image: https://www.globalnewslines.com/uploads/2025/08/0dd7281ffdaa0ecd2c2c5e5ae424be9f.jpg

Two years ago, I was presented with what appeared to be the perfect storage spaces [https://realmo.com/self-storage-facilities/for-sale/] investment opportunity. The broker's package showed a 180-unit facility in a growing Phoenix suburb with 94% occupancy, $1.8 million in annual revenue, and asking price of $12.5 million. The numbers worked beautifully - projected 15% IRR, strong cash-on-cash returns, and located in a market that every industry report highlighted as a top growth area.

I was so excited about the deal that I nearly skipped my usual detailed analysis and jumped straight to making an offer. The facility's financial statements looked pristine, the market seemed undersupplied, and comparable sales suggested significant upside potential. Everything about this investment screamed "winner" - which should have been my first warning sign.

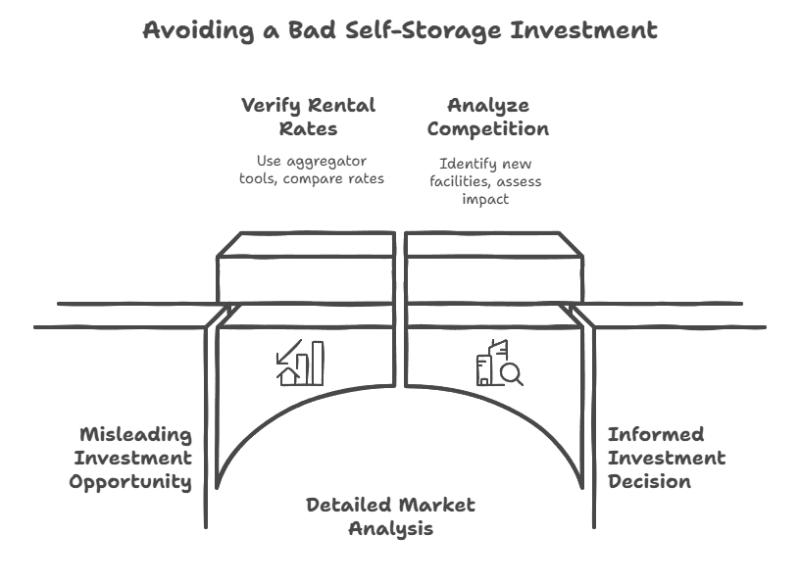

Fortunately, something nagged at me about the rental rate data. The facility was reportedly achieving $1.85 per square foot for standard 10x10 units, which seemed high for the submarket. Instead of trusting the broker's numbers, I decided to spend a weekend diving deep into aggregator tools and conducting my own market analysis.

What I discovered nearly made me sick. Using three different aggregator platforms, I found that comparable facilities in the immediate area were averaging $1.35 per square foot for similar units. The reported occupancy rate was accurate, but rental rates were inflated by 35% through a combination of promotional rates that would expire within six months and cherry-picked data from their highest-priced units.

Even worse, my analysis revealed that four new self-storage facilities totaling 1,200 units were scheduled to open within three miles of the property over the next 18 months. This supply increase would have created devastating oversupply in a market that was already becoming competitive. The broker had conveniently omitted this information from his market analysis.

Why Self-Storage Data Is Both Your Best Friend and Biggest Enemy

The self-storage industry generates more operational data per square foot than almost any other real estate sector. Every unit rental, rate change, occupancy fluctuation, and tenant interaction creates data points that can be analyzed for investment insights. This data richness makes self-storage uniquely suited to systematic analysis using technological tools.

But this same data abundance creates significant challenges for investors who don't know how to process information effectively. Brokers and sellers can easily manipulate data presentation to tell whatever story serves their interests. A facility with terrible performance can be made to look attractive by selecting favorable time periods, cherry-picking specific unit types, or presenting gross revenues without corresponding expense information.

The democratization of real estate data through aggregator platforms has fundamentally changed self-storage investing by giving individual investors access to market intelligence that was previously available only to institutional players. However, most investors don't understand how to use these tools effectively or validate the information they provide.

The Aggregator Tool Ecosystem: What Actually Works

After testing dozens of platforms over the past five years, I've identified the tools that consistently provide value for serious self-storage investors versus those that are primarily marketing vehicles for brokers and property management companies.

Radius Plus stands out as the most comprehensive platform for market analysis, providing detailed competitive data, demographic analysis, and supply pipeline information. Their strength lies in accuracy of existing facility data and identification of planned developments that affect future supply levels. I use Radius Plus for initial market screening and competitive analysis on every potential investment.

