Press release

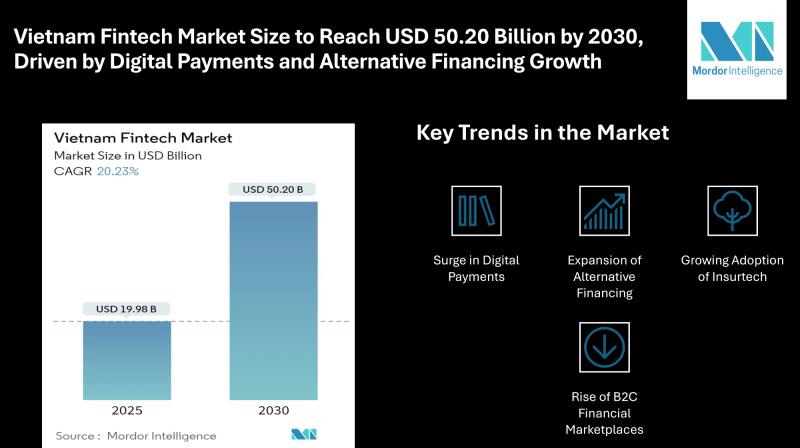

Vietnam Fintech Market Size to Reach USD 50.20 Billion by 2030, Driven by Digital Payments and Alternative Financing Growth

Mordor Intelligence has published a new report on the "Vietnam Fintech Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction to the Vietnam Fintech Market

The Vietnam fintech market is entering a period of accelerated expansion, fueled by widespread smartphone adoption, increasing internet penetration, and rising demand for digital-first financial services. The Vietnam fintech market size is estimated at USD 19.98 billion in 2025 and projected to reach USD 50.20 billion by 2030, growing at a CAGR of 20.23% during the forecast period (2025-2030).

Vietnam's young and tech-savvy population, coupled with a large unbanked segment, is creating favorable conditions for fintech adoption. Services ranging from mobile payments to peer-to-peer (P2P) lending and online insurance platforms are rapidly transforming how financial services are delivered. With government policies encouraging digital financial inclusion, the fintech market in Vietnam is well-positioned to attract both domestic and international investment.

Report Overview: https://www.mordorintelligence.com/industry-reports/vietnam-fintech-market?utm_source=openpr

Key Trends Shaping the Vietnam Fintech Market

Surge in Digital Payments

Digital payments remain the dominant driver of growth in the Vietnam fintech market share. Consumers are increasingly using mobile wallets for online purchases and in-store transactions. E-commerce platforms and retail merchants are integrating fintech solutions, driving a cultural shift toward cashless transactions.

Expansion of Alternative Financing

Alternative financing, particularly P2P lending, is gaining traction as small businesses and individuals seek accessible credit outside of traditional banking channels. These platforms play a vital role in filling financing gaps for underserved SMEs, helping to stimulate broader economic growth.

Growing Adoption of Insurtech

Digital insurance services are making inroads, with online platforms simplifying the purchase of life, health, and non-life insurance products. Insurtech providers are leveraging mobile applications to reach new demographics, offering convenient solutions for Vietnam's expanding middle class.

Rise of B2C Financial Marketplaces

B2C financial marketplaces are emerging as a one-stop solution for banking, credit, and wealth management services. These platforms enhance consumer choice by aggregating multiple financial products in a digital environment, thereby fostering competition and improving accessibility.

Policy Support and Investments

The Vietnamese government continues to encourage digital payment adoption and financial technology growth through regulatory support. Meanwhile, investors are directing capital into fintech startups, particularly those operating in payments, lending, and personal finance solutions. This combination of regulation and investment is accelerating innovation and scaling opportunities across the market.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/vietnam-fintech-market?utm_source=openpr

Market Segmentation of the Vietnam Fintech Market

The Vietnam fintech market report provides a detailed segmentation of the industry across multiple service areas:

By Digital Payments

Online Purchases

POS (Point of Sales) Purchases

By Personal Finance

Digital Asset Management Services

Other Personal Finance Solutions

By Alternative Financing

Peer-to-Peer (P2P) Lending

Other Financing Platforms

By Insurtech

Online Life Insurance

Other Digital Insurance Services

By B2C Financial Services Marketplaces

Banking and Credit

Additional Marketplace Services

This segmentation highlights the diversity of the fintech market in Vietnam, showcasing how services address the needs of consumers, enterprises, and financial institutions.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players in the Vietnam Fintech Market

The competitive landscape of the Vietnam fintech market includes a mix of established players and fast-growing startups, each driving innovation in their respective domains:

MonoPay - A leading platform specializing in payment solutions that streamline online and offline transactions.

MoMo - Vietnam's most widely recognized e-wallet, offering digital payment services, bill payments, and financial products.

Moca - Known for its integration with ride-hailing and delivery platforms, Moca has become a significant player in mobile payments.

ZaloPay - Backed by Vietnam's popular messaging app, Zalo, the platform leverages a large user base to expand its digital payment services.

AirPay - A versatile e-wallet offering seamless payment options for gaming, e-commerce, and utility services.