STORMap excels at granular facility-level analysis and provides real-time pricing intelligence that helps evaluate revenue optimization opportunities. Their platform tracks pricing changes across thousands of facilities, enabling investors to identify markets where rates are rising or falling and facilities that may be underperforming relative to local market potential.

I particularly value STORMap's ability to analyze pricing strategies and occupancy management practices of specific facilities. Understanding how competitors manage their rate structures and promotional strategies provides insights into operational improvements that can drive value creation post-acquisition.

Yardi Matrix provides institutional-grade market intelligence with excellent coverage of large metropolitan areas. Their quarterly reports and market surveys offer insights into investment activity, cap rate trends, and development pipelines that help inform acquisition timing and exit strategies.

Advanced Metrics That Separate Professionals From Amateurs

Most investors focus on obvious metrics like occupancy rates and rental rates per square foot, but the most profitable opportunities are often identified through more sophisticated analysis that reveals operational inefficiencies and market positioning problems.

Revenue optimization analysis examines the relationship between occupancy rates and rental rates to identify facilities that are either under-priced (high occupancy, low rates) or over-priced (low occupancy, high rates). The optimal balance varies by market, but facilities operating significantly outside normal patterns often represent value creation opportunities.

Market penetration analysis compares a facility's capture rate to the theoretical demand in its primary market area. Facilities with low penetration rates in high-demand markets often have operational problems that can be corrected, while facilities with high penetration rates in declining markets may face long-term challenges regardless of current performance.

Unit mix optimization involves analyzing the relationship between unit sizes, rental rates, and local demand patterns to identify opportunities for operational improvements. Markets with strong demand for specific unit types (like climate-controlled or vehicle storage) often support premium pricing that isn't reflected in overall facility performance.

Expense ratio analysis compares operating expenses as a percentage of gross revenue across similar facilities to identify properties with operational inefficiencies or unusual cost structures. Facilities with expense ratios significantly above or below market norms often indicate management problems or cost reduction opportunities.

Step-by-Step Market Analysis That Actually Works

Effective self-storage market analysis requires a systematic approach that builds from macro market conditions down to facility-specific operational details. The process I've developed over hundreds of deals consistently identifies opportunities while avoiding major pitfalls.

Phase 1: Market Screening starts with identifying metropolitan areas or submarkets with favorable demographic and economic characteristics. I look for population growth above 2% annually, median household income above $50,000, high mobility rates, and diverse economic bases that provide recession resistance.

Phase 2: Supply Analysis involves mapping existing facilities, analyzing their characteristics, and identifying planned developments that will affect future market conditions. I pay particular attention to the age and quality of existing facilities, as older properties often provide opportunities for value-add improvements.

Phase 3: Competitive Positioning examines how potential acquisitions compare to existing facilities in terms of location, amenities, pricing, and operational sophistication. The best opportunities often involve facilities that are under-performing relative to their competitive position due to management deficiencies or deferred maintenance.

Phase 4: Financial Validation involves reconstructing facility financial performance using market data rather than relying solely on seller-provided information. I build revenue models based on competitive pricing analysis and verify expense estimates using industry benchmarks and local cost data.

The Due Diligence That Saves Millions

The most expensive mistakes in self-storage investing come from accepting surface-level data without independent verification. Professional-grade due diligence requires combining aggregator tool analysis with primary research that validates critical assumptions.

Physical market verification involves visiting competitive facilities during different times of day and week to observe actual occupancy levels, customer traffic patterns, and operational practices. I've discovered numerous instances where reported occupancy rates were significantly inflated due to non-revenue units being counted as occupied or seasonal fluctuations being ignored.

Revenue verification requires analyzing actual rental roll data, promotional discount programs, and collection rates that affect net revenue realization. Many facilities report gross revenues without disclosing the impact of promotional rates, late fees, or collection losses that significantly reduce actual cash flow.

I once discovered that a facility reporting $2.1 million in annual revenue was actually collecting only $1.7 million due to extensive promotional discounting and poor collection practices. This 19% difference in effective revenue completely changed the investment economics and required significant price adjustment.

Technology Integration for Operational Due Diligence

Modern self-storage facilities generate enormous amounts of operational data that can be analyzed to understand management effectiveness and identify improvement opportunities. Learning to interpret this data provides significant advantages in acquisition analysis.