These companies are strengthening their Vietnam fintech market share by focusing on user-friendly platforms, strategic partnerships, and expanding financial product offerings. Competition among them is intensifying, driving improvements in service quality and customer adoption.

Explore more insights on Vietnam fintech market competitive landscape: https://www.mordorintelligence.com/industry-reports/vietnam-fintech-market/companies?utm_source=openpr

Conclusion: Outlook of the Vietnam Fintech Market

The Vietnam fintech market is poised for robust growth over the next five years, supported by strong demand for digital payments, the rise of P2P lending, and expanding insurtech solutions. The growing role of B2C marketplaces and asset management services further emphasizes the industry's diversification.

With a favorable regulatory climate, high consumer adoption of mobile platforms, and strong investment interest, Vietnam is emerging as one of Southeast Asia's most dynamic fintech hubs. The Vietnam fintech market size is expected to more than double by 2030, reflecting the country's shift toward a cashless, digitally driven financial ecosystem.

For complete market analysis, please visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/vietnam-fintech-market?utm_source=openpr

Industry Related Reports

UAE Fintech Market: UAE Fintech Market is Segmented by Service Proposition (money Transfer and Payments, Savings and Investments, Digital Lending and Lending Marketplaces, And Online Insurance & Insurance Marketplaces).

Get more insights: https://www.mordorintelligence.com/industry-reports/uae-fintech-market?utm_source=openpr

US Fintech Market: US Fintech Market is Segmented by Service Proposition (Digital Payments (Mobile POS Payments, Digital Remittance, and Digital Commerce), Digital Investments (Neo-Brokers and Robo-Advisors), Alternative Lending, Alternative Funding (Crowd Investing and Crowd Funding), Neo-banking, and Online insurance and insurance marketplaces.

Get more insights: https://www.mordorintelligence.com/industry-reports/us-fintech-market?utm_source=openpr

China Fintech Market: The China Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), by End-User (Retail and Businesses), and by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices).

Get more insights: https://www.mordorintelligence.com/industry-reports/china-fintech-market?utm_source=openpr

Saudi Arabia Fintech Market: The Saudi Arabia Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), by End-User (Retail and Businesses), and by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices).

Get more insights: https://www.mordorintelligence.com/industry-reports/saudi-arabia-fintech-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Vietnam Fintech Market Size to Reach USD 50.20 Billion by 2030, Driven by Digital Payments and Alternative Financing Growth here

News-ID: 4152486 • Views: …

More Releases from Mordor Intelligence

Kitchen Cabinets Market Size to Reach USD 124.42 Billion by 2031, Driven by Resi …

Kitchen Cabinets Market Overview:

The kitchen cabinets market size was valued at USD 91.07 billion in 2025 and estimated to grow from USD 95.95 billion in 2026 to reach USD 124.42 billion by 2031, at a CAGR of 5.36%. This growth is anchored by increasing home renovation activities in North America and Europe, rapid construction of urban apartments in Asia-Pacific, and a growing preference for ready-to-assemble (RTA) and semi-custom cabinetry.…

Hazardous Waste Management Market Size to Reach USD 77.42 billion by 2031 - Mord …

Hazardous Waste Management Market Overview:

The hazardous waste management market continues to gain attention as industries and governments focus on safe waste handling and regulatory compliance. According to Mordor Intelligence, the hazardous waste management market size is USD 56.40 billion in 2026 and will expand to USD 77.42 billion by 2031 at a 6.54% CAGR, supported by rising industrial activity and stricter environmental policies worldwide. These figures highlight the role…

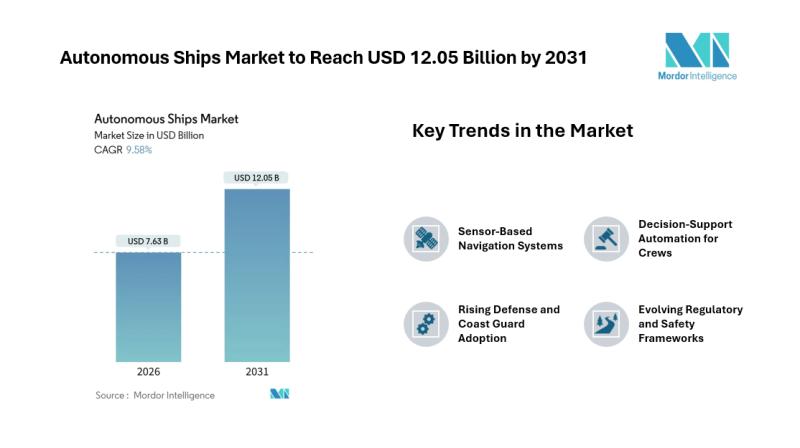

Autonomous Ships Market to Reach USD 12.05 Billion by 2031, Driven by Automation …

Introduction

The autonomous ships market is gaining steady attention as the global maritime sector seeks safer, more efficient, and cost-optimized operating models. According to Mordor Intelligence, the Autonomous Ships market size is estimated at USD 7.63 billion in 2026 and is projected to reach USD 12.05 billion by 2031, registering a 9.58% CAGR during the forecast period. This growth underscores the expanding role of the Autonomous Ships industry as shipping…