Management software analysis reveals the sophistication of current operations and identifies opportunities for improvement. Facilities using outdated software systems often have significant revenue optimization opportunities through dynamic pricing, improved customer management, and better financial reporting.

Pricing strategy evaluation involves analyzing historical rate changes, promotional programs, and competitive responses to understand management's approach to revenue optimization. Facilities with simplistic pricing strategies often provide immediate value creation opportunities through more sophisticated rate management.

Common Analysis Mistakes That Destroy Returns

After reviewing hundreds of self-storage investments over the years, I've identified patterns in analytical mistakes that lead to poor investment outcomes.

Over-reliance on historical performance without understanding the factors that drove past results leads many investors to pay for performance that isn't sustainable. A facility that performed well under previous market conditions may struggle as competition increases or demographics change.

Ignoring development pipelines causes investors to underestimate future supply competition that can dramatically impact facility performance. I've seen numerous investments that looked attractive based on current market conditions but became marginal as new supply entered the market.

Misunderstanding seasonal fluctuations leads to incorrect assumptions about sustainable occupancy and revenue levels. Many markets have significant seasonal demand variations that must be factored into financial projections and operational planning.

Building a Systematic Investment Process

Success in self-storage investing requires developing systematic processes that consistently identify opportunities while avoiding common pitfalls. The most successful investors I know follow disciplined approaches that combine technology tools with experienced judgment.

Deal flow management involves using aggregator tools to monitor markets continuously rather than reactively analyzing individual opportunities. I set up automated alerts for new listings, significant rate changes, and market supply additions in target markets to identify opportunities early.

Standardized analysis templates ensure that every potential investment receives thorough evaluation using consistent criteria. This systematic approach prevents emotional decision-making and ensures that important factors aren't overlooked during the excitement of finding an attractive opportunity.

Market expertise development requires focusing on specific geographic areas where you can develop deep knowledge of local conditions, competitive dynamics, and operational requirements. Successful self-storage investors typically concentrate their efforts rather than spreading investments across numerous markets.

The Future of Self-Storage Analysis

Emerging technologies and data sources are creating new opportunities for sophisticated market analysis while also changing competitive dynamics in ways that affect investment strategies.

Artificial intelligence and machine learning applications are improving demand forecasting, pricing optimization, and customer behavior analysis in ways that provide operational advantages for facilities that adopt these technologies effectively.

Real-time market intelligence through automated data collection and analysis enables more responsive investment and operational decision-making. Investors who can access and interpret real-time market data have significant advantages over those relying on periodic reports.

Mobile and digital integration is changing customer expectations and operational requirements in ways that favor facilities with modern technology infrastructure. Properties that can't adapt to digital customer acquisition and management may face competitive disadvantages.

Making Aggregator Tools Work for Your Investment Strategy

The aggregator tools and analysis techniques I've described provide powerful capabilities for self-storage investors, but success requires implementing these tools within a broader investment strategy that matches your experience, capital resources, and market knowledge.

Start with markets where you have existing knowledge or connections, and use aggregator tools to deepen your understanding rather than expand into unfamiliar territories. The most profitable opportunities often come from applying sophisticated analysis to markets you already understand rather than finding exotic deals in distant locations.

Focus on developing expertise in specific facility types or market segments rather than trying to analyze every opportunity. Whether you specialize in value-add acquisitions, development projects, or stable cash-flowing properties, concentrated expertise generates better results than scattered efforts.

Media Contact

Company Name: REALMO

Contact Person: Alexandra Goss - Director of Public Relations

Email: Send Email [http://www.universalpressrelease.com/?pr=realmo-highlights-the-role-of-aggregator-tools-in-avoiding-costly-selfstorage-investment-errors]

Country: United States

Website: https://realmo.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. GetNews makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release REALMO Highlights the Role of Aggregator Tools in Avoiding Costly Self-Storage Investment Errors here

News-ID: 4152901 • Views: …

More Releases from Getnews

Let Kids Be Kids, Arshiner's 2026 Spring/Summer Collection Brings Festive Joy in …

In 2026, American parents' approach to choosing children's clothing is undergoing a quiet transformation. Instead of focusing on outfits for specific festive occasions to create a sense of ritual, they are now embracing real-life daily scenarios. During those moments of running, exploring, laughing, and growing, clothing should be an extension of joy and freedom. At the heart of this trend is the idea that children should not only shine on…

"One Outfit, Multiple Wears" Becomes a New Travel Trend: EKOUAER Travel Homewear …

From an overstuffed suitcase that's hard to zip up, to tight outfits on the plane that make it difficult to breathe, to the moment when you check into a hotel and want to go out for a cup of coffee but can't find a comfortable and appropriate outfit... At such times, we often lament: A truly enjoyable journey really requires a set of homewear that can "go wherever you go."…

HowtoAchieveBothSafetyandComfortinSpringandSummerClose-to-SkinOutfits, COOFANDYO …

Image: https://www.globalnewslines.com/uploads/2026/02/14ee3a9cbf6b505268b80216af836535.jpg

As temperatures gradually warm, spring and summer styling has become a focus in men's daily dressing. Compared to autumn and winter, spring and summer clothing is lighter, thinner, and more close-fitting, with longer and more extensive contact with the skin. This shift has led people to pay greater attention to the safety, comfort, and breathability of clothing materials. When garments almost become a "second skin," factors such as skin-friendliness,…

Hosted.com Updates SSL Certificate Products to Improve Website Security and Sear …

Hosted.com has updated its SSL certificate products for stronger encryption, simpler management, and greater compatibility, enabling safer data transfers.

Image: https://www.globalnewslines.com/uploads/2026/02/be1cf9bfb7800118ad5226ddeb684757.jpg

Hosted.com, a provider of web hosting and domain registration services, announced an update to its SSL (Secure Sockets Layer) Certificate offerings. The product line is available immediately and is intended to support secure website connections, data protection, and HTTPS encryption as security and search visibility requirements continue to evolve.

SSL certificates encrypt…

More Releases for Tool

Data Annotation Tool Market Data Annotation Tool Market

The study on the Global Data Annotation Tool Market published by Fact.MR is a comprehensive analysis of the key factors that are likely to determine the growth of Data Annotation Tool Market in the upcoming years. Further, the study dives deep to investigate the micro and macro-economic parameters that are expected to influence the global scenario of the Data Annotation Tool Market during the forecast period (2022-2031).

The report examines the…

Research Report and Overview on Titanium Carbide Tool Market, 2020-2026 with Mit …

"Global Titanium Carbide Tool Industry Research Report” Provides Detailed Insight Covering all Important Parameters Including Development Trends, Challenges, Opportunities, Key Insights and Competitive Analysis of Titanium Carbide Tool Market.

COVID-19 can affect the global economy in 3 main ways: by directly affecting production and demand, by creating supply chain and market disturbance, and by its financial impact on firms and financial markets.

To know How COVID-19 Pandemic will impact this market/industry-DOWNLOAD sample…

Aluminum Carbide Tool Market Trend, Segmentation and Forecast to 2025| Mitsubish …

High speed steel tools and carbide tools are widely used machine tools. From which carbide tools are most popular for machining applications. Carbide tools have exceptional characteristics like wear resistance, material strength, chemical inertness and other superior properties.

The Aluminum Carbide Tool market was valued at xx Million US$ in 2018 and is projected to reach xx Million US$ by 2025, at a CAGR of xx% during the forecast period. In…

Titanium Carbide Tool Market Size Study and Regional Forecasts 2019-2025| Mitsub …

High speed steel tools and carbide tools are widely used machine tools. From which carbide tools are most popular for machining applications. Carbide tools have exceptional characteristics like wear resistance, material strength, chemical inertness and other superior properties.

The Titanium Carbide Tool market was valued at xx Million US$ in 2018 and is projected to reach xx Million US$ by 2025, at a CAGR of xx% during the forecast period. In…

What's driving the Solid Carbide Tool Market growth? Key Players are: Mitsubishi …

The worldwide market for Solid Carbide Tool is expected to grow at a CAGR of roughly over the next five years, will reach million US$ in 2024, from million US$ in 2019, according to a new Big Market Research study.

Get Discount Sample @ https://www.bigmarketresearch.com/request-for-discount/3009309?utm_source=SBL

This report focuses on the Solid Carbide Tool in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes…

Global Knurling Tool Market 2018-2025 Aloris Tool, Dorian Tool, Sassatelli

Recently added detailed market study "Global Knurling Tool Market" examines the performance of the Knurling Tool market 2018. It encloses an in-depth Research of the Knurling Tool market state and the competitive landscape globally. This report analyzes the potential of Knurling Tool market in the present and the future prospects from various angles in detail.

The Global Knurling Tool Market 2018 report includes Knurling Tool market Revenue, market Share, Knurling Tool…