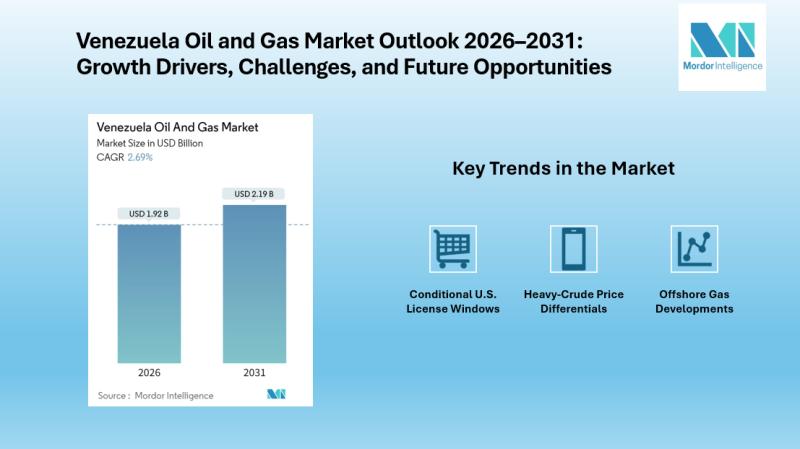

Venezuela Oil and Gas Market rising at CAGR of 2.69% by 2031, Driven by Offshore …

The Venezuela Oil and Gas Market is projected to grow from USD 1.92 billion in 2026 to USD 2.19 billion by 2031, registering a CAGR of 2.69%. Key growth drivers include offshore gas discoveries, heavy-crude price spreads, and selective U.S. license windows, while challenges such as sanctions, under-investment, and infrastructure gaps continue to weigh on the sector

Browse Full Report Details Followed by TOC: https://www.mordorintelligence.com/industry-reports/venezuela-oil-and-gas-market?utm_source=openpr

Despite being home to some of the…

More Releases for Vietnam

Vietnam Marvel Travel: Redefining Premium Travel Experiences Across Vietnam

Vietnam Marvel Travel, a leading premium travel agency in Vietnam, is redefining how international and domestic travelers explore the country through high-quality tours, luxury cruises, and tailor-made travel experiences. With a strong focus on service excellence, comfort, and authenticity, the company helps travelers discover Vietnam's most iconic landscapes and cultural destinations with ease and confidence.

Vietnam, 29th Dec 2025 - Vietnam Marvel Travel's vision is to become a trusted premium travel…

Vietnam beverages Market : Key Findings for Market Analysis and Business Plannin …

Vietnam beverages Market Analysis and Forecast, 2019-2028

The Vietnam beverages market was over US$ 2.5 billion in 2019 and is expected to grow at a CAGR of around 14.2% over the forecast period of 2022-2028.

Market Overview

The Vietnam beverages market study by RationalStat comprises comprehensive market analysis and insights across the key market segments and geography. The market report analyzes the Vietnam market for the historical period of 2019-2021 and the forecast…

Vietnam beverages Market | Outlook and Opportunities: A Forecast of Growth, Inve …

Vietnam beverages Market Analysis and Forecast, 2022-2028

The Vietnam beverages market was US$ 480 Bn in 2021 and is expected to grow at a CAGR of around 12.5% over the forecast period of 2022-2028.

Download PDF Sample of beverages Market report @ https://www.themarketinsights.com/request-sample/280160

Market Scope & Overview

The Vietnam beverages market study by RationalStat comprises comprehensive market analysis and insights across the key market segments and geography. The market report analyzes the Vietnam market…

Vietnam beverages market Key Information By Top Key Player | Sabeco, Heineken Vi …

The Vietnam beverages market was over US$ 2.5 billion in 2019 and is expected to grow at a CAGR of around 14.2% over the forecast period of 2022-2028.

Market Scope & Overview

The Vietnam beverages market study by RationalStat comprises comprehensive market analysis and insights across the key market segments and geography. The market report analyzes the Vietnam market for the historical period of 2019-2021 and the forecast period of 2022-2028 based…

Vietnam Agriculture Market, Vietnam Agriculture Industry, Vietnam Agriculture Li …

Agriculture has always been of pronounced importance for Vietnam, as feeding the realm’s largest population is not a relaxed task. The Vietnam government has been associate the agriculture industry with a number of policies, demanding to alleviate the output and seeking methods to ensure the sector is developing healthily and sustainably. The Vietnam federal government has been decidedly supportive of agriculture for decades, and there is extensive political consensus as…

The Baby Food Sector in Vietnam, 2018 Key Trends and Opportunities By Vietnam Da …

"The Baby Food Sector in Vietnam, 2018", is an analytical report by GlobalData which provides extensive and highly detailed current and future market trends in the Vietnamese market.

Vietnamese mothers have prepared fresh food for their babies but, as the economy has developed and more women have been drawn into the urban workplace, these mothers have increasingly found they have less time to spend preparing food and to spend with their